Spotlight on Security

Monthly Recap

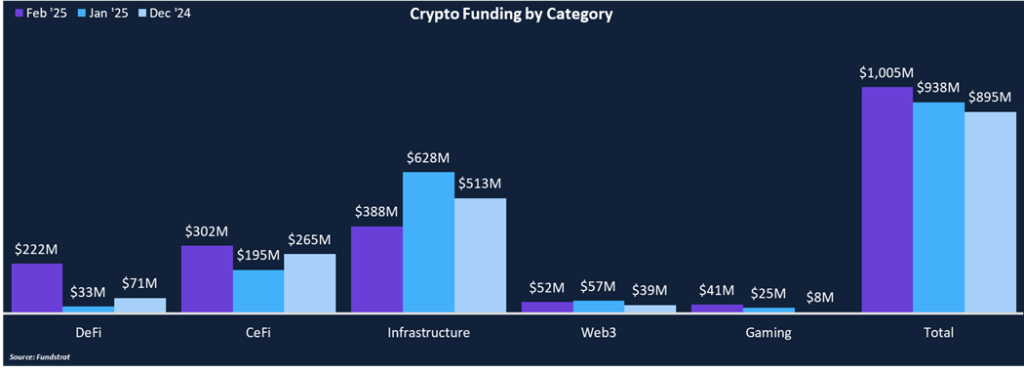

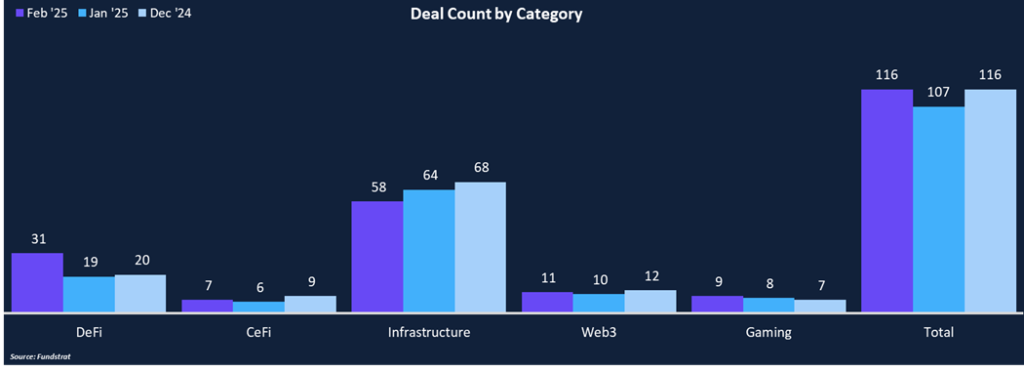

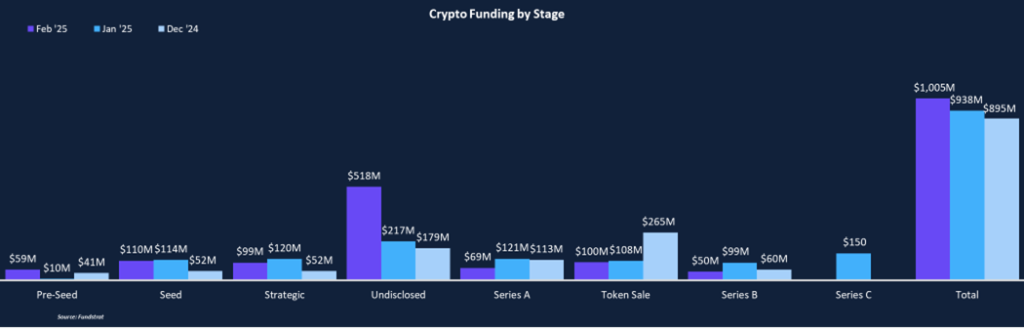

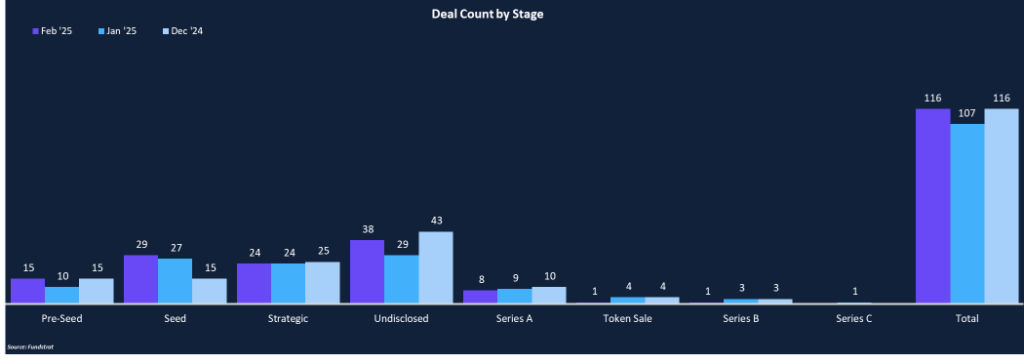

February showed a modest increase in funding amount and deal count compared to January. Total funding rose 7% to $1 billion, and deal count increased 8% to 116 deals. Infrastructure was the leading category, with $388 million raised across 58 deals. CeFi has had its third consecutive month of nine-figure investment with less than 10 deals. The largest raise in February was a $200 million undisclosed round completed by Figure (CeFi), a consumer lending company founded by former SoFi executive Mike Cagney. Most of Figure’s business is via traditional consumer lending products, but they have a growing crypto product allowing users to borrow against their Bitcoin or Ethereum holdings. Hype surrounding Web3 and Gaming companies has faded in recent months, with both categories collectively comprising 8% of total funding in the last three months. From a deal stage standpoint, trends have been relatively consistent over the previous three months. Seed rounds continue to be the most popular, comprising 11% of funding and 25% of deal count.

Funding by Category

Funding by Stage

Deal of the Month

Blockaid, a crypto security firm, raised $50 million in a Series B round led by Ribbit Capital, with participation from Google Ventures, Variant, and Cyberstarts. Blockaid provides end-to-end on-chain security and is one of the only platforms that detects and responds to fraud, scams, financial risks, and smart contract exploits in real time. Blockaid will use the capital to fund operational growth, research, and development.

Why is This Deal of the Month?

Hacks and exploits have been a recurring problem for crypto protocols and exchanges and remain at the forefront of people’s minds, considering Bybit recently suffered a $1.5 billion exploit (explained by Blockaid here). Chainalysis data shows that $2.2 billion was stolen by crypto hackers in 2024, a 21% year-over-year increase. The Bybit hack alone equates to 68% of 2024’s total, emphasizing the need for innovative security solutions for exchanges and protocols.

As an end-to-end security platform, Blockaid provides operational security, end-user protection, on-chain asset security, and crypto fraud detection. Blockaid indexes on-chain data and applies advanced machine learning, artificial intelligence, and clustering algorithms to detect similarities in patterns, bytecode, and other on-chain activity associated with threats. Additionally, Blockaid is equipped to protect against crypto fraud with out-of-the-box AML and OFAC compliance solutions, ACH and wire transfer monitoring, transaction blocking, and real-time compliance alerts.

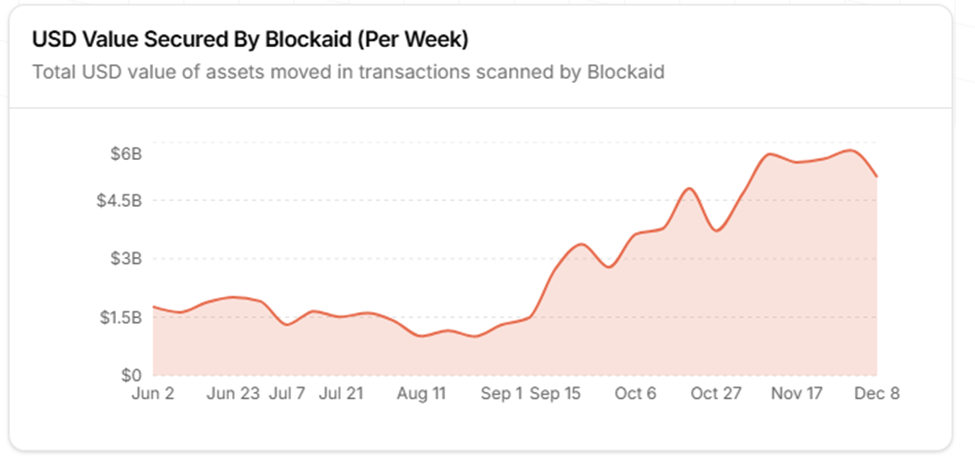

With such a comprehensive security platform, Blockaid has been integrated with some of the most popular wallet providers and dapps, including Coinbase, Metamask, Opensea, Lido, Uniswap, and more, giving them large amounts of transaction data to scan in real time. Blockaid has seen a significant rise in its total secured assets as more and more protocols begin leveraging Blockaid’s services.

Cumulatively, Blockaid has scanned over 2.4 billion transactions, secured over $101 billion in assets, prevented 71 million attacks, and averted over $5.3 billion in losses. Blockaid leadership believes they can prevent hundreds of millions of incidents in 2025.

Selected Deals

Defi.App, a consumer crypto super-app, raised $2 million in an extended seed round led by Mechanism Capital, with participation from Selini Capital, North Rock Digital, and others. The funding round valued Defi.App at $100 million. Defi.App was founded in 2023 with the goal of simplifying defi for consumers while still maintaining custody of assets. The user experience for defi users is still very cumbersome with multiple steps needed to complete simple actions. DeFi.App allows users to buy tokens across various chains with one click on their mobile app. Additionally, users can access derivative and yield markets. There is no need for gas fees or bridges. Defi.App abstracts away the complexities of defi and provides an experience more akin to Robinhood or Public. Defi.App has gone live with its beta application and hopes to launch the full version in the first half of this year, along with their token, HOME.

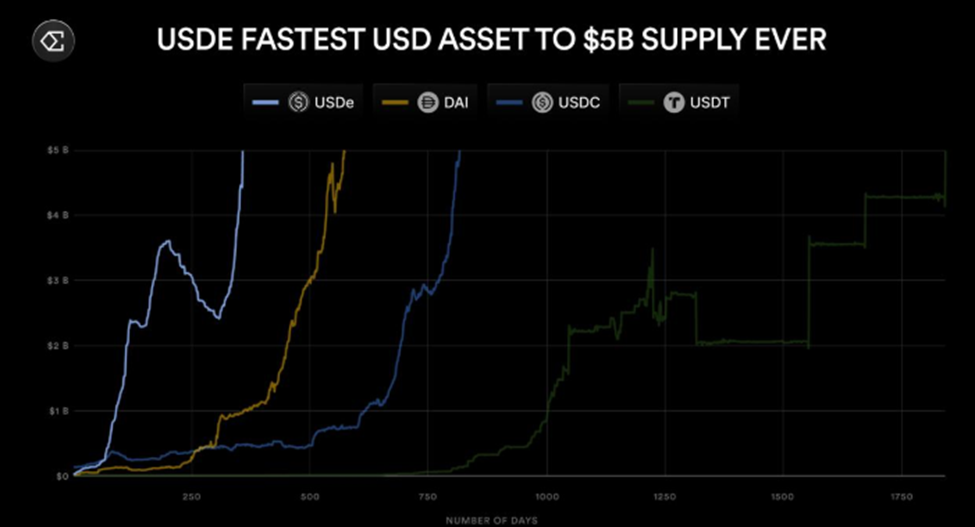

Ethena Labs, the development company behind Ethena, a stablecoin protocol, raised $100 million via a private sale of its native token, ENA. The round included prominent investors such as Polychain Capital, Dragonfly Capital, Pantera Capital, Franklin Templeton, F-Prime Capital, and a Fidelity-affiliated venture capital firm. The sale was completed at $0.40 per ENA, slightly below current price levels. As a reminder, Ethena allows users to deposit different collateral options, such as ETH or stETH, in return for minting their stablecoin, USDe. Ethena then opens a derivatives short position to remain delta neutral and collect funding fees. Users can stake their USDe and collect the funding fees. Ethena’s traction has been very impressive, becoming the fastest stablecoin protocol to reach 5 billion in total supply.

Ethena has expressed its intentions to move into institutional finance, and adding prominent backers such as Franklin Templeton ahead of its iUSDe launch will likely be beneficial. iUSDe is a wrapped version of staked USDe, which includes additional transfer restrictions at the token level, making it more practical for traditional finance institutions to hold. Ethena projects that iUSDe could provide up to $10 billion in additional capital to the protocol and could serve as a key bridge between crypto and traditional finance.

Raise, a leader in the global gift market and pioneer in blockchain-powered payments and loyalty, raised $63 million in a Strategic round led by Haun Ventures. Other investors included Amber Group, Anagram, Blackpine, Borderless Capital, GSR, and others. The funding round brings Raise’s total funding to over $220 million. With global gift card sales projected to exceed 2.3 trillion by 2030, gift cards have evolved beyond simple transactional tools and have become an integral component of the modern retail ecosystem. Raise’s mission is to redefine gift cards as a secure, fully programmable retail currency that strengthens trust and fosters deeper engagement between brands and customers. Raise’s blockchain initiatives kicked off this year with integrations of their mobile app with leading crypto wallet providers. Raise will use the funding to develop its proprietary blockchain-backed gift card program, Smart Cards, and expand Retail Alliance Foundation, its non-profit coalition dedicated to uniting global retailers and brands to create a more secure, interoperable, and fraud-resistant gift card network.

Raise has already facilitated over $5 billion in transactions for its nearly 7 million users and 1,000+ retail partnerships and believes blockchain powered gift cards are the next evolution for how to continue serving customers.