Personal AI and Crypto Converge

Weekly Recap

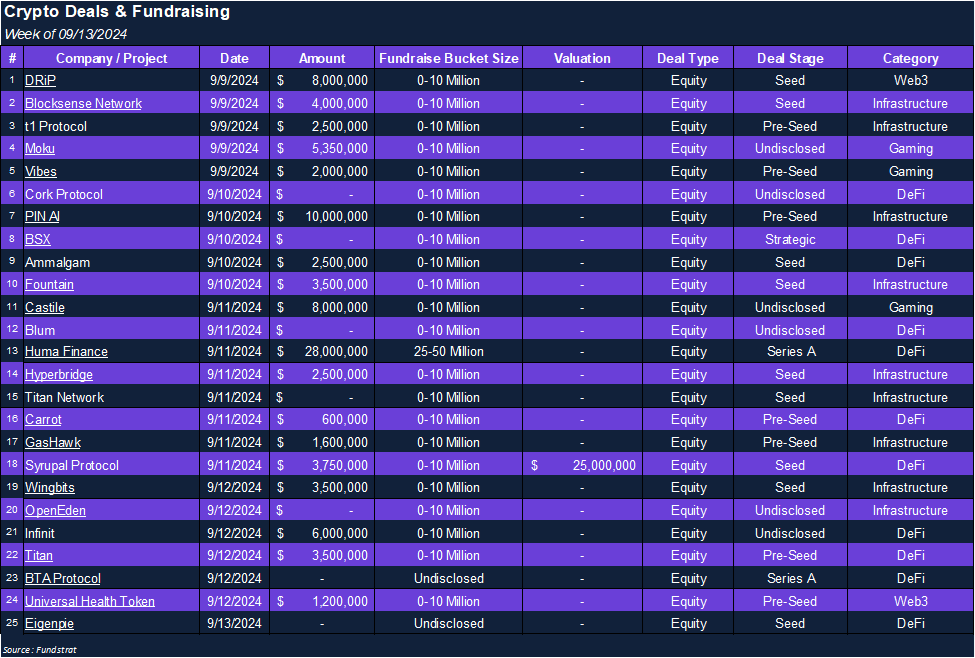

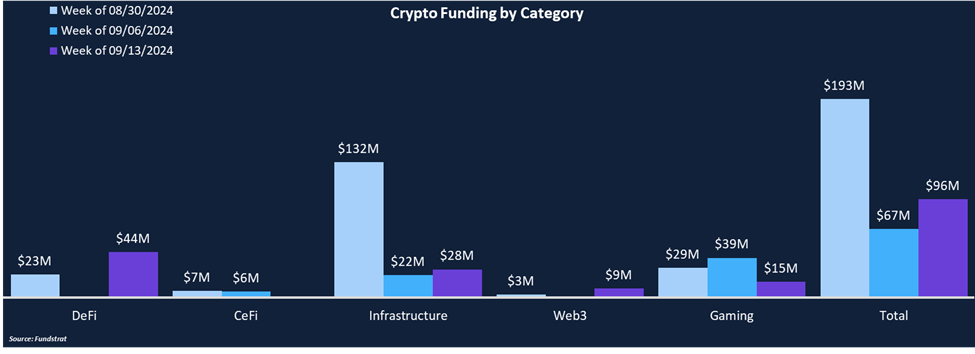

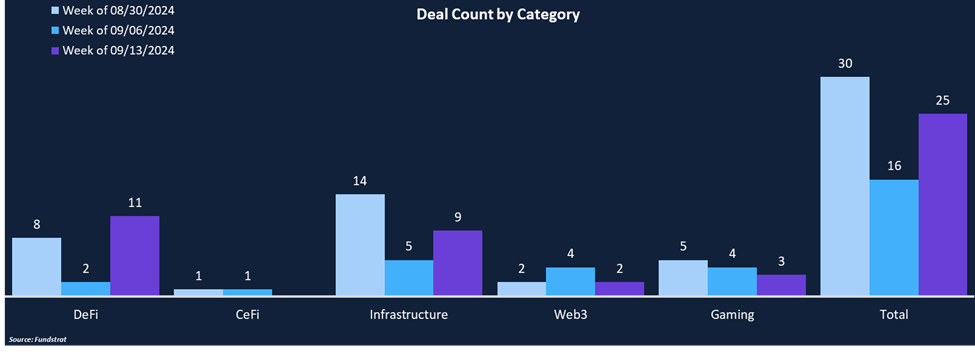

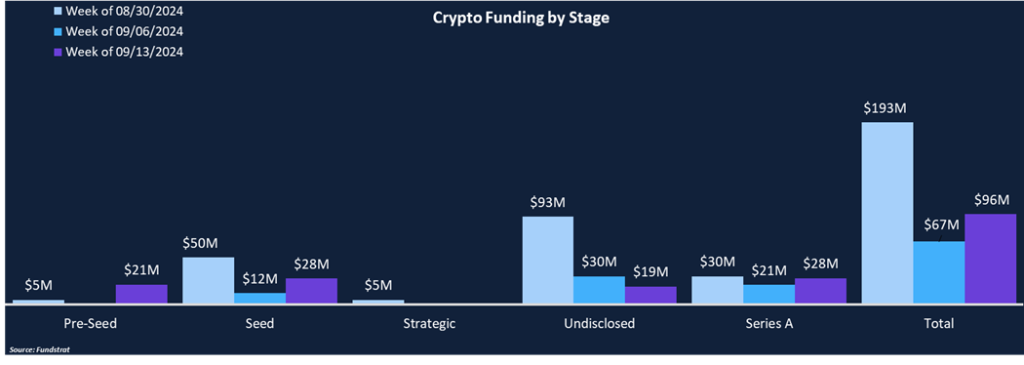

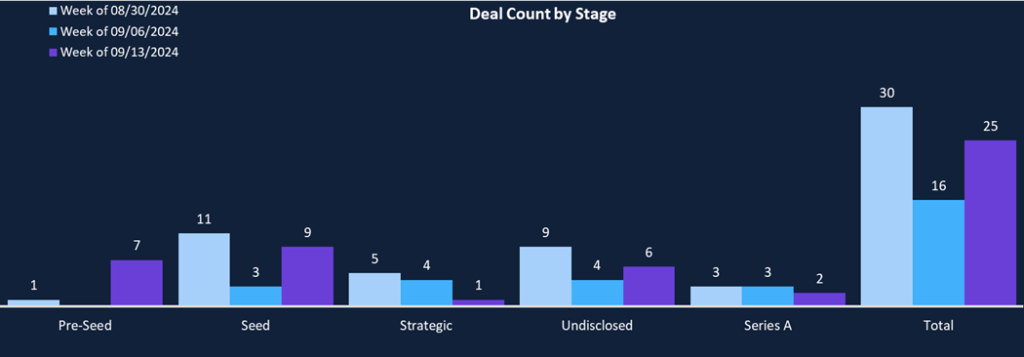

Funding activity bounced back from last week’s muted totals, with total funding rising 44% from $67 million to $96 million and deal count increasing 56% from 16 to 25. DeFi was the leading category from both a fundraising and deal count perspective, raising $44 million across 11 deals. This week’s largest deal was a DeFi investment – Huma Finance raised $28 million in a Series A round to expand its PayFi network. Seed and Series A rounds were tied for the most funded deal stage, both totaling $28 million, although the number of Seed rounds outpaced Series A by seven deals. There was an increase in pre-seed funding rounds this week, with $21 million in funding across seven deals, including a $10 million round from PIN AI (DotW), representing the second-largest pre-seed round in 2024.

Funding by Category

Funding by Stage

Deal of the Week

PIN AI, an open platform for personal artificial intelligence, has raised $10 million in a pre-seed round from investors including a16z, Hack VC, Foresight Ventures, Alumni Ventures, and others. PIN AI is also backed by notable angel investors, including the founder of NEAR, the CEO of Mysten Labs (Sui), and the president of the Solana Foundation. PIN AI converges on AI and crypto by offering a privacy-focused, on-device AI assistant that democratizes on-device intelligence for users.

Why is This Deal of the Week?

PIN AI is striving to create the first open-source Personal Intelligence Network (PIN), a new platform for personalized AI with crypto-economic security, giving users the necessary privacy and ownership of their data. Large technology companies are set to monopolize access to AI services, given their vast resources and large amounts of data collection through existing consumer devices and apps. PIN AI is being built to compete with big tech, including Apple’s newly launched AI intelligence solution. PIN AI offers users AI-powered personal services and democratizes the underlying AI models while preserving users’ data privacy.

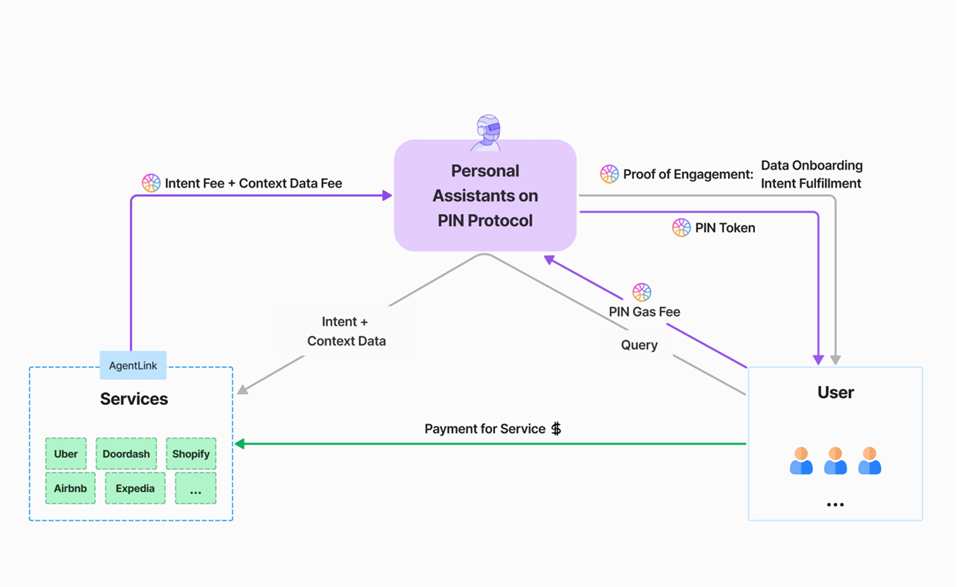

The PIN Protocol operates with three distinct parts: Data Connectors and an On-Chain Registry, a Private Storage and Compute Layer, and Agent Links and an Intents Market.

- Data Connectors and On-Chain Registry – tracks and verifies users’ data from external data sources (health apps, budget trackers, Uber, etc.), leveraging ZK proofs to verify authenticity and update the registry without revealing private data. The registry is built on PIN AI’s own blockchain, which is powered by Proof-of-Engagement.

- Storage and Compute Layer – provides a secure data layer beyond a user’s device. It uses a permanent storage solution with a data access gadget to store massive amounts of user data and make the most relevant data readily available to personal AI agents.

- Agent Links and Intents Market – AgentLink is PIN AI’s specialized agent network that can execute tasks. User intent fulfillment gets opened to agents, creating a permissionless exchange mechanism with the registry keeping track of performance metrics and matching queries to agents based on KPIs (cost, performance, quality).

AgentLink connects users, consumer applications, and the PIN AI personal assistant. Users can query the AI agent, and the agent will interact with apps and execute the necessary intent. For example, the agent can ingest finance guides, budget apps, and credit card transactions to provide personal insights on user spending habits and where to improve.

PIN AI hopes to bootstrap its network by working directly with web2 developers such as Amazon, DoorDash, Uber, etc. to convert their applications into agentic services. PIN AI’s vision is ambitious, but, if successful, could change the way we use AI on our personal devices. PIN AI’s full product is expected to go live in October.

Selected Deals

Infinit, a defi abstraction layer, raised $6 million in an undisclosed round led by Electric Capital, Mirana Ventures, and Hashed Fund. Other investors included Maelstrom, Robot Ventures, Bankless Ventures, and others. Infinit is a defi abstraction layer that allows for the seamless creation of money markets, DEXes, and yield protocols on any chain in just a few clicks. Infinit’s modular approach will enable developers to easily customize their defi protocols, clearing the way for quicker scaling and better execution of go-to-market strategies. Infinit is already powering 12 Defi apps across Ethereum, Mantle, and Blast, with a total TVL of $630 million. Infinit plans to integrate into more chains, including Arbitrum, Berachain, Monad, and Abstract Chain, to continually increase its total addressable market across crypto.

Huma Finance, a payment financing (PayFi) network, raised $28 million in funding in a Series A round led by Distributed Global, with participation from Hashkey Capital, Folius Ventures, and others. Additionally, Huma received a $10 million investment from the Stellar Development Foundation to provide liquidity to the platform. Most of the major global economies depend on payment financing to grease the economy’s rails including things like credit cards or trade finance. Huma is striving to bring its PayFi network onto blockchain rails and leverage stablecoins to create a more efficient and accessible alternative to traditional payment networks. Huma has already financed over $950 million in payments with a 0% credit default rate and expects to surpass $10 billion in financed payments next year. Huma plans to use the fresh capital to expand its PayFi network to Solana and the Stellar network.

Universal Health Token (UHT), a Web3 health protocol, raised $1.2 million in a pre-seed round from Animoca Brands, P2 Ventures, Tezos Foundation, and KGen. UHT incentivizes healthy lifestyle choices through its token and partner app, GOQii, a health data tracking app. GOQii was founded in 2015 and has over 5 million downloads and 450k monthly active users. GOQii is an off-chain app that will convert in-app points into UHT tokens on its own Polygon Edge Chain. Together, UHT and GOQii seamlessly integrate all aspects of health data including exercise, diet, sleep, and vitals, to support a cohesive web3 user experience. Users earn tokens for healthy activities, and health professionals can implement UHT rewards as an incentive mechanism for following treatment plans. The platform includes access to tailored guidance from doctors, fitness coaches, and medical experts built off users’ health data. UHT is also integrated into a health marketplace where it can be used to purchase real-world items or services.