Series A Funding Continues to Shine

Weekly Recap

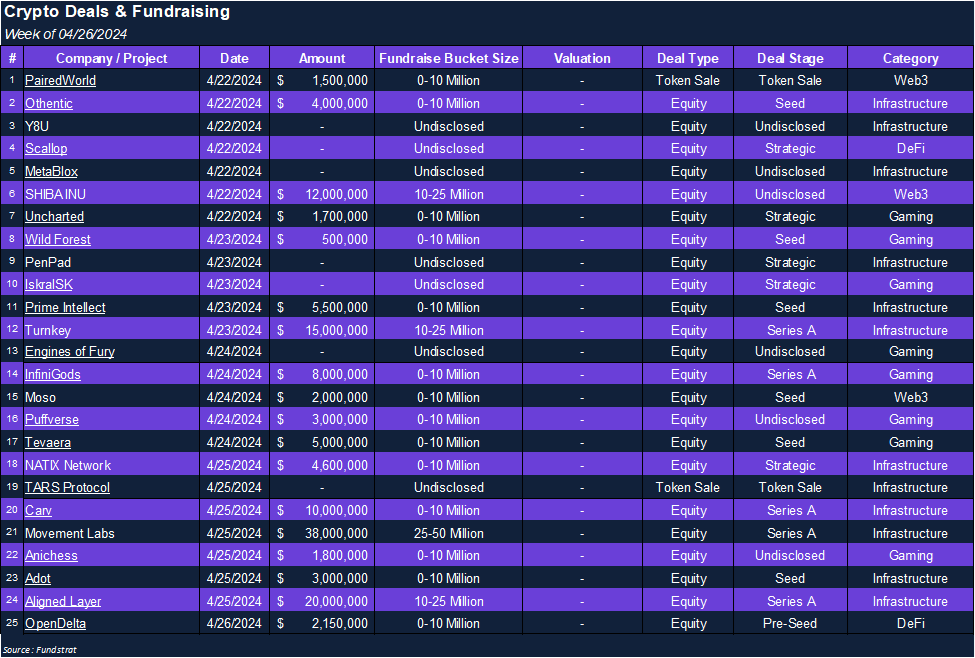

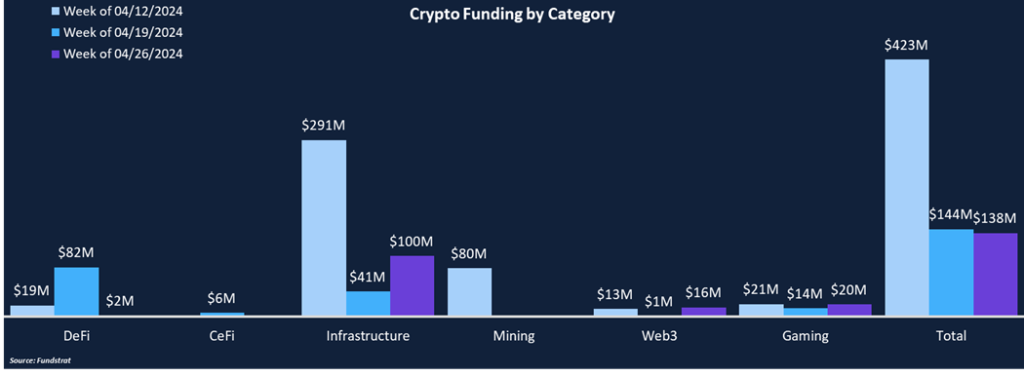

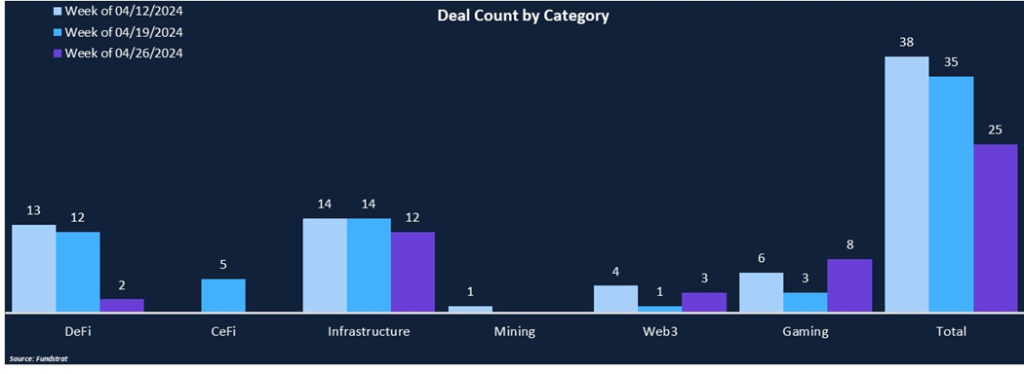

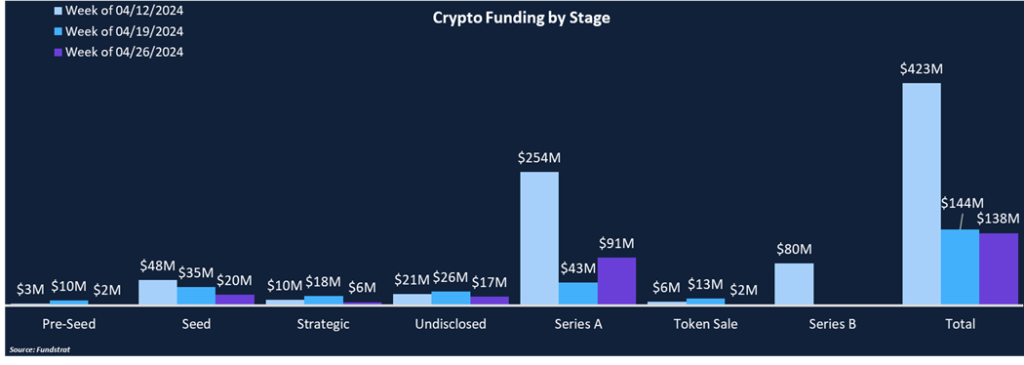

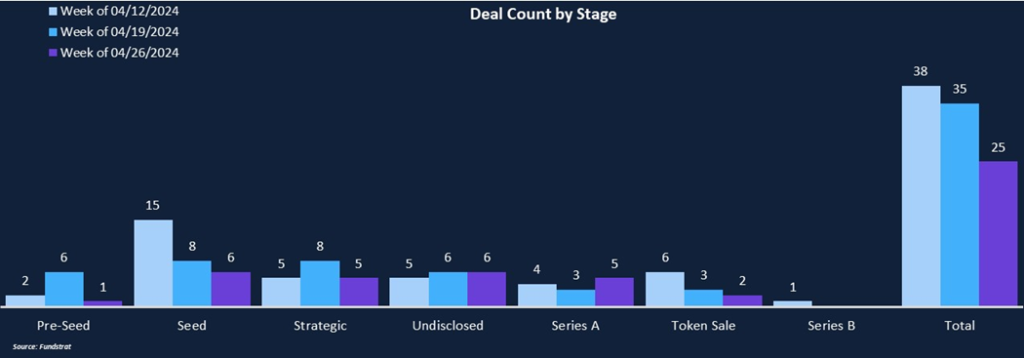

Crypto funding was relatively unchanged week-over-week, with a 4% decrease to $138 million, while deal count saw a larger decrease, falling 29% to 25 deals. Infrastructure deals comprised 73% of total funding and Web3 and Gaming combined for 26%, with remaining categories making up the last 1%. As highlighted in our Q1 Funding Report, Series A funding has been a standout deal stage this year, and this week maintained the trend. There were five Series A rounds totaling $91 million, representing 20% of deals and 66% of funding. A notable token sale was completed by the Shiba Inu development team, raising $12 million from investors for rights to future TREAT tokens, which will be the native token of a privacy focused L3 built on top of Shibarium.

Funding by Category

Funding by Stage

Deal of the Week

Movement Labs, a blockchain development company leveraging Facebook’s Move language, raised $38 million in a Series A round led by Polychain Capital. Other investors included Hack VC, Maven 11, Nomad Capital, OKX Ventures, Aptos Labs, and others. Movement Labs is hoping to address blockchain security issues and scalability limitations via its Move-powered ZK L2. The funding will be used to hire top-tier talent across various business functions and enhance product development.

Why is this Deal of the Week?

Most Ethereum smart contracts are built using the Solidity coding language, and while Solidity has seen widespread adoption, its flexibility and complexity exposes smart contracts to various security vulnerabilities that have resulted in over $5 billion in exploits over the last two years. Move is a programming language developed by Facebook and is growing in popularity with other blockchains like Aptos and Sui built using Move. Move addresses some of the security pitfalls plaguing Solidity. The MoveVM allows developers to run code fully-verified at runtime, preventing attack vectors such as reentrancy attacks.

Movement is launching M2, first MoveVM powered Ethereum L2, which introduces a parallelized execution environment capable of processing 30,000 transactions per second with EVM compatibility, allowing Ethereum developers to easily port their applications to M2. Movement hopes they can enable Ethereum scalability with a focus on security, preventing any more large exploits. Movement’s vision goes beyond M2, and is also developing M1, a decentralized shared sequencer, and the Move Stack, an execution layer framework compatible with various rollups irrespective of underlying technology. Movement is aiming to launch M2’s testnet, Parthenon, in the next couple weeks and hopes to launch mainnet before the year ends.

Selected Deals

Natix, a Solana-based DePIN project focused on mapping data, raised $4.6 million in a strategic funding round co-led by Borderless Capital and Tioga Capital with participation from Laser Digital, Big Brain Holdings, IoTeX, and WAGMI Ventures. Similar to Hivemapper, Natix collects geospatial data through its app Drive& via mobile phone cameras or dashcams. In exchange for providing data, users earn in-app-NATIX, which is a placeholder for NATIX tokens, when their airdrop occurs (expected in Q2). Natix primarily uses its data to assist autonomous driving companies in training their vehicles. 93,000 drivers have mapped over 28 million kilometers through the Natix app since launching last year.

Turnkey, a wallet infrastructure company, raised $15 million in a Series A round led by Galaxy Digital and Lightspeed Faction. Other investors included Coinbase Ventures, Sequoia, Alechmy, Figment Capital, and Mirana Ventures. Turnkey was founded by ex-Coinbase employees who helped build its custody solution and they are bringing their experience to Turnkey to build a better user experience for dApp end-users. Turnkey allows users to create thousands of embedded wallets, eliminate manual transaction flows, and automate on-chain actions, while providing industry leading key storage, passwordless authentication, and a customizable policy engine.

Aligned Layer, a proof-verification layer, raised $20 million in a Series A round led by Hack VC with participation from DAO5, Nomad Capital, Finality Capital, and Iterative Layer. Aligned Layer is an EigenLayer AWS with the purpose of verifying validity and ZK proofs and reducing proof generation and verification costs. Aligned Layer allows developers to focus on product development without concerning themselves with infrastructure constraints. Aligned Layer uses the Rust and Go programming languages and plans to release its own SDK to help developers integrate with Aligned. Aligned is expected to launch an EigenLayer testnet in the coming weeks.