Private Markets Heating Up

June Recap

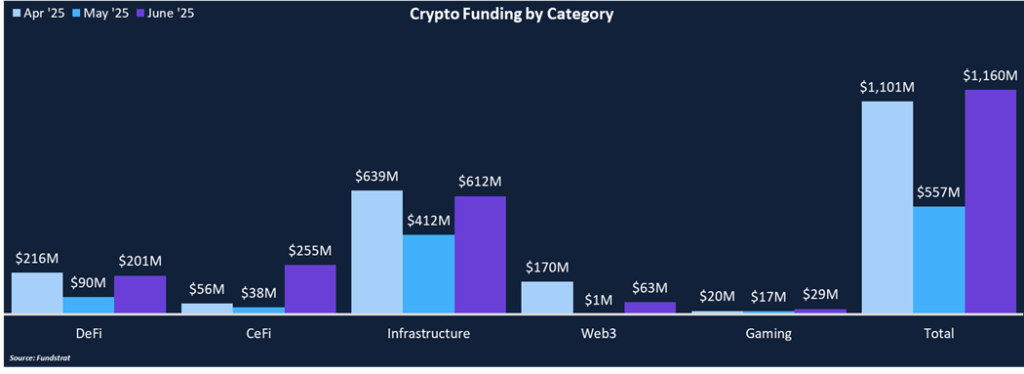

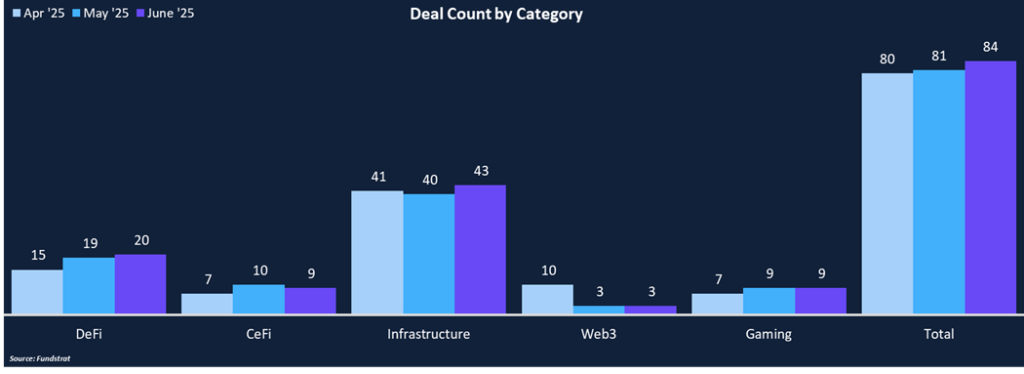

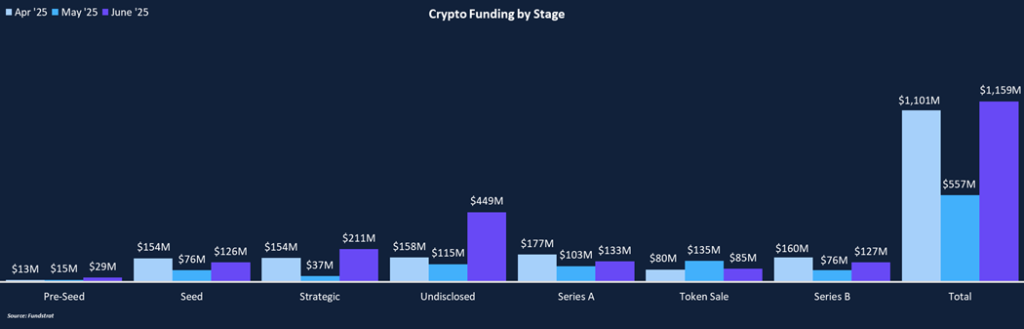

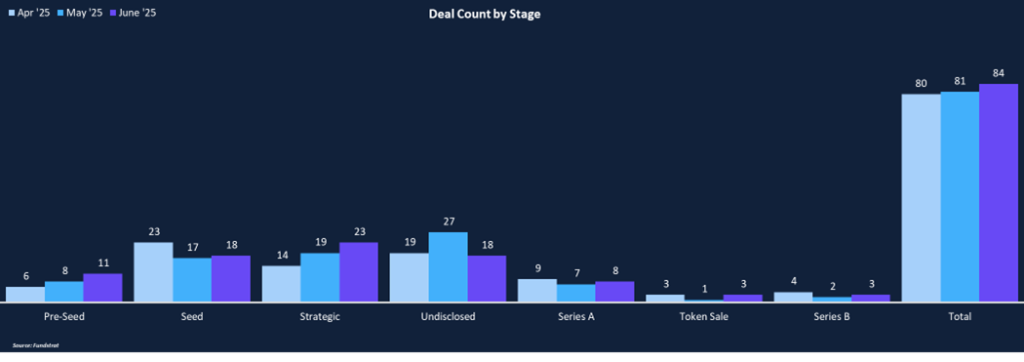

June was another good month for crypto funding, with $1.2 billion in total funding across 84 deals, representing a 108% MoM increase, while deal count was relatively flat with a 3.7% increase. June was the second month in 2025 to have over $1 billion in funding, topping April’s high of $1.1 billion. Unsurprisingly, Infrastructure was the leading category, making up 53% of funding and 51% of deal count. CeFi was the second leading category, making up 22% of funding and 11% of deal count. Gaming and Web3 remain the weakest categories, with under $100 million in total funding across 12 deals. From a deal stage perspective, Strategic rounds were the leading category in both funding and deal count, with $211 million across 23 deals. There were three Series B rounds in June, totaling $127 million. Similarly, there were three token sales in June totaling $85 million, including a $70 million OTC purchase of EIGEN from a16z.

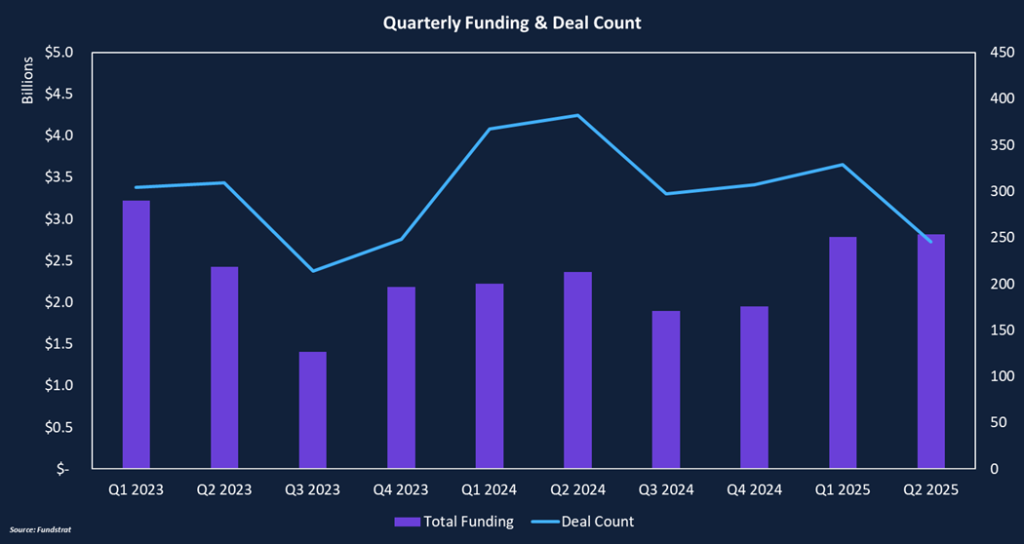

June wrapped up Q2, bringing quarterly funding totaling $2.8 billion, the highest quarterly amount since Q1 2023. Interestingly, despite Q1 and Q2 being the most funded quarters in two years, there hasn’t been a notable rise in deal counts, signaling less froth compared to the 2021 and 2022 craze. This also aligns with the increase of larger mid-to-late-stage funding rounds this year.

Funding by Category

Funding by Stage

Deal of the Month

Global Token Exchange (GTE), a central limit order book (CLOB) spot and derivative DEX on MegaETH, raised $15 Million in a Series A round from Paradigm. GTE is striving to provide the fastest on-chain exchange and rival both centralized players like Binance and Coinbase and decentralized ones like Hyperliquid. GTE will be fully non-custodial and hopes to achieve best-in-class latency.

Why is This Deal of the Month?

CLOBs are an exchange type that takes the central limit of all bid and ask orders to determine the price of an asset and match buyers and sellers accordingly. These exchanges enable high-performance trading (HFT) and support sophisticated and institutional traders. Building a fully on-chain CLOB exchange has been a long-standing goal for many teams over the years. Permissionless trading and self-custody are core components of the crypto ethos, and history has shown the importance of both dynamics during events like the GME frenzy and FTX fiasco. Users shouldn’t need to compromise the security and control of their assets at the expense of trading performance. To build an on-chain CLOB, high-performance execution, low costs, and complex matching logic are needed. Many blockchains have struggled to support these requirements, which is why Hyperliquid built its own L1 specifically designed to support HFT.

GTE is built on MegaETH, which may be the first general-purpose L1 to have the necessary infrastructure prerequisites to support high throughput applications like GTE. GTE has reported it can handle 100k orders per second at 1ms latency, allowing it to compete with Binance, Coinbase, and Hyperliquid. While GTE’s core product will be their CLOB perp DEX, they have also vertically integrated every aspect of trading, from asset creation to spot and leverage, to give users the best on-chain experience possible. GTE will have two different launchpads – one for established projects looking to TGE with deep liquidity, and another for permissionless token launches akin to pump.fun. Tokens that graduate on the permissionless token launchpad will graduate directly to its AMM DEX. GTE will be a one-stop-shop for all token trading in the MegaETH ecosystem with best-in-class performance. The capital will be used to support development efforts ahead of mainnet launch, expected sometime this year. GTE is currently on testnet where users can try the platform (and potentially earn a future airdrop).

Selected Deals

OpenRouter, a unified interface for hosting LLM models, raised $40 million in a Series A round led by a16z and Menlo Ventures, with participation from Sequoia and other angel investors. The funding round values OpenRouter at $500 million. Inference is one of the fastest growing costs for forward-looking companies, often due to the use of four or more models across business units. Businesses are leveraging OpenRouter to reduce costs and improve inference efficiency. OpenRouter hosts popular models including Gemini 2.5 Pro, GPT 4.1, Claude Sonnet 4, among more than 400 others. Companies are choosing OpenRouter due to perks such as zero logging by default, with the ability to route requests to providers that fit their data standards. OpenRouter boasts automatic multi-cloud failover across 50+ providers for best-in-class uptime and helps them serve over trillions of token requests every week. Their billing process is streamlined and unified, with real-time spend analytics and clear reporting, allowing businesses to remain agile with their inference spend. With a single API, OpenRouter is suited to serve business needs whether they are a $500/mo company experimenting on new products, or a global product consuming millions of dollars of inference. OpenRouter has expanded to a $100 million+ annual run rate with companies collectively spending more than $10 million on its services in recent months. The funding will be used to accelerate product development and bring new models to the platform as it expands its enterprise support to become the backbone for companies who rely on multiple AI models.

Zama, a cryptography company working on fully-homomorphic encryption (FHE) for blockchains, raised $57 million in a Series B round from Pantera Capital and Blockchange Ventures. The funding round brings Zama’s total funding to over $150 million and values the firm at over $1 billion, making it one of the first FHE companies to achieve unicorn status. FHE allows data to be kept private while its being used, allowing confidential details to remain hidden – perfect for sensitive AI or blockchain applications that contain private details or information. Potential use cases powered by Zama’s technology include confidential stablecoin issuance, private swaps or transfers, private equity tokenization, which will all be accessible for a wider developer base without needing deep cryptographic expertise. Zama can also enhance the pace of blockchain development in industries that are traditionally highly confidential such as healthcare or defense. Zama’s testnet went live in June and the funding will help expansion and adoption efforts ahead of their mainnet launch.

Scalable Capital, a European wealth management platform, raised $176.5 million in an undisclosed round led by Sofina and Noteus Partners. The funding round brings its total funding to over $500 million. Traditional wealth management has been gated by high fees, steep minimums, and complex processes which limit the average person’s opportunity to benefit. Scalable capital is working to change that by stripping unnecessary costs, simplifying the process, and offering institutional grade risk management, as they strive to become the largest retail investment platform in Europe. Scalable Capital has recognized crypto’s role in a portfolio, which has largely been ignored by traditional wealth managers. Scalable’s platform allows users to invest in crypto assets and receive staking rewards from eligible assets. Scalable also allows its users to trade crypto ETPs. Scalable also just launched private equity trading, an asset class that is typically only accessible by professional investors. Scalable Capital has over a million clients across Germany, Austria, Italy, France and Spain and manages over $30 billion in assets. The funding will be used to improve Scalable Capital’s technology and introduce new features such as setting up portfolios for children.