Gaming Goes Mobile

Weekly Recap

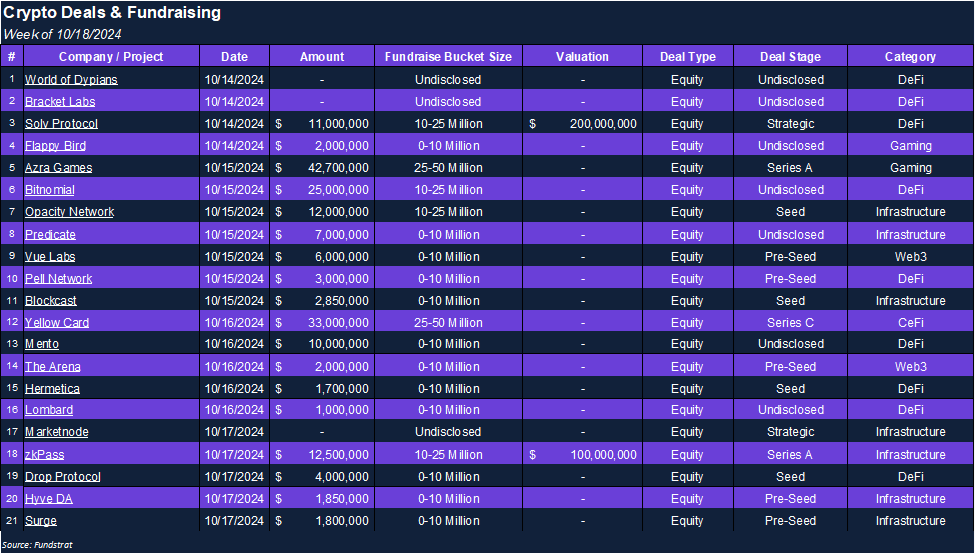

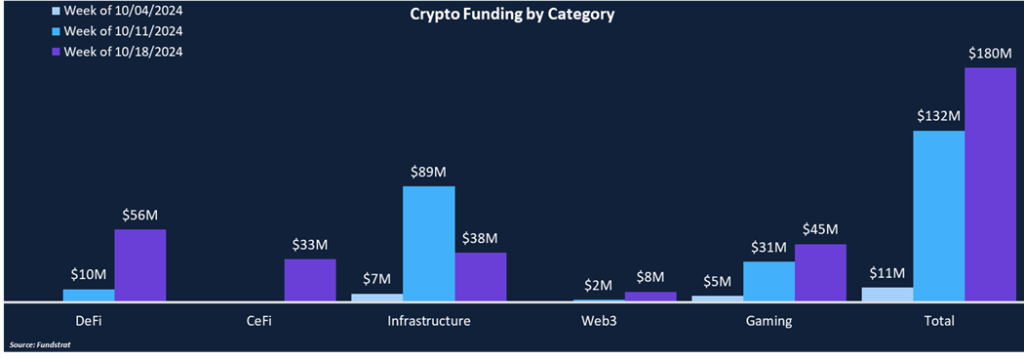

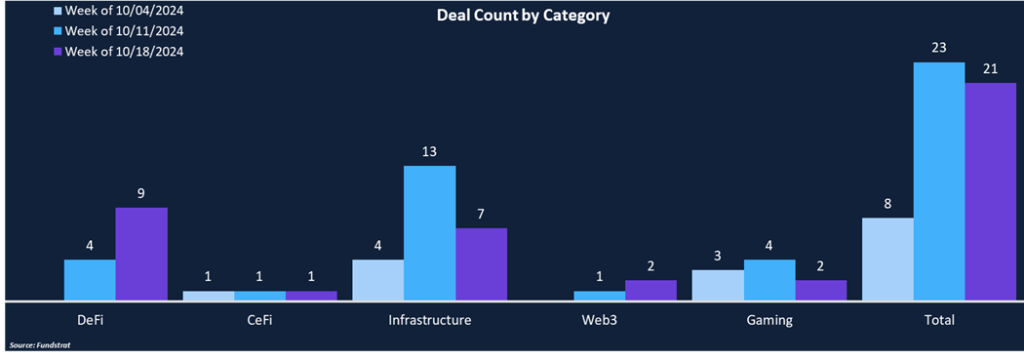

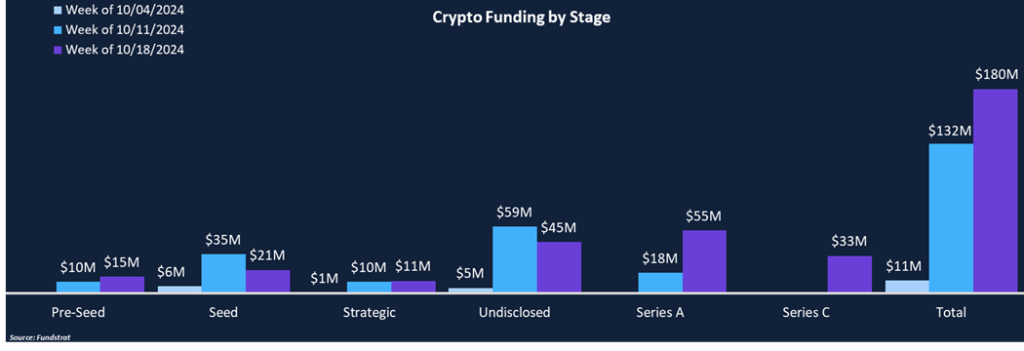

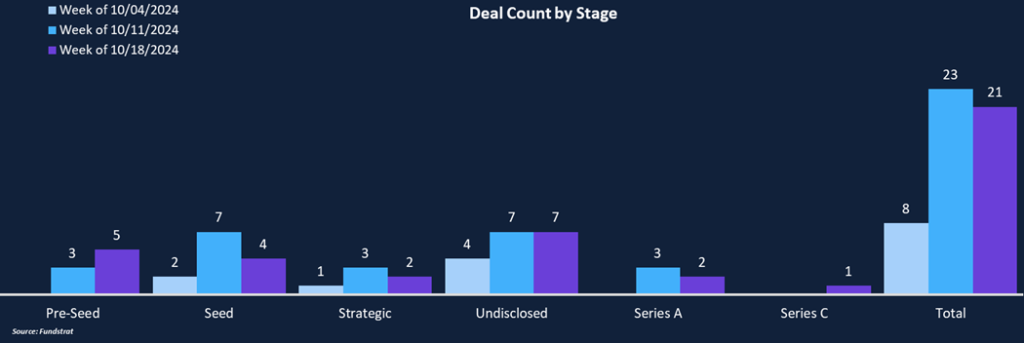

Weekly funding rose by 37% from $132 million to $180 million, while the total deal count decreased slightly from 23 deals to 21. Funding was relatively evenly dispersed across categories, with four out of five categories raising more than $30 million, except Web3, which saw $8 million in funding. DeFi was the leading category in total funding and deal count, raising $56 million across nine deals.

Series A was the deal stage garnering the most funding, raising $55 million across two deals, including the Deal of the Week, Azra Games. Yellow Card, an African-based payments company, completed a $33 million Series C round, marking only the second Series C round of 2024. Additionally, two companies raised capital at valuations of $100 million or greater: Solv Protocol earned a valuation of $200 million and zkPass at $100 million.

Funding by Category

Funding by Stage

Deal of the Week

Azra Games, a web3 gaming studio, raised $42.7 million in a Series A round led by Pantera Capital, with participation from a16z and NFX. The funding round brings Azra’s total funding to $$68.3 million and will position Azra for rapid growth and innovation as they bring console RPG experiences to mobile. Azra’s Series A round represents the largest Gaming fundraise of 2024 and the tenth largest Series A round across all verticals.

Azra was founded in 2022 by Mark Otero with a focus of pushing the boundaries of mobile role-playing games (RPG) and providing a console-quality experience on mobile platforms. Otero launched his first game studio in 2008, which was quickly acquired by Electronic Arts. He then joined EA and was part of the team responsible for multiple blockbuster RPG games, including Star Wars: Galaxy of Heroes, one of the highest-grossing mobile games ever. Now, Otero and the team have reunited at Azra Games with the goal of creating the next generation of RPG games.

Why is This Deal of the Week?

RPGs are an extremely popular sub-sector within gaming, making up approximately 30% of gaming app revenue worldwide, and marking the top-grossing game sector from 2019 to 2022. The majority of RPG games were traditionally built for consoles or PCs as mobile devices faced hardware constraints, but as mobile technology has evolved, the sector is rapidly growing. Mobile games are expected to make up 49% of all gaming revenue in 2024, and the percentage is expected to continue expanding as hardware constraints diminish and handheld devices continue evolving.

Azra believes they can create the fourth generation of mobile RPGs. The first generation emerged with mobile app stores and 2D graphics constrained by limited memory and weak processors. The second generation saw enhancements in UI and better battle animations, and the third generation capitalized on the proliferation of smartphones, providing 3D graphics and interactive experiences. Azra thinks the fourth generation of RPGs will compete with PC and console RPGs, featuring on-chain ownership, open worlds, over-the-shoulder camera perspectives, real-time battles, and extended PvE campaigns. Azra is working to make its vision a reality with the development of its flagship title, Project Legends, which will serve as the marquee display of Azra’s revolutionary mobile RPG gaming experience.

Selected Deals

Yellow Card, a crypto exchange and payments company, raised $33 million in a Series C round led by Blockchain Capital. Other investors included Polychain Capital, Third Prime Ventures, Castle Islan Ventures, Galaxy Ventures, and others. Yellow Card is only the second crypto company to complete a Series C round in 2024, bringing Yellow Card’s total funding to $85 million. Yellow Card is based in Nigeria and is a digital payments hub for 20 African countries, allowing people to transfer money across borders for a fraction of traditional remittance costs. Yellow Card does not charge transaction fees but instead collects revenue on the spread between stablecoin prices and local currencies during conversions. As many emerging markets suffer from unstable currencies or underdeveloped banking systems, Yellow Card offers a way for customers to access more stable assets including a range of stablecoins as well as Bitcoin and Ether. Yellow Card was founded in 2016 and after six years of building relationships in the region and growing its local payment rails, larger firms like Coinbase have opted to partner with Yellow Card instead of trying to break into the region on their own. Yellow Card will use the fresh capital to enhance its APIs and widgets as it looks to expand into new markets, including Egypt, Ethiopia, and Morocco.

Towns, a permissionless group chat protocol, raised $25.5 million in a Series A round from a16z, Framework Ventures, and Benchmark. Towns operates on River Protocol, an on-chain messaging protocol providing decentralized encrypted messaging. Traditional messaging platforms present centralization problems where content and communities can be restricted or censored. Towns allows anyone to build their own digital town square entirely by their own rules. Towns represent the future of community building where creators control the space, members, and experience. All messages are encrypted end-to-end ensuring users have privacy and security to communicate freely. Users can also monetize their space within Towns, creating membership fees or custom entitlements, giving complete control over how to grow a town.

Solv Protocol, a Bitcoin staking infrastructure protocol, raised $11 million in a Strategic round, bringing their total funding to $25 million and valuing Solv at $200 million. Key investors include Laser Digital, Blockchain Capital, Gumi Cryptos Capital, OKX Ventures, and others. Solv has grown as a unified standard for staked Bitcoin with the creation of SolvBTC. Solv has accumulated over $1.77 billion in TVL and over 481k total users. The launch of their Staking Abstraction Layer (SAL) will simplify Bitcoin staking across different blockchains and allow holders to access yields across different opportunities and ecosystems. Solv is introducing three Bitcoin LSTs, each corresponding to Babylon, Core Network, and Ethena’s staking mechanisms. Each LST will offer unique value, and users can access each across different blockchains through Solv’s SAL framework. The funding will be used to continue developing SAL products to increase Bitcoin utility.