DeFi Shines to Start August

Weekly Recap

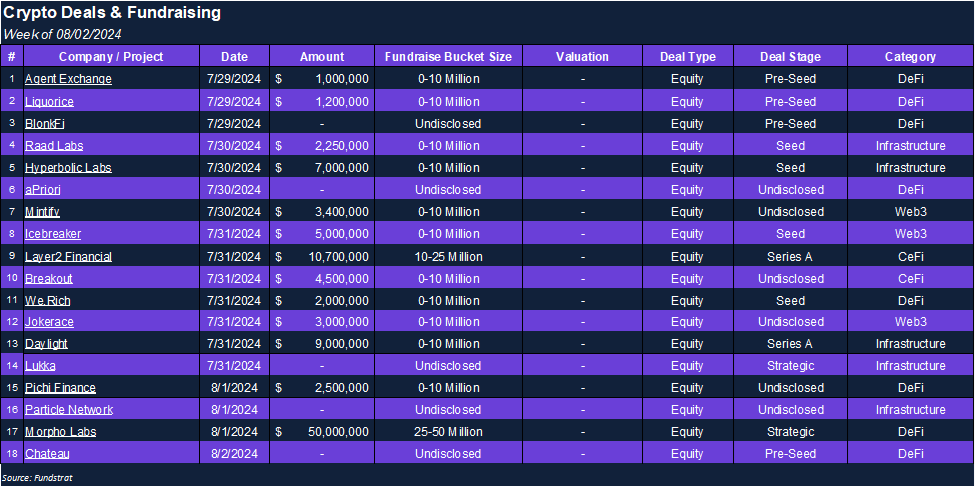

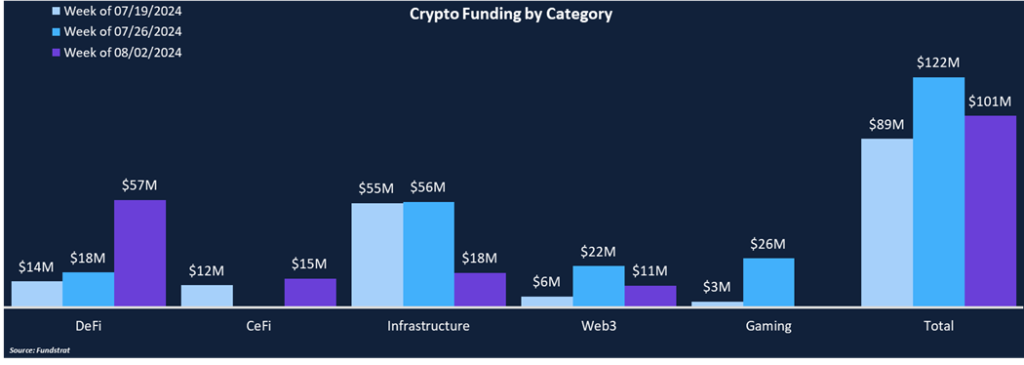

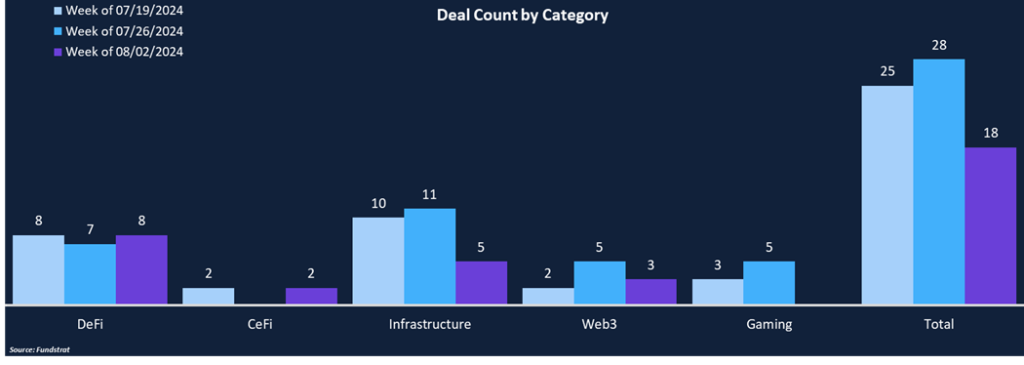

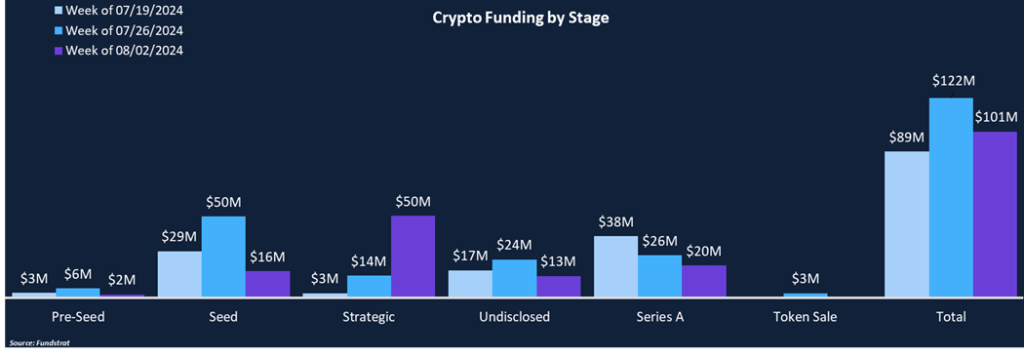

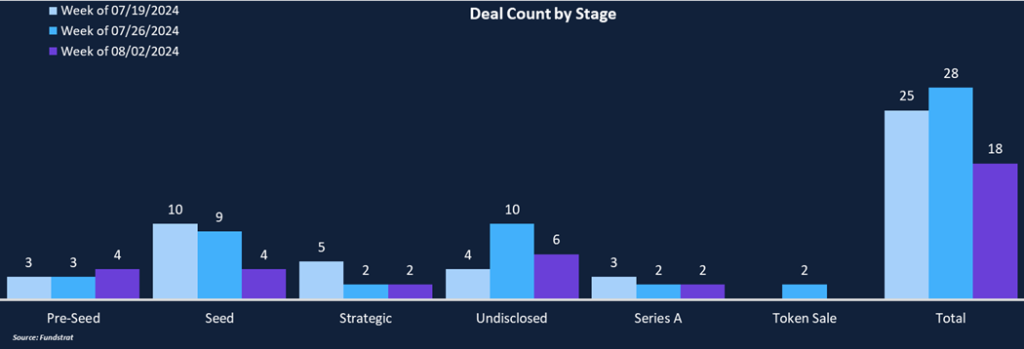

Total funding dropped 17% from $122 million to $101 million, while the deal count fell 36% from 28 to 18. Although totals were muted compared to the prior two weeks, this week had the highest average deal size, at $5.6 million. DeFi was the leading category from both a fundraising and deal flow perspective, raising $57 million across eight deals, including our Deal of the Week, Morpho Labs. Uncharacteristically, Infrastructure projects only garnered $18 million in investment across five deals, one of the lower totals seen in recent months. Deal count was relatively evenly distributed across stages, although Series A and Strategic rounds comprised 70% of total funding. There is still a notable lack of any later-stage funding rounds.

Funding by Category

Funding by Stage

Deal of the Week

Morpho Labs, the development company behind Morpho, a decentralized lending protocol, raised $50 million in a strategic round led by Ribbit Capital, with participation for a16z, Coinbase Ventures, Variant, Pantera, Brevan Howard and other notable names. The funding will be used to expand Morpho’s ecosystem and support grants for contributors and become the most trusted infrastructure across defi.

Why is This Deal of the Week?

Morpho currently has two main products: Morpho Blue and Morpho Optimizers. Morpho Blue is the current version of its lending protocol, which allows for permissionless lending and borrowing. Morpho Optimizers was the first version of the protocol, which was built on top of other lending protocols like Aave and Compound to optimize rates among defi users while maintaining the same liquidity and risk parameters.

Lending and borrowing are two of the critical activities that fuel financial markets, adding leverage to the system and allowing investors to take advantage of rate differentials. From there, savvy market participants can build structured products by combining different strategies. Morpho is evolving beyond a pure application into an infrastructure layer, allowing investors or protocols to create structured products on its foundational protocols. Morpho already has multiple “vaults” managed by professional investors that provide different risk and return profiles, providing investors with simplified defi strategies. Morpho has seen impressive traction in a short period, nearly tripling its TVL since the start of the year to over $1.7 billion.

Selected Deals

Layer2 Financial, a payments infrastructure company, raised $10.7 million in a Series A round led by Galaxy Digital with participation from Accomplice Blockchain and Sapphire Ventures. Layer2 Financial leverages fiat and digital currencies to facilitate billions of dollars of transactions. With a single API, Layer2 allows businesses to accept and make payments via ACH, Fedwire, SWIFT, SEPA, and EFT. Additionally, Layer2 handles all compliance across different jurisdictions so companies don’t need to concern themselves with knowing the proper KYC and AML rules. The fresh funding will be used to enhance product development, market expansion, tech infrastructure and add talent to its teams.

Daylight, a decentralized physical infrastructure network (DePIN), raised $9 million in a Series A led by a16z, with participation from Framework Ventures, Lattice and others. Daylight allows users to connect their energy generation devices such as smart thermostats, solar inverters, batteries, and electric vehicles to its protocol and receive incentives for providing energy. Users can also get access to energy upgrades for their homes or buildings by joining the Daylight marketplace. Additionally, Daylight has an on-chain platform for distributed energy capacity and data. The fresh funding will support the protocol’s development and the distribution of its energy devices.

Breakout, an online crypto proprietary trading firm, has raised $5.4 million from investors including RockawayX, Mechanism Capital, and others. Retail traders can sign-up to pass a trading evaluation, after which, Breakout will fund their accounts and share in profits. The evaluation options include a one-step evaluation option, requiring a 10% gain with strict drawdown rules, or a two-step evaluation, needing a 5% gain followed by 10%, with more flexible drawdown limits. Successful traders can receive a funded account with up to $200,000 in notional funds and earn 80-90% of their profits as payouts. Breakout plans to use this funding to expand in Asia-Pacific and Latin America and grow its user base through a global affiliate program.