Interoperability Becoming a Major Focus

Weekly Recap

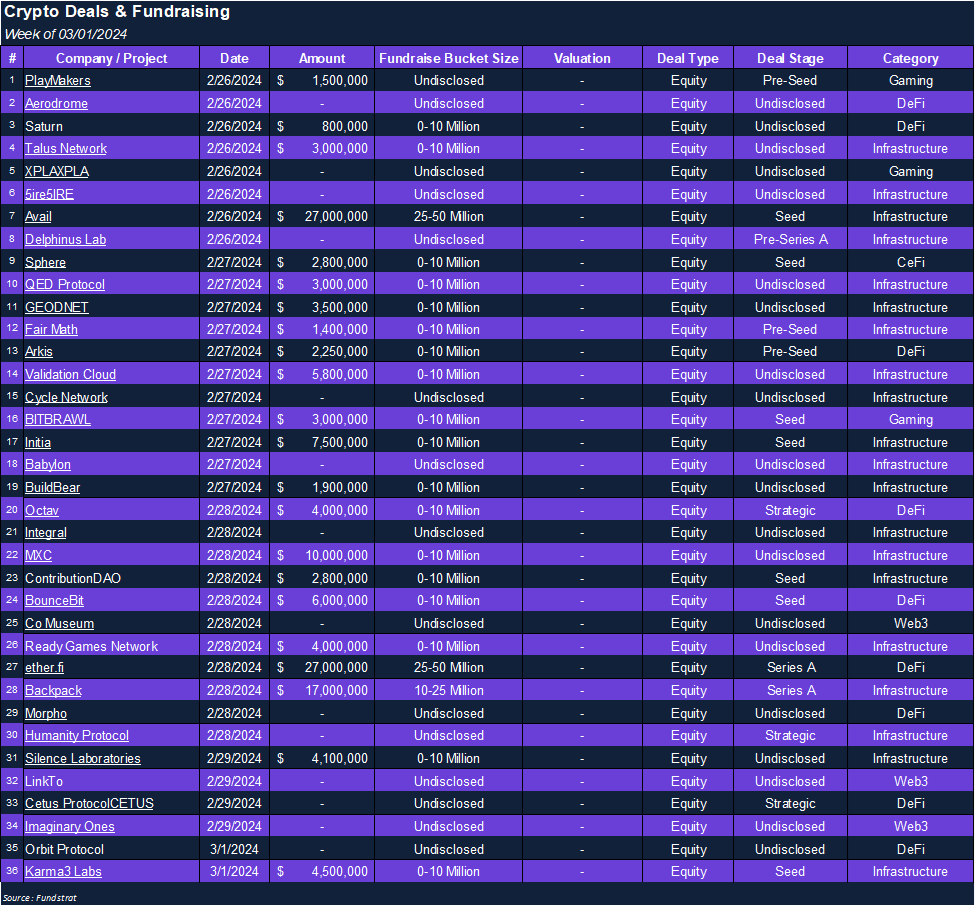

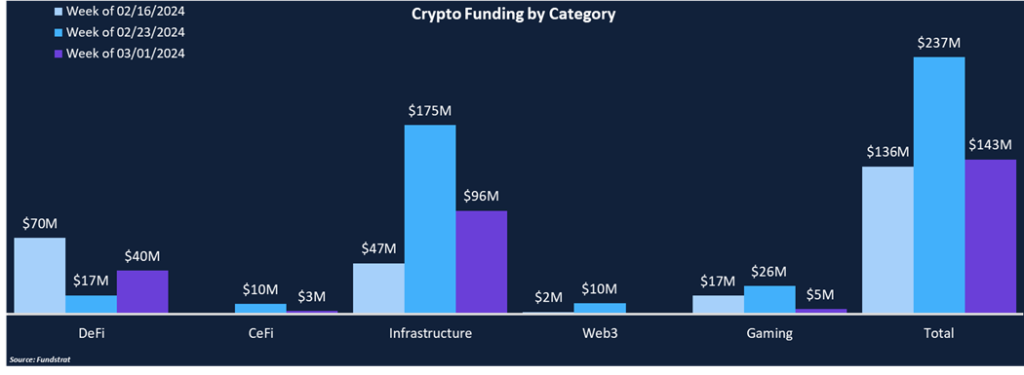

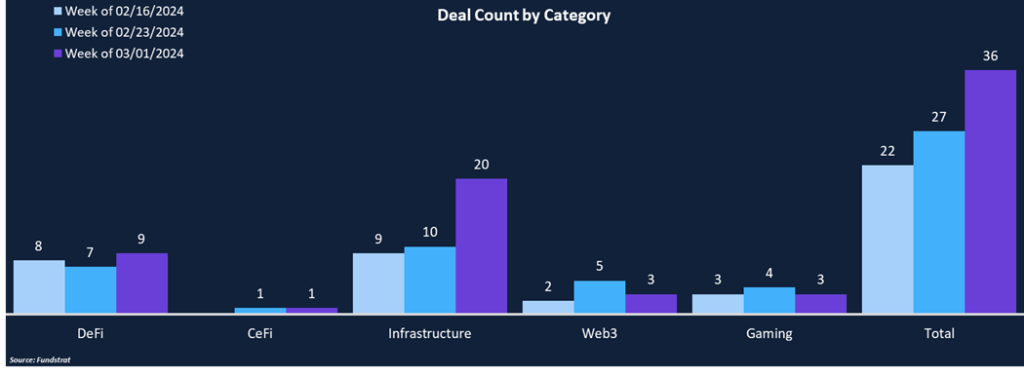

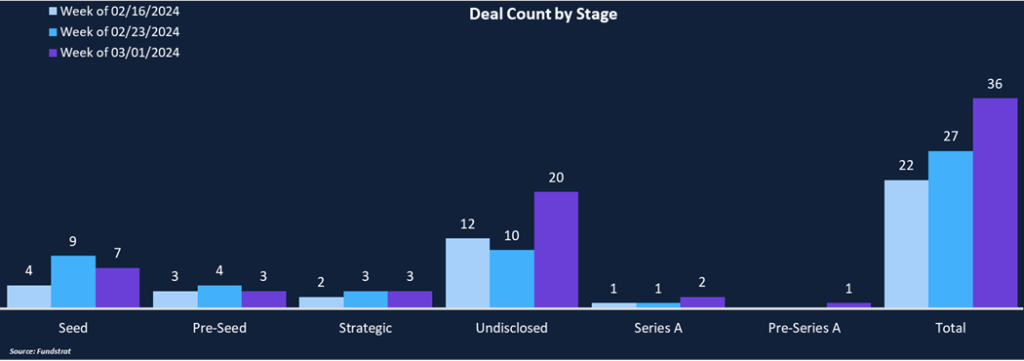

Despite total deal count rising 33% to 36 deals, total fundraising fell almost 40% to $143 million. Only three projects raised over $10 million this week, and the average deal size was $6.5 million. Similarly to last week, funding was concentrated in Infrastructure and DeFi, together representing 95% of total fundraising and 81% of the deal count. CeFi continues to be an unpopular category, with just two deals in the last three weeks.

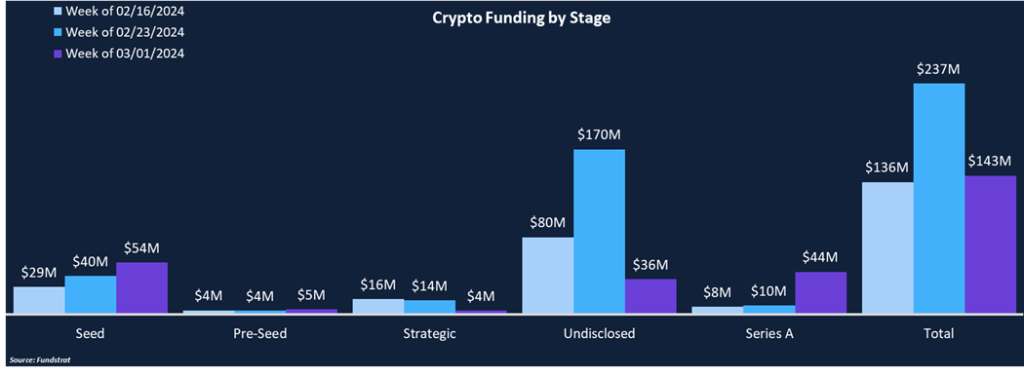

Seed rounds garnered the lion’s share of funding and deal flow, comprising 38% of fundraising and 19% of deal count. Seed rounds have been the dominant deal stage in 2024 thus far, with a significant lack of mid-to-late-stage deals. There have been zero series C+ in 2024 and just two series B rounds. It will be interesting to monitor if this trend reverses in the second half of the year as companies mature and see more substantial adoption.

Funding by Category

Funding by Deal Stage

Deal of the Week

Avail, a Web3 infrastructure layer, raised $27 million in a seed round led by Dragonfly Capital and Peter Thiel’s Founders Fund. Other investor participation included SevenX, Figment, and Nomad Capital. Avail initially launched in 2020 under Polygon Labs before spinning off on its own and is led by former Polygon executives Anurag Arjun and Prabal Banerjee. The additional capital is earmarked for product development, expanding the team, and marketing efforts.

Why is This Deal of the Week?

In an increasingly rollup-centric world, cross-chain interactions are more cumbersome than they should be, and liquidity is divided across numerous networks, creating an environment where blockchains are trying to draw users and capital from one chain to another when the focus should be about onboarding net new users and improving overall end-user experience.

Avail is hoping to solve the scaling, fragmentation, and security issues that currently plague crypto by becoming the unifying force between all rollups. Avail has three core products known as the “Avail Trinity.” The trinity is comprised of a data availability layer, a nexus unification layer, and a fusion security layer.

- Avail DA – Avail DA anchors the Avail ecosystem with scalable data availability, harnessing cutting-edge zero-knowledge proofs and KZG polynomial commitments to ensure immediate and reliable data integrity that allows rollups to scale.

- Avail Nexus – A custom ZK coordination rollup on top of Avail that enables seamless state verification and sequencer selection, whether engaging with a single rollup, navigating multiple rollup ecosystems, or transacting across different L1 chains.

- Avail Fusion – Fusion Security takes the native assets of other chains and allows them to contribute to Avail consensus. It also enables new rollup tokens to help secure the Avail base layer.

By becoming the infrastructure layer for crypto, Avail hopes to create a seamless and unified experience with a single user interface that allows for the management of all assets across all chains. Liquidity will be unified, and there will be minimal need for users to bridge assets.

Selected Deals

Initia, an interoperability network built in the Move Smart Contracting Language, raised 7.5 million in a seed round led by Delphi Digital and Hack VC, with other participation from Nascent, Figment Capital, a_capital, and Big Brain Holdings. Initia is also backed by prominent crypto angel investors, including Cobie, DCF God, Zaheer (Split Capital), Nick White, and Smokey the Bera. Initia’s architecture will allow rollups to utilize the EVM, WasmVM, or MoveVM, simplifying blockchain development and supporting seamless interoperability between chains.

Ether.fi, a liquid restaking protocol, raised $27 million Series A led by CoinFund and Bullish. Other investor participation included Ambre Group, Arrington Capital, Bankless Ventures, Foresight Ventures, and others. Ether.fi allows users to receive a liquid restaking token (LRT) in exchange for their Ether that gets deposited into EigenLayer (last week’s DotW). LRTs allow users to leverage their deposits throughout the DeFi ecosystem while still earning EigenLayer rewards, similar to how Lido works with Ethereum staking.

Sphere Labs, a stablecoin operating system, raised $2.8 million in a seed round led by Jump Crypto and TCG Crypto, with participation from Hudson River Trading, Republic Capital, and Solana Ventures, among others. Stablecoins are revolutionizing the payments sector with cost-effective, secure, quick cross-border payments, and Sphere is building an operating system that provides an intuitive interface to connect consumers with stablecoins.