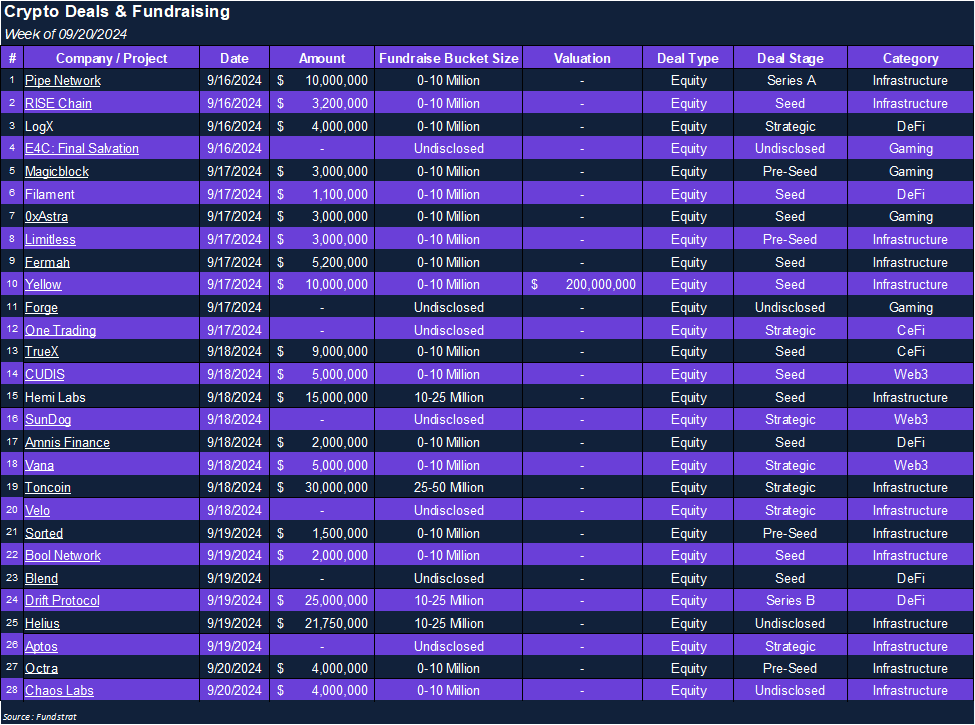

Funding Rebounds from Slow September Start

Weekly Recap

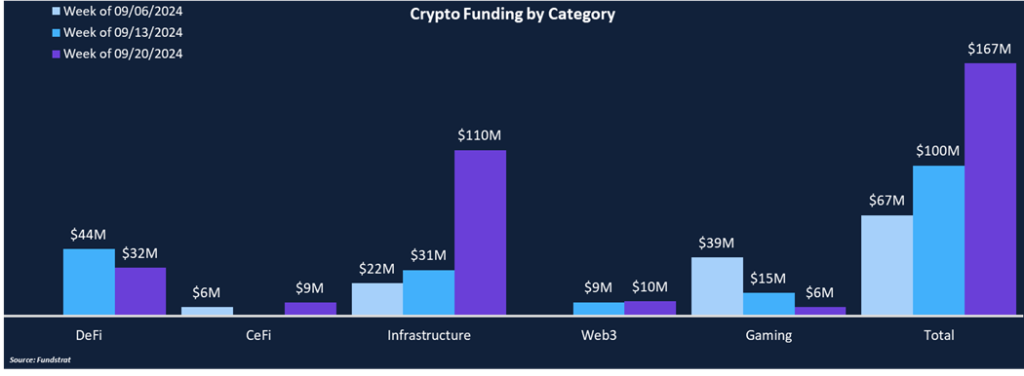

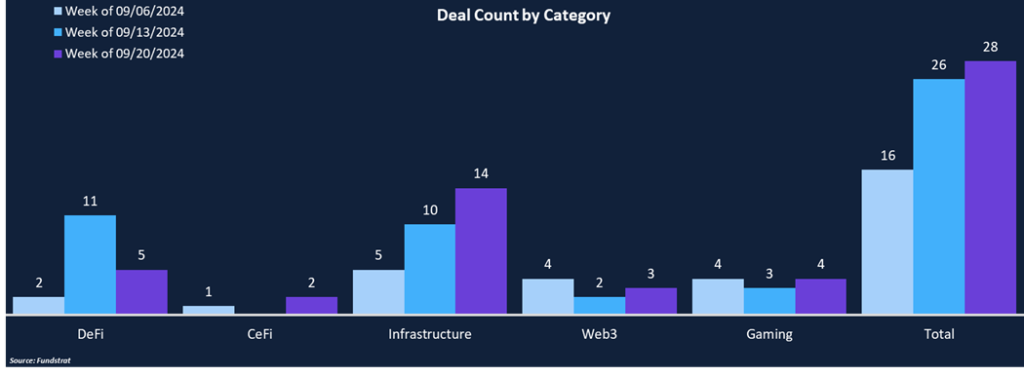

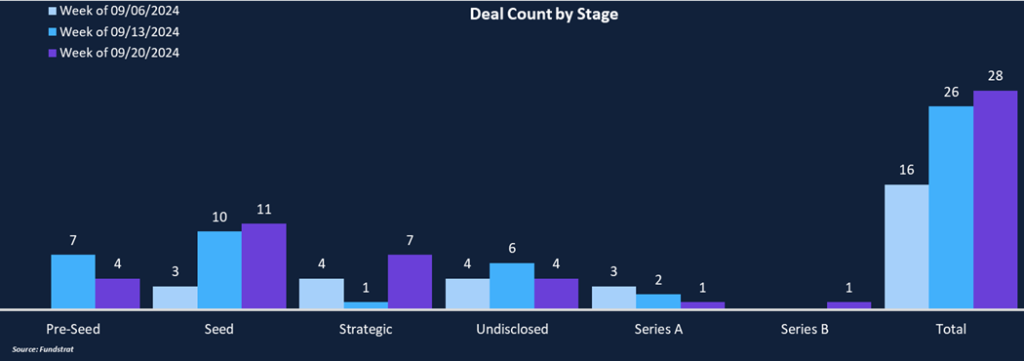

Weekly funding increased 67% from $100 million to $167 million, while the deal count rose a modest 8% from 26 to 28. Infrastructure was the clear winner this week, raising $110 million across 14 deals, representing two-thirds of total funding and half of the total deal count. There were two CeFi deals totaling $9 million in funding, which remains a laggard category, tallying only 55 deals so far this year.

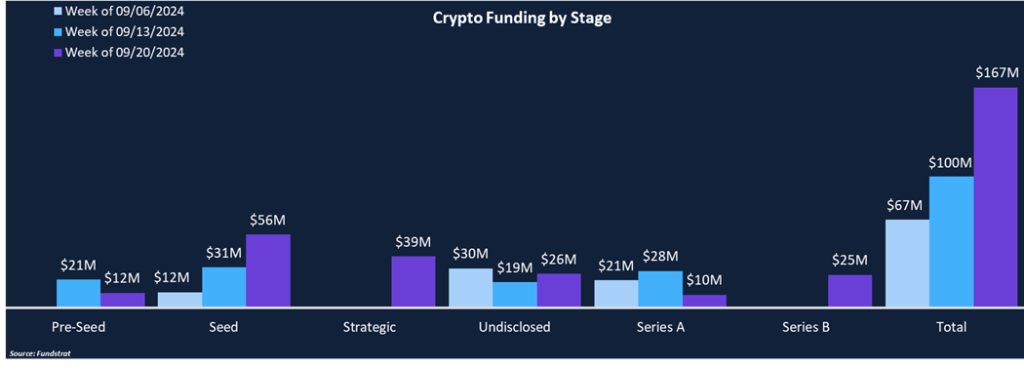

There were 11 Seed rounds announced this week totaling $56 million, including our Deal of the Week, Hemi Labs. Two large-cap layer-1 networks received funding through Strategic rounds. TON N/A% raised $30 million from Foresight Ventures and Bitget, and APT N/A% raised an undisclosed amount, also from Foresight Ventures. Drift, a decentralized trading platform, completed a $25 million Series B round, representing the first Series B round in over four weeks.

Funding by Category

Funding by Stage

Deal of the Week

Hemi Labs, a crypto infrastructure company, raised $15 million in a seed round led by Binance Labs, Breyer Capital, and Big Brain Holdings. Other investors included crypto.com, Gate Ventures, SALT Fund, Sunflower Capital, Hyperchain Capital, and others.

Why is This Deal of the Week?

Common themes seen across crypto venture deals are new projects building Bitcoin L2s, Ethereum L2s, or interoperability solutions for the two. Most projects have been focused on one or the other, solving some problems but leaving the overarching ecosystems fractured with different technologies incompatible with others. Hemi Labs is taking a new approach, trying to combine the best of both worlds into a singular solution: the Hemi Network.

The Hemi Network is a modular blockchain designed for superior scaling, security, and interoperability by unifying components of Bitcoin and Ethereum into a single super-network. The Hemi Network’s core components include:

- Hemi Virtual Machine (hVM) – hVM integrates a full Bitcoin node within an Ethereum Virtual Machine (EVM), allowing developers to leverage the familiarity of the EVM while building smart contracts that work with Bitcoin, and maintaining full backwards compatibility with existing EVM dapps.

- Hemi Bitcoin Kit (hBK) – The Hemi Bitcoin Kit unlocks direct smart contract access to granular indexed views of the bitcoin state, allowing for EVM execution of trustless bitcoin-native applications like staking, lending markets, and MEV marketplaces, which were previously impractical.

- Proof-of-Proof (PoP) Consensus – Hemi’s Proof-of-Proof (PoP) consensus mechanism leverages Bitcoin’s full security, allowing for efficient Bitcoin security-as-a-service to other networks.

- Tunnels – Hemi’s Tunnels provide sophisticated, noncustodial bidirectional asset transfers by maintaining state awareness of both networks at the protocol level, vastly improving upon traditional bridges.

Hemi’s modular architecture allows for enhanced asset programmability, supporting features including on-chain routing, time-lock, password protection, and gasless transfers. Hemi’s novel vision for how to unite Bitcoin and Ethereum has the potential to enhance the efficiency of blockchain interoperability and change the way developers approach layer-2 scaling. The Hemi Network is currently live on testnet with plans to launch on mainnet sometime in Q4.

Selected Deals

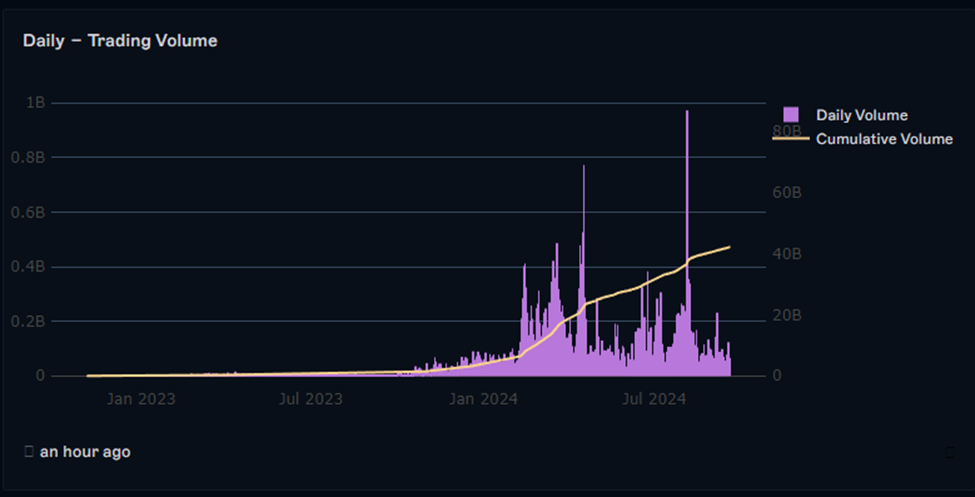

Drift, a Solana-based decentralized trading platform, raised $25 million in a Series B round led by Multicoin Capital. Other investors included Blockchain Capital, Folius Ventures, Maelstrom, and Primitive. Drift’s funding round represents one of the few Series B rounds this year and the first in over four weeks. Drift’s goal is to become the “Robinhood of crypto” by building its SuperApp, a comprehensive suite of DeFi products, including spot and perpetual futures trading, borrow/lending markets, and prediction markets. To date, Drift has facilitated over $42 billion in notional trading volume, 200,000 users, and accumulated over $364 million in TVL. Drift’s native token, DRIFT, has been an outperformer through September, gaining 51.77% thus far. Drift will use the funding to continue adding functionality to its platform and double the company’s headcount to 50 people within the next year.

Helius, a Solana development company, raised $21.75 million in an undisclosed round led by Founders Fund and Haun Ventures. Other investors included Foundation Capital, 6thMan Ventures, Chapter One, and Spearhead. Helius offers a full suite of Solana development tools, including high-performance Solana RPCs, webhooks, APIs, and developer tooling kits. Helius’ RPC nodes are some of the most battle-tested across the ecosystem, offering extremely low latency and high reliability with 27/7 support. Helius’ webhooks support data streaming for up to 100k accounts as well as event detections such as NFT sales or DeFi swaps to allow for real-time data feeds, improving dapp responsiveness and allowing projects to remain alert for what’s relevant to them. The funding will be used to accelerate Helius’ mission of advancing crypto and the development of the Solana ecosystem.

CUDIS, an AI web3 wellness company, raised $5 million in a Seed round led by Draper Associates, with participation from Skybridge, Penrose, SNZ, Foresight Ventures, and others. CUDIS sells a “smart ring” similar to Oura that monitors health metrics like heart rate, sleep, exercise, and more to feed CUDIS’ biometric data dashboard. CUDIS leverages personal trainers and artificial intelligence to offer a personal AI coach that can analyze user data and offer personalized recommendations or exercise plans. Users earn rewards for utilizing the CUDIS ring by recording activities or checking in with the AI coach, and all user data is stored privately on Solana. Points will be redeemable for CUDIS’ token in the future, although the timeline and conversion rates have not been announced. There is a new trend emerging of web3 and wellness intersecting as crypto economic incentives offer a unique way to entice people to make healthy lifestyle choices.