BitDigest - Tuesday April 28, 2020

Apr 28, 2020

Author

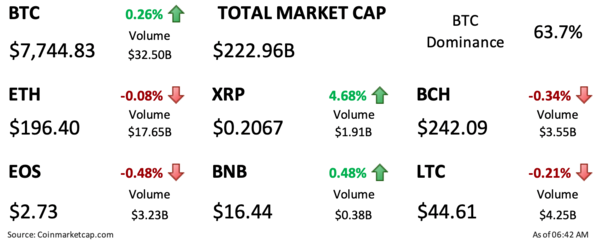

- Crypto prices are flat overnight with XRP being the only REBEL constituent to show a greater than 100 bps move

- China announces plans to expand its DCEP project to six more geographic markets

- Russian President Putin says his country cannot have a cryptocurrency because cryptocurrencies have no national borders

The Crypto Fear & Greed Index jumped this week to “27” moving into the ‘Fear’ range after residing at “17” or ‘Extreme Fear’ last week. The positive move in sentiment brings the index to the high levels it has been at since falling in early March. The Index hit a high of “28” yesterday.