Prediction Markets Repricing

August Recap

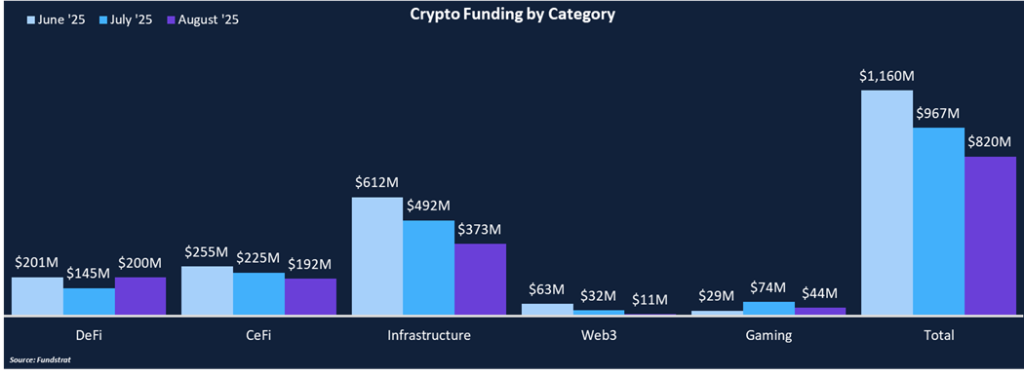

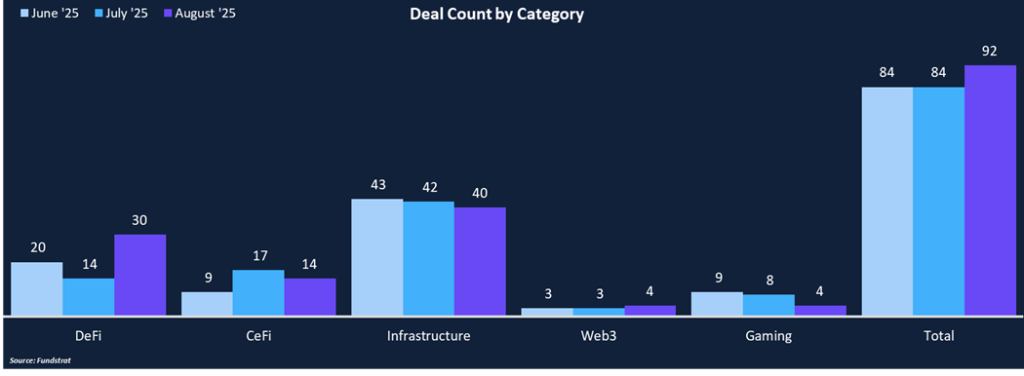

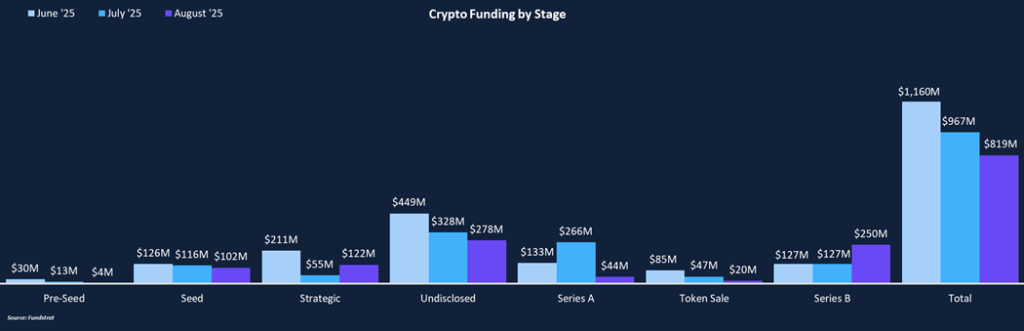

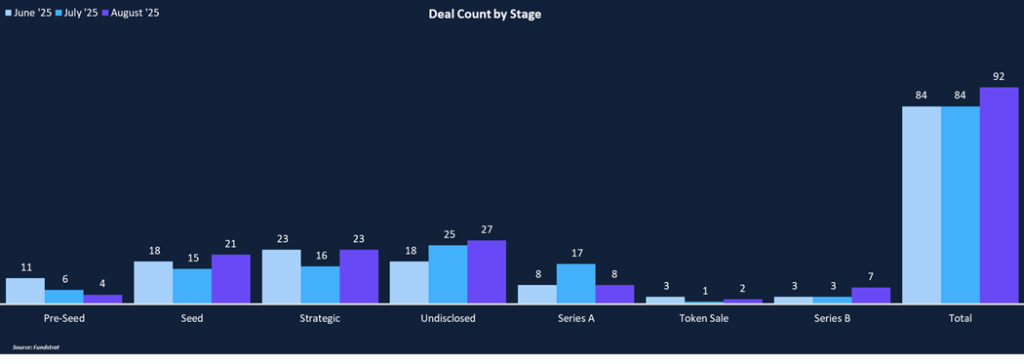

Although funding fell approximately 15% from July’s total, August funding remained strong, totaling $820 million across 92 deals. Year-to-date funding is significantly ahead of 2024’s pace, reaching $7.5 billion thus far compared to $8.5 billion for all of 2024. August’s funding was heavily concentrated in Infrastructure, DeFi, and CeFi, which represented 93% of total funding and 91% of deal count. It was a strong month for Series B rounds, with seven rounds totaling $250 million. Series B led disclosed funding categories and included Rain’s $58 million raise led by Sapphire Ventures. Rain provides end-to-end infrastructure that enables businesses to offer stablecoin-backed credit cards, wallets, and on/off-ramp services to their customers. From a deal count perspective, Strategic rounds led all categories with 23, including our Deal of the Month: Polymarket.

Funding by Category

Funding by Stage

Deal of the Month

Polymarket, a prediction markets platform, raised an undisclosed amount in a Strategic round from 1789 Capital. Additionally, Donald Trump Jr. (a 1789 Capital partner) has joined Polymarket’s advisory board. Earlier this week, the CFTC issued a “no-action” recommendation for Polymarket and event-based contracts. This paves the way for Polymarket to resume U.S.-based operations and exempts them from certain swap-reporting and recordkeeping obligations. The regulatory win, strategic investment, and new advisory expertise should help Polymarket expand its footprint as the go-to platform for accurate, real-time insights into public sentiment on topics ranging from politics and economics to culture and global events.

Why is This Deal of the Month?

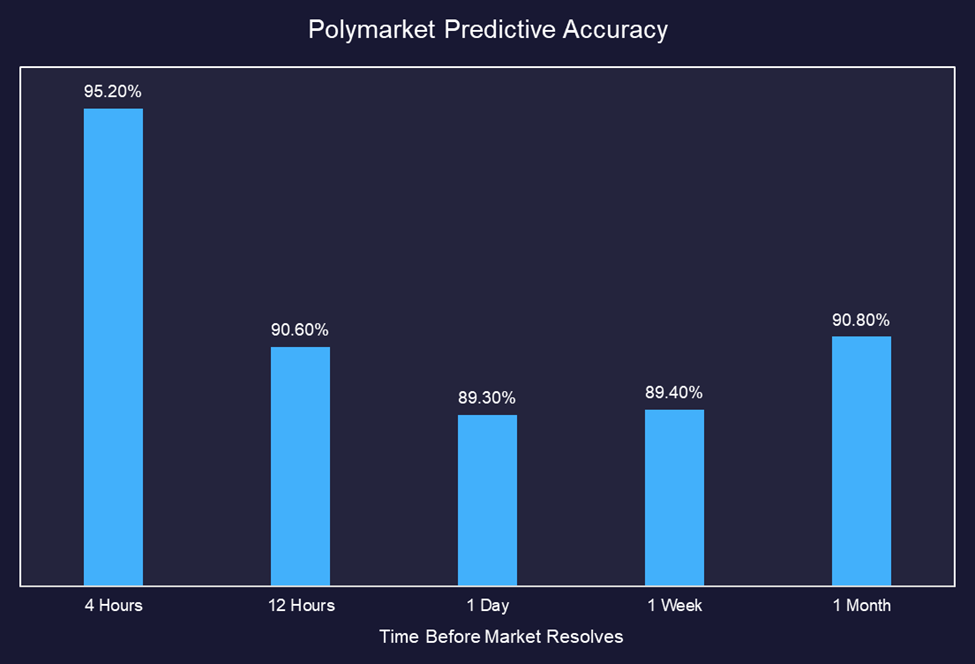

Polymarket’s rise over the past year highlights the growing investor interest in prediction markets as both a novel financial instrument and an information discovery tool. A key differentiator between prediction markets and traditional betting is predictive accuracy. Polymarket has consistently predicted outcomes with greater than 90% accuracy over various time frames.

Prices in these markets often move ahead of polls, analysts, and media consensus, reflecting real-time shifts in sentiment. Polymarket and other prediction platforms are increasingly becoming authoritative sources for real-time news. During last year’s election, Polymarket prices were significantly ahead of the polls, marking a pivotal moment for prediction markets, as their data was integrated into Bloomberg and frequently cited on news networks.

Investors now recognize prediction markets as a powerful signal: they replace lagging data by distilling collective knowledge into actionable probabilities. Traders’ incentives to wager correctly create a filtering mechanism that rewards information quality over noise, making these platforms efficient and self-correcting. From a capital markets perspective, Polymarket’s success suggests prediction markets could evolve into a core component of the financial information stack. Just as options markets reveal implied volatility and expectations for corporate earnings, prediction markets can surface crowd-implied probabilities for political outcomes, macroeconomic prints, or industry adoption trends. This opens opportunities for hedge funds, corporates, and policymakers to tap into a new, forward-looking data source. The billion-dollar valuations assigned to prediction platforms like Polymarket and Kalshi reflect this recognition: these aren’t just betting venues, but infrastructure for real-time, decentralized forecasting that could rival traditional data providers.

Selected Deals

OpenMind, a machine intelligence firm, raised $20 million in an undisclosed round led by Pantera Capital, with participation from Ribbit, Coinbase Ventures, HSG, DCG, and others. OpenMind is building open systems, shared intelligence, and decentralized coordination tools with the goal of enabling robots to think, learn, and work together. While many companies are developing humanoid hardware, OpenMind focuses on the missing intelligence infrastructure layer. Its OM1 operating system is modular and multiplatform, integrating LLMs, specialized vision models, and other agentic workflow components depending on the use case. OM1 is hardware agnostic and designed to support the integration of intelligent machines into everyday life. Additionally, OpenMind released its FABRIC protocol, which allows machines to verify identities, share context, and coordinate across environments. OM1 is the brain, the robot is the body, and FABRIC is the nervous system. Together, these tools enable seamless communication and intelligence sharing for multi-robot coordination.

M0, a stablecoin as a service company, raised $40 million in a Series B round led by Polychain Capital and Ribbit Capital, with participation from Pantera Capital and Bain Capital Crypto. M0 enables companies to easily issue customized stablecoins. All stablecoins deployed using M0’s infrastructure are composable and natively swappable, essentially sharing a single liquidity layer. M0’s federated issuer model allows qualified entities to hold reserves and mint stablecoins. When a digital dollar becomes strategically important, companies can choose to hold reserves and become native issuers, minimizing external dependencies. M0 has already supported the launch of multiple notable stablecoins, including Noble Dollar, Usual, USDai, and Metamask USD. The M0 ecosystem has surpassed 320 million in stablecoin supply with a 103% collateralization rate, generating over $6 million in minter fees. The new funding will support ecosystem growth and the global proliferation of stablecoins.

IVIX, an AI-powered anti-money laundering platform, raised $60 million in a Series B round led by OG Venture Partners, with participation from Insight Partners, Citi Ventures, Team8, Disruptive AI, Cardumen Capital, and Cerca. The funding brings IVIX’s total to $95 million. The raise follows five years of rapid growth, customer acquisition, and identifying over a billion dollars in illicit financial activity. Law enforcement agencies have struggled to keep pace with traditional methods of evasion, offshore accounts, and money laundering schemes. Blockchain technologies have further complicated enforcement with mixers, anonymity, and the growth of digital transactions. Estimates place the global shadow economy at over $20 trillion. IVIX is among the first platforms to leverage AI to address this challenge. Using vast amounts of public blockchain data, IVIX builds graph analytics that provide authorities full visibility into financial crime and criminal networks. The platform reports 99% accuracy in correctly identifying individuals behind hidden activity and 97% accuracy in detecting financial crime and noncompliance. IVIX aims to become the intelligence layer that uncovers unseen connections powering the illicit economy. The funding will accelerate R&D and support the widespread adoption of its solutions for financial crime prevention.