Avax Fuels Jump in Funding

Weekly Recap

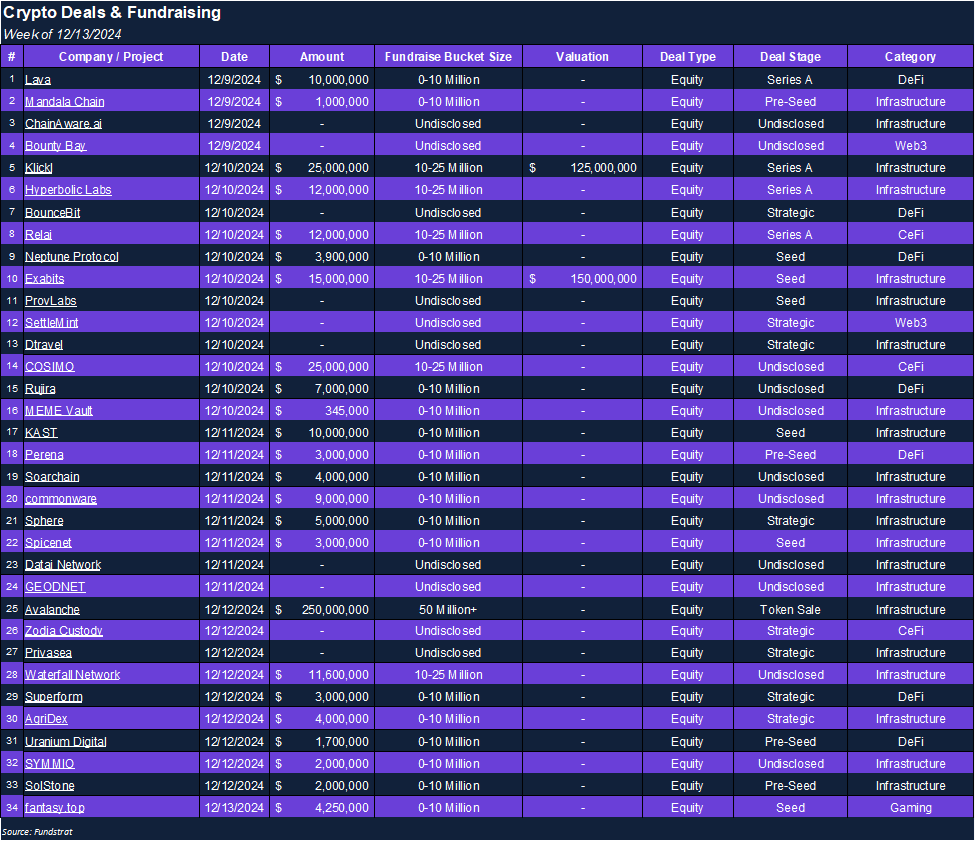

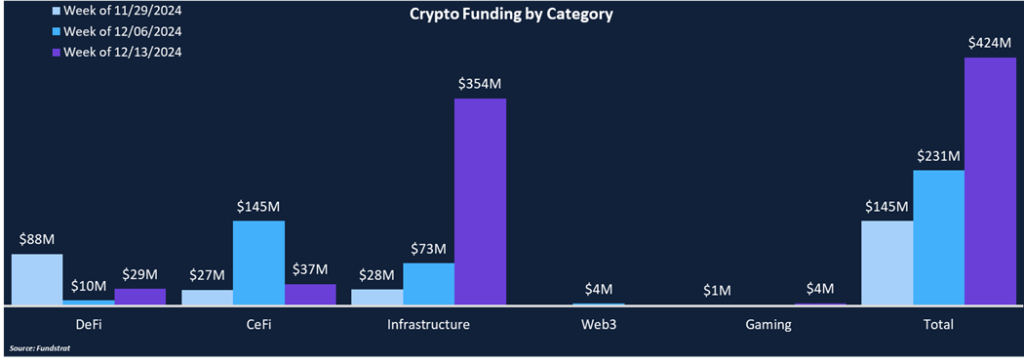

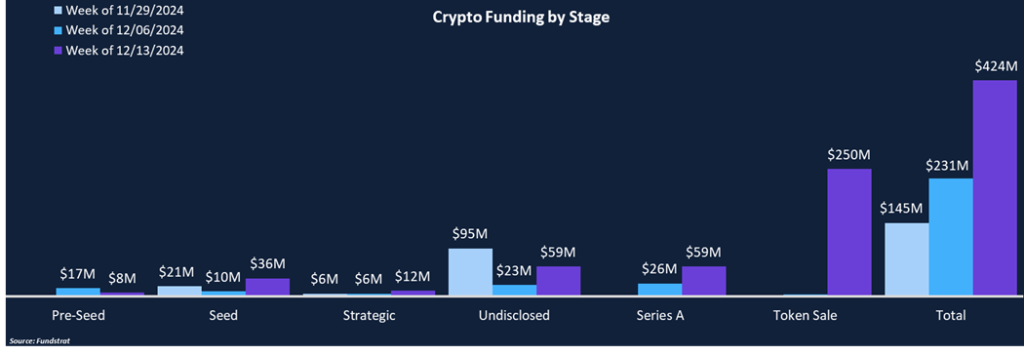

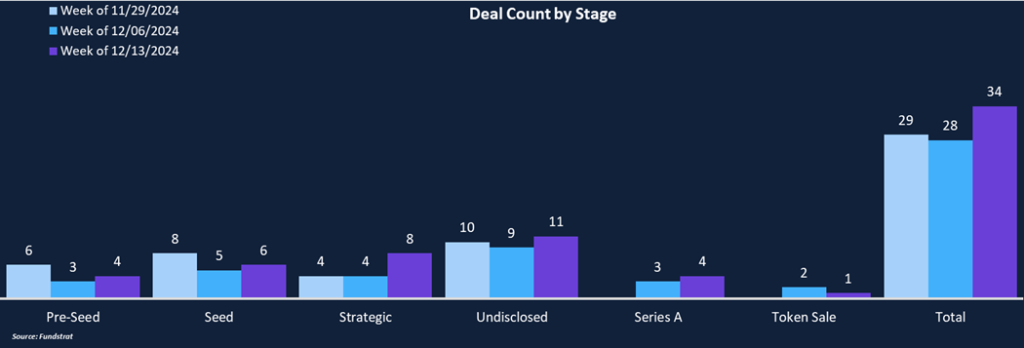

Crypto funding saw a large jump week-over-week, increasing 83% from $231 million to $424 million, and total deal count rose by 21% from 28 to 34. The large funding total was helped by a $250 million token sale completed by Avalanche ahead of its Avalanche9000 upgrade. Infrastructure dominated amongst categories, totaling $354 million across 21 deals, making up 84% of funding and 62% of total deal count. The last three weeks have shown an increase in CeFi funding, which has only been bested by Infrastructure. In contrast, Web3 and Gaming have seen minimal deal flow over the past month as investors may be focusing on picks and shovels in preparation of potential increased adoption in 2025.

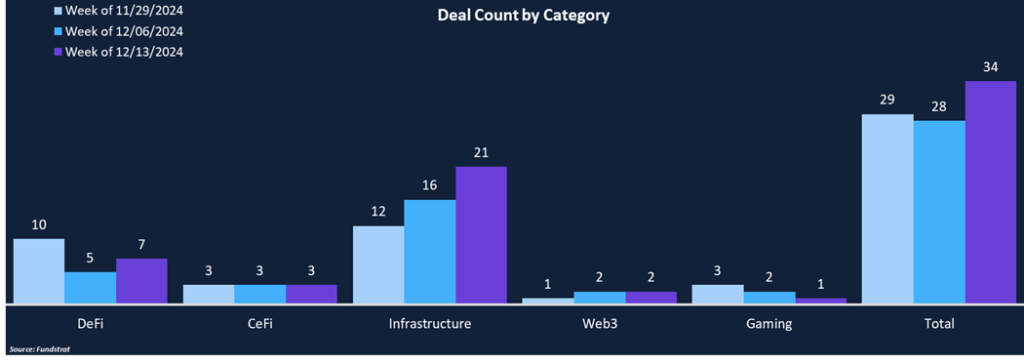

From a deal stage perspective, beyond Avax’s token sale, Series A had the most funding, totaling $59 million across four deals. Strategic rounds tallied the most deals (8) comprising 24% of total deal count, but only 3% of funding. Seed rounds were the second most popular, with six deals including Fantasy.Top’s $4.25 million fundraise, which was also the only Gaming deal this week.

Funding by Category

Funding by Stage

Deal of the Week

Commonware, a blockchain development company, raised $9 million in an undisclosed round co-led by DragonFly Capital and Haun Ventures. Commonware was founded by former Ava Labs executive Patrick O’Grady. Angel investors include Dan Romero, Smokey the Bera, Kevin Sekniqi, Andrew Huang, and others.

Why Is This Deal of the Week?

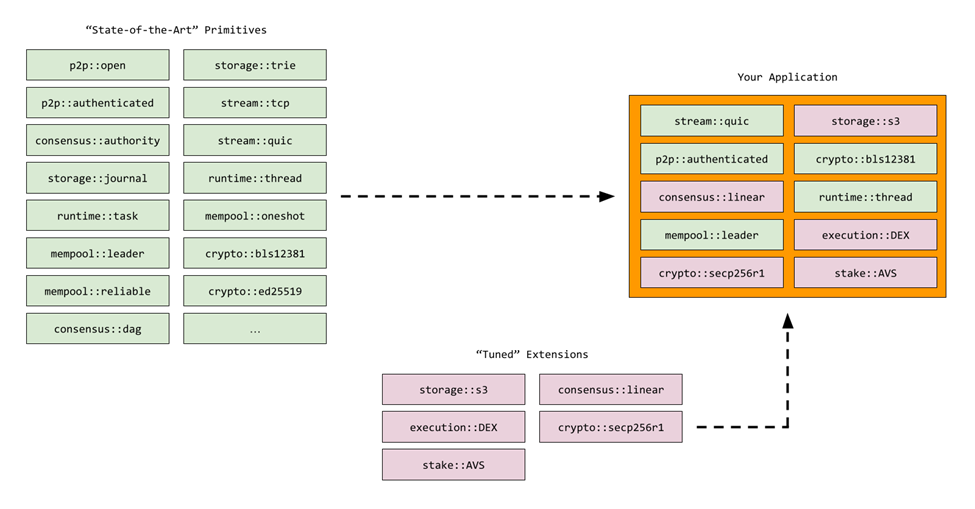

Today’s blockchain stack is designed to be a jack of all trades and is not purpose built for any specific task. Blockchains offer balanced interfaces to meet a broad range of developer needs. Developers are finding that general purpose solutions are limiting for specific applications and are shifting towards a preference to purpose-built solutions. Commonware has recognized the shifting tide and is building a new technology stack designed from the ground up that hopes to offer what other general-purpose frameworks cannot.

Commonware’s “anti-framework” is a development solution with no standards or predetermined assumptions. There are no explicit layers, specific security assumptions, hard coded block types, or finality definitions. It’s not a monolithic or modular solution, but instead can be used to build either. Commonware provides an open collection of primitives that can be designed to work together, be rearranged, augmented, or even rewritten without having to fork applications. The collection of primitives is known as “Commonware.” Commonware users can build from scratch or insert selected primitives into existing blockchains. Commonware has six primitives completed, including a primitive for person-to-person authentication and encryption communication between two public keys, verifiable randomness, and a new consensus dialect.

Commonware will use the funding to continue developing new primitives and is looking to onboard three teams to build applications using Commonware, all using different security assumptions.

Selected Deals

Klickl, a Middle Eastern bank and virtual asset service provider, raised $25 million in a Series A round co-led by Aptos and Web3Port, with participation from Summer Ventures, Heritage Horizon Capital, Alphasquare Group, and Heng Feng Group. The funding round brings Klickl’s valuation to $125 million. Klickl offers consumers a one-stop-shop platform for crypto with services including bank services, crypto payments, a brokerage platform, custody and wallet solutions, and a crypto exchange. Klickl offers a software-as-a-service solution for companies looking to dive into crypto. The Klickl SaaS is a complete blockchain franchise and crypto asset solution. It allows companies to start a crypto asset business seamlessly through its proprietary modular infrastructure stack. Klickl will use the fresh capital to focus on high-growth markets in the Middle East and Africa while channeling investments into the Klickl Web3 ecosystem. Klickl is striving to be more than just a bank and become a financial hub in the web3 universe.

Avalanche, a layer-1 network, raised $250 million in a locked OTC token sale, led by Galaxy Digital, Dragonfly Capital, and Parafi Capital. Over 40 investment firms participated in the raise, including Skybridge, SCB Limited, Big Brain Holdings, Chorus One, and others. The fundraising goal was to align with the correct strategic partners and to support the Avalanche9000 upgrade. Avalanche9000 is a significant upgrade to the network designed to drive scalable purpose-built subnets which all operate in parallel to the Avalanche mainchain. The Avalanche9000 upgrade should reduce development costs by 99.9% and transaction costs by more than 25 times. Avalanche9000 launched on testnet in November with over $40 million in incentives for developers. Avalanche has claimed that there are over 5,000 subnets already in development, spanning sectors like gaming, payments, defi, and tokenization. Avalanche9000 is expected to go live on mainnet in early 2025 and should help drive further activity to the Avalanche ecosystem, which has seen a steady increase in transactions over the course of the last three months.

Sphere Labs, a global payments network, raised $5 million in a strategic round with participation from Coinbase Ventures, Kraken Ventures, Anza, Anagram, Pyth and others. Sphere believes the end game of payments is not a single company, but a network of companies working together to transfer value. Sphere offers cross-border payments for businesses, high net worth individuals, and individuals. Sphere offers out of the box solutions to handle APIs and regulatory complexities. Users can setup wallets tied to their bank accounts and transfer between stablecoins and fiat currencies seamlessly. The Sphere API connects directly to banks to settle transfers in under a half hour. In addition to payments infrastructure, Sphere offers comprehensive analytics, AML and fraud detection, email notifications, all within a comprehensive dashboard. The funding will be used to invest in further regulatory compliance and risk management solutions.