2024 Funding Recap

Jan 17, 2025

Author

Key Takeaways

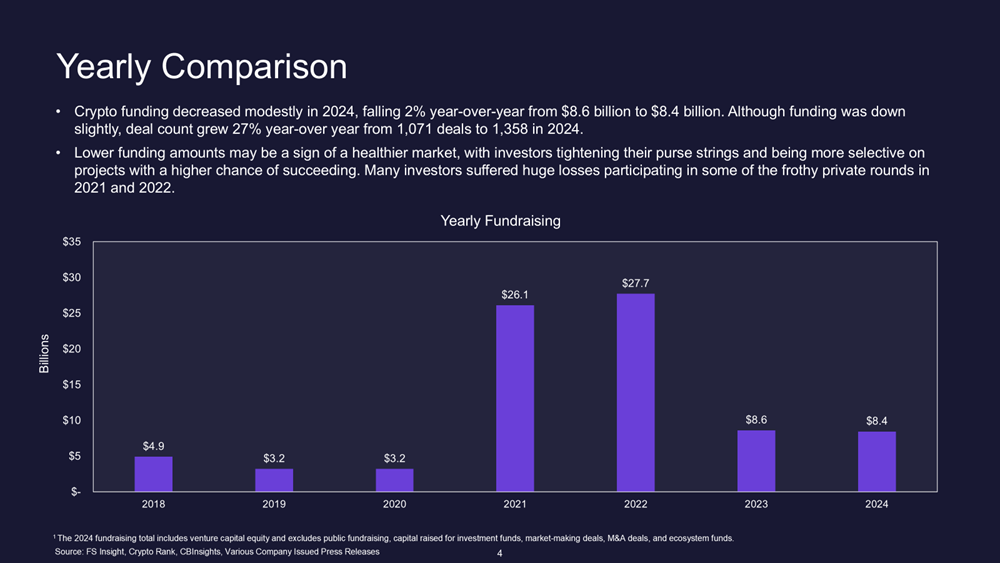

- Funding Down, Deal Count Up: Crypto funding decreased modestly in 2024, falling 2% year-over-year from $8.6 billion to $8.4 billion. Although funding was down slightly, deal count grew 27% year-over year from 1,071 deals to 1,358.

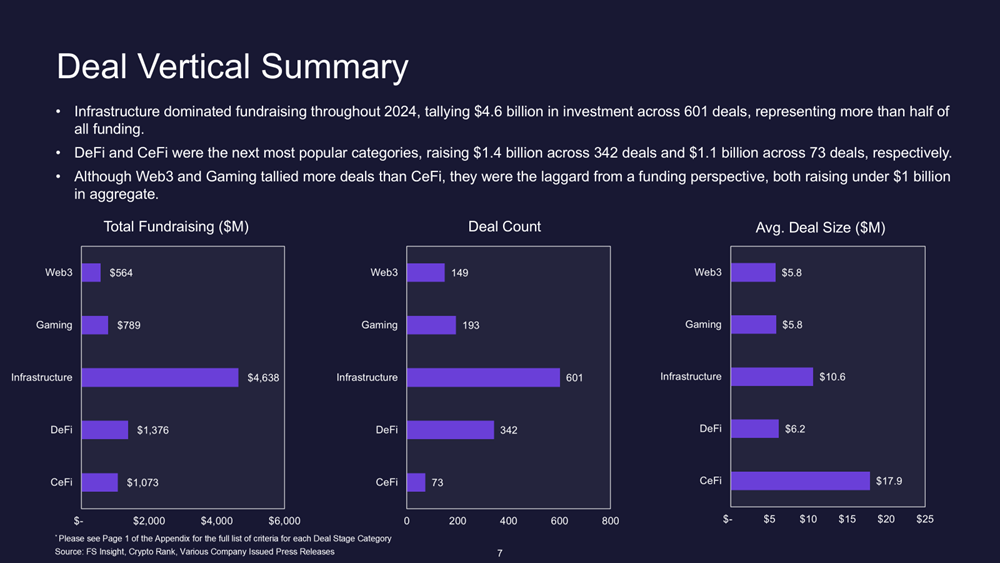

- Infrastructure Remains King: Infrastructure dominated fundraising throughout 2024, tallying $4.6 billion in investment across 601 deals, representing more than half of all funding.

- Unicorns Concentrated in Infrastructure Plays: The two largest valuations in 2024 came from layer-1 blockchains, Monad and Berachain. There were six companies that achieved unicorn status, with all of them falling into the Infrastructure category, with the exception of Hashkey Group (CeFi).

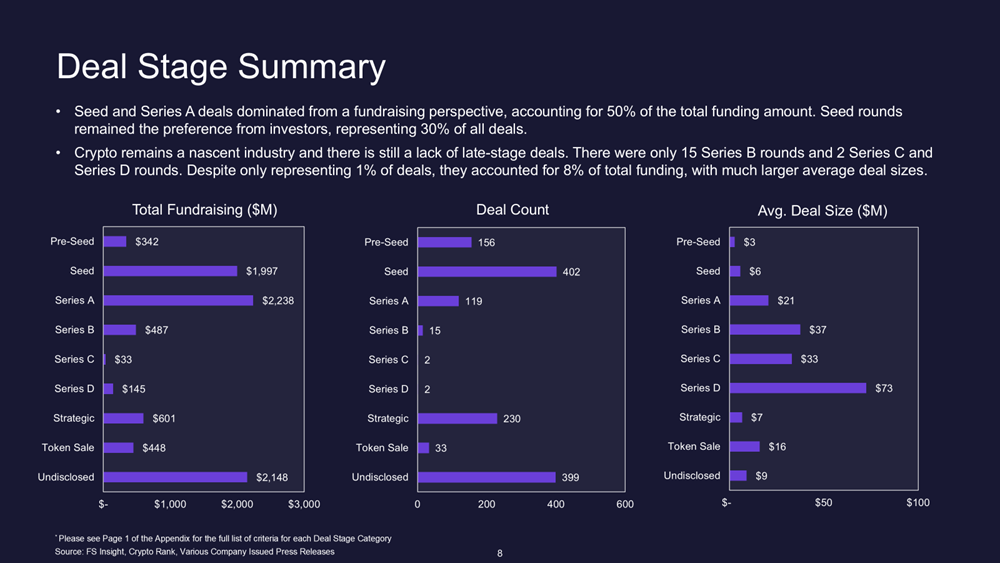

- Seed & Series A are Preferred: Seed and Series A deals were preferred in 2024, accounting for 50% of the total funding amount. Seed rounds were the most popular deal stage for the third year in a row, representing 30% of all deals.

- Private Market Trends: Common themes throughout 2024 included artificial intelligence, data solutions, and intents-based projects. All three categories are beginning to converge within the DeFai movement as AI agents begin transacting on-chain on behalf of users.

Click HERE for the full report.

Key Slides:

Yearly Comparison

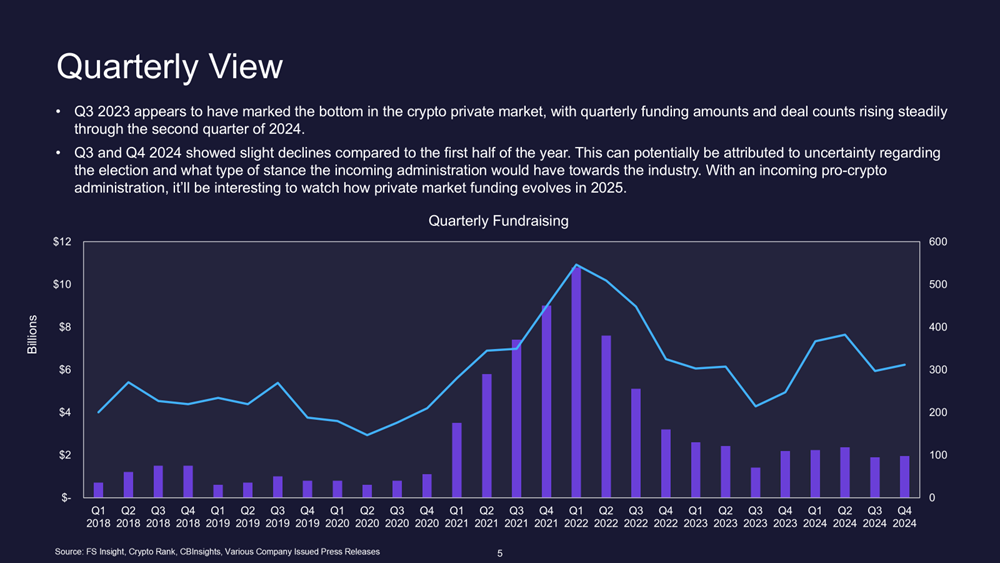

Quarterly View

Deal Vertical Summary

Deal Stage Summary

Largest Valuations