Tokenization Turning Heads

Weekly Recap

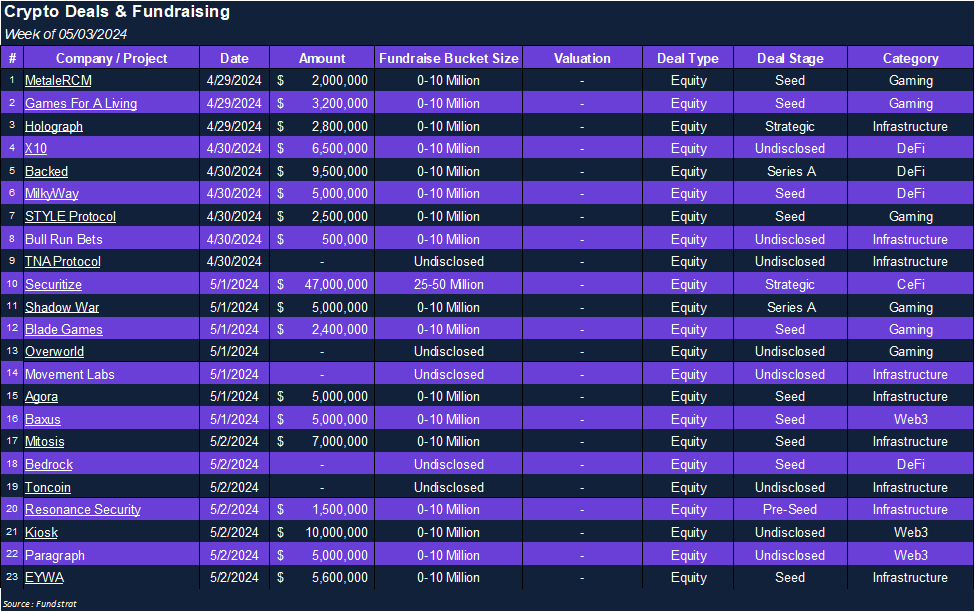

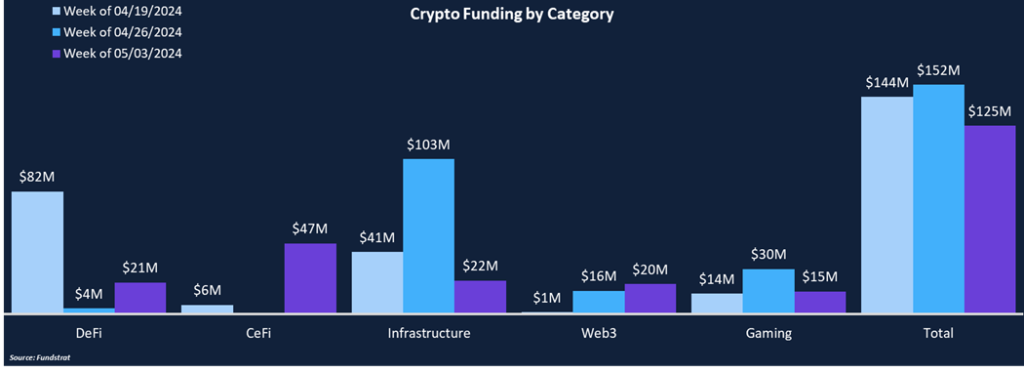

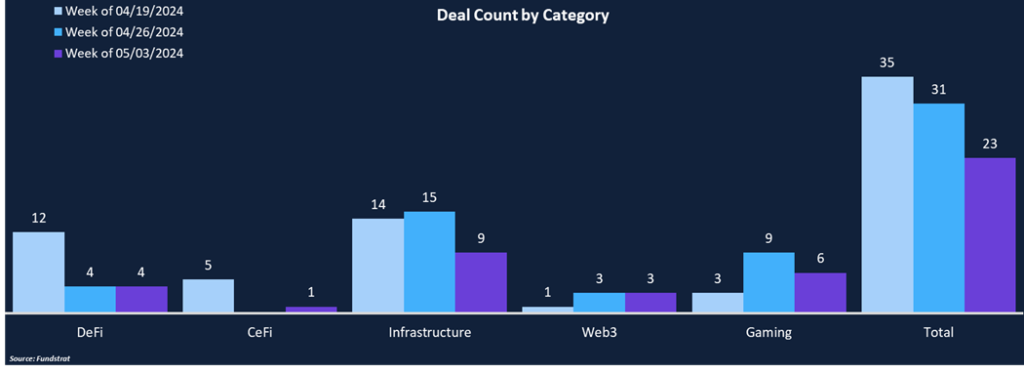

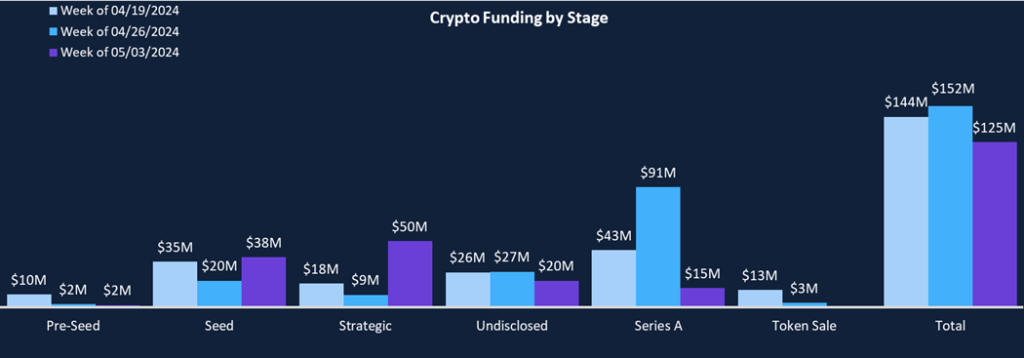

Weekly funding fell from $152 million to $125 million across 23 deals compared to last week’s 31. The largest deal of the week was a $47 million strategic round completed by Securitize, notably led by BlackRock and making CeFi the leading fundraising category this week. As one of the largest asset managers in the world, the investment carries significant weight in legitimizing the tokenization sector. BlackRock used Securitize to issue its first tokenized fund, BUIDL.

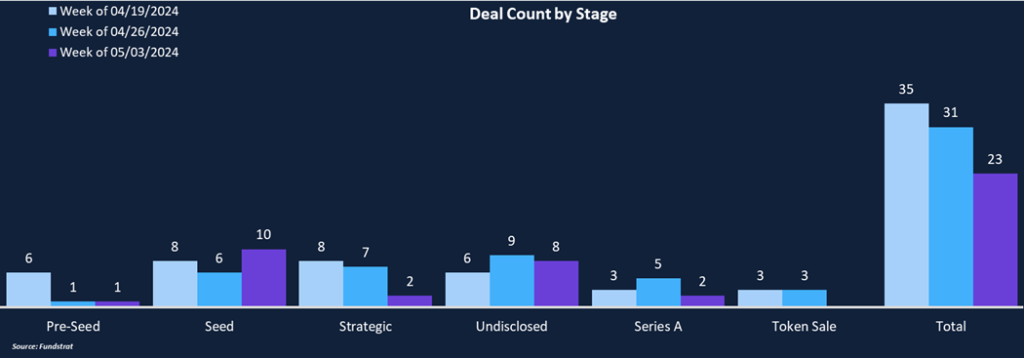

The remainder of funding was relatively evenly distributed across other categories with DeFi, Infrastructure, and Web3 all garnering over $20 million in funding. Strategic and Seed rounds were the most funded deal stages, totaling 40% and 30% of the total, respectively. Seed rounds were also the most popular from a deal count perspective, tallying 10 deals, approximately 43% of all deals.

Last week, we highlighted Movement Lab’s Series A round led by Polychain Capital. This week, Binance announced an undisclosed investment into Movement, providing the Move-based network with another significant industry partner.

Funding by Category

Funding by Stage

Deal of the Week

Baxus, an luxury alcohol trading platform, raised $5 million in a seed round led by Multicoin Capital with participation from Solana Ventures, Narwhal Ventures, and FJ Labs. Baxus leverages blockchain technology to authenticate ownership and facilitate trading of collectible wine and spirits.

Why is this Deal of the Week?

The high-end wine and spirits market is a global $470 billion market that lacks liquid marketplaces. Baxus is predominantly focused on high-end whiskey. Owners of the physical assets send their collectibles to Baxus, who authenticates and stores them, and then issues an NFT on Solana as a digital certificate of ownership. Bottles are fully insured and properly stored in temperature and humidity-controlled environments. NFTs can then be listed and made available for sale similar to OpenSea or any other NFT marketplace. After purchasing NFTs, investors can redeem them with Baxus in exchange for the physical bottles or barrels.

Baxus serves as a unique example of the utility digital assets and blockchain technology can bring to traditional business models. Tokenization of RWAs is quickly becoming a killer use case for crypto as highlighted by this week’s investment rounds into Baxus, Securitize, and Backed. Baxus is leveraging tokenization to bring innovation to a niche industry. It won’t be surprising to see Baxus dive into other markets like fine art or real estate and digital certificates of ownership slowly become the new standard.

Selected Deals

Agora, a cross-chain governance protocol, raised $5 million in a seed round led by Haun Ventures. Other investors included Coinbase Ventures, Balaji Srinvasan, and Seed Club. Agora is an out-of-the-box governance solution that promotes decentralization and community-led growth. Features include snapshot integrations, security councils, proposal sponsorship, and transaction simulations. Protocols can deploy Agora’s solution without writing a single line of code, enabling developers to focus on products. Protocols like Optimism, ENS, and Uniswap have deployed Agora’s solutions.

Backed, a tokenized asset issuer, raised $9.5 million in an undisclosed round led by Gnosis, with participation from Exor Seeds, Cyber Fund, Mindset Ventures, Stake Capital Ventures, and others. Backed has issued over $50 million in tokenized assets including bonds, ETFs, and individual stocks like Coinbase and Tesla. The funding will be used to accelerate Backed’s tokenized offerings and onboard asset managers.

Bedrock, a multi-asset liquid restaking protocol, raised an undisclosed amount in a seed round led by OKX Ventures, Long Hash Ventures, and Comma 3 Ventures. Bedrock supports ETH, BTC, and IOTX staking via EigenLayer, Babylon, and IOTX. Bedrock has accumulated over $200 million in TVL across its three assets, enabling users to earn additional yield and access instant liquidity. Bedrock has recently partnered with Celer Network to bring restaking to Arbitrum, Manta, Linea, Scroll, and zkLink Nova.