Funding Rebounds to End Q2

Weekly Recap

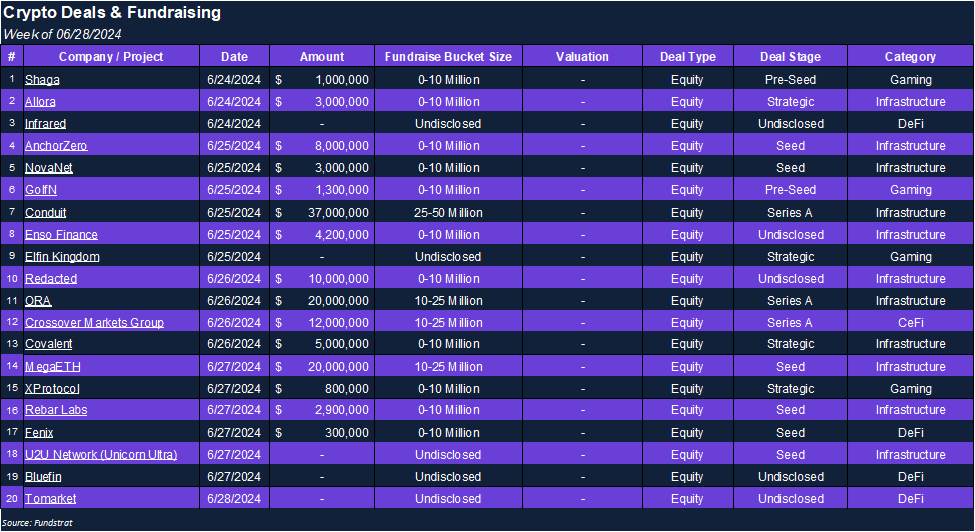

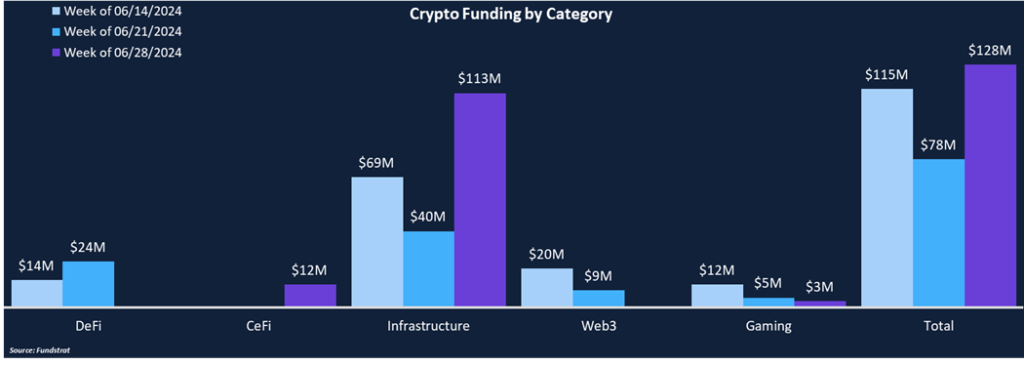

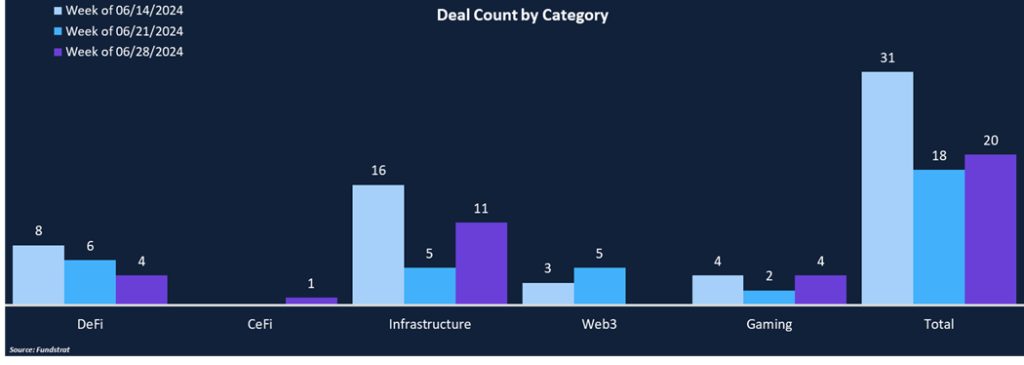

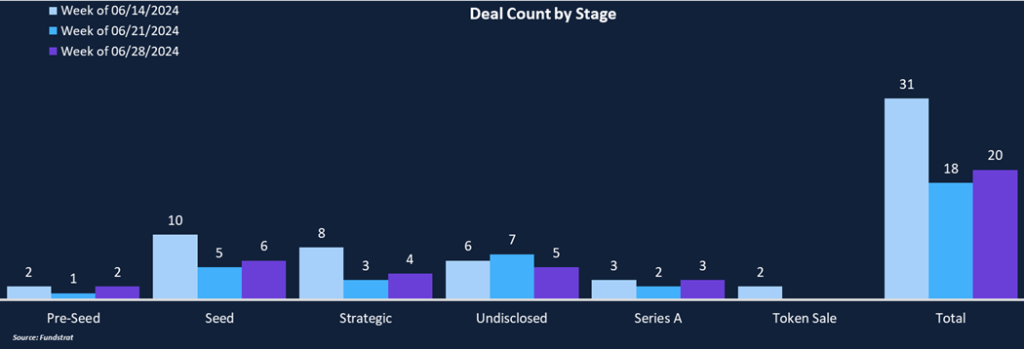

In the final week of Q2, crypto funding bounced back, rising 64% from $78 million to $128 million, while deal count rose modestly from 18 to 20. The funding total was dominated by Infrastructure, which comprised 88% of the total and also made up 55% of the total deal count. CeFi broke its streak of two weeks with no deal flow with a singular Series A round completed by Crossover Markets, an execution-only crypto exchange. Although DeFi posted four deals this week, they were all for undisclosed amounts.

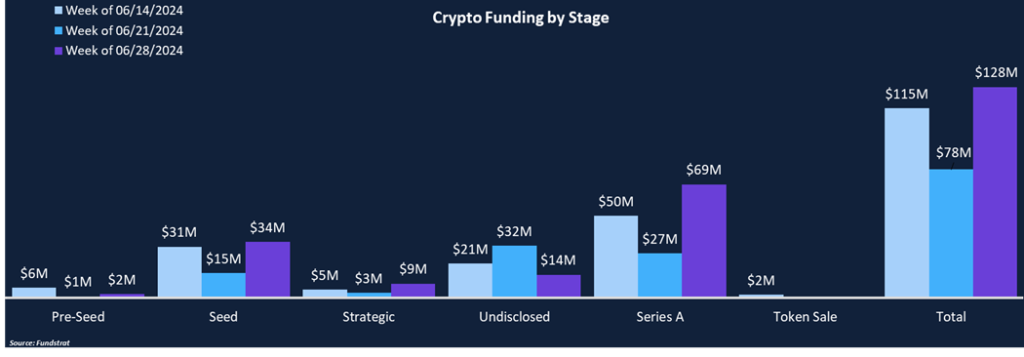

Funding was concentrated in Series A and Seed stages, contributing 54% and 27% of total funding, respectively. Seed rounds were the most common stage, tallying six deals, while the remainder of deals were relatively evenly distributed across Strategic, Series A, and Pre-Seed stages.

June finished with $509 million in funding across 94 deals, the lowest monthly totals thus far in 2024. Q2 funding and deal count showed 13% and 4% increases compared to Q1. Looking ahead, Q3 totals historically tend to be the lowest of the year, as there is less activity during the summer months.

Funding by Category

Funding by Stage

Deal of the Week

ORA, a trustless AI protocol, raised $20 million in a Series A round from Polychain Capital, Hashkey Capital, SevenX Ventures, and HF0. ORA is a verifiable oracle protocol which integrates AI inference directly into smart contracts to enhance compute capabilities, unlocking a new set of AI powered dapps. The funding will be used to develop and enhance its infrastructure and expand the ecosystem.

Why is This Deal of the Week?

The convergence of crypto and AI continues to accelerate, but smart contract limitations are still an inhibitor due to their inability to interact natively with AI models. Many of the largest and most advanced models are operated by centralized entities with little consideration for integrating with blockchains. On-chain models struggle to gather sustainable contributions and monetize outputs, resulting in projects fizzling out or lack of adoption. ORA is tackling all these problems by creating a trustless AI protocol that enhances smart contracts and creates a sustainable funding mechanism for AI projects.

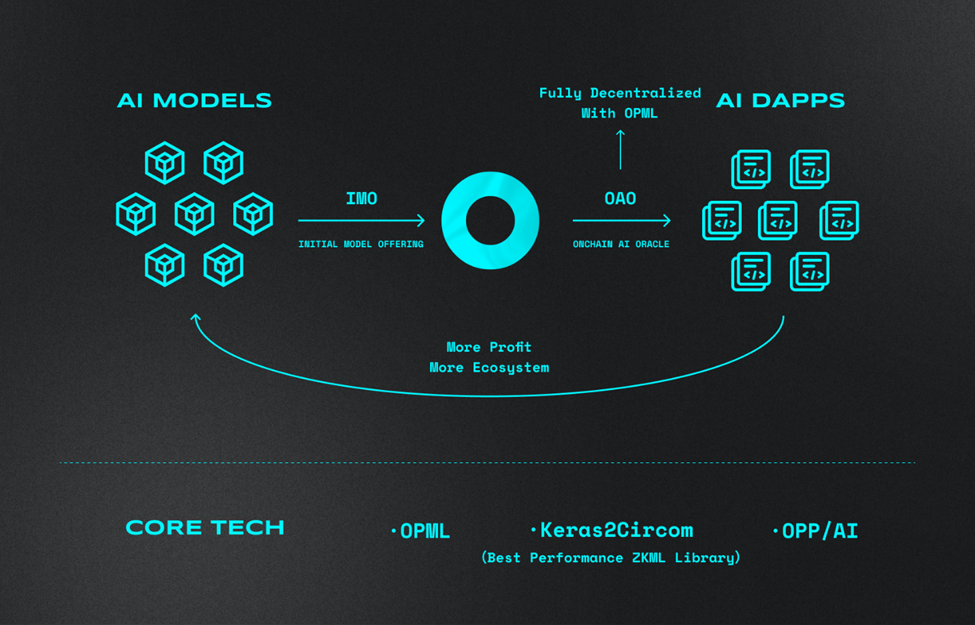

ORA has two overarching components fueling its protocol: an Initial Model Offering (IMO) and an On-Chain AI Oracle (OAO). Initial Model Offerings are the term for the tokenization of AI models, bringing AI inferences on-chain, unlocking open-source contributions and aligning long-term incentives between contributors and investors. When an AI model completes an IMO, the project releases ERC20 shares, which entitles purchasers to revenue generated by the model. This aligns the improvement of the model with investors’ goal of increasing earnings while creating tokenized inference assets verified by ORA’s OAO oracles.

ORA’s AI-powered oracle network creates verifiable proofs for ML computations, allowing on-chain AI inferences to be verified and leveraged across different blockchains. ORA’s on-chain AI engine is integrated with three different machine learning models to support computations, hoping to allow any open-ML model to seamlessly integrate into the oracle network. Together, IMOs and OAOs unlock new potential for AI-powered smart contracts, with AI inferences becoming composable across apps and blockchains. Developers utilizing OAOs receive all-in-one infrastructure with AI capabilities and automation, higher performance, shorter finality, and the ability to run any ML model or arbitrary program.

Selected Deals

GolfN, a golf-to-earn project, raised $1.3 million in a pre-seed round with investor participation from Citizen X, Fourth Revolution Capital, Joe McCann, and others. GolfN is a gamified digital collectible game where users can earn different NFTs or rewards for completing activities on the golf course. At the end of the round, players can see their accumulated rewards and use them to upgrade their digital clubs or accessories. GolfN is built on Solana and released its genesis NFT collection in March, selling out in less than an hour. GolfN is integrated at over 30,000 golf courses worldwide and plans to launch its mobile app later this year, but users can add themselves to the waitlist in the meantime. The fresh funding will be used to scale the GolfN app and expand the ecosystem.

Conduit, a rollup-as-a-service platform, raised $37 million in a series A round led by Paradigm and Haun Ventures, with other participation from Coinbase Ventures, Robot Ventures, and Bankless Ventures. 287 rollups launched using Conduit’s infrastructure, which have accumulated over $1.2 billion in TVL. Collectively, Conduit’s rollups are processing 20% of Ethereum transactions, and Conduit has helped scale Ethereum on-chain computing by more than 15 times. All Conduit rollups are supported by their in-house cloud solution, boasting 99.98% historical uptime. The fresh capital will help Conduit facilitate products that help developers build their own customized rollups supporting a wider range of user applications.

MegaETH, an Ethereum scaling solution, raised $20 million in a seed funding round from DragonFly Capital, Big Brain Holdings, Robot Ventures, Figment Capital, Vitalik Buterin, and others. Most EVM-compatible blockchains can only reach 3-digit transactions per second (TPS). MegaETH is targeting 100,000 TPS by leveraging its heterogeneous blockchain structure and a hyper-optimized EVM execution setting, making MegaETH the first “real-time blockchain.” The heterogeneous architecture allows nodes with different hardware specifications to specialize in optimized tasks while the execution environment maximizes resource efficiency. MegaETH claims to process transactions as soon as they arrive and publish state changes in under 10 milliseconds. MegaETH’s public testnet is scheduled to launch in early fall, with the mainnet expected to go live by the end of the year.