Blockchain Redefining Wholesale Payments

September Recap

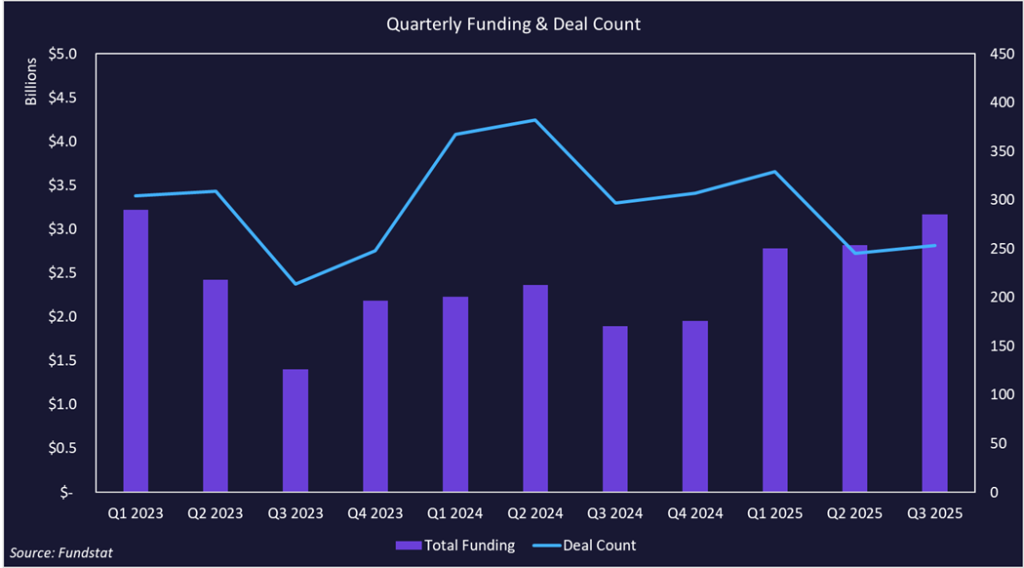

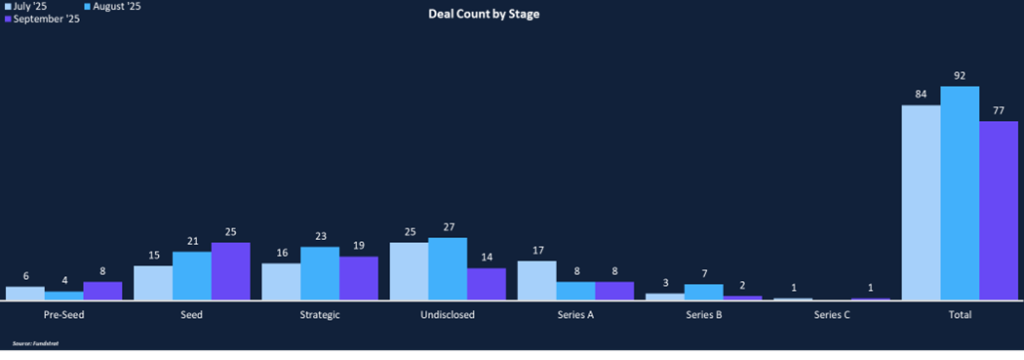

Q3 ended on a strong note with September representing the highest monthly funding of the year at $1.38 billion across 77 deals. Quarterly funding totals have been on an upward trend since Q4 of last year, with this quarter marking the highest quarterly amount since Q1 2023. Optimism surrounding the industry has increased under the new administration and notably after the passing of the GENIUS Act.

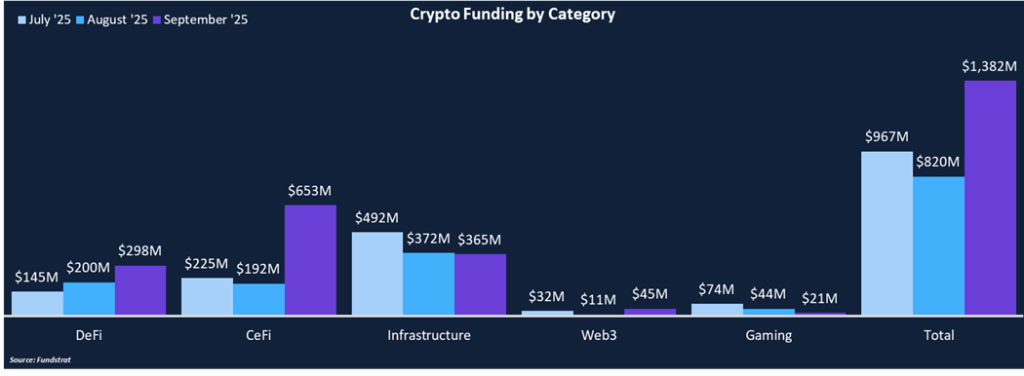

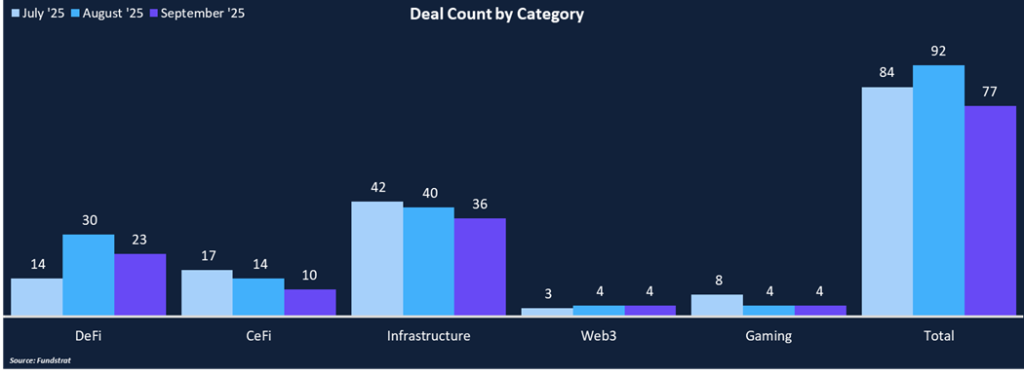

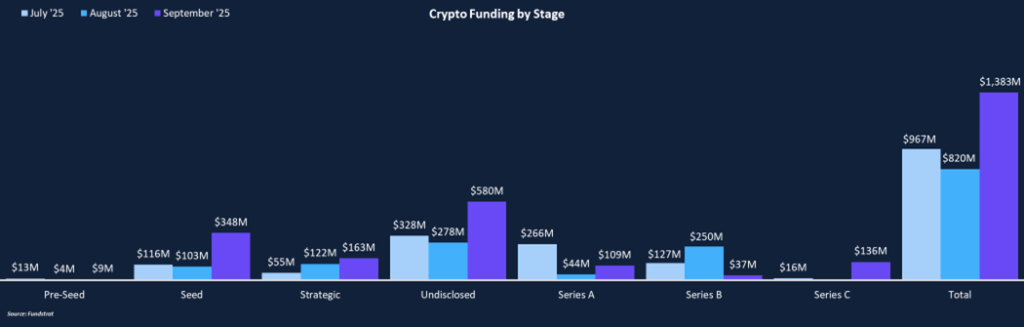

From a monthly perspective, September showed a 69% increase in funding compared to August, despite a 16% decrease in the total deal count. There were three nine-figure deals, with Kraken’s $500 million round being the largest, which also helped CeFi earn the most funded category. Infrastructure was second, and includes our Deal of the Month, Fnality. Seed rounds were the most popular deal stage throughout September, comprising 33% of the deal count and a quarter of all funding. There were nineteen strategic investment rounds announced, with notable ones including Yzi Labs’ investment in Ethena and Circle Ventures’ investment in Crossmint.

Funding by Category

Funding by Stage

Deal of the Month

Fnality, a payments infrastructure company, raised $136 million in a Series C round led by major financial institutions, including WisdomTree, Bank of America, Citi, KBC Group, Temasek, and Tradeweb. This capital infusion underscores strong institutional support for Fnality’s mission to build a blockchain-based global settlement network that bridges traditional wholesale markets with emerging tokenized asset platforms. The proceeds will fuel Fnality’s expansion into additional major currencies and the development of new liquidity management and settlement tools for tokenized assets like digital securities and stablecoins. The strategic participation of leading banks and market infrastructures highlights a broader industry push to modernize market infrastructure for a tokenized finance era.

Why is This Deal of the Month?

Fnality’s core product is a regulated blockchain wholesale payment network anchored in central bank money. Wholesale payments are high-value, low volume transfers that move money across large financial institutions like central banks, commercial banks, and large corporations. Fnality’s platform enables near-instant, atomic settlement of transactions (for example, delivery-versus-payment for digital securities and payment-versus-payment for FX) with 24/7 availability, reducing intermediaries and improving capital efficiency in financial markets. By providing an institutional-grade digital cash layer on blockchain rails, Fnality’s network serves as critical infrastructure that allows traditional institutions to seamlessly transact in tokenized assets with the safety and liquidity of central bank money.

Fnality’s first key launch was the Fnality Payment System (FnPS) for the pound sterling. It was the first fully regulated distributed ledger-based payment system. The goal is to have a network of similar regulated payment networks that can seamlessly interoperate across jurisdictions and currencies. The result would be a complete transformation of the current global payments system. While many large traditional finance institutions are exploring their in-house digital asset solutions, Fnality may ultimately present a simpler and more effective solution for companies to upgrade their financial infrastructure.

Selected Deals

Kraken, a centralized crypto exchange, raised $500 million in an undisclosed round led by Tribe Capital, valuing Kraken at $15 billion. Founded in 2011, Kraken is one of the longest operating exchanges in the industry and is among the top 10 global exchanges. Kraken is building an all-in-one finance app for crypto users with spot and derivatives trading, margin trading, staking, and a suite of institutional and OTC services. Kraken has recently enabled equity and tokenized equity trading and is developing its own Ethereum L2, akin to Base. Kraken has reportedly been preparing for a US IPO, which wouldn’t make them the first crypto exchange to go public recently, with Bullish and Gemini being two of the latest.

Flying Tulip, an all-in-one defi protocol, raised $200 million in a Seed round from investors including CoinFund, Brevan Howard Digital, FalconX, DWF, Lemniscap, and others. Flying Tulip also conducted a public token sale at the same valuation. Flying Tulip integrates a native stablecoin, money markets, spot trading, derivatives, and on-chain insurance within a single cross-margin, volatility-aware system designed for capital efficiency. Flying Tulip introduces a new capital allocation mechanism and tokenomics design that supports capital preservation and sustainable value creation through yield-funded buybacks and long-term protocol growth. The goal is to reduce liquidity fragmentation from systems that use isolated liquidity pools for different products. Flying Tulip was founded by crypto veteran Andre Cronje, who is also the founder of Yearn Finance and Sonic. Public trading of the Flying Tulip token has not yet gone live.

Melee, a Solana-based prediction markets platform, raised $3.5 million in a pre-seed round from Variant. Melee enables permissionless prediction market creation, featuring a unique pricing mechanism that rewards users for being early and accurate. Prediction markets have seen a surge in trading volumes and mindshare over the past few months. One of the main areas that could disrupt the duopoly of Polymarket and Kalshi is the provision of a method for market creators to share in trading fees, as opposed to the centralized model. Melee is doing precisely that as they work towards what they call “viral markets,” where they rely on influencers, podcasters, and streamers who can launch markets tied to their audience’s interests and earn a share of the fees from trading volume. Melee is currently in beta, with its public launch expected to come in the next few months.