Infrastructure Dominates August

Weekly Recap

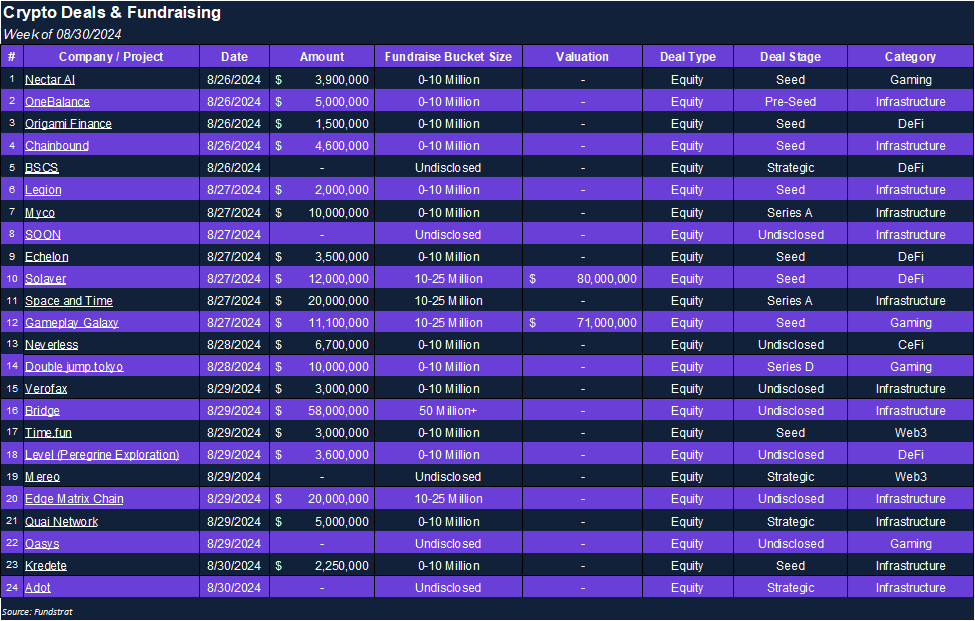

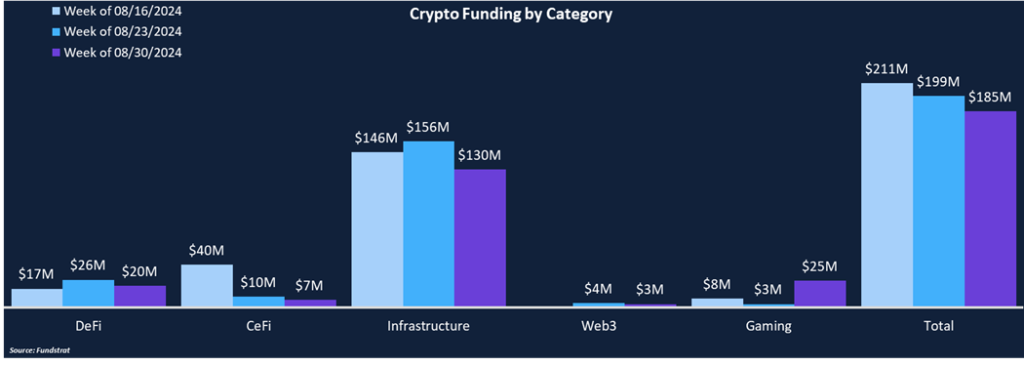

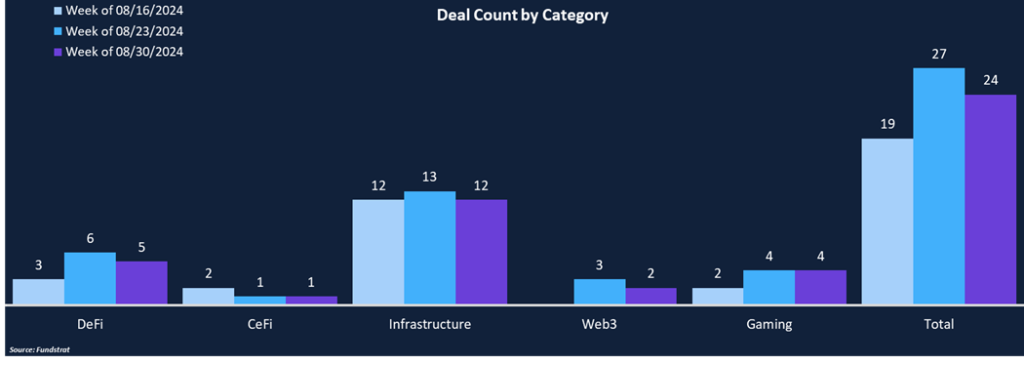

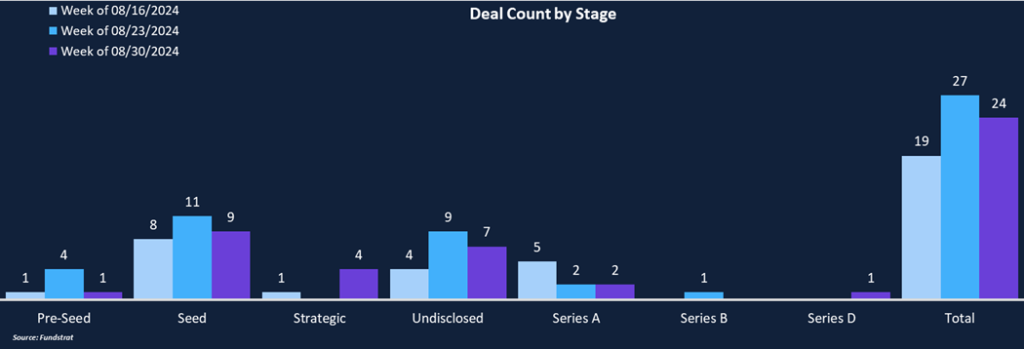

Weekly totals in fundraising and deal count showed slight decreases week over week. Total funding fell 7% from $199 million to $185 million, and deal count dropped 11% from 27 to 24. Infrastructure has dominated the month of August, making up 65% of the month’s funding and comprising 70% of this week’s total. Gaming and DeFi made up the majority of the remaining funding, representing 14% and 11% of the total, respectively. The week’s largest deal was an Infrastructure deal: Bridge, a stablecoin money movement platform, announced $58 million in total funding from Sequoia, Haun Ventures, Ribbit, and Index.

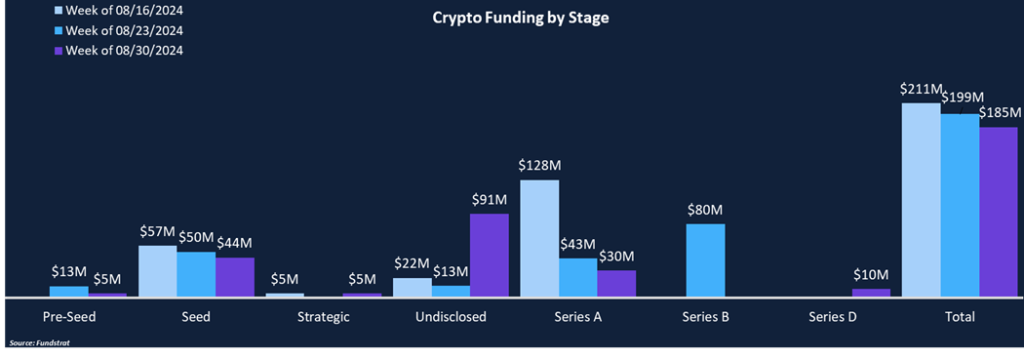

Among deal stages, Seed rounds were the leading category in terms of deal flow, with nine deals, and had the highest funding total of disclosed rounds, at $44 million. This week saw the first Series D investment round in over two years. Double Jump Tokyo raised $10 million in a Series D round led by SBI Investment. Double Jump Tokyo is a blockchain game development company, and the funding will be used to further develop and support blockchain games.

Funding by Category

Funding by Stage

Deal of the Week

Time.fun, a time tokenization platform, raised $3 million in a seed round led by Brevan Howard Digital, with participation from Coinbase Ventures, Palm Tree Crypto, Zee Prime Capital, Maelstrom Fund, and Breed VC. The round was structured as a SAFE agreement with token warrants. Time.fun is a novel web3 social media platform built on the Base network that allows creators to tokenize and monetize their time.

Why is This Deal of the Week?

Time is one of the only universal assets that everyone possesses. Everyone values their time and others’ time differently, but there hasn’t been a way to tangibly quantify these discrepancies across people. Time.fun is taking a novel approach to this problem, allowing anyone to tokenize minutes of their time, enabling the buying, selling, and redemption of a traditionally intangible asset. Time.fun uses a bonding curve (similar to friend.tech) that sets a price on a number of tokenized minutes, allowing traders to speculate on the value of someone’s time or if someone is interested in taking advantage of a user’s time, they can choose to redeem the purchased time. Time.fun currently supports redemptions through one-on-one video conferences, calls, or Q&A answered over messaging. Time.fun utilizes escrow contracts to protect against anyone not honoring their time obligations, with the ability to issue refunds if needed.

Creator activity on the platform is incentivized as users can earn ETH by having others trade or redeem their time, or by referring users to the platform. In addition to creator rewards, a portion of trading and redemption fees will go towards a “timeholder fund,” which can be used however the creator sees fit, for example, by investing in a specific project and distributing profits back to holders. Time.fun launched its app yesterday and hopes to become the go-to place for connecting with people, with plans to build more products with tokenized minutes as a base currency.

Selected Deals

Solayer, a Solana restaking network, raised $12 million in a seed round led by Polychain Capital and Hack VC. Other investors included Binance Labs, Bitscale Capital, Big Brain Holdings, and others. Solayer hopes to emulate Eigenlayer in creating a shared economic security model, leveraging Solana instead of Ethereum, and enhancing the liveliness and scalability of the Solana ecosystem. Users can deposit staked-SOL into Solayer and earn multiple sources of yield: native staking yield, MEV-boost, and AVS yield. In return, depositors receive sSOL, which can additionally be used throughout defi. Since launching in May, Solayer has accumulated over $177 million in TVL, over 100k unique depositors, and launched mainnet with four validated services. Solayer has quickly become the 15th largest protocol on Solana from a TVL perspective.

Space and Time, a decentralized data warehouse, raised $20 million in a Series A round led by Framework Ventures, Faction VC, and Arrington Capital. Other investors included DCG, OKX Ventures, M12, Circle Ventures, and others. Space and Time is a decentralized replacement for blockchain databases, data warehouses, API servers, and indexing services. Standard data structures involve both on-chain and off-chain data being loaded into a transactional database, performing data transformations, and then being pushed out to analytics dashboards or APIs, models, etc., but they can’t be pushed back out to smart contracts. With Space and Time, indexed blockchain data and off-chain data can be loaded into SxT (its data solution), and its Proof-of-SQL allows for smart contracts to use verified data while still being able to push to traditional APIs and front-ends. Additionally, Space and Time is integrating artificial intelligence into its products, with users being able to prompt a chatbot to generate SQL queries, removing the need for technical know-how and creating instant charts and dashboards. Space and Time’s chatbot is powered by OpenAI’s LLM.

Edge Matrix Chain, a decentralized compute network, raised $20 million in a funding round led by Polygon Ventures and Amber Group. Other investors included One Comma, Cyberrock Venture Fund, and others. EMC is designed to scale and support GPU and compute projects for crypto AI projects while introducing a new asset class of tokenized real-world GPU/CPU resources. EMC has three main components: the EMC Protocol, the EMC Hub, and Jarvis. The EMC protocol is a dePIN network for decentralized compute. The EMC Hub is the marketplace for compute and AI services within the EMC ecosystem, with plans to integrate rewards pools, enhancing engagement with ecosystem projects, and Jarvis is an AI agent integrated with AI dApps within the EMC ecosystem. The funds will be used to help launch its layer-1 chain focused on AI apps. EMC is also partnered with our most recent Liquid Ventures recommendation, Nuco.Cloud. EMC is one of the compute providers for its PRO product, which went live this month.