Abstraction Layers Becoming Prevalent

Weekly Recap

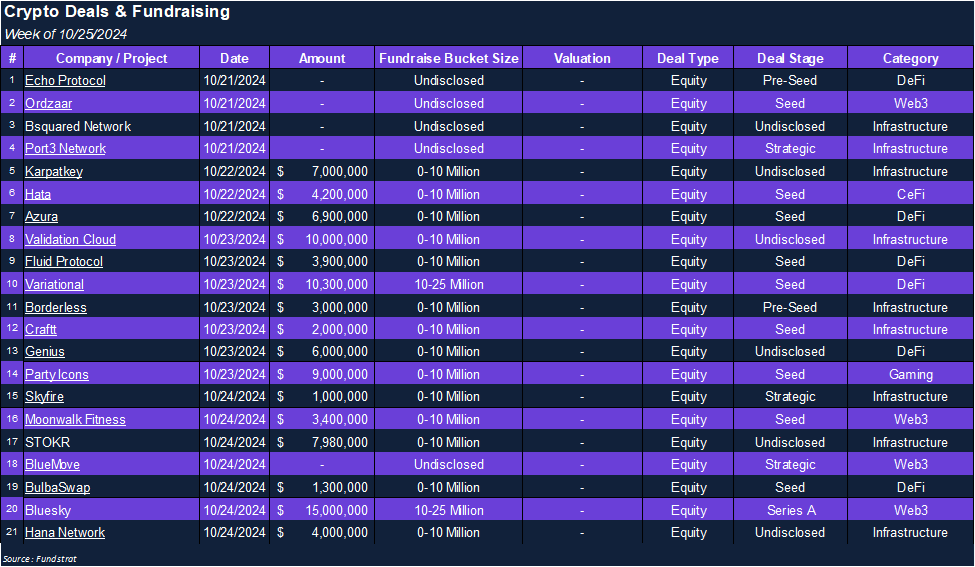

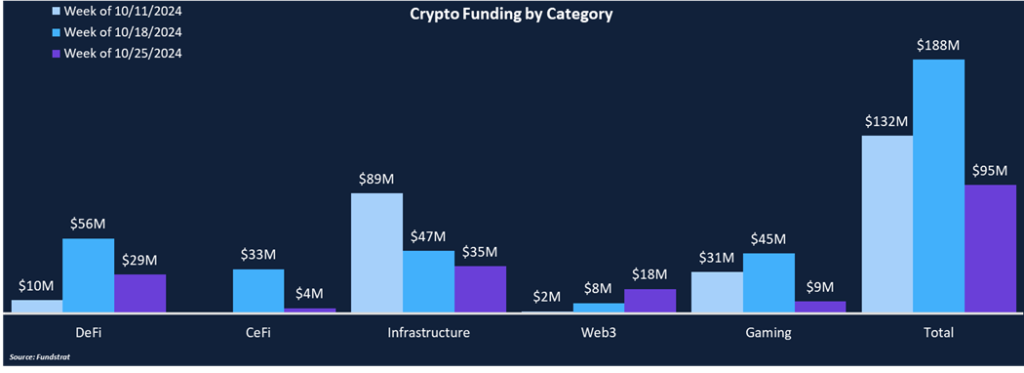

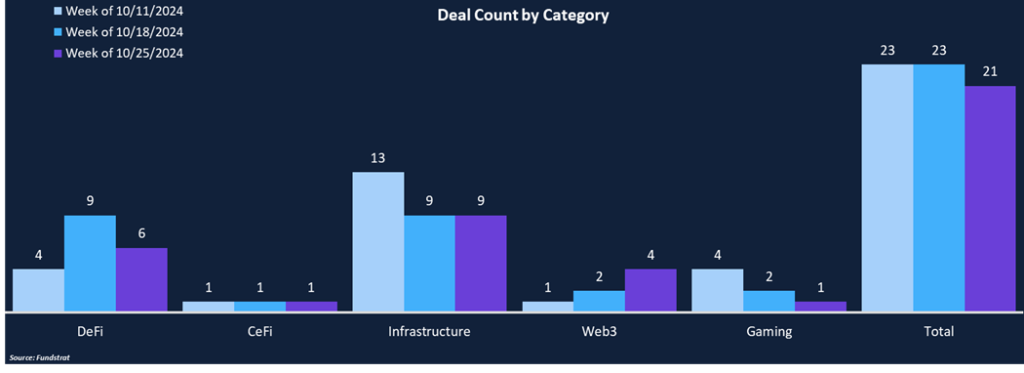

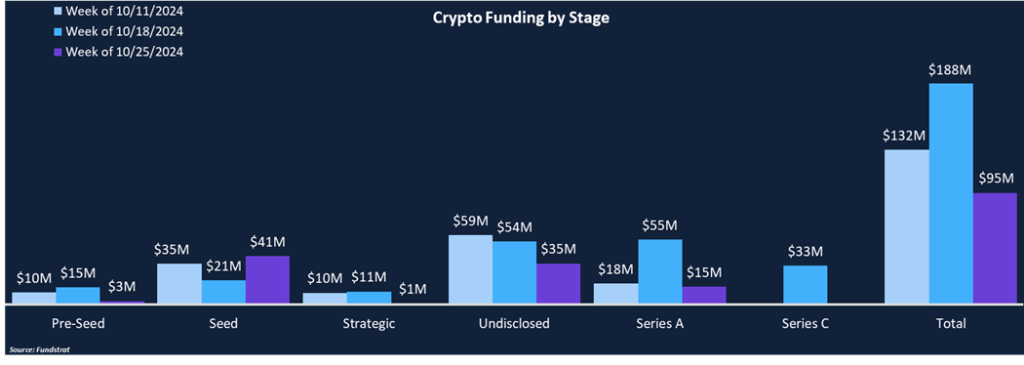

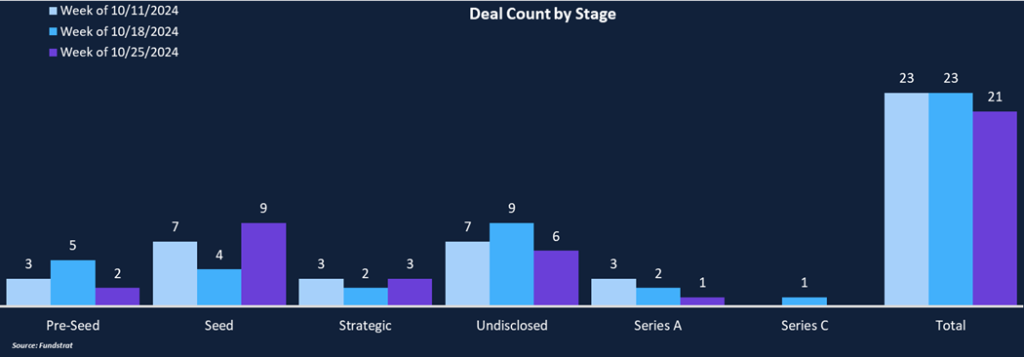

Total funding fell 49% week-over-week from $188 million to $95 million, and total deal count decreased modestly from 23 to 31. Infrastructure and DeFi were the two leaders in fundraising, accounting for approximately two-thirds of the total. The week’s largest deal was a $15 million Series A round completed by Bluesky, a Web3 social network. Party Icons was the sole Gaming company that raised capital this week. They raised $9 million in a seed round to accelerate the development of their multi-game universe, which is available on mobile and PC. Across deal stages, funding was concentrated in Seed rounds, which represented 43% of both total funding and total deal count, totaling $41 million across nine deals.

Although not included in the numbers below, a notable acquisition was announced this week. Payments giant Stripe acquired Bridge for $1.1 billion. The deal marks a premium compared to the $200 million valuation they earned in their August Series A funding round. Bridge is a payments/stablecoins platform founded by Coinbase veterans. The two companies will work together to advance stablecoins and digital payments into more real-world businesses.

Funding by Category

Funding by Stage

Deal of the Week

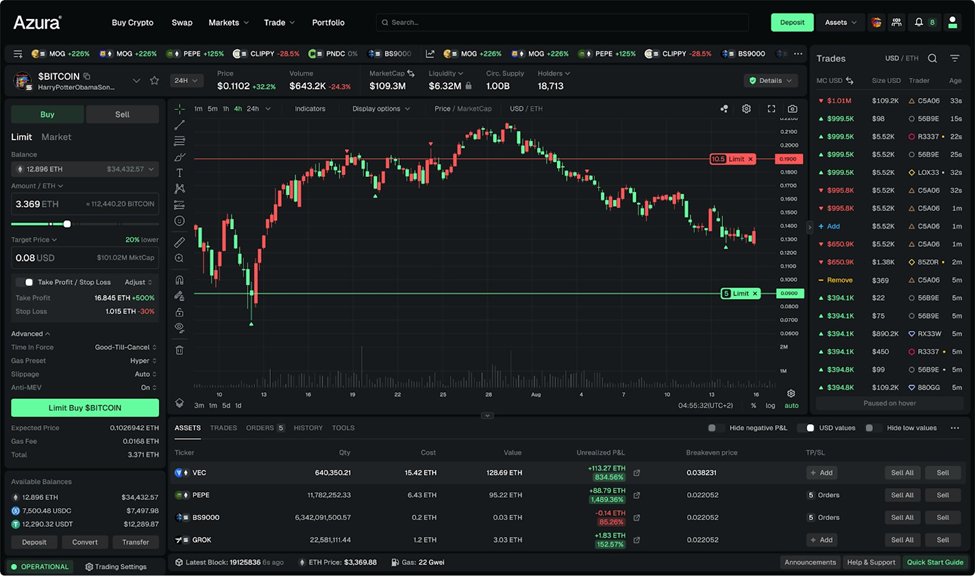

Azura, an on-chain interfacing layer, raised $6.9 million in a Seed round led by Initialized Capital, with participation from Winklevoss Capital, Alliance DAO, Volt Capital, and others. Azura’s team comes from prestigious companies spanning traditional finance and crypto, including Citadel, Two Sigma, Bloomberg, Coinbase, and Flashbots. The Azura application bundles together and abstracts away DeFi’s complexities through hundreds of bespoke integrations. Azura has created an application and interfacing standard to support any blockchain or protocol, to allow anyone to trade across all chains, assets, and products.

Why is This Deal of the Week?

DeFi is likely still in its infancy in the grand scheme of things, as the user experience is still relatively clunky and challenging for new users to navigate. It’s analogous to the early internet, where functionality was complex and fragmented, with users relying on various search engines, directories, and message boards to navigate correctly. Similarly, DeFi users must figure out how to bridge across chains, use different decentralized exchanges, and ensure they have the proper gas token across chains and wallets. By creating a one-stop shop for DeFi liquidity, trading, and bridging, Azura thinks they have the solution to significantly lower crypto’s barriers to entry and scale DeFi adoption substantially.

Azura aggregates different forms of decentralized infrastructure into a single application, including blockchains, bridges, and decentralized exchanges. By bundling and abstracting away complexity, Azura’s users are left with a much more enjoyable web3 experience that makes it significantly easier to onboard new users. Azura’s proprietary intent-based order execution engine acts as an interfacing standard between various chains and protocols, facilitating a simple CEX-like trading experience. Additionally, Azura offers fiat on and off-ramps, embedded wallets, and a unified dashboard for managing a multi-chain portfolio. Experienced users can work faster and more efficiently, while new users can onboard and begin trading within minutes. Users maintain full custodial control of their assets, and all actions occur on-chain, allowing for enhanced security and complete transparency.

Azura’s product is now open for public use, enabling a robust and performant spot trading experience across seven EVM chains and Solana. While Azura’s focus is on spot trading to start, the team imagines a future where anyone with an internet connection can access a wide array of decentralized financial tools including yield farming, perpetual futures trading, prediction markets, NFTs, RWAs and anything else built on blockchain rails.

Figure: Azura Trading Interface

Selected Deals

Moonwalk Fitness, a web3 fitness app, raised 3.4 million in a seed round led by Hack VC, with participation from Binance Labs, CMS, Reciprocal Ventures, Flowdesk, and others. Moonwalk Fitness offers users a gamified walking experience where users pay to compete in pre-set walking matches. Users can set up their own challenges with different parameters for the challenge’s duration, daily step count, and how much the entrance fee is. If users fail to reach the daily step count, they forfeit a portion of their deposit, which is evenly distributed among people who did hit their goal. Step counts sync directly from mobile device apps making it easy to track and keeping participants with the same counters. Moonwalk Fitness is built on Solana, and users can deposit USDC, SOL, or BONK to start entering contests. Many may remember the StepN craze, but Moonwalk differs in not introducing a new token, inflationary rewards, or NFTs. It’s very clear where walking rewards are sourced, creating a transparent and fun way to incentivize healthy lifestyle choices with the chance to earn money.

Variational, a peer-to-peer trading and settlement protocol, raised $10.3 million in a Seed round led by Bain Capital Crypto and Peak XV Partners. Other investors included Coinbase Ventures, Dragonfly Capital, Hack VC, and North Island Ventures. Variational was founded by Lucas Schuermann and Edward Yu in 2021, and both are ex-Genesis employees who left prior to Genesis’ bankruptcy. Variational’s first protocol is Omni, a retail-focused trading platform for perpetual futures. Omni trading for traditional perps, pre-launch tokens, token baskets, yield and volatility perps, and other novel products. Variational’s second product is Pro, an institutional trading platform. Beyond institutional trading, Pro will target the yield generation and lending markets, something both founders have experience with at Genesis. Variational is built on Arbitrum and is currently in its testnet phase. It is expected to launch a closed mainnet beta before the year ends and then a public mainnet in Q1. Variational is also planning to release a token, although the exact timeline has not been disclosed.

Skyfire, a crypto payment network for AI agents, raised $1 million in a strategic round from Coinbase Ventures and the a16z Crypto Startup Accelerator (CSX), bringing Skyfire’s total funding to $9.5 million. Skyfire is building the financial stack for the AI economy, where AI agents can make autonomous payments without human involvement after initial wallet funding. Skyfire believes that traditional payment rails were never built to interact with AI, and a new solution is needed to accelerate AI utility. Beyond payment rails, Skyfire offers a digital identity solution where vendors and customers can ensure the credibility of payors or payees, which will be essential in preventing AI financial fraud.