Muted Funding During the Holidays

Weekly Recap

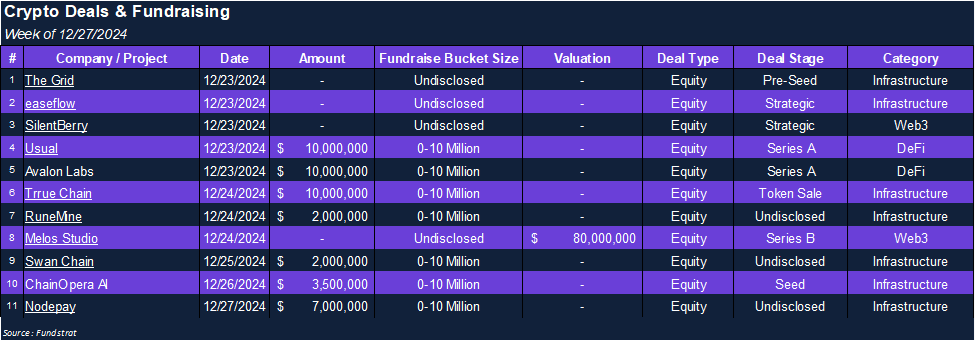

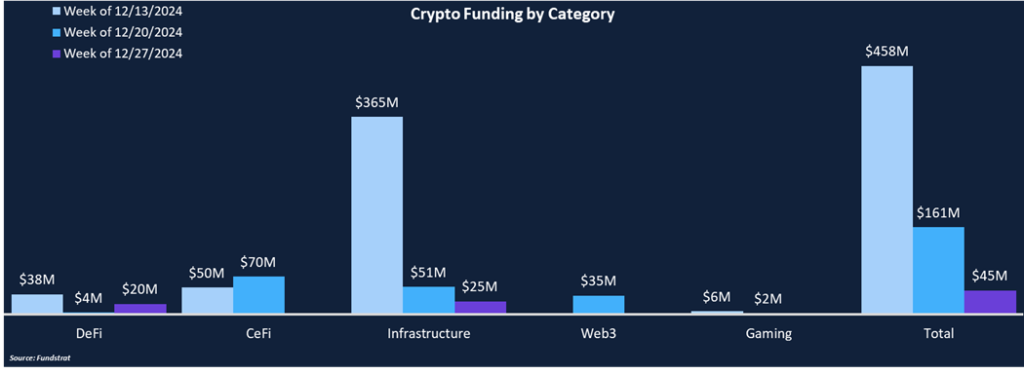

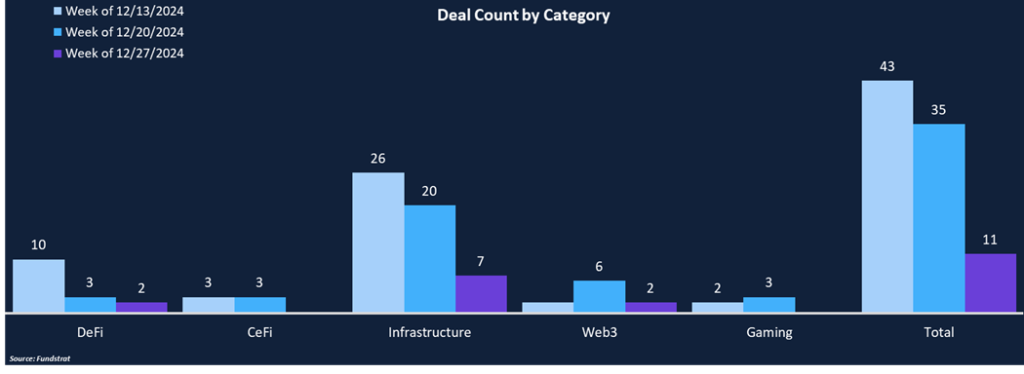

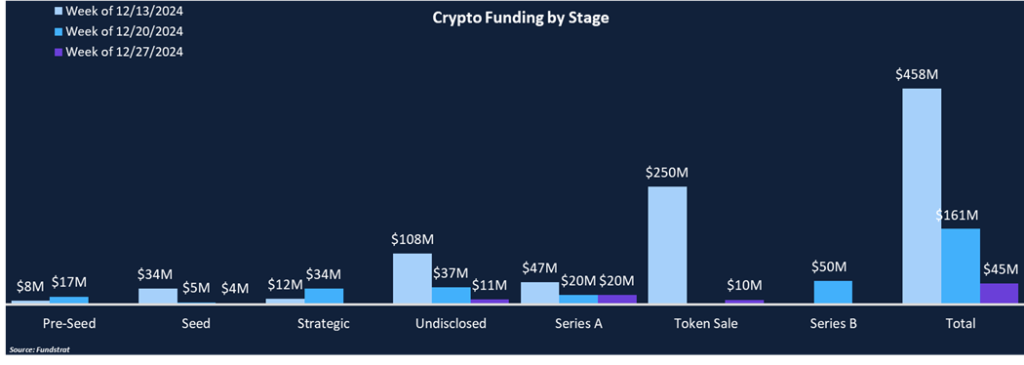

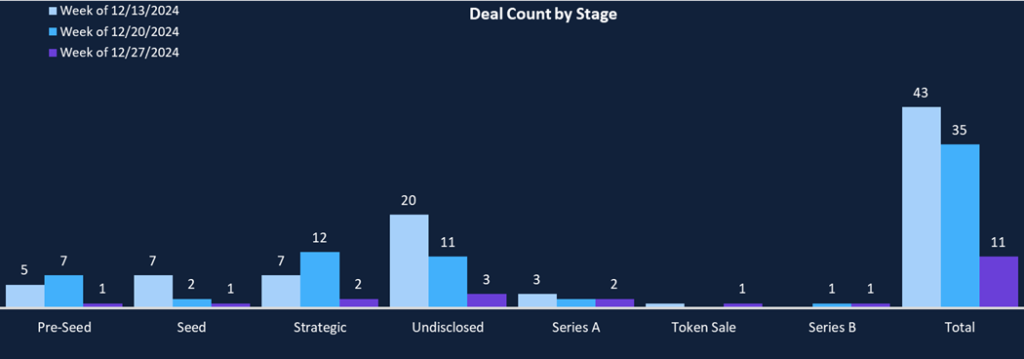

As expected, funding totals during the holidays were comparatively low. Both total funding and deal count fell by approximately 70%. There were 11 deals this week totaling $45 million in funding. All disclosed funding amounts fell into the Infrastructure and DeFi categories, while Web3 tallied two deals for undisclosed amounts. Infrastructure-led deal counts among categories (7), and there were no CeFi or Gaming deals to end the year. Funding was concentrated in Series A rounds with two $10 million investments into Usual and Avalon Labs (both DeFi). Although Q4 funding looked bleak through October and November, there was a rebound in December, totaling about $900 million (nearly double November’s amount), bringing the Q4 total to $1.95 billion across 307 deals.

Funding by Category

Funding by Stage

Deal of the Week

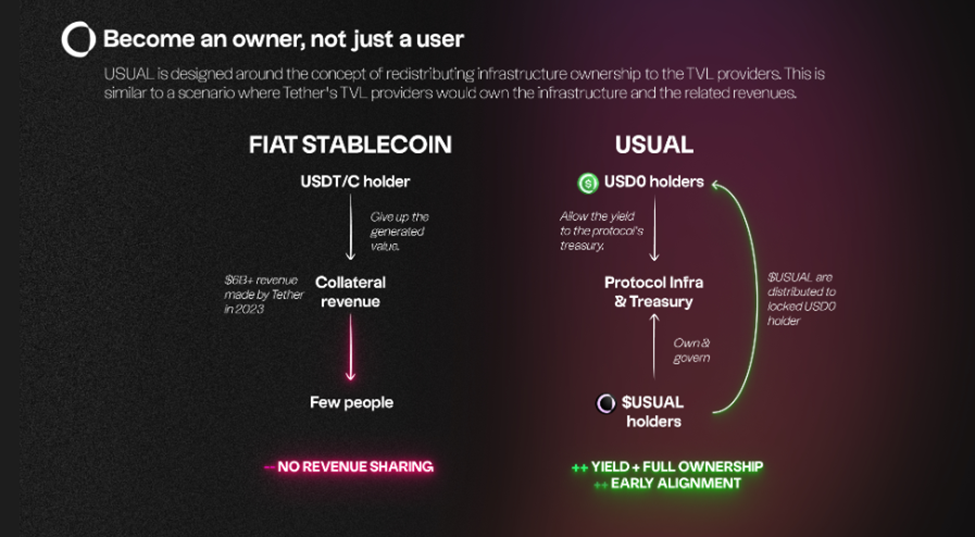

Usual, a decentralized stablecoin protocol, raised $10 million in a Series A round led by Binance Labs and Kraken Ventures. Other investors included Ethena, Galaxy Digital, M^0, Ondo, GSR, Wintermute, and others. Usual is a decentralized fiat-backed stablecoin issuer that redistributes value and ownership to users through its native token USUAL.

Why is This Deal of the Week?

The two largest stablecoins are Tether and USDC, both of which are issued by centralized providers who reap the benefits of their products and distribute limited value back to users. Usual is aiming to change this dynamic by giving users control of the protocol, with 90% of protocol revenue going directly to the Usual community. Usual is creating a new, equitable approach to stablecoins and token-based finance.

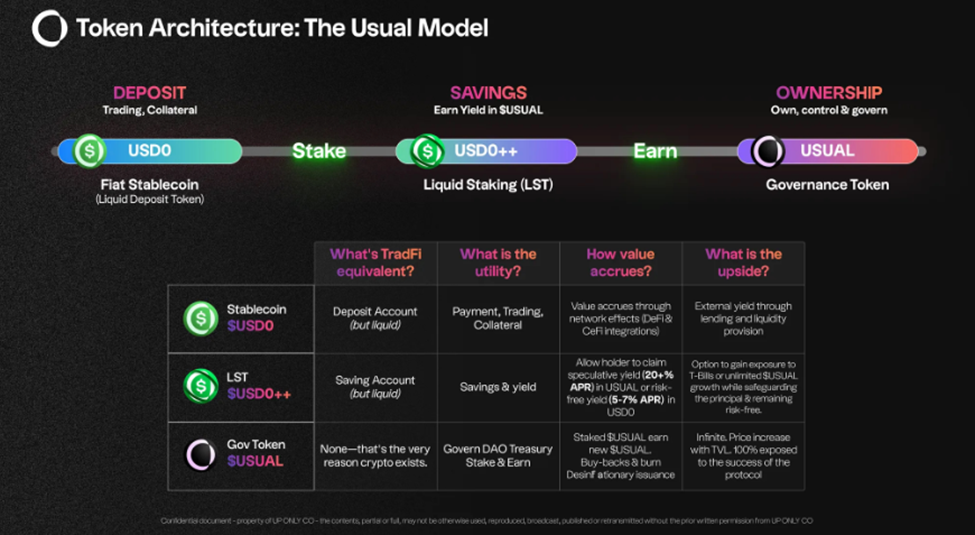

Usual’s protocol is comprised of three different tokens: USD0, USD0++, and USUAL.

- USD0 is a fully collateralized fiat stablecoin leveraging tokenized US Treasury products, providing a reliable, safe, and secure stablecoin redeemable for high-quality RWAs.

- USD0++ is a liquid staking token of USD0. Users can lock their USD0 for four years in return for the underlying collateral yield plus additional USUAL rewards. USD0++ is fully transferable and tradable on secondary markets.

- USUAL is the protocol’s token, which can be staked for a percentage of all future Usual emissions and governance control over the Usual treasury. Usual emissions are directly correlated to protocol TVL growth, with emissions decreasing as TVL continues rising.

Usual’s growth since launching has been impressive. It added more than $1 billion in TVL in the last month, and its four-year revenue is projected to exceed $270 million. USD0 has expanded to the seventh largest stablecoin, and the Usual treasury has grown to over $17 million in the past few weeks. Current APYs for USD0++ are around 67%, and USUAL staking yields have been over 700%. Usual is working steadily to integrate USD0 and USD0++ into the broader DeFi ecosystem, with more than 50 integrations already.

Selected Deals

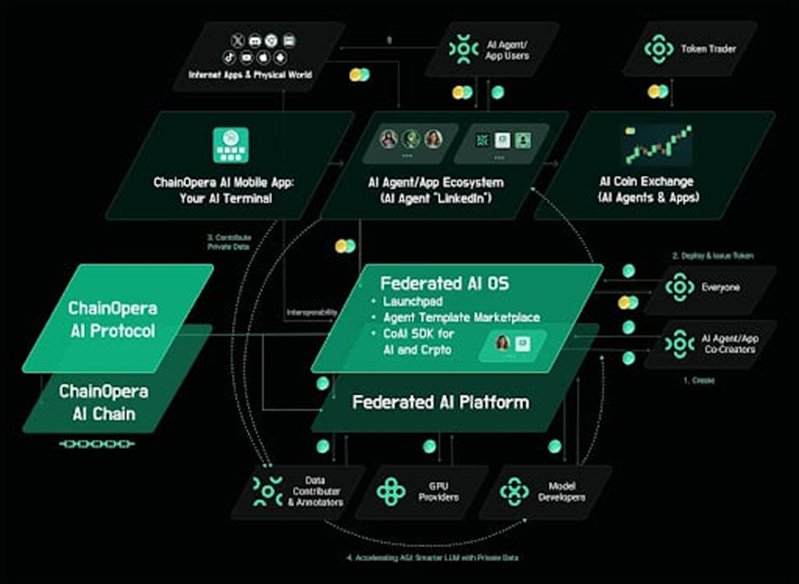

ChainOpera AI, an L1 and AI agent operating system, raised $3.5 million in a seed round led by Finality Capital, Road Capital, and IDG Capital, with participation from Camford VC, Amber Group, ABCDE Capital, and Modular Capital. The seed round brings ChainOpera’s total funding to $17 million. The ChainOpera ecosystem is comprised of its layer one network and artificial intelligence protocol. The AI protocol includes an operating system for deploying and managing AI agents, a federated AI platform for contributing AI resources (CPU/GPU, data, models, etc.), and its flagship AI agents and apps – particularly its AI Terminal mobile app, which showcases the power of its community-driven AI network. The fresh capital will be used to support the development of its AI ecosystem and support monetization, data sovereignty, privacy, and collaboration. The funds will position ChainOpera to create an innovative AI ecosystem with fair value distribution for all participants.

Nodepay, an AI training and development platform, raised $7 million in an undisclosed round from IDG Capital, Mythos, Elevate Ventures, Optic Capital, and others. Nodepay is building a decentralized platform for transforming unused internet bandwidth into real-time data pipelines for AI models. Users earn rewards for donating their spare bandwidth to Nodepay. The real-time data improves AI inference with accurate and timely information, known as Retrieval Augmented Generation (RAG). Nodepay’s platform uses RAG, a decentralized answer engine, and reinforcement learning for more accurate model outputs while democratizing the AI economy. Nodepay already has over 1.5 million active users in over 190 countries and plans to continue its expansion as a leader in the AI and blockchain industries. Users can begin contributing to the Nodepay network by downloading their mobile app and browser extension. Nodepay will use the funding to commercialize its infrastructure and prepare for its Solana launch.

Avalon Labs, the development company behind Avalon Finance, raised $10 million in a Series A round led by Framework Ventures, with participation from UTXO Management, Kenetic Capital, and Presto Labs. Avalon Finance is a liquidity hub for Bitcoin DeFi. Avalon facilitates fixed Bitcoin loans at 8%. Users can collateralize their Bitcoin positions in return for USDa, Avalon’s stablecoin. Additionally, Avalon supports cross-chain lending, CeDeFi lending, and restaking lending. Across all its products, Avalon has accumulated over $1.7 billion in TVL and more than 200,000 users. Avalon will use the funding to continue its mission of expanding Bitcoin’s value beyond a store of value and into a more productive asset.