Sluggish Start to Q4

Weekly Recap

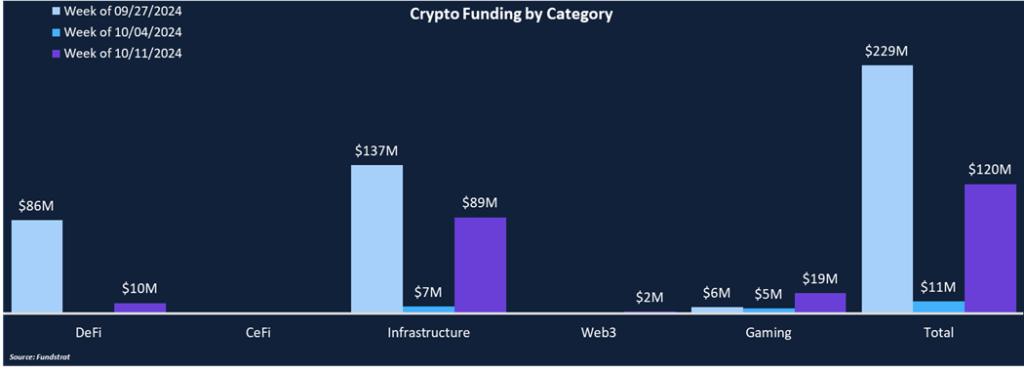

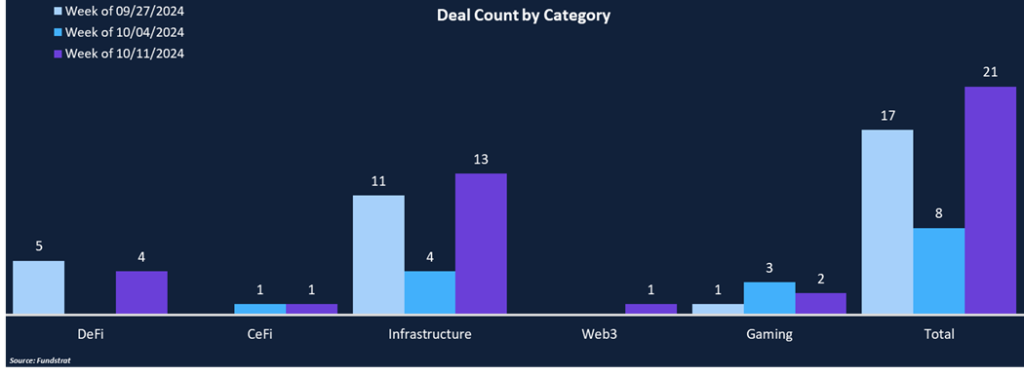

Q4 has represented the least funded quarter in each of the past two years, and two weeks into this year, the trend is on pace to remain intact. The first week of the fourth quarter was one of the least funded weeks all year, with just $11 million raised across eight deals. Although not overly impressive, funding rebounded this week to $120 million across 21 deals. Concentration in the Infrastructure category continues to present itself as a recurring theme, representing 74% of this week’s funding and 62% of the deal count. Gaming was the second most funded category, which included a $10 million Seed round completed by PiP World, which is aspiring to become the “Duolingo of crypto” through a gamified educational experience.

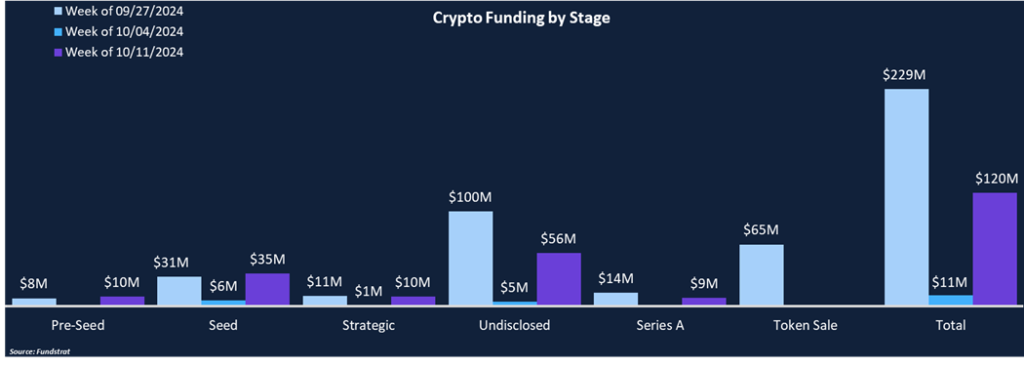

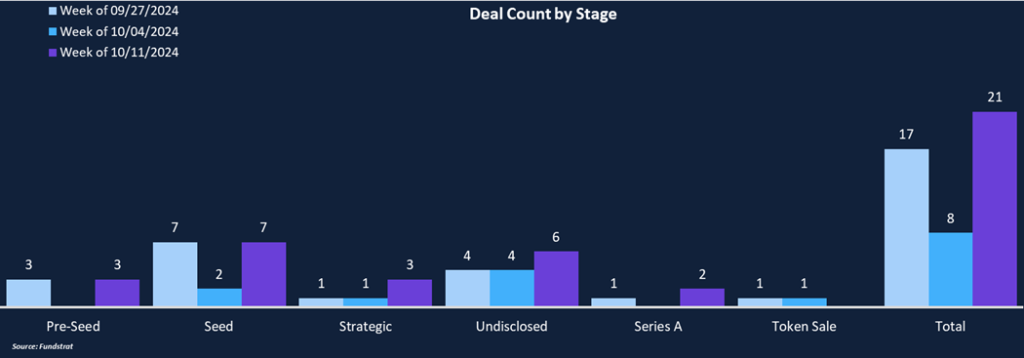

Seed rounds led fundraising and deal counts among disclosed deals, representing 29% of total funding and 33% of total deal count. Three strategic rounds were completed this week, including TON 8.89% raising $10 million from Gate.io. The crypto exchange plans to deepen its involvement and governance of the network and contribute to its ongoing development.

Funding by Category

Funding by Stage

Deal of the Week

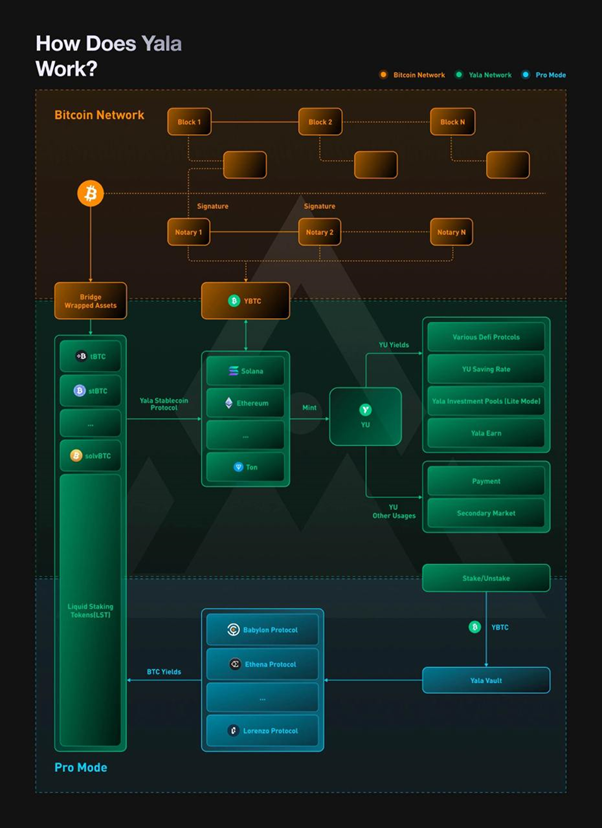

Yala Finance raised $8 million in a Seed round co-led by Polychain Capital and Ethereal Ventures. Other investors included Amber Group, HashKey Capital, Anagram, Galaxy Vision Hill, and others. Yala’s founders include ex-employees from Binance, Circle, and Alchemy Pay. Together they are aiming to drive the development and expansion of Bitcoin DeFi with the development of a Bitcoin-backed, yield bearing stablecoin called YU.

Why is This Deal of the Week?

Bitcoin as a standalone asset represents more than half the total value of the entire asset class. Most Bitcoin remains on Bitcoin’s base layer, unproductive and idle. There is an enormous opportunity to turn Bitcoin into a productive asset and unlock a new wave of capital efficiency within the industry. Yala Finance is aiming capitalize on this opportunity by creating a bitcoin-backed, yield-bearing stablecoin.

Users can deposit bitcoin into MetaMint, a cross-chain protocol allowing for instant conversion of native bitcoin into stablecoins on EVM chains. Users will receive yBTC, a tokenized representation of their deposit, and instantly mint YU on a destination chain. MetaMint removes the need for bridging or wrapping and simplifies the user experience. Yala is also incorporating an insurance feature into its protocol to address 10-minute block production and additional safeguards to prevent liquidations from high volatility or restaking. Yala plans to extend collateral options to staked bitcoin, which they call “Pro Mode.”

Yala is still being developed, with its testnet launch expected this month and mainnet launch planned for the first quarter of 2025. Yala’s native token YALA -4.94% will also launch alongside mainnet. Investors have already committed over 2,000 BTC in deposits and the funding will be used to enhance development and add more people to the business development, engineering, and marketing teams.

Selected Deals

OpenGradient, a decentralized AI network, raised $8.5 million in a Seed round from investors, including Coinbase Ventures, a16z CVX, Foresight Ventures, SALT, Black Dragon Capital, and others. OpenGradient is aiming to accelerate open-source AI development by democratizing model ownership, streamlining AI deployment, and ensuring universal access to cutting-edge AI technologies. OpenGradient’s E2E platform offers scalable on-chain AI computing, ensuring verifiability and attribution while enhancing security for AI deployment and hosting. OpenGradient uses a multi-layer technology stack, including an EVM-compatible blockchain with heterogeneous AI compute architecture (HACA) and a proprietary library of feature-rich tools to support and scale secure AI workflows on-chain. They also have their own SDK for web2 developers to leverage, reducing the burden of learning the on-chain nuances of AI development. OpenGradient’s testnet is expected to go live before the year ends.

Semantic Layer, a dapp infrastructure layer, raised $3 million in a seed round led by Figment Capital, with participation from Hack VC, Robot Ventures, Bankless Ventures, Fenbushi Capital, and others. The current MEV distribution is skewed, with over 70% going to validators, and the rest is split between builders and searchers, while users receive none. Users are the sole originators of the transaction, and Semantic Layer believes they should receive the majority of MEV shares. Additionally, malicious actors can send private transactions to prevent circuit breakers from front-running their transactions, making proactive security very difficult. Semantic Layer aims to improve transaction execution with its Verifiable Aggregation Rules (VAR) and Verifiable Sequencing Rules (VSR), which give more control to dapps when dealing with multi-chain transaction ordering and bundling. Semantic Layer’s Application Specific Sequencing (ASS) framework also helps reduce MEV leakage and prevent malicious transactions from executing. Together, Semantic Layer is striving to make the meta transaction programmable, enabling customized MEV distribution and native scaling for protocols. The funding will be used to enhance the development of Semantic Layer and improve company awareness within the industry.

Ithaca, an infrastructure development company, raised $20 million from Paradigm. Ithaca is a spin-off company from Paradigm, with Paradigm’s CTO and general partner Georgios Konstanopoulos serving as Ithaca’s CEO. Paradigm co-founder, Matt Huang will also serve as Ithaca’s Chairman. Ithaca is striving to accelerate the development of the crypto frontier. Its first project is a layer-2 network called Odyssey, built using Reth, the OP Stack, and Conduit, and will be the first of multiple technologies that Ithaca plans to develop. Odyssey plans to set itself apart from other L2s by shipping multiple features slated on the Ethereum roadmap that no team has built yet. Odyssey will enable more robust smart contract wallets to provide frictionless onboarding to crypto. Odyssey is live on testnet and open for developers to begin creating applications.