Funding Declines During Election Week

Weekly Recap

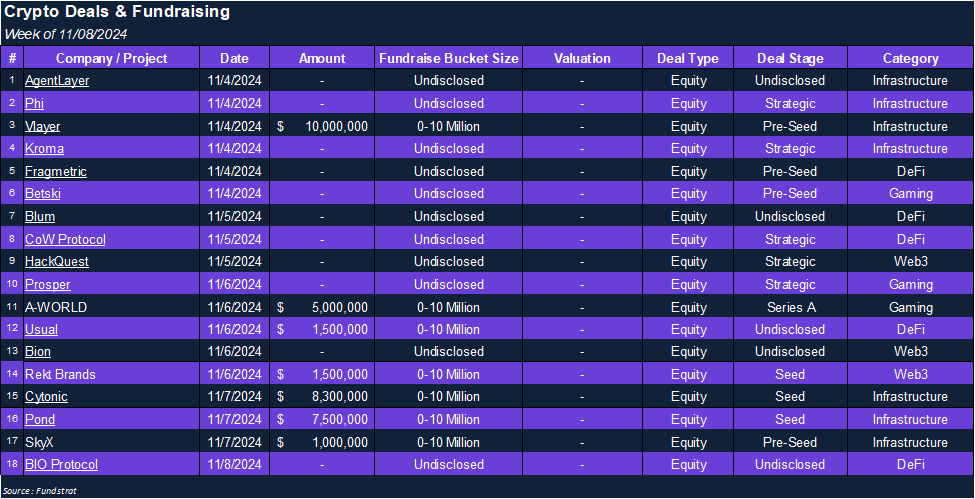

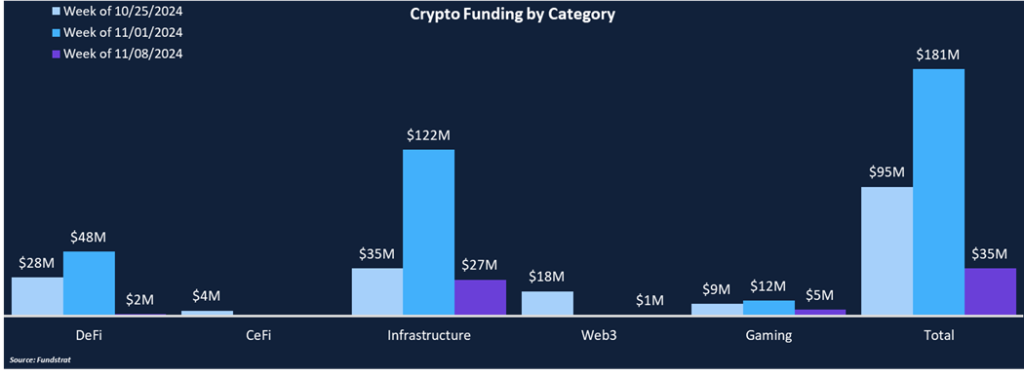

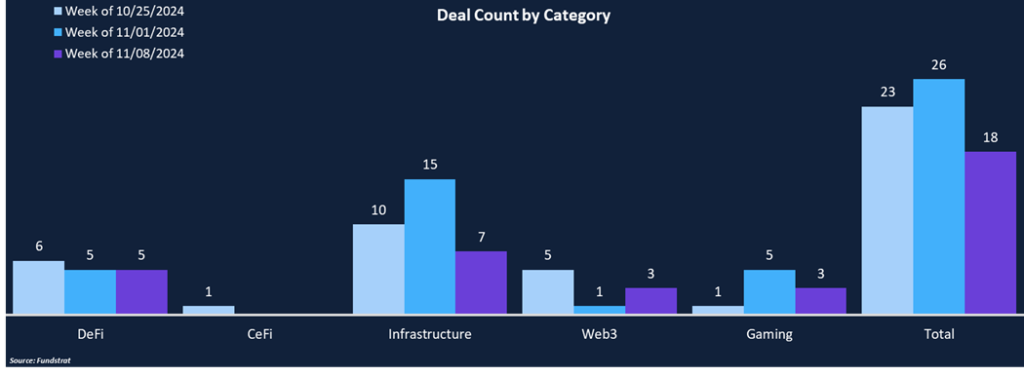

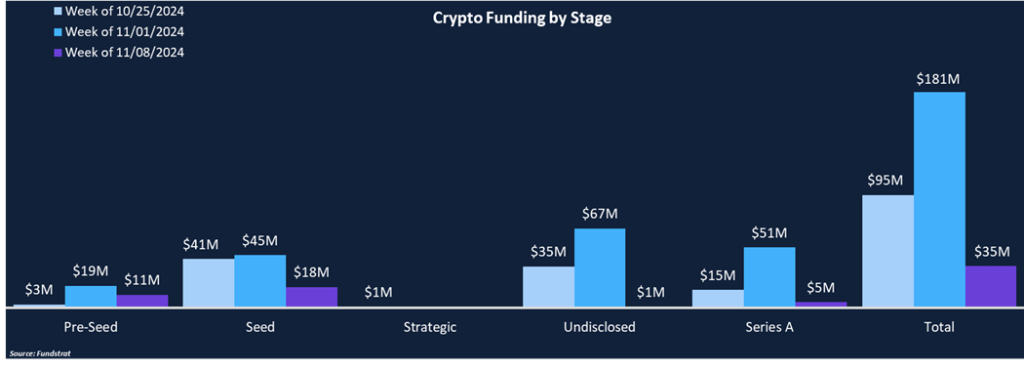

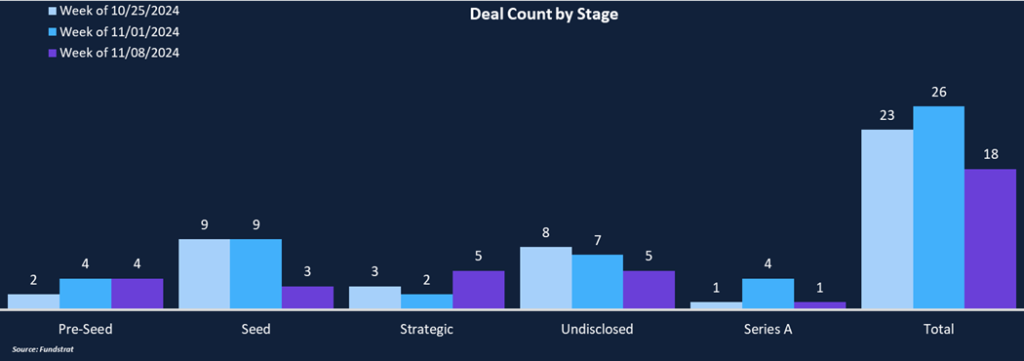

Weekly funding sharply declined, falling 81% from $181 million to $35 million, with total deal count dropping 31% from 26 to 18. The decreases can potentially be attributed to projects foregoing announcements in light of a week filled with U.S. election headlines. 77% of funding fell into the Infrastructure bucket, totaling $27 million across seven deals. Similarly, funding was concentrated in Pre-Seed and Seed deal stages, collectively comprising 82% of funding and 39% of total deal count. A-WORLD, a web3 game built on BNB Chain, represented the sole Series A round announced this week. They raised $5 million from IBGTG Capital and Sketch Ventures to continue developing their battle card game.

Funding by Category

Funding by Stage

Deal of the Week

Vlayer, a zk-infrastructure company, raised $10 million in a pre-seed round from a16z, BlockTower Capital, Credo Ventures, and others. A $10 million pre-seed round ties them for the second largest pre-seed round in 2024 and the third largest going back to 2023. Vlayer is creating “Solidity 2.0” to reduce industry bottlenecks and improve the developer experience.

Why Is This Deal of the Week?

Blockchain applications are largely a function of their underlying data infrastructure, and one of the notable limitations has been bottlenecks in integrating off-chain data into smart contracts. Vlayer recognizes the importance of legacy data integrations and ensuring the privacy and integrity of that data. As a verifiable infrastructure layer, Vlayer is hoping to enhance the developer experience and facilitate the efficient use of web2 and web3 data into smart contracts.

Vlayer’s enhanced smart contract infrastructure leverages advanced cryptography techniques like zk-proofs and multi-party computation (MPC) to ensure data is tamperproof and private. Vlayer introduces two new smart contracts: Prover and Verifier. Both are standard Solidity contracts with enhanced capabilities. Prover is the off-chain portion, which introduces four new transaction types:

- Time Travel – allows applications to interact with the EVM state at a specific block and execute functions in the current state.

- Teleport – allows applications to interact with multiple chains inside a single Solidity call.

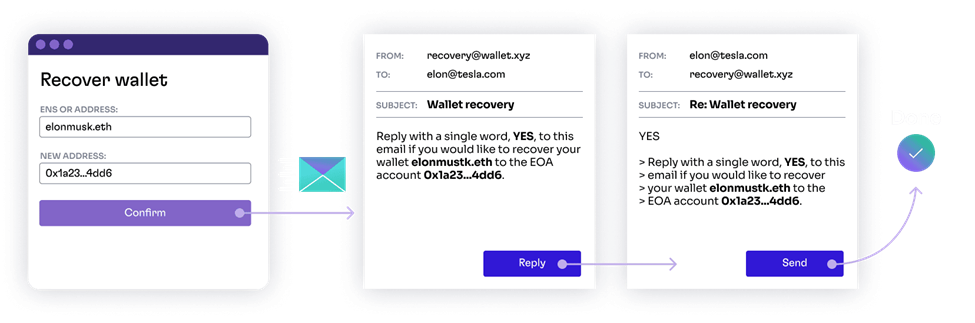

- Email Proofs (ZK Email) – verifies and integrates email content into on-chain applications.

- Web Proofs (zkTLS) – Scrapes and validates data from webpages or APIs to be used in smart contract executions.

Verifier subsequently takes arguments returned by Prover to execute on-chain transactions. The use cases for Vlayer are extensive as large amounts of useful data remain off-chain. For example, a wallet recovery function can be built on top of an Email Proof. A user can go through the traditional “forgot password” process by requesting a reset email, and if the email successfully passes the cryptographic proof, a smart contract can execute the wallet recovery.

This is one simplified use case, but the ability to bridge the gap between web2 and web3 data could result in a new wave of useful blockchain applications being built through Vlayer’s technology.

Selected Deals

Cytonic, a multi-chain execution layer, raised $8.3 million in a seed round led by Lemniscap and Lattice, with participation from Nomura, IOBC Capital, Lyrik Venture, Arthur Hayes, and others. Fragmentation of developer talent, liquidity, and users across chains has made it a competition across ecosystems to retain capital and attention. Many blockchains use different technology stacks such as the Ethereum Virtual Machine (EVM) or Solana Virtual Machine (SVM) making transaction processing or product development different across ecosystems. Cytonic’s MultiVM allows for a single node across different virtual machines, enabling Atomic Cross-VM Interoperability, allowing for cross-chain swaps between ERC, SPL, and BRC tokens. On the developer side, applications can be ported from one chain to another in a single click. Cytonic’s airdrop app launch is taking place this month, with testnet slated for December, and then mainnet beta launch in April 2025.

BIO, a decentralized science protocol, raised an undisclosed amount from Binance Labs. The BIO protocol decentralizes IP creation within the medical community, allowing scientists, patients, and investors to fund and develop initiatives through bioDAO’s. BIO’s network currently consists of seven DAOs on Ethereum. Goals across those bioDAOs span initiatives such as women’s health, hair loss, neurodegeneration treatment, and others. In addition to the funding announcement, BIO also initiated the second phase of its genesis token auction, already generating over $11 million in investments. The fresh capital will be used to expand its ecosystem and continue driving biotech innovation through decentralized funding and coordination.

AgentLayer, a decentralized AI agent network, raised an undisclosed amount from BingX. AgentLayer hopes to foster a symbiotic relationship with humanity and enhance productivity and creativity, supporting applications including chatbots, virtual assistants, and analytics, all of which can autonomously interact with other agents and end-users. AgentLayer’s components include AgentNetwork, a high-performance layer-2, AgentOS, a framework for zero-code AI agent deployment, AgentEx, a gateway for discovering and investing in AI agents, AgentLink, a set of protocols for agent communication and collaboration, and ModelHub, a collection of LLMs for agent development. The AGENT token is the currency of the economy, supporting transactions, governance, staking, and incentivizing ecosystem participation. AgentLayer has seen 4 million registered wallets, and its agent pages have accumulated 5.4 million in views.