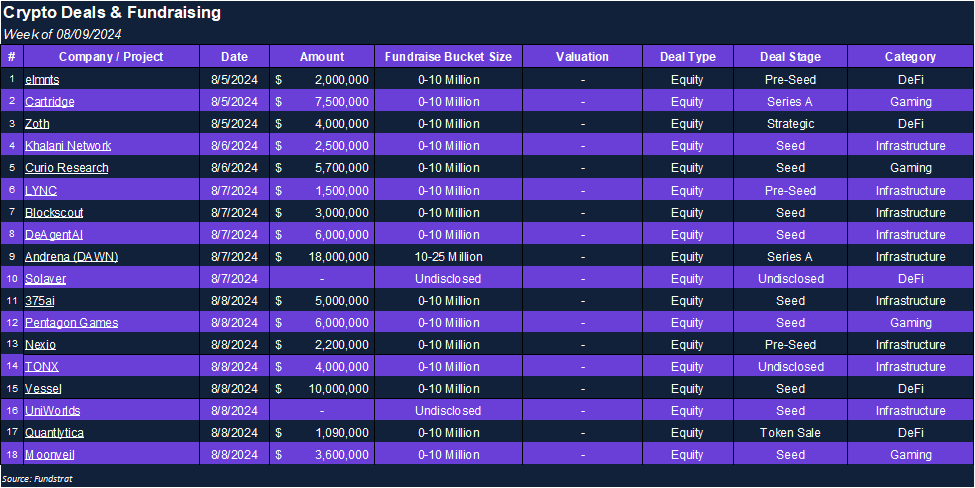

dePIN & Gaming Popular in Quiet Week

Weekly Recap

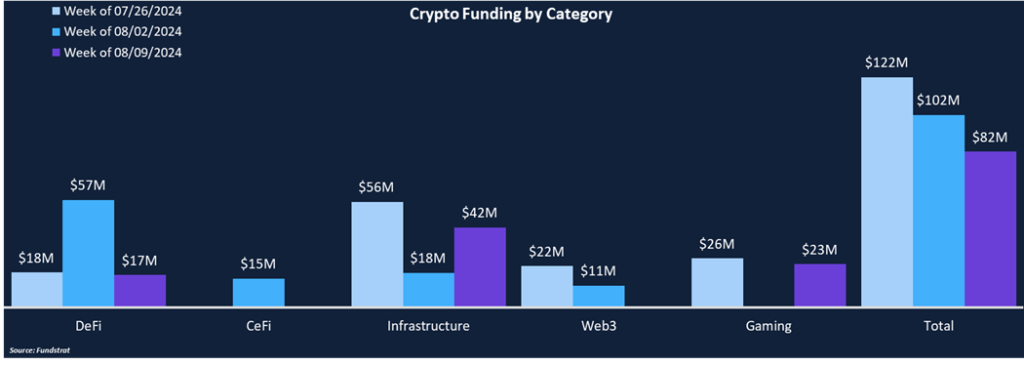

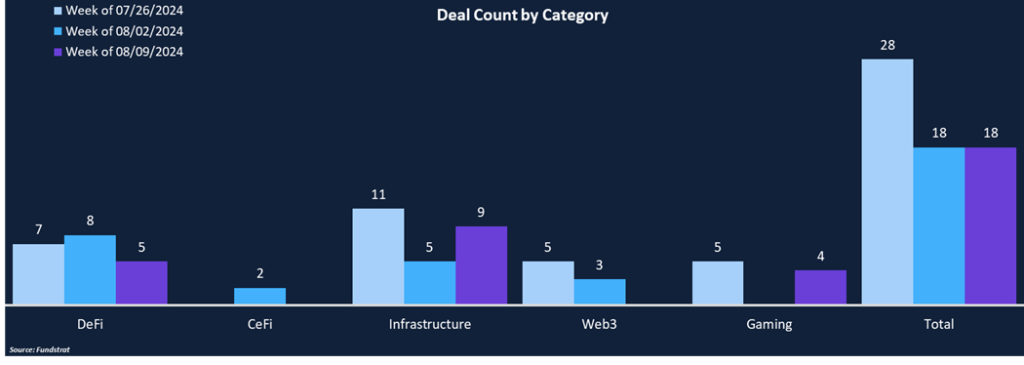

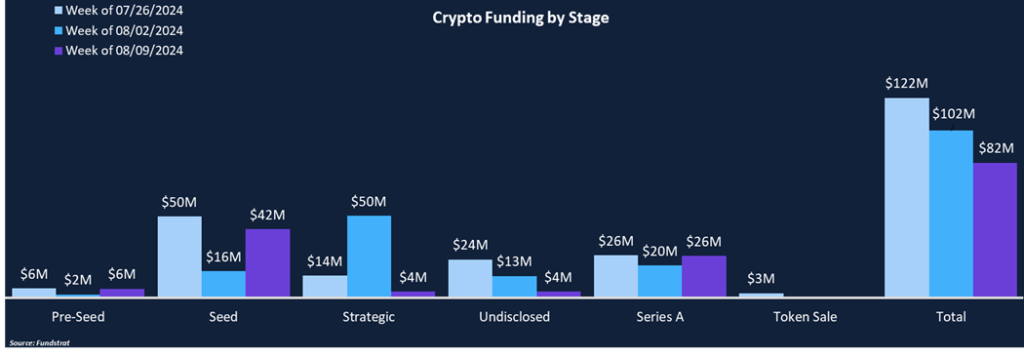

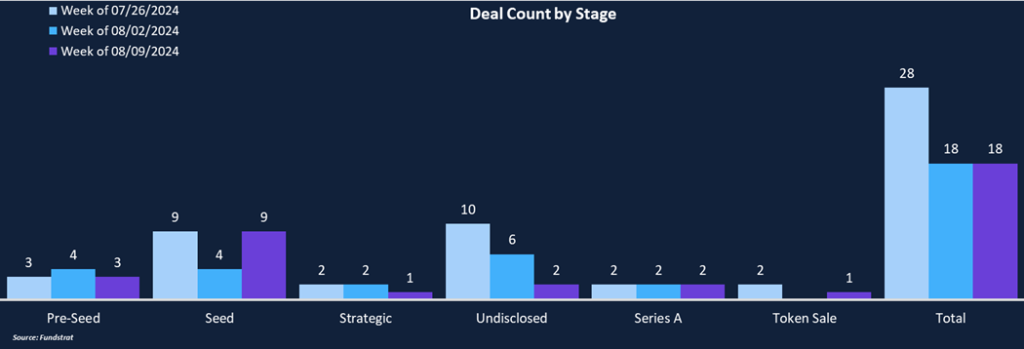

Weekly funding fell 19% to $82 million, while the deal count was steady week-over-week at eighteen deals. Two categories were absent of funding this week, with CeFi and Web3 not tallying any deal flow. Of the three categories notching deals, Infrastructure made up 51% of funding and 50% of deal count. Gaming posted a strong week with four deals totaling $23 million in funding. From a deal stage perspective, seed rounds made up the majority of fundraising and deal count, comprising about half of both totals.

Almost halfway through Q3, funding levels remain suppressed compared to the first half of the year. Both Q1 and Q2 saw over $2 billion in funding and over 350 deals, while Q3 is on pace for about $1.5 billion and 300 deals, as the summer months typically represent the lowest quarter of the year. Similarly, Q3 2023 posted approximately $1.4 billion in funding, although with fewer deals (214).

Funding by Category

Funding by Stage

Deal of the Week

Andrena, an internet services company, raised $18 million in an extended Series A round led by Dragonfly Capital, with participation from ParaFi Capital, Wintermute, 6th Man Ventures, Robot Ventures, and others. The funding will be used to continue developing its decentralized autonomous wireless network (DAWN), a dePIN network aimed at providing affordable decentralized internet services at multi-gigabit speeds. The round was structured as a SAFE agreement with token warrants and brings Andrena’s total funding to $38 million.

Why is This Deal of the Week?

The wireless internet services market is estimated to reach $696 billion in 2024 and continue growing at a CAGR of 6.6% over the next four years, reaching $897 billion by 2028. Despite broadband internet being an essential component of daily life, customers still lack competitively priced and consumer-friendly solutions, largely due to the oligopolistic market structure dominated by a few large corporate providers. For reference, half of Americans do not have multiple ISPs to choose from, and many ISPs have single-digit NPS scores. DAWN, Andrena’s Solana-based dePIN network, aims to commoditize internet bandwidth and shift the internet from a provider-owned model to a consumer-owned model. With DAWN’s hardware, users can operate as their own mini data centers, selling excess bandwidth or purchasing additional bandwidth from the network. Similar to how solar panels allow households to control energy consumption and sell excess energy back to the grid, DAWN’s foundational protocol will bootstrap and orchestrate multi-gigabit, user-powered mesh networks.

DAWN’s mobile app will serve as the hub for native token purchases, which will be used to pay for internet bandwidth. The app will connect to home hardware devices, linking users to the DAWN internet marketplace and enabling bandwidth sharing. DAWN will incentivize network participants with reward points for staying connected to the network or operating as validators. Among the reasons to pay close attention to this project, DAWN’s wireless network will launch having already achieved decent traction, covering over 3 million households in the U.S., with plans to eventually expand to Asia, Europe, and Latin America. Currently in its testnet phase, DAWN has not yet announced a timeline for its mainnet and token launch.

Selected Deals

Vessel, a zero-knowledge powered DEX, raised $10 million in a seed round from Sequoia Capital, Avalanche Foundation, Folius Ventures, and others. One of the tradeoffs among crypto exchanges is balancing transparency with efficiency. With Vessel’s ZKP techniques and off-chain transaction processing with on-chain verification, they plan to transform crypto trading. Vessel uses a hybrid orderbook AMM, combining the best features of both models, giving traders optimal price execution and enhanced market participation. Vessel also claims to have extremely high throughput, able to handle over 1000 transactions per second with latency under 50 milliseconds. Vessel will offer spot and perpetual trading and plans to add other crypto derivatives to the platform. The funds will be used to integrate CEX efficiency with DEX transparency, enhance liquidity efficiency, and develop ZKP solutions for DeFi.

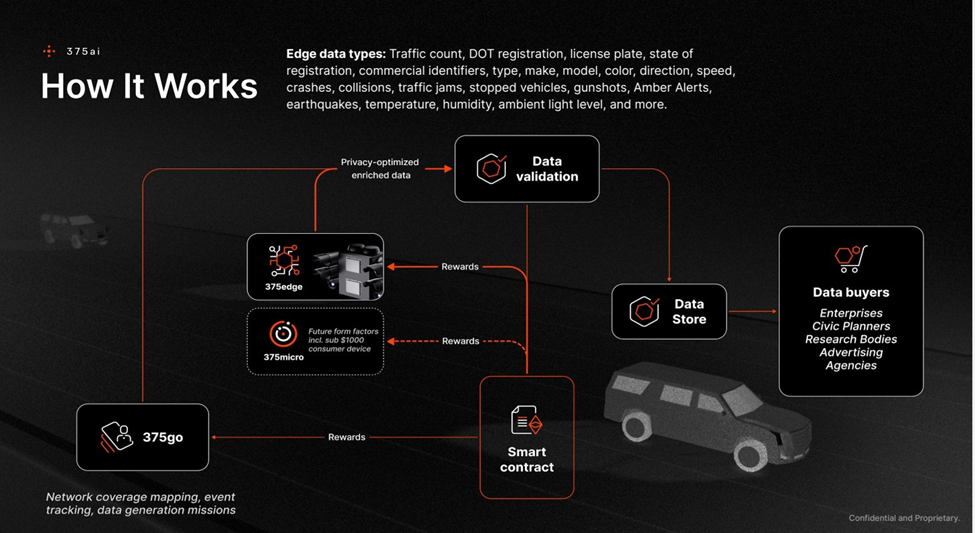

375ai, an edge data intelligence network built on Solana, raised $5 million in a Seed round from 6th Man Ventures, Factor, Arca, EV3, Primal Capital, and Auros. Edge intelligence is the when data computation or AI applications occur at the “edge” of where data is originally created (think directly on IoT devices/sensors), compared to data that is created and subsequently transported to cloud servers before being utilized or manipulated. With the growth of artificial intelligence applications and connected devices, the demand for edge data intelligence has accelerated. 375ai is creating an AI node network designed to collect and analyze multi-modal data in real-time and provide high-fidelity data streams to that can be purchased via their data marketplace. 375edge is their first product which is focused on collecting traffic and environmental data. The fresh capital will be used to expand operations and enhance product development.

Cartridge, a web3 gaming infrastructure company, raised $7.5 million in a Series A round led by Bitkraft Ventures. Other investors included Fabric Ventures, Primitive Ventures, StarkWare, Dune Ventures, and Ergodic Capital. Cartridge provides a web3 gaming toolkit, empowering developers to easily build provable on-chain games and autonomous worlds. Cartridge offers three different solutions: Dojo, Slot, and Controller. Dojo provides a comprehensive toolchain for developing provable games, applications, and worlds. Slot is an execution layer for Dojo games, offering horizontally scalable execution sharding for low latency execution. Controller is an identity and reputation layer for players, providing onboarding and self-custodial embedded wallets. Cartridge already has seven games built using Dojo. The funds will be used to accelerate on-chain game development.