Two Companies Earn Unicorn Status

Weekly Recap

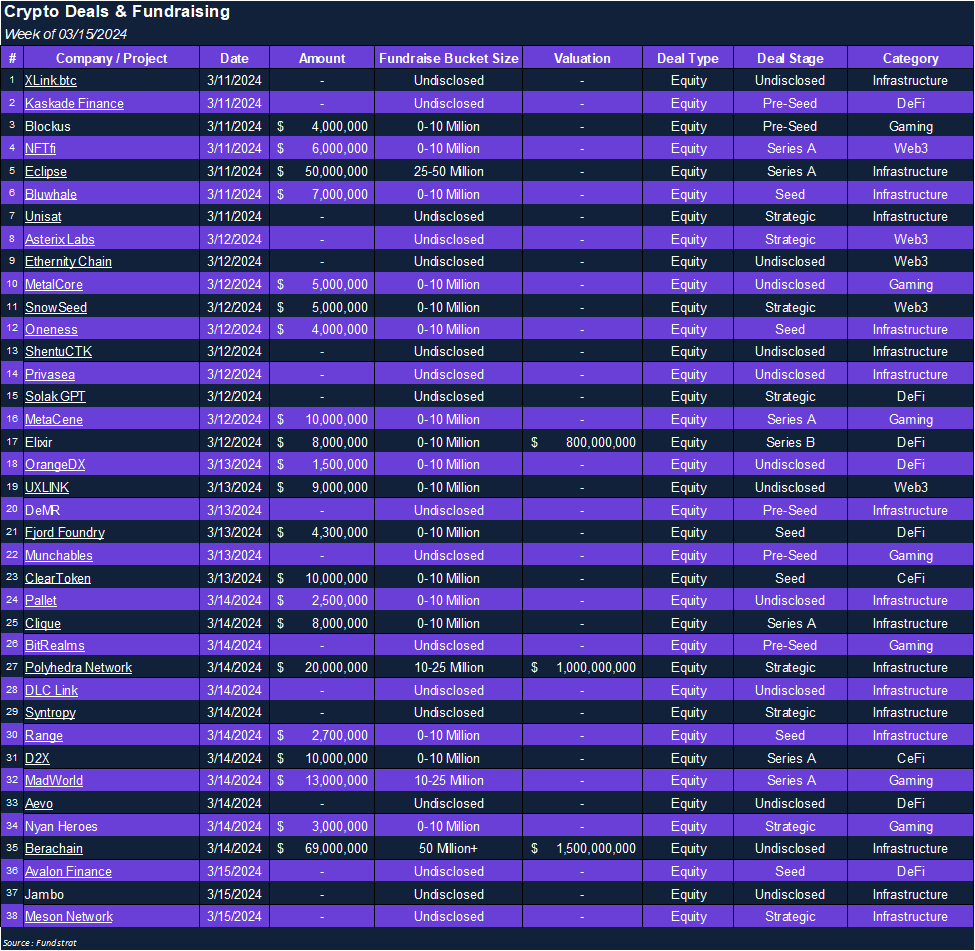

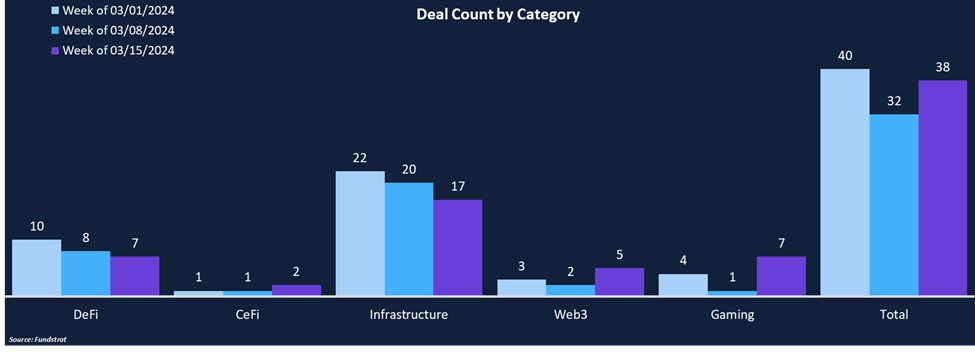

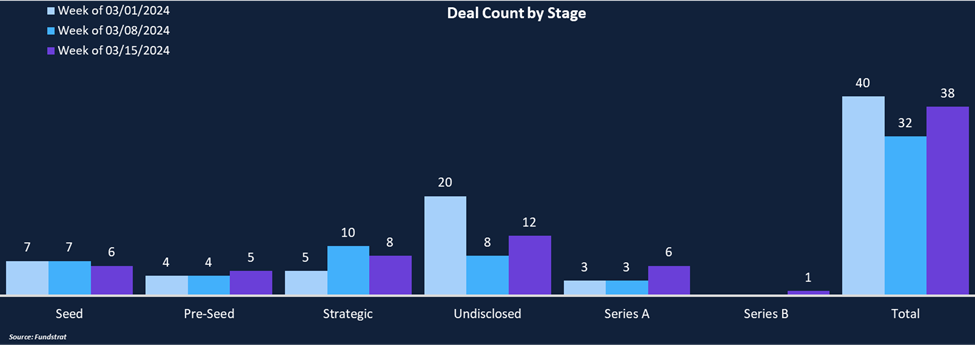

Crypto funding continued to show strength through the first half of March, with $252 million in total funding across 38 deals, marking a 41% week-over-week funding increase. The infrastructure category represented approximately two-thirds of funding and almost half of total deal count, including a $69 million undisclosed round from Berachain, an EVM-compatible L1 network powered by proof-of-liquidity. The round was co-led by large TradFi asset manager Brevan Howard and Framework Ventures, who valued Berachain at $1.5 billion. Berachain was one of two companies that earned unicorn status, as Polyhedra Network was valued at $1 billion. Elixir was not far off, obtaining a valuation of $800 million, rounding out an impressive week for private market valuations. Only eight deals in 2023 valued companies at $800 million or greater, and 2024 has amassed six before the end of the first quarter.

Funding by Category

Funding by Deal Stage

Deal of the Week

Elixir, a modular DPoS network built to power liquidity across order-book exchanges, raised $8 million through a series B round led by Mysten Labs (Sui) and Maelstrom (Arthur Hayes family office). Other investors included GSR, Flowdesk, Manifold, and Amber Group. The deal brings Elixir’s valuation near unicorn status, valuing the network at $800 million. Elixir will use the fresh funding to continue developing its product, which should help improve liquidity across order-books.

Why is this Deal of the Week?

A major problem within crypto is liquidity fragmentation, as there are numerous chains and exchanges that investors can utilize. The fragmentation has helped the AMM model gain popularity as asset prices are algorithmically determined as a function of LP deposits, allowing for low liquidity requirements. In contrast, order-books, which directly match buyers and sellers, have more substantial liquidity requirements to provide a positive trading experience. Orderbook exchanges tend to be more capital efficient and offer users more flexibility in order types. Elixir is hoping to alleviate the liquidity problems across order-book exchanges. Elixir is cross-chain and composable, serving as a liquidity layer to allow protocols to integrate natively into Elixir’s infrastructure, unlocking liquidity and bootstrapping exchanges. Over 30 protocols are already integrating Elixir, including dYdX, Vertex, HyperLiquid, and Apex. Elixir is planning to launch its token, ELX, which will serve as a utility and governance token for its ecosystem. Elixir’s mainnet launch is scheduled for August, at which point they will create use cases for ELX as a security incentive and move towards decentralized governance.

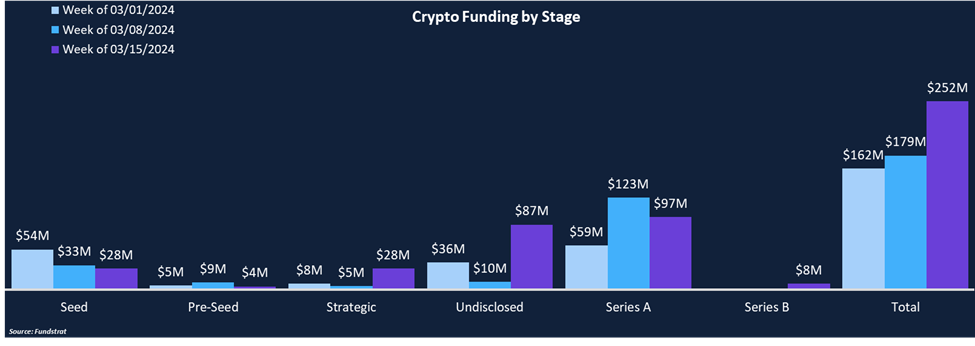

Selected Deals

Polyhedra Network, the infrastructure company behind zkBridge, has raised $20 million in a strategic round led by Polychain Capital. Other investors included Animoca Brands, Emirates Consortium, Hashkey Capital, MH Ventures, and others. The strategic round values Polyhedra at $1 billion, representing one of the highest valuations among private deals in 2024. Polyhedra utilizes zk proofs at the base of its products to ensure security, scalability, and trust minimization. zkBridge is their key product, securing over 20 million cross-chain transactions between 25 chains. The funding will be used to escalate Polyhedra’s continued growth by hiring new employees and exploring new global markets.

ClearToken, a centralized crypto clearing house, raised $10 million in a seed round from investors including Laser Digital (Nomura), GSR, Flow Traders, LMAX Digital, and Zodia Custody. Clearing houses serve as a buyer/seller for all transactions, finalize trades, settle accounts, and regulate asset delivery, providing better risk-management and reducing counterparty risk. There is a lack of clearing houses within the crypto industry – partly due to blockchains’ inherent nature – but ClearToken believes many institutions will still prefer to use central counterparty clearing (CCP) services. ClearToken hopes to clear all regulatory hurdles in the U.K. and has begun the regulatory clearing house process with the Bank of England. They plan to offer preliminary settlement services this year and clearing services in the next 12-18 months.

MetaCene, a leading meta-MMO gaming platform, raised $10 million via a series A round led by Folius Ventures and SevenX Ventures. Other investors included The Spartan Group, Mantle Network, Animoca Brands, and Longling Capital. MetaCene is striving to create a borderless on-chain homeland, uniting MMORPG players, content creators, and Web3 enthusiasts. MetaCene was founded by gaming industry veterans from studios such as Blizzard, Shanda Games, and Perfect World. The funding will be used to accelerate MetaCene’s ambitious vision and attract top talent across tech, design, and community management.