Large Series A Rounds Fuel Funding Surge

Weekly Recap

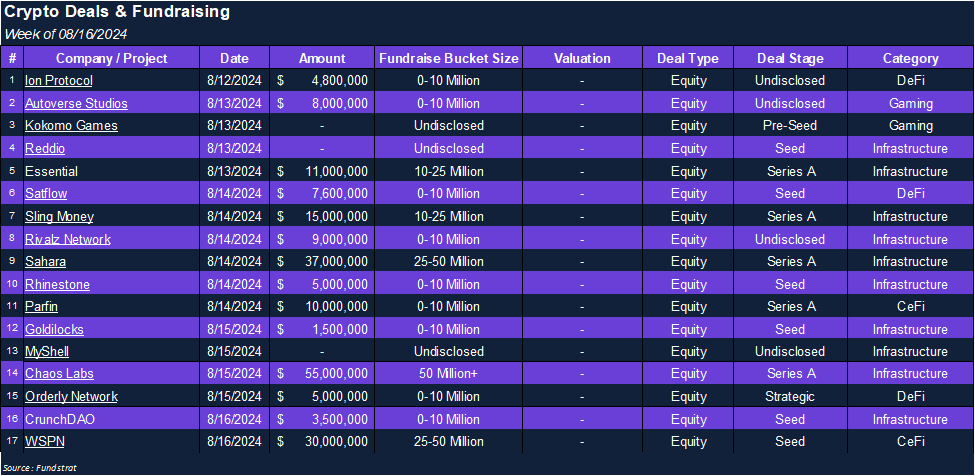

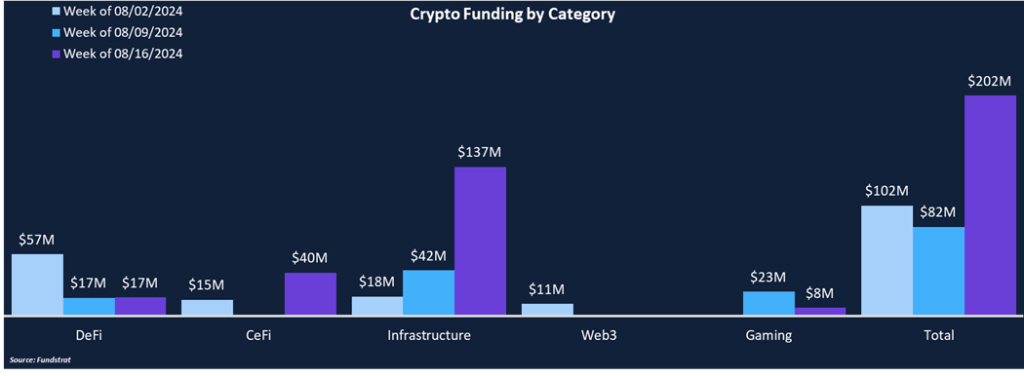

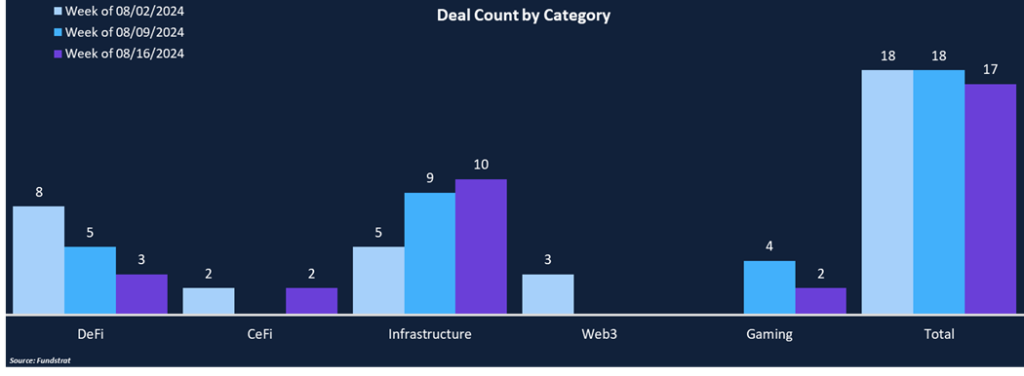

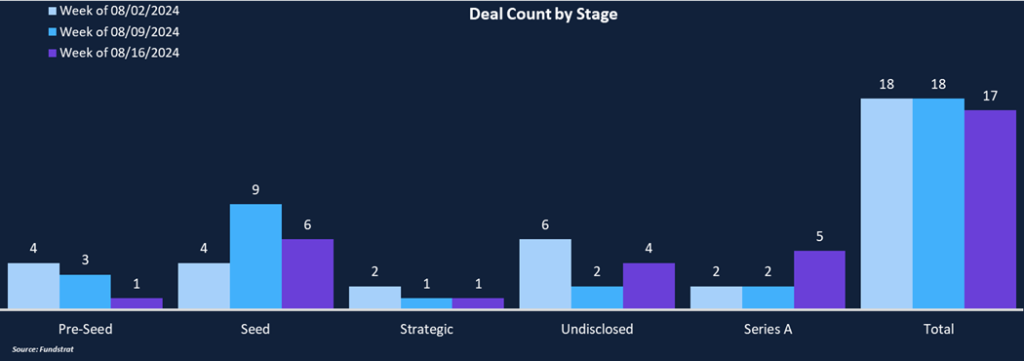

Weekly funding saw a notable increase from $82 million to $202 million, a 147% increase, while this week’s deal count was roughly in-line with the previous two weeks, notching 17 deals compared to 18. Infrastructure was the leading category in terms of fundraising, making up approximately two-thirds of the total with $137 million. CeFi was the next most funded category at $40 million, with the two companies receiving funding (Sling & WSPN), both being centered around stablecoin payments.

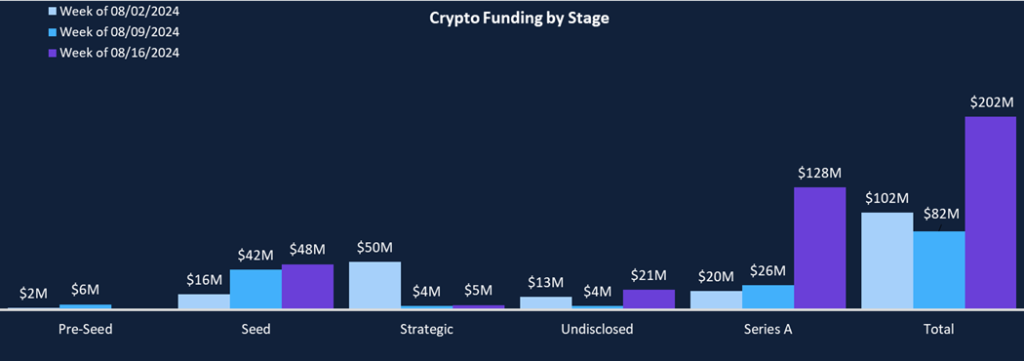

Series A rounds received $128 million in funding, making up 63% of the total, and was the second most popular deal stage, only behind Seed rounds, which saw one additional deal (6). The considerable Series A total was in large part to Chaos Labs (DotW) and Sahara Labs’ $55 million and $37 million rounds. Series A rounds have been becoming more commonplace in 2024 compared to 2023, with 80 Series A deals so far this year compared to 91 in all of 2023.

Funding by Category

Funding by Stage

Deal of the Week

Chaos Labs, an on-chain economic security protocol, raised, $55 million in a Series A round led by Haun Ventures. Other investors include F-Prime Capital, Slow Ventures, Spartan Capital, and others. The fresh funding round will fuel Chaos Labs’ mission to enhance on-chain eocnomic security through innovative risk management solutions.

Why is This Deal of the Week?

DeFi protocols often rely on stale data points for risk analysis and are slow to respond to evolving metrics, burdened with manual calculations and data aggregation. Counterparts within TradFi markets, like options and futures exchanges, often utilize risk engines built on top of high-performance data feeds to inform their decision-making.

Chaos Labs is striving to transform on-chain economic security, utilizing high-quality data feeds to inform risk management decisions. Chaos’ technology combines offchain market data and dynamic risk parameters to give protocols instant updates reflecting the dynamic environment associated with crypto. Their product suite includes risk management tools, data analytics, and economic incentive optimizations. Over the past year, Chaos Labs has tripled its customer base to over 20 protocols, including large DeFi names like Aave, Jupiter, dYdX, and Ethena. Their underlying technology has helped secure over $860 billion in cumulative trading volume, $25 billion in loans, and $35 million in incentives. Chaos Labs is setting the standard for on-chain risk management and hopes to cement itself as the go-to solution for all of DeFi.

Selected Deals

Sahara Labs, a decentralized AI platform, raised $37 million in a Series A roundco-led by Pantera Capital, Binance Labs, and Polychain Capital. Other investors included Binance Labs, Samsung Next, Matrix Partners, Nomad Capital, Foresight Ventures, and others. Concern over copyright, privacy, resource access, and economic imbalances continue to grow as AI development and adoption continues to accelerate. Both users and contributors are looking for ways to secure ownership and receive proper compensation for contributions. Sahara AI empowers everyone to control and own their AI assets, including underlying data and models. The fresh capital will support Sahara Labs’ team expansion and enhance the performance of its AI blockchain ecosystem.

Sling Money, a global payments company, raised $15 million in a Series A round led by Union Square Ventures, Ribbit Capital, and Slow Ventures. Sling Money combines stablecoin technology with a user-friendly interface and seamless integration into fiat payment systems to facilitate global remittance faster and cheaper than traditional providers. Sling Money allows users to instantly send money to over 50 countries across Europe and Africa to other users, between personal accounts, or to non-sling users. Transfers take a few seconds compared to global remittances, which often take hours to days to settle, and a percentage of funds are taken as a fee. Sling Money has little to no fees, facilitated by the use of Paxos’ stablecoin, Pax Dollar (USDP). The Sling app seamlessly converts between fiat currency and USDP across domiciles. The Sling app is currently available in the Apple and Google stores, although there is a waitlist before accessing the full functionality.

Parfin, a digital asset management service provider, raised $10 million in a Series A round led by Parafi Capital, with participation from Framework Ventures, L4 Venture Builder, and Nuclea. Parfin provides institutional solutions such as a crypto brokerage, portfolio management tools, and tokenization, and stablecoin payment infrastructure. Parfin is also building Rayls, a permissioned EVM layer-2 tailored towards institutional finance. Rayls supports the UniFi ecosystem, combining the reliability, privacy, and compliance of TradFi with the access and innovation of DeFi. Rayls is participating in a CBDC pilot initiated by the Central Bank of Brazil and was previously funded and highlighted by professional service company Accenture. Parfin will use the funding to continue developing Rayls, attract top-talent, and continue its global expansion.