Crypto Hardware Has Room for Improvement

March Recap

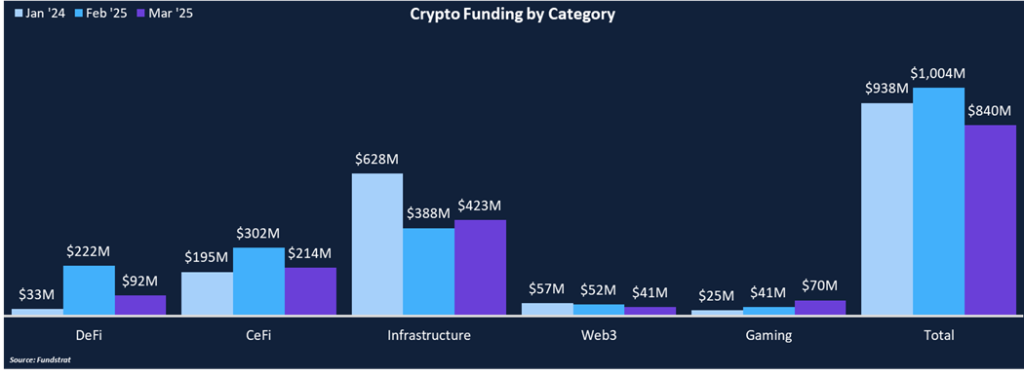

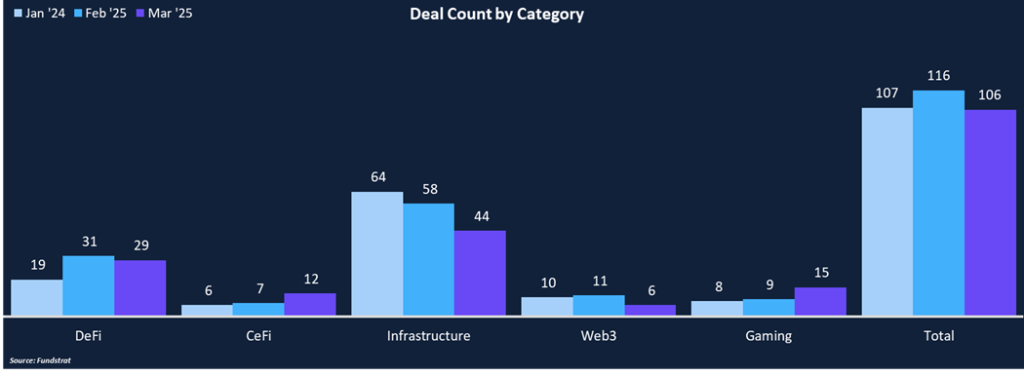

March showed declines in private funding activity and represented the lowest monthly total for the first quarter. Total funding fell 16% from February’s $1 billion to $840 million, while total deal count dropped 9% from 116 to 106. Infrastructure was the leading category, representing 50% of funding and 42% of all deals. There have been more CeFi deals to start 2025, with 25 through the first quarter compared to 73 for all of 2024. CeFi was the second most funded category in March, which included Mesh’s $82 million Extended Series B round, the largest deal in March. Web3 and Gaming deals continue to underperform, with the two categories collectively representing 13% of funding and 20% of deal flow.

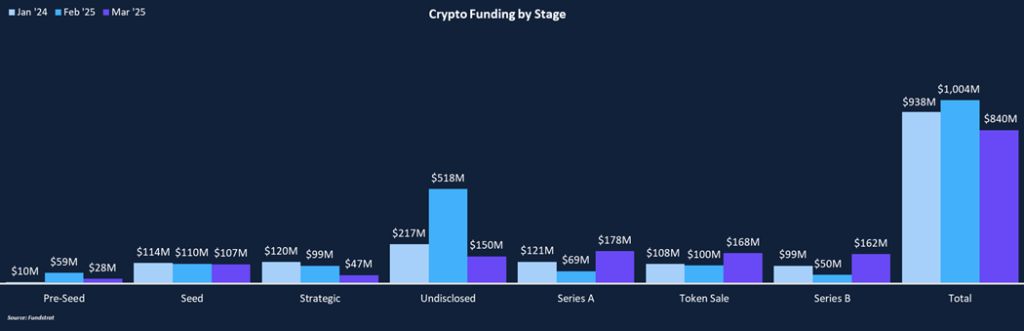

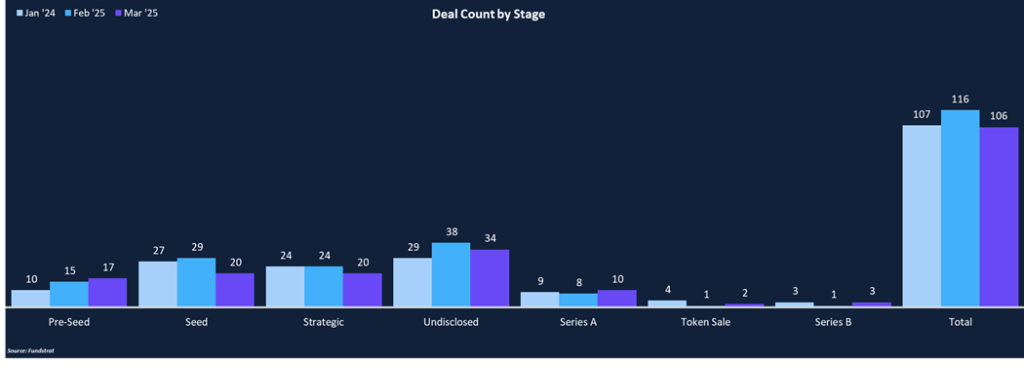

Funding was relatively evenly distributed across deal stages, with four out of six deal stages (not including undisclosed) totaling more than $100 million in funding. Series A was the most funded category, totaling $178 million across 10 deals. Pre-Seed and Strategic rounds lagged from a funding perspective, representing 3% and 7% of total funding, respectively, but they accounted for larger percentages of total deal count at 16% and 19%.

Funding by Category

Funding by Stage

Deal of the Month

DoubleZero, a global fiber network for high performance distributed systems and blockchains, raised $28 million in a token sale from DragonFly Capital and Multicoin Capital. Other investors included Foundation Capital, Borderless Capital, Frictionless, DBA, and others. The token sale valued DoubleZero at $400 million. DoubleZero is striving to create a new internet to bring high-performance networking and hardware acceleration to crypto.

Why is This Deal of the Month?

Fiber-optic cables are the backbone of the global internet. They can transmit large amounts of data at extremely fast speeds, with networks spanning oceans to connect the globe. The Atlantic Council estimates that 95% of international internet traffic is transmitted through subsea fiber-optic cables.

DoubleZero is creating the first dedicated physical infrastructure layer for blockchain communication, addressing the fundamental bottleneck that software alone cannot solve. By combining fiber links run by independent contributors with edge-filtering hardware in a permissionless network, DoubleZero enables blockchain systems to achieve dramatically higher performance without sacrificing decentralization and maintaining crypto economic security guarantees. DoubleZero taps into excess subsea cable capacity to create dedicated highways for distributed systems, slashing latency and boosting global bandwidth. DoubleZero’s fiber contributors are mostly data centers, enterprises with private connections, or telecom companies with underutilized fiber. The network currently spans 17 cities across 12 countries.

In addition to hardware, DoubleZero hopes to optimize data flow for node operators. The DoubleZero network has a dual-ring architecture design: a filter ring and an execution ring. The filter ring provides custom filtering technology that eliminates 70% of spam traffic, freeing validators to focus on legitimate transactions. The execution ring optimizes network pathways to deliver pre-validated transactions at unprecedented speeds, bypassing public internet bottlenecks. DoubleZero refers to itself as the world’s first N1 (not an L1 or L2), the base network infrastructure layer for distributed systems. The funding will be used to expand the team across different business functions and accelerate product development.

Selected Deals

Mesh, a stablecoin payments company, raised $82M in a Series B round led by Paradigm, with participation from Consensys, QuantumLight, Yolo Investments, and others. The fresh funding brings Mesh’s total funding to $120 million. The investment round was one of the first to be entirely facilitated through Paypal USD (PYUSD). Mesh is on a mission to allow users to pay for everyday things with any crypto they hold while ensuring merchants can settle in the stablecoin of their choice, similar to how fiat payments are handled. Mesh’s proprietary SmartFunding technology allows for immediate conversion of assets like BTC, ETH, and SOL into stablecoins, allowing consumers to use the payment of their choice and merchants to receive stablecoins. Mesh supports over 40 different assets across 15 different blockchains. Customers can connect to popular exchanges and wallets to send assets directly to merchants’ platforms. Customers don’t need to leave the merchant’s website, utilize APIs, or copy and paste send addresses. Mesh has partnered with many major companies like Revolut, Paypal, MetaMask, and others to make its technology available to over 400 million users in over 100 countries. The funding will be used to accelerate its product development and expand into more payments platforms.

Walrus, a data storage and delivery platform built on Sui, completed a $140 million private token sale led by Standard Crypto, with participation from a16z, Electric Capital, Creditcoin, Franklin Templeton, and others. Walrus was originally developed by Mysten Labs and allows any application to publish, read, and program large data files. Walrus has innovated on traditional storage networks with its Red Stuff encoding algorithm, which breaks data into slivers for efficient storage and allows for faster data access, increased resiliency, and scalability. Proof of availability is established upfront and confirmed via random challenges to reduce the costs of proving file storage availability. Blobs and storage capacity are stored as objects on Sui, allowing tokenized storage to be leveraged as resources within smart contracts. Walrus mainnet launched last week, allowing applications to leverage stored data ranging from AI datasets, rich media files, websites, blockchain history, and more. Applications built on Walrus can leverage both on-chain and off-chain data files, ensuring that data is supported during the entire storage lifecycle. Walrus is poised to accelerate the adoption of programmable storage, driving innovation across industries that rely on secure and interactive data management. Walrus plans to utilize the funding to expand and maintain its decentralized data storage platform and advance further development.

FlowDesk, a crypto trading and market-making firm, raised $52 million in an extended Series B round. Approximately 80% of the funding was equity, while the remaining 20% was structured as debt. HV Capital led the equity portion with participation from Eurazeo, Cathay Innovation, and ISAI VC, while the debt portion came from accounts managed by Blackrock. FlowDesk raised $50 million last year in its initial Series B offering, which valued the firm at over $250 million. FlowDesk provides trading services, market making, liquidity provisioning, OTC trading, and brokerage and treasury management. FlowDesk is integrated across more than 10 chains, 140+ CEX and DEXs, and offers more than 1,000 trading pairs. FlowDesk stated that their revenue grew eightfold in 2024, and they hope to continue growing. FlowDesk will use the fresh funding to capitalize on tokenization opportunities and expand its OTC derivatives business. FlowDesk has plans to open a crypto credit desk and disrupt the centralized lending sector. The credit desk would facilitate borrowing and lending at competitive rates and provide collateralized loans for HNI against Bitcoin or other assets. Lastly, the funding will help support Flowdesk in doubling its 140+ person workforce and opening a UAE-based office, adding to its Singapore, France, and U.S. offices.