Q3 Funding Recap

Oct 4, 2024

Author

Key Takeaways

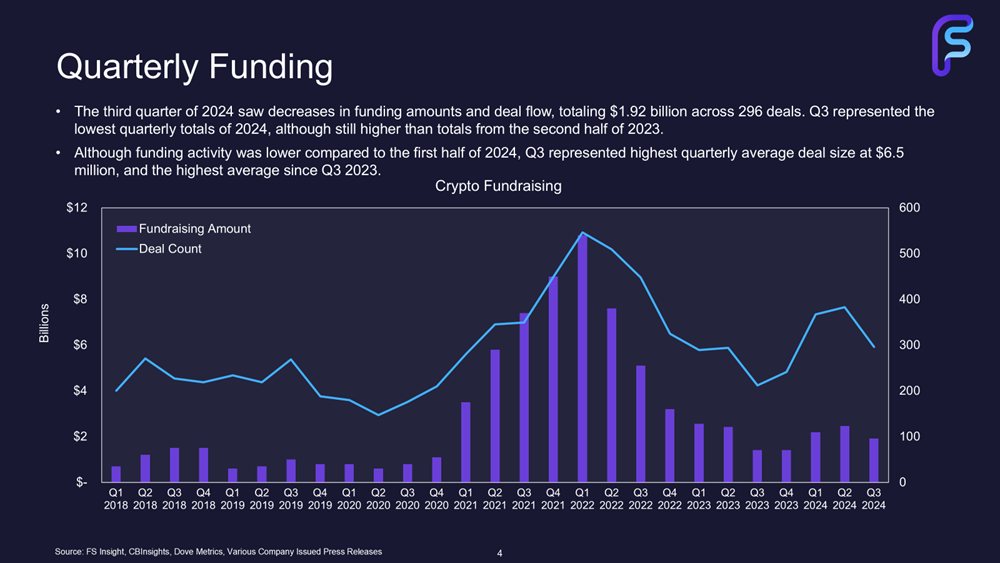

- Funding Dives in Q3: Q3 saw $1.92 billion in funding across 296 deals, marking quarter-over-quarter decreases of 22% in funding and 23% in deal count. Although QoQ funding activity was down, YoY funding showed a 37% increase.

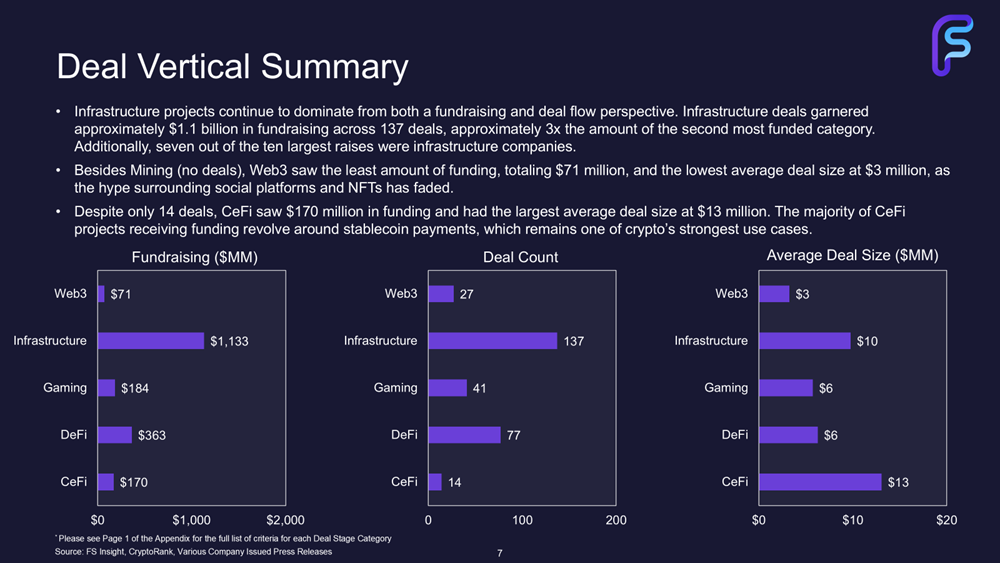

- Infrastructure Dominates Q3: Infrastructure projects continue to dominate from both a fundraising and deal flow perspective. Infrastructure deals garnered approximately $1.1 billion in fundraising, representing 59% of total quarterly funding and over 3x the next largest category.

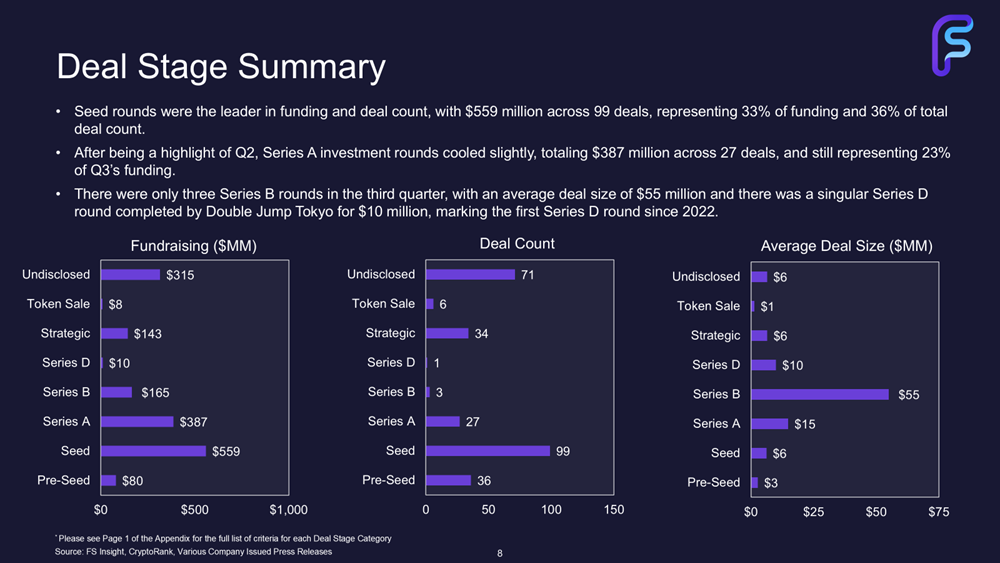

- Seed Rounds Represent One-Third of Funding: Seed rounds were the leader in funding and deal count, comprising $559 million across 99 deals, representing 33% of funding and 36% of total deal count. Later-stage funding rounds remain scarce, with only three Series B and one Series D rounds.

- No Unicorns: Only six projects achieved valuations greater than $100 million in Q3, with the largest being Initia, at $350 million. No projects achieved a valuation of over $1 billion, compared to four companies in Q1 and two in Q2.

- Noticeable Subsectors: Three notable trends emerged throughout Q3, including a resurgence in AI-related projects, recognition of the importance of robust data solutions, and Web3 companies looking to disrupt the health and wellness sector.

Click HERE for the full report.

Key Slides

Quarterly Funding

Deal Vertical Summary

Deal Stage Summary

Largest Valuations