Infrastructure & DeFi Remain VC Favorites

Weekly Recap

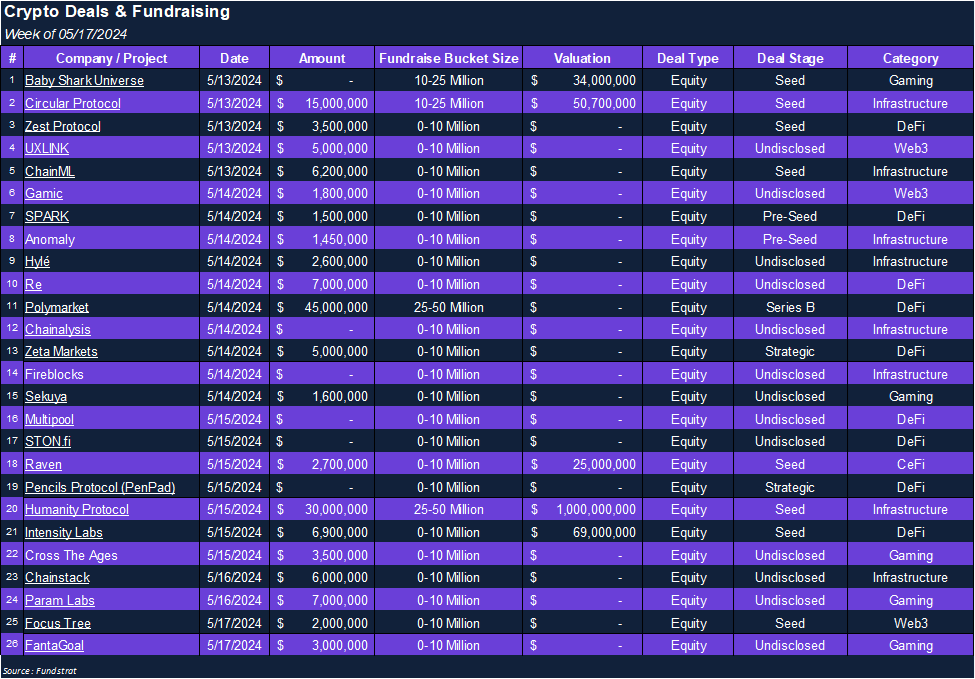

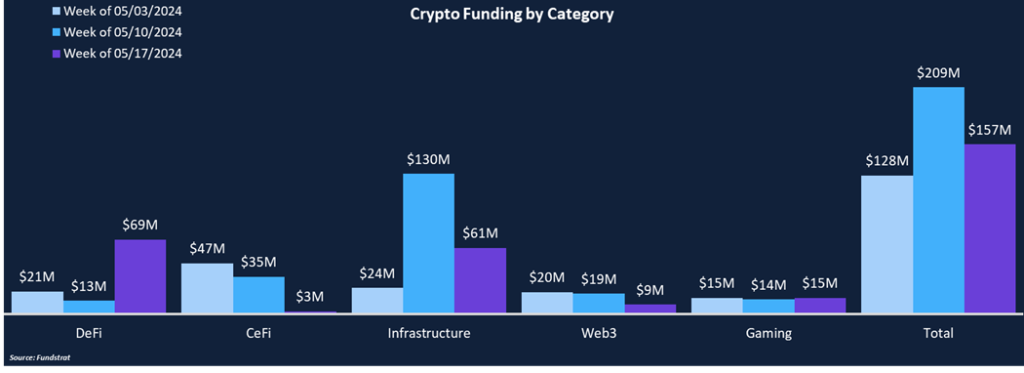

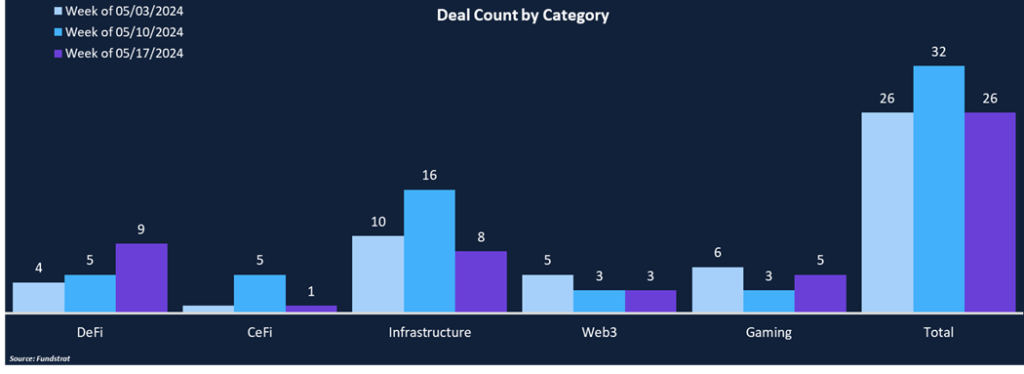

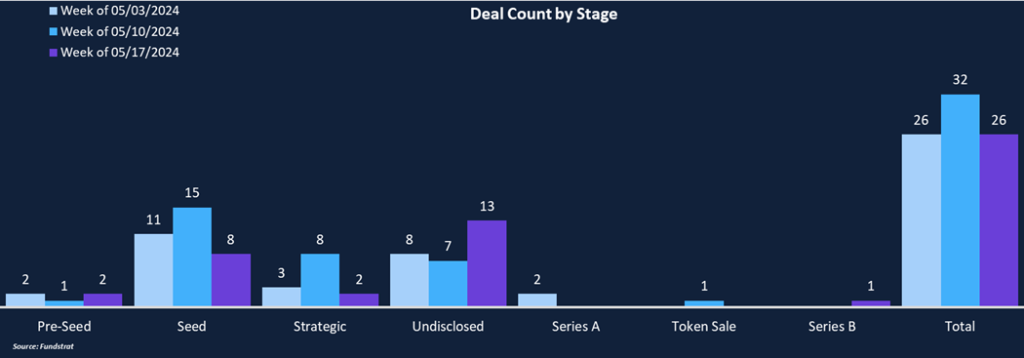

Weekly funding decreased 25% from $209 million to $157 million, and the total deal count declined 19% from 32 to 26 deals. DeFi was the most funded category this week, anchored by Polymarket’s $45 million Series B round, the largest fundraise of the week. Infrastructure was not far behind, totaling $61 million across eight deals. As we begin to approach the end of 1H 2024, Infrastructure and DeFi have been the two consistent leaders in both funding and deal counts thus far. Infrastructure deals have comprised 53% of 2024 funding and 40% of all deals, while DeFi has marked 15% of funding and 27% of deals.

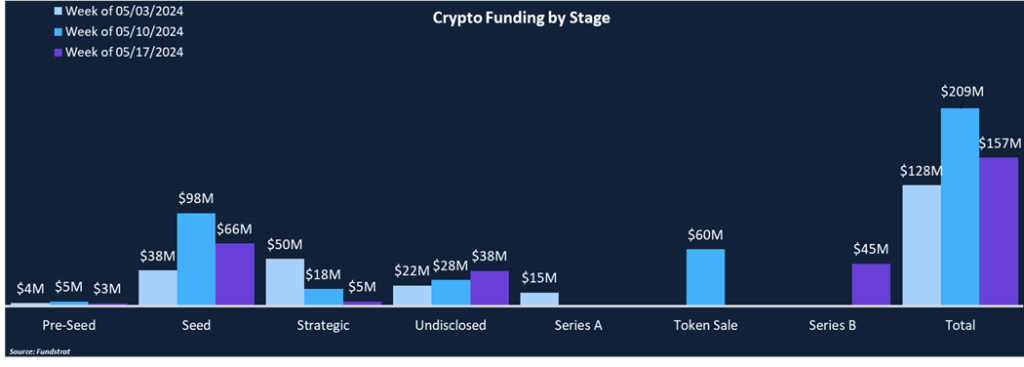

Seed rounds garnered the most investment this week, totaling $66 million, including Humanity Protocol’s $30 million round (DotW), which is comparatively large to historical seed rounds. The investment round also granted Humanity unicorn status, representing the sixth company in 2024 to achieve a valuation of over $1 billion.

Funding by Category

Funding by Stage

Deal of the Week

Humanity Protocol, a zero-knowledge powered decentralized identity project, raised $30 million in a seed round led by Kingsway Capital, with participation from Animoca Brands, Blockchain.com, Shima Capital, Hashed, and others. The funding round valued Humanity Protocol at a massive $1 billion valuation as they seek to compete with Worldcoin.

Why is This Deal of the Week?

Humanity is a zkEVM layer-two network powered by its Proof of Humanity (PoH) consensus mechanism. Humanity Protocol is sybil-resistant at the network and application level, maintaining the integrity of both online and offline environments to create a credible decentralized network. Ensuring the uniqueness and integrity of people’s identities is paramount for supporting many basic activities like proof of ownership, access to restricted services, distribution of universal basic income, and validating credentials. Despite the importance, the World Bank estimates that over 850 million people worldwide still do not have an official ID, preventing them from accessing essential human services.

Humanity Protocol is striving to become the largest decentralized open identity graph. In the first month since emerging from stealth, Humanity has already received over half a million waitlist signups, a small fraction of its total addressable market. Humanity will use the fresh funding to expand the team and product development ahead of its public testnet launch in the second half of this year and continue towards its goal.

Selected Deals

Polymarket, a prediction market platform, raised $45 million in a Series B round led by Founders Fund, ParaFi, and 1confirmation. Other notable investors include Vitalik Buterin, Dragonfly Capital, and Kevin Hartz. The proliferation of prediction markets and sports betting has been pronounced over the last few years. Platforms like Stake, DraftKings, and FanDuel have all seen large increases in their platform volumes as users look to speculate on different kinds of events. Polymarket is no different, and its use of smart contracts and stablecoins to facilitate wagering has made it a popular choice among gamblers. Polymarket has estimated that the platform has seen over $200 million in wagers so far in 2024, and it is likely to see increased activity on political markets ahead of the November election.

Raven, a proprietary trading and market making firm, raised $2.7 million in a seed round led by Hack VC. The seed round valued Raven at $25 million and was founded by three former Wintermute employees. As a prop trading firm, Raven’s main goal is to trade its capital to grow profits although they will be providing market making services as well. Raven plans to use the fresh capital to expand its market making services on more centralized and decentralized exchanges. Signs of more crypto market makers are beginning to emerge as the industry picks up attention and companies look to fill the gap left by previous industry blowups.

Intensity Labs, the development company behind Shogun, raised $6.9 million in a seed round led by Polychain Capital and DAO5. The funding round was structured as a simple agreement for future equity (SAFE) with token warrants, bringing Shogun’s FDV to $69 million. Shogun is an intents-based defi protocol aiming to maximize trader extractable value (TEV), which is the maximum potential profit a trader can extract via multiple trading strategies. Shogun will provide a platform where traders can access every asset on every chain that maximizes TEV by routing liquidity through a network of intent-based market makers. Shogun is launching its on-chain routing tool this quarter with plans to launch additional products as the year progresses.