Slow Start for September

Weekly Recap

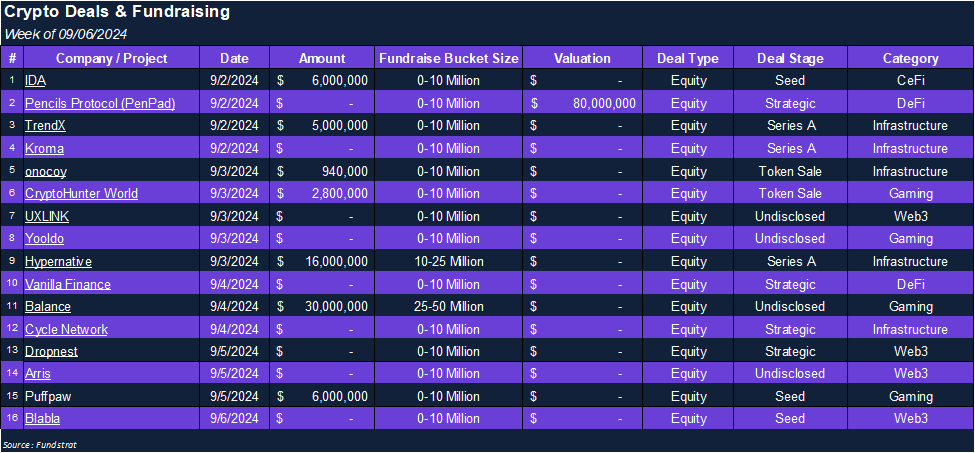

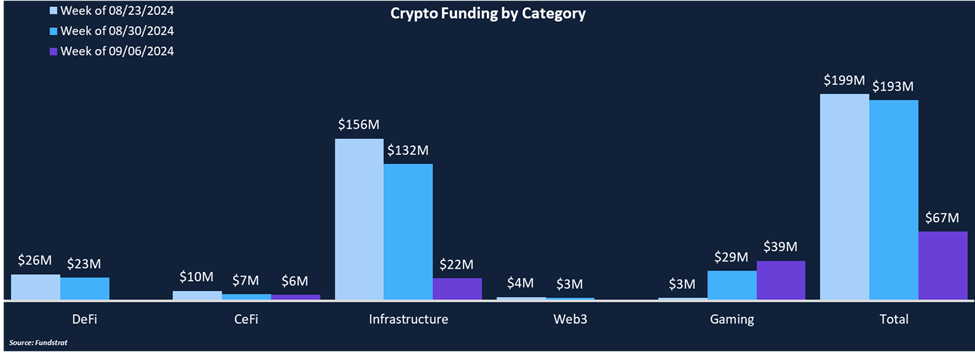

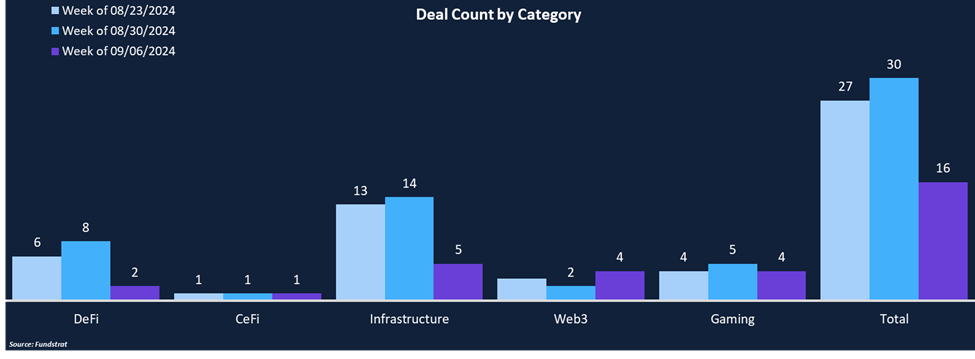

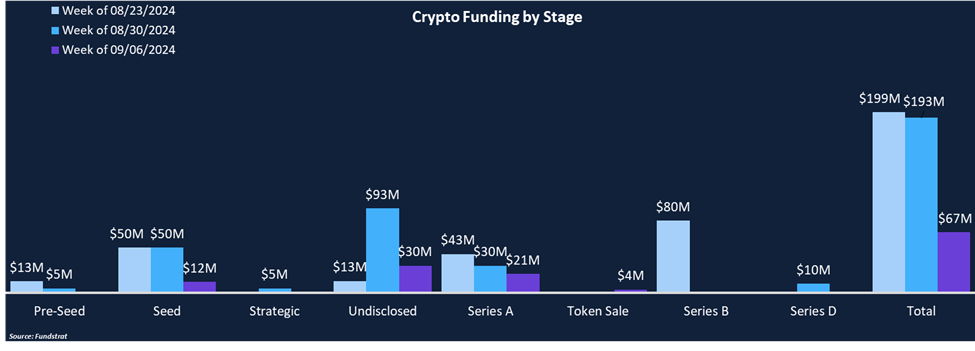

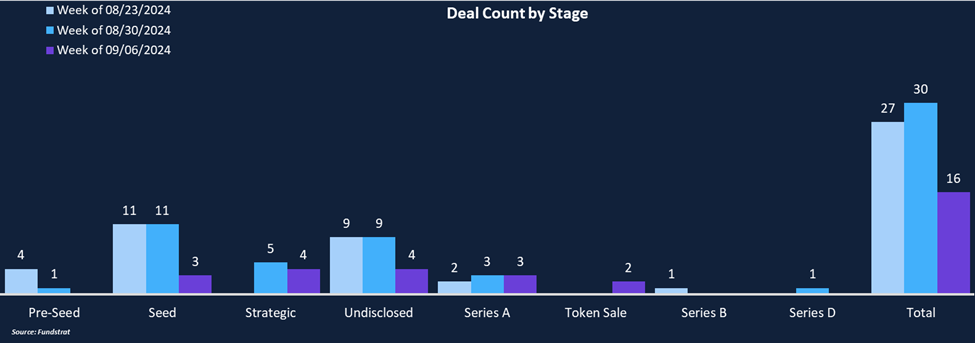

Funding totals were low in a short week following the Labor Day holiday. Total funding fell by 66% from $193 million to $67 million, while total deal count fell 47% from 30 to 16. Only three categories tallied disclosed funding this week, with Gaming being the leader at $39 million. Infrastructure was the leader from a deal count perspective, with five deals comprising 31% of the total. There were two DeFi deals, including one from Pencils Protocol, valuing the token auction and yield optimization protocol at $80 million. Series A rounds led deal stage categories with $21 million in funding across three deals. Additionally, there were two token sales completed by Onocoy and CryptoHunter World, totaling $4 million in fundraising.

Funding by Category

Funding by Stage

Deal of the Week

Hypernative, a blockchain security platform, raised $16 million in a Series A round led by Quantstamp. Other investors include Borderless capital, CMT Digital, Re7 Capital, and others. The funding will be used to expand into new security stack verticals and allow Hypernative to expand globally, grow its team, and establish real-time monitoring and response as a standard security practice.

Why is This Deal of the Week?

Hacks and exploits remain an enormous problem across crypto, with more than $2 billion lost to hacks in 2023 and $1.38 billion in the first half of 2024. Audits are proving insufficient in preventing exploits as 100% of hacked firms in 2023 had completed audits, and teams collectively spent over $1 billion on those audits. Hypernative’s mission is to make crypto hacks a thing of the past. Hypernative’s threat detection system provides an additional layer of security, actively monitoring over 200 risk types from on-chain and off-chain data, covering smart contract hacks, bridge security incidents, front-end compromises, and private key theft.

Hypernative has three main products: its risk platform, security oracle, and screener. Hypernative’s risk platform provides automated actions and alerts to keep protocols aware of potential risks. Its security oracle identifies contracts or wallets as malicious before allowing interactions and removes can blacklist addresses without needing to pause the whole protocol. Lastly, its screener proactively scans blockchain addresses to evaluate on-chain reputations and identify risks ahead of time. Over the past year, Hypernative has expanded its functionality to more than 40 chains and added hundreds of new detectors to identify the industry’s largest set of risks. Hypernative has detected 99.5% of hacks over the last year, with a false positive rate under .001%. Most hacks were detected 2 minutes before the first malicious transaction and Hypernative has helped prevent theft of over $100 million in user funds. Over 100 different projects rely on Hypernative for their security, including Balancer, Blockdaemon, Chainlink, Circle, Consensys, Ethena, Etherfi, Linea, Uniswap, Starknet, and Solana, as they establish themselves as a prominent name in blockchain security.

Selected Deals

Puffpaw, a dePIN network predicated on a “vape to earn” model, raised $6 million in a Seed round led by Lemniscap. Other investors included Volt Capital, Spartan, Folius Ventures, and others. Puffpaw is built on Berachain and is attempting to incentivize people to quit smoking with the help of its Puffpaw Smart Vape (PSV), a healthier alternative to smoking with nicotine-free organic flavorings. All usage is tracked via the PSV, and data is recorded on-chain, adding incentives to reduce smoking activity and try and help the 1.3 billion global smokers quit their habit. The concept is similar to Stepn, which implemented the “move to earn” model. Puffpaw’s mainnet launch and TGE are scheduled for Q4 this year, and the 10k genesis node pre-sale is slated for this month.

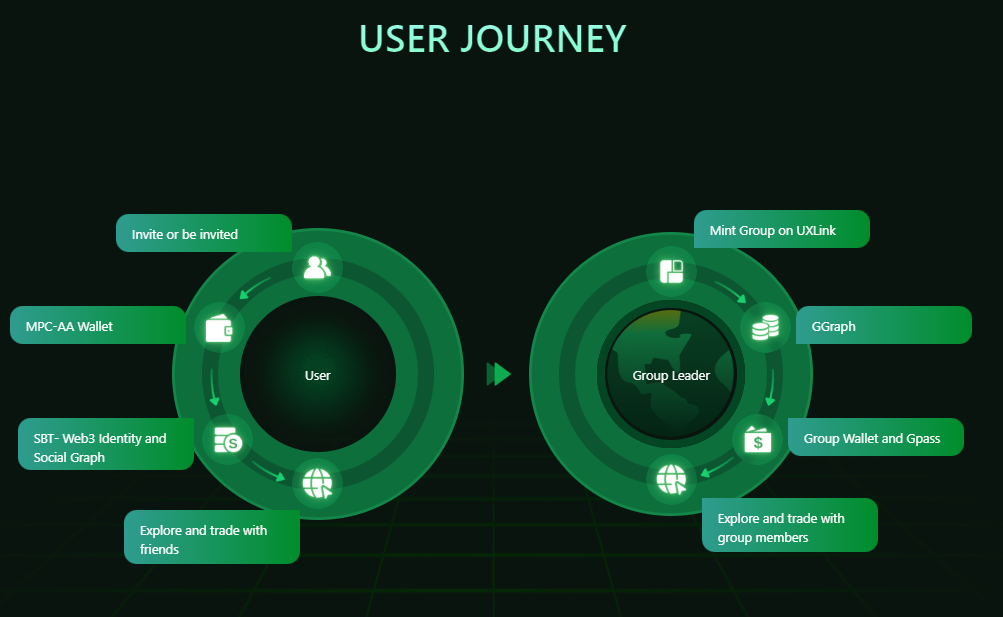

UXLINK, a web3 social infrastructure platform, raised an undisclosed amount in a strategic round from Animoca Brands. UXLINK will work closely with Animoca to accelerate user growth and ecosystem building. UXLINK’s social growth layer aims to seamlessly integrate social groups across Telegram and other web2 platforms for a unified experience. UXLINK’s apps encompass onboarding, wallets, DIDs, graph forming, and group tools, working to unlock the power of social networks in a one-stop-shop. UXLINK is focused on authentic bi-directional connections between creators and users, with both earning rewards for creating connections and interacting across groups. UXLINK’s tools allow users and developers to discover, distribute, and trade crypto assets in a unique socialized group-based manner. UXLINK has accumulated approximately 26 million users across over 100,000 groups.

Balance, an AI-powered blockchain focused on gaming, raised $30 million across two undisclosed rounds led by a16z and Galaxy Interactive. Other investors included Animoca Brands, K5, CLF Partners, MBK Capital, and others. Balance is a sub-product of E-PAL, a social gaming platform with over 4.2 million users, partnerships with over 80 web2 and web3 gaming companies, and 150 games across both segments. Balance is a zkEVM built to support simple web3 wallets, tradable in-game assets, and digital identities to be used across games. Balance will leverage E-PAL’s existing user base, enhance game development, and improve the web3 gaming experience for its users. The funding will primarily be used to enhance Balance’s infrastructure.