Improving the DeFi Experience with Intents

Weekly Recap

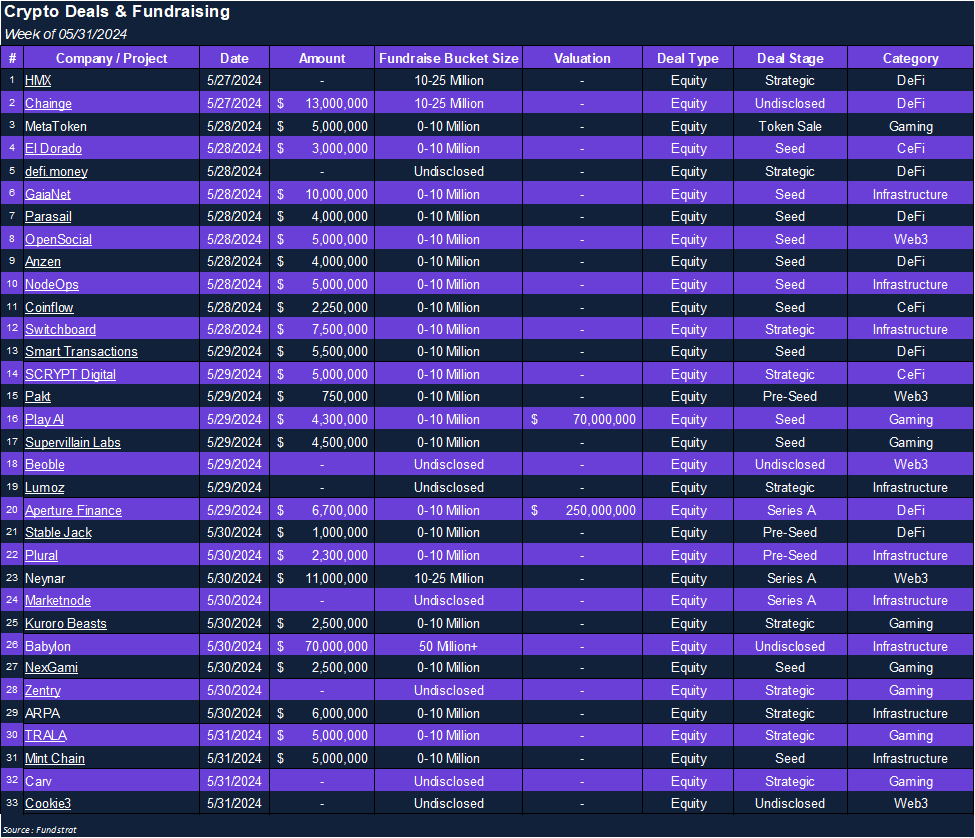

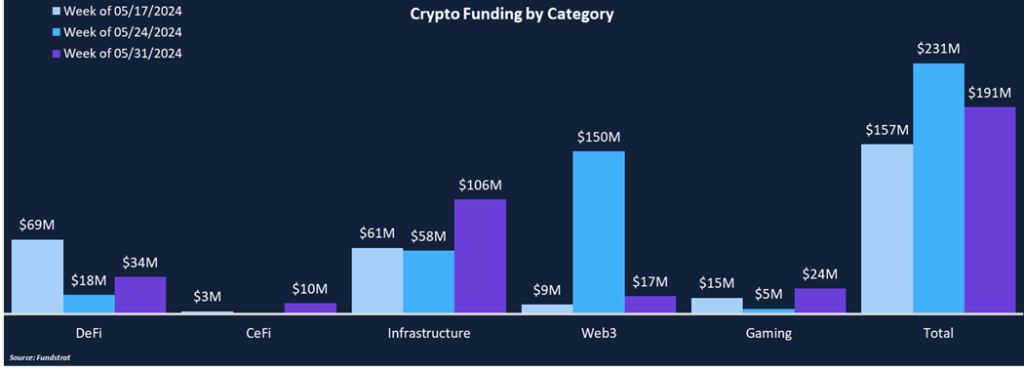

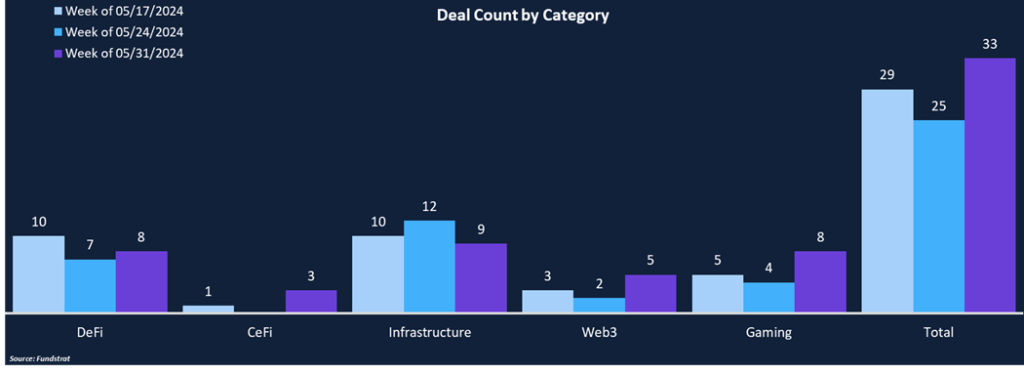

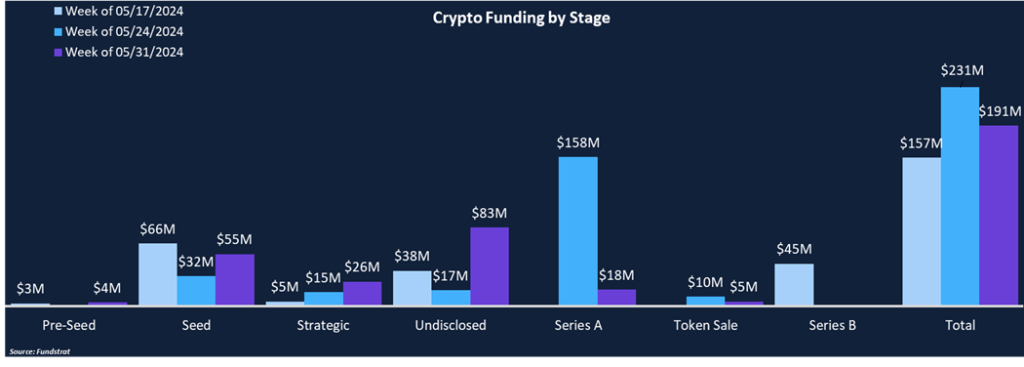

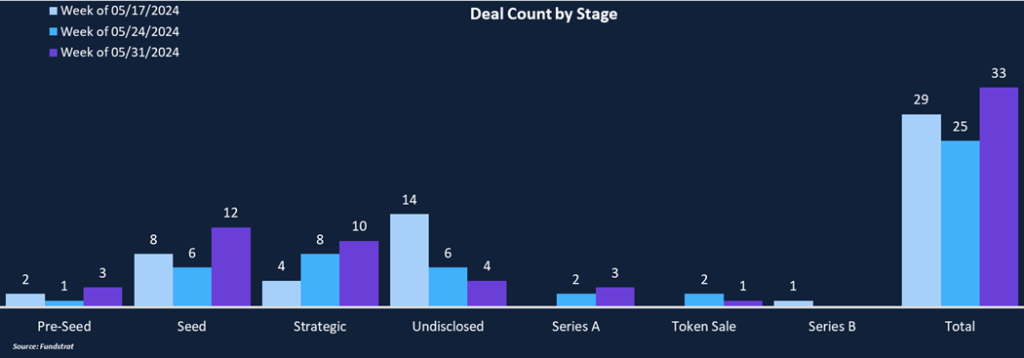

Total funding fell 18% week over week to $191 million, while the deal count rose 32% to 33. May saw $883 million in funding across 136 deals, being slightly above the 2024 average of approximately $800 million per month. Infrastructure was the leading category with $106 million in funding, primarily comprised of Babylon’s $70 million undisclosed round led by Paradigm. The Gaming category posted its highest totals in recent weeks, with $24 million raised across eight deals. Many believe gaming will be the sector that drives mass adoption in the industry, but the category has been a laggard from a funding perspective. DeFi had the second most deals (8), including Aperture Finance, our Deal of the Week. Seed rounds represented approximately 29% of funding and 36% of the deal count, and MetaToken completed only token sale, raising $5 million to expand the development of its iGaming ecosystem.

Funding by Category

Funding by Stage

Deal of the Week

Aperture Finance, an AI-powered intents-based DeFi protocol, raised $6.7 million in a Series A round led by Skyland Ventures, Blockchain Founders Fund, and Krypital Group. Other investors included Alchemy, SNZ, Stratified Capital, and others. The funding round gave Aperture a valuation of $250 million. Aperture is building a novel AI agent that leverages in-house intents infrastructure to revolutionize the defi user experience. The funding will be used to enhance Aperture’s infrastructure, expand its solver network, and enhance the user experience.

Why is This Deal of the Week

One of the major pain points for DeFi and crypto as a whole is that the experience is still very clunky compared to web2 apps. Beyond a steep learning curve, users need to sign messages, approve tokens, determine gas limits, and deal with a generally unpleasant UI.

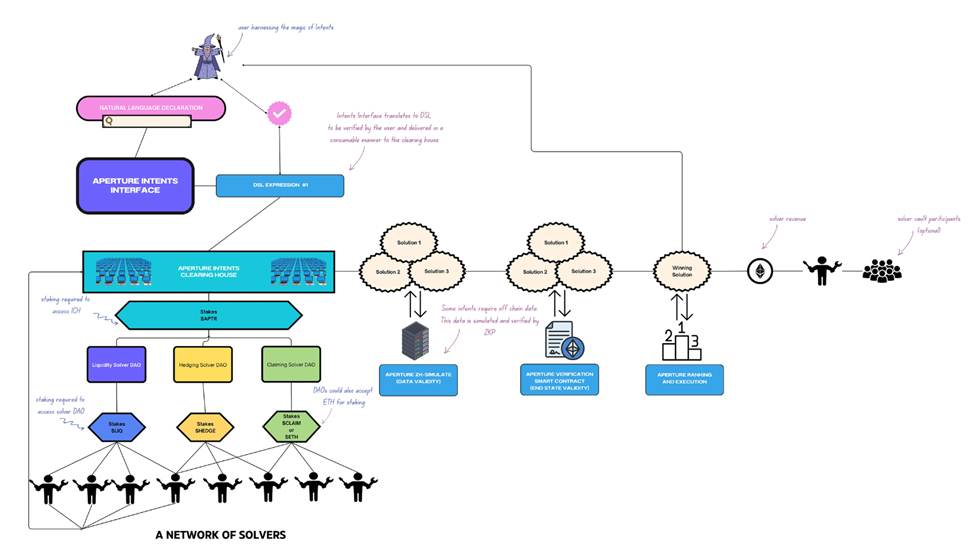

Intents are a design architecture in which users can declare the end goal of their transaction rather than identifying an execution path, and then “solvers” compete to complete the transaction with any execution path. Aperture has developed a proprietary intents-based programming language to allow for enhanced expressiveness of user intents, allowing them to specify their goals with ease and precision, and creating a better experience.

With IntentsGPT, users can use regular language to interact with Aperture’s AI agent and complete complex DeFi transactions. For example, a user can state, “claim all eligible airdrops for me for a 1% fee or cheaper,” and Aperture’s LLM will bridge the gap between a user-friendly interface and technical functionality to execute transactions. Aperture is live on 9 EVM-compatible chains and has facilitated over $3 billion in volume across 2.6 million transactions and 289k users. Aperture’s token APTR 4.74% launched earlier this morning on multiple centralized exchanges, including Bybit and Gate.

Figure: Aperture Design Architecture

Selected Deals

Babylon, a bitcoin restaking protocol, raised $70 million in an undisclosed round led by Paradigm with participation from Hack VC, Polychain Capital, Bware Labs, Bullish, and others. Babylon allows PoS networks to utilize Bitcoin staking as an option for validating their networks, expanding crypto-economic security potential to the more than $1 trillion dormant bitcoin and Bitcoin holders can stake their tokens in a self-custodial manner to earn yields subsidized from PoS networks. Networks can designate how much Bitcoin to accept and what rewards they are willing to offer and due to Babylon’s modular design, there are no constraints on which PoS chains Babylon stakers can validate. The funding will be used to accelerate Babylon’s mission to make Bitcoin the base-layer for crypto economic security.

Switchboard, a permissionless oracle network, raised $7.5 million in a Series A round led by Tribe Capital and Rockaway X with support from Aptos Labs, Solana Foundation, and StarkWare. Switchboard has three main solutions: Data Feeds, Randomness, and Secrets. Data Feeds provide secure real-time data to smart contracts cost effectively. Randomness provides secure and verifiable randomness for dApps, eliminating the need for slow and expensive solutions, and Secrets is a secure data storage solution to keep sensitive information like API keys, passwords, and database credentials private and safe from malicious attacks. Switchboard has accumulated over $1.75 billion in total value secured (TVS) across its three products, making it the fifth most among all oracle networks. The fresh capital will be used to accelerate Switchboard’s mission to provide permissionless and secure oracle solutions to the web3 economy.

El Dorado, a crypto wallet and payments provider, raised $3 million in a seed round led by Coinbase Ventures and Multicoin Capital. El Dorado offers a digital wallet, P2P marketplace, and remittance services, allowing LATAM customers to purchase stablecoins with fiat currencies within their country, purchase goods directly, or send money across borders. Many Latin America countries suffer from volatile currencies and stablecoins provide citizens a way to protect their wealth and seamlessly navigate the region’s financial landscape. El Dorado has integrated over 70 different payment channels and is currently available in Argentina, Colombia, Panama, Peru, and Venezuela. The funding will be used to grow its user base and improve security features to meet regulatory requirements in new markets.