Story of Intellectual Property

Weekly Recap

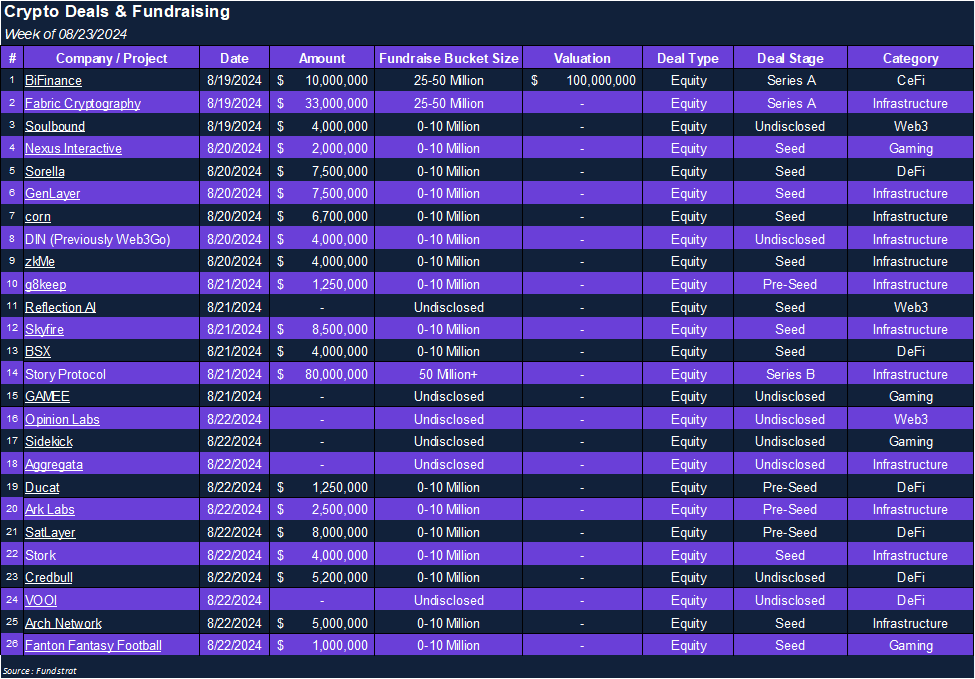

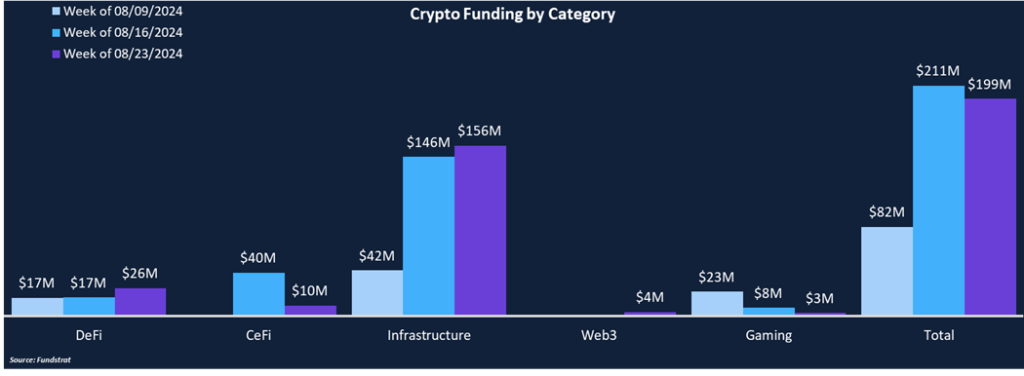

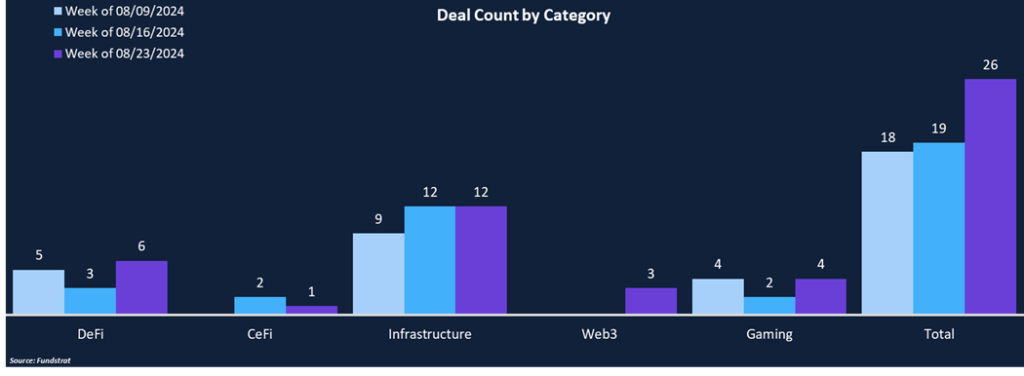

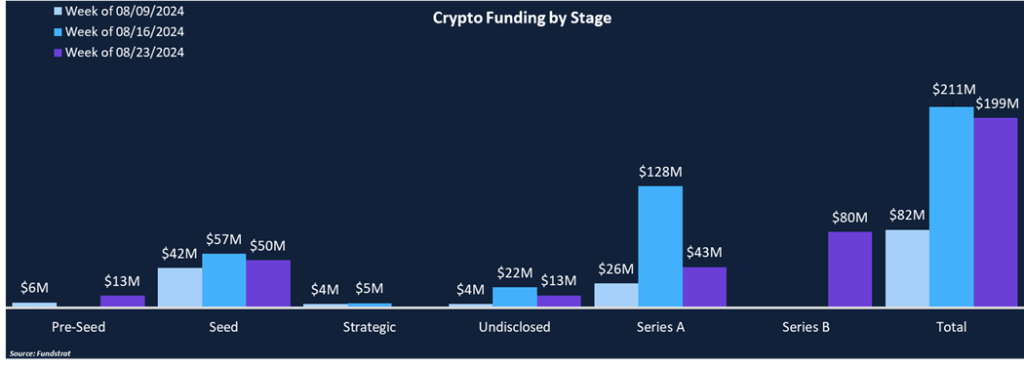

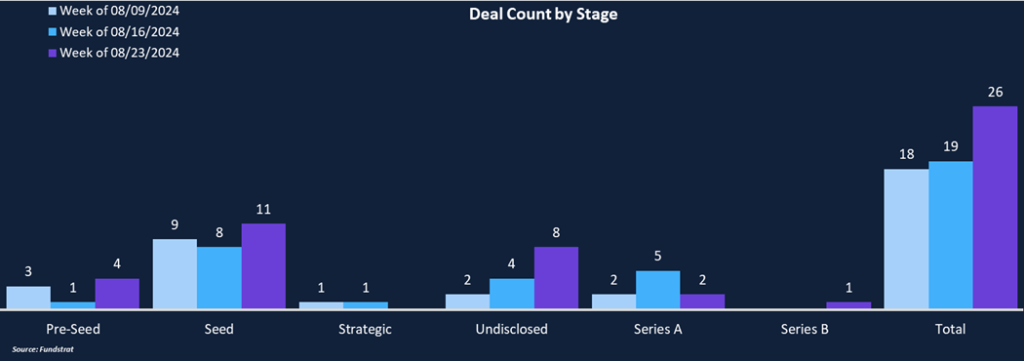

Weekly funding showed a slight decrease, falling from $211 million to $199 million, while the total deal count increased 37% from 19 deals to 26. Infrastructure was the leading category, totaling $156 million in funding across 12 deals and making up over three-quarters of the total amount. DeFi was the second leading category, with $26 million in funding, including SatLayer, a Bitcoin restaking solution similar to EigenLayer. This week consisted of the first Series B round in over six weeks, completed by PIP Labs (Story Protocol), our Deal of the Week. Seed rounds comprised the highest portion of deal flow, representing 42% of the total deal count while only making up 25% of funding.

Although not included in the totals below, a notable mining M&A transaction was announced this week. Bitfarms agreed to acquire Stronghold Digital Mining for $125 million in stock. Stronghold shareholders will receive 2.52 Bitfarms shares for each share held, an approximate 70% premium from its 90D volume-weighted average price. The transaction also includes assumed debt of about $50 million. The transaction is notable, considering Bitfarms is actively fending off a takeover attempt from Riot Platforms.

Funding by Category

Funding by Stage

Deal of the Week

Programmable IP (PIP) Labs, the developer of Story Protocol, raised $80 million in a Series B round led by a16z. Other investors included Polychain Capital, Scott Trowbridge, and Adrian Cheng. The round was structured as equity with token warrants. The round brings PIP Labs’ total funding to $140 million. Story Protocol is a layer one blockchain designed to protect content creators’ intellectual property and ensure creators are compensated properly.

Why is This Deal of the Week?

With the acceleration of AI-generated content, it’s hard to know who created what and what compensation should be attributed to whom. Story Protocol wants to tackle this problem by tokenizing all intellectual property, making it programmable in the AI age. Story Protocol will allow creators to register their IP on-chain, allowing it to be easily tracked and verified, protecting creator rights and ensuring proper monetary compensation. From there, with the help of Story Protocol’s proof-of-creativity mechanism, creators can easily license their IP to AI models or other creators, avoiding the need for contracts and cumbersome legal paperwork and facilitating flourishing creator and AI economies. PIP Labs has stated that there are over 200 teams covering more than 20 million IPs already building on Story. The mainnet launch is expected before the year ends. It is built on the Cosmos SDK but will be fully compatible with the EVM. The team failed to issue a timeline for when Story’s native token will launch.

Selected Deals

SatLayer, a Bitcoin restaking solution, raised $8.5 million in a pre-seed round led by Hack VC and Castle Island Ventures. Other investor participation included Franklin Templeton, Amber Group, OKX Ventures, Bing Ventures, and others. SatLayer is building the universal security layer powered by Bitcoin. SatLayer is built on top of Babylon and is a Bitcoin equivalent of EigenLayer, allowing users to restake their Bitcoin, which in turn is used to secure Bitcoin Validated Services (BVS). SatLayer opened the first round of deposits today (capped at 100 BTC), where users can earn rewards that will likely (although not confirmed) be redeemable for SatLayer tokens in the future.

Skyfire, a crypto payment network for AI agents, raised $8.5 million in a seed round from Circle, Ripple, Gemini, and Draper Associates. Skyfire is attempting to build the financial stack for the AI economy. Its SDK will empower AI agents to receive or send payments for services, data, or products, removing the need for credit cards, bank accounts, or human interaction. Skyfire’s infrastructure enables the trustless AI economy by leveraging stablecoins. Additionally, with its digital identity solution, vendors and customers can verify that they are sending/receiving funds from a trusted source. AI agents are becoming increasingly popular, and facilitating operational finance between agents is a novel and untapped market.

Fanton Fantasy Football, a blockchain-based fantasy sports platform, raised $1 million in a Seed round led by Animoca Brands, Delphi Ventures, and Kenetic Capital, with other participation from Hashkey, TON Accelerator, and Paka Fund. Fanton Fantasy Football operates on the TON Network and allows users to play fantasy sports with NFTs representing players. Performance is determined according to the players’ real-world performances, and then users can earn real money and prizes. The platform has already attracted over 120k users and paid over $100k in prizes. Fanton just completed its presale for its token, FTON, which can be purchased in OTC markets.