Stablecoins In Focus

July Recap

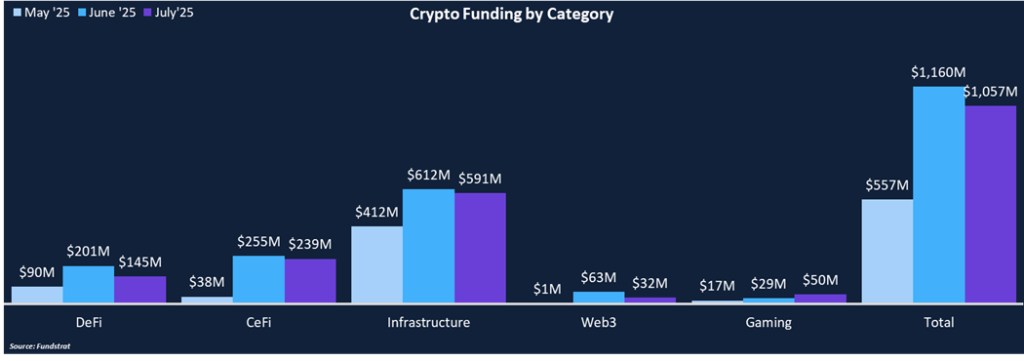

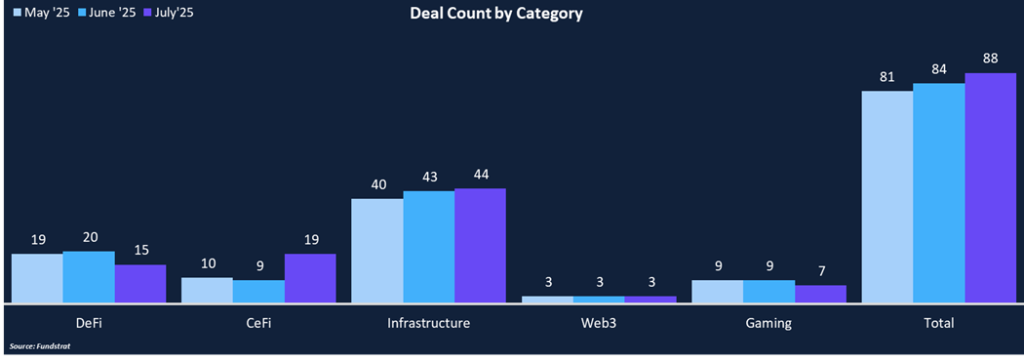

Funding continues to impress, totaling $1.1 billion across 88 deals. July represents the second consecutive month with over $1 billion in funding and the fourth in 2025, compared to just one in 2024. Infrastructure made up about half of total funding and deal count, including our Deal of the Month, Stable, a USDT-centric layer one chain built to transform payments. CeFi was the second leading category in funding and deal count, representing slightly less than a quarter of both totals.

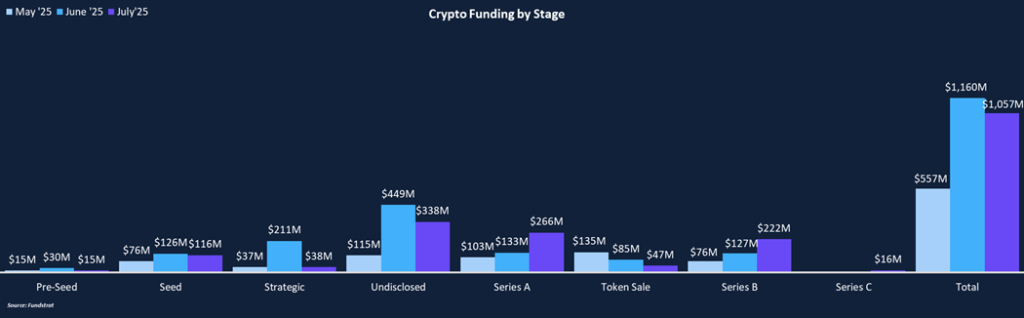

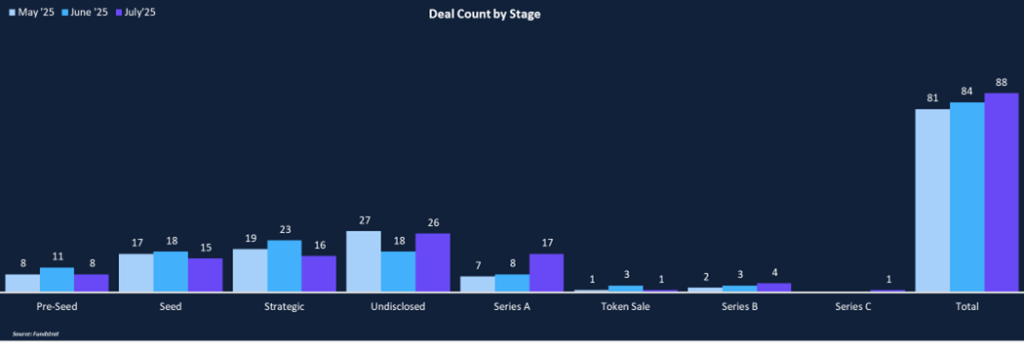

Series A and Series B rounds were the leading deal stages, with both categories accumulating over $200 million in funding. There were 17 Series A rounds in July, the highest monthly count since March 2024, potentially indicating a slow maturation among crypto startups. There was one token sale in July conducted by ETH Strategy, an on-chain ETH treasury company, raising $46.5M through different tranches of its ICO (STRAT). Treasury companies have been the latest trend, and ETH Strategy hopes to be the leading on-chain competitor, accumulating ETH and providing investors with leveraged exposure. They hold over 12k ETH in their treasury, putting them in the top 25 largest ETH treasuries.

Funding by Category

Funding by Stage

Deal of the Month

Stable, a USDT optimized layer 1 chain, raised $28 million in a seed round led by Bitfinex, USDT0, and Hack VC. Other investors included Franklin Templeton, Susquehanna, Bybit, Mirana Venture, Kucoin Ventures, and others. The funding will be used to advance the next evolution of stablecoin infrastructure.

Why is This Deal of the Month?

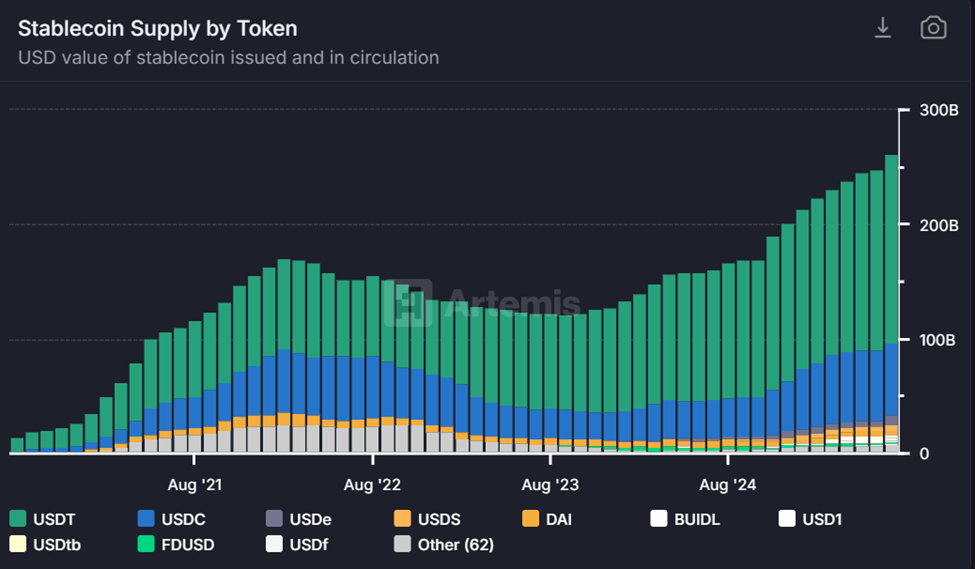

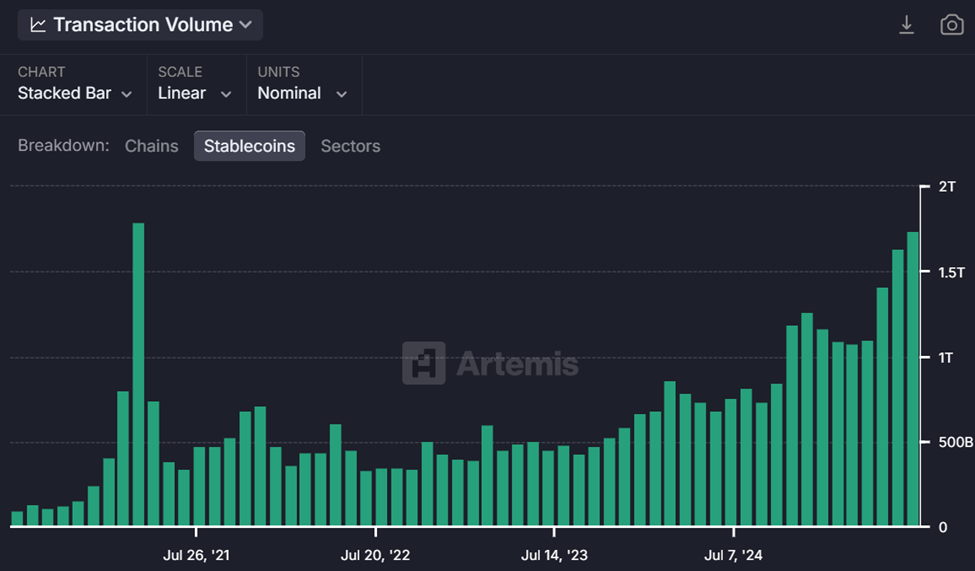

Aside from Bitcoin, stablecoins are arguably the most successful digital asset product to date. They serve hundreds of millions of consumers worldwide and facilitate trillions in monthly transfers. They are used for savings, payments, remittance, and power the majority of the DeFi ecosystem. Total stablecoin supply has surpassed 250 billion, with USDT making up approximately 60% of the total. Tether continues to establish itself as the market leader, processing over $1.5 trillion in monthly transfer volume in each of the last two months.

Most of Tether’s success has been achieved without a friendly regulatory environment in the U.S., but a rapid shift in regulatory policy is accelerating the pace of innovation and adoption. With the passing of the GENIUS Act, the road is paved for fully compliant stablecoins to make their way into U.S. capital markets.

With that in mind, Stable recognizes that major pain points still need to be addressed for proper scaling, including on-ramping tools for stablecoin acquisition, fees, inconsistent settlement, and liquidity fragmentation. Stable is building “Stablechain,” a USDT-centric L1 chain explicitly designed to address these shortfalls. As the largest and most used stablecoin, USDT will serve as the backbone for seamless payments, cross-border transfers, embedded financial apps, and simplifying global finance.

Stable will boast sub-second finality, EVM compatibility, and enterprise-scale throughput.USDT will be the native gas token, and cross-chain interoperability will be enhanced through USDT0 and LayerZero technology. Stable plans to integrate its own “Stable Wallet” with features like social logins, credit and debit card integrations, and human-readable wallet aliases. Later phases for Stablechain include optimistic parallel execution, dedicated block space for institutions, and an optimized DAG-based consensus mechanism.

Selected Deals

Manifold Labs, the development company behind multiple Bittensor subnets, raised $10.5 million in a Series A round led by OSS Capital, with participation from DCG, Tobi Lutke, Jacob Steeves, Ala Shaabana, and others. Manifold Labs is behind Targon (SN4), the third-largest subnet by market cap (not including Root). Targon is a decentralized, verifiably confidential, and trustless AI cloud that serves over 20 billion paid inference tokens a day. Targon is backed by 1,500+ H200s with more than $60 million in annual compute incentives flowing through the network. The funding will be used to help Targon continue scaling supply and increase its compute efficiency while attracting more network demand. In addition to its H200s, Targon has plans to incentivize other types of hardware, including B200s, H100s, and L40s, to create durable supply commitments.

XMTP, a secure decentralized messaging network, raised $20M in a Series B round led by a16z, Union Square Ventures, and Faction at a $300M valuation. Other investors included Coinbase Ventures, Distributed Global, and Sound Ventures. The Series B round brings XMTP’s total funding to $40 million after its Series A round in 2021. XMTP allows for full encryption of group chats, DMs, and notifications, allowing developers to build encrypted apps on top of their infrastructure. XMTP is built on the IETF standard Messaging Layer Security (MLS) protocol, the same security foundation used by Google, Cisco, Mozilla, and others. XMTP allows any collection of wallet addresses to be unified into a single messaging identity and supports ENS, Base, and Lens names, smart accounts, and ERC-4337 wallets. With a fully decentralized infrastructure, messaging is never interrupted, and no central authority can censor or limit messaging access. XMTP has accumulated over 2 million users, 1,000s of developers, and over 60 production apps, and the fresh funding will allow them to continue expanding.

Billions Network, a universal human and AI network, announced $30 million in total funding from investors including Polychain Capital, Coinbase Ventures, Polygon, Liberty City Ventures, and BitKraft. With the acceleration of AI development and AI-generated content, it is becoming harder and harder for users to distinguish between what was created by humans and what is AI. There is a surplus of social media bots, AI agents, and deepfakes flooding the internet. Billions recognizes that in addition to human identification, AI entities will need to verify themselves as they become integral to real-world businesses and operations. Billions believes that its digital identity network is essential to unlocking the potential of the internet of value. The goal is to create a verified internet that humans can utilize with full trust. Users can verify their identity via the Billions mobile app and determine which data is shared or public. Additionally, AI agents can also verify themselves, so users know if they are interacting with a trusted AI 3rd-party. All information is encrypted onto personal devices, and no hardware other than a mobile phone is needed. The funding will be used to continue expanding and building on its 1 million+ verified users.