Funding Surges on The Back of EigenLayer

Weekly Recap

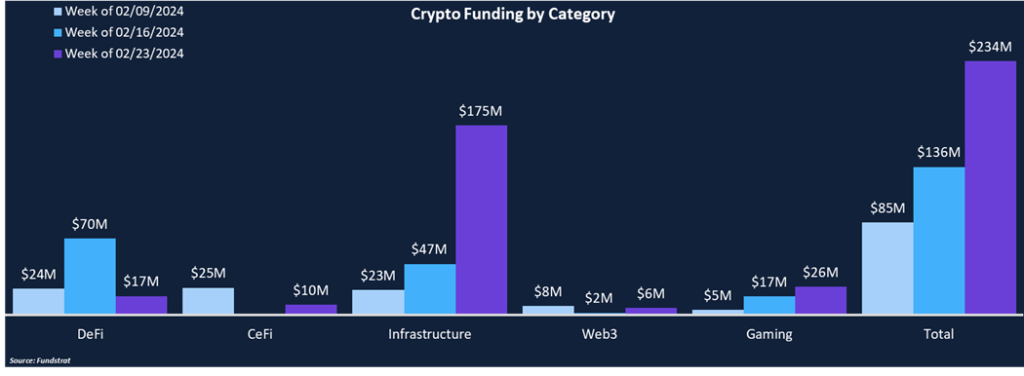

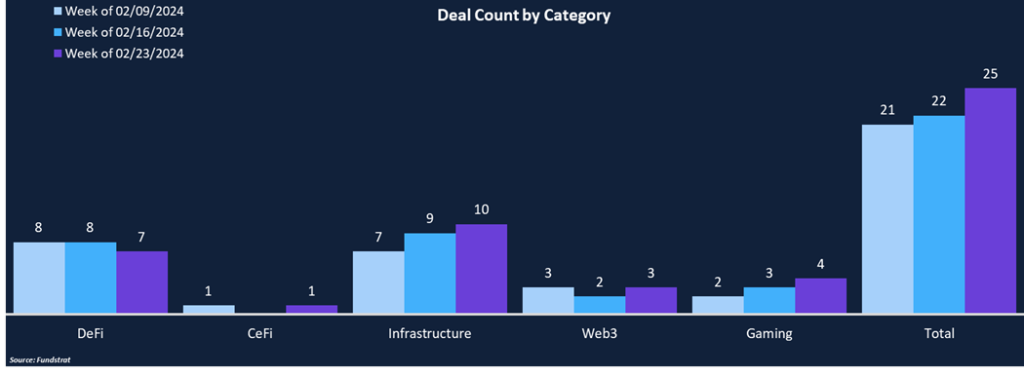

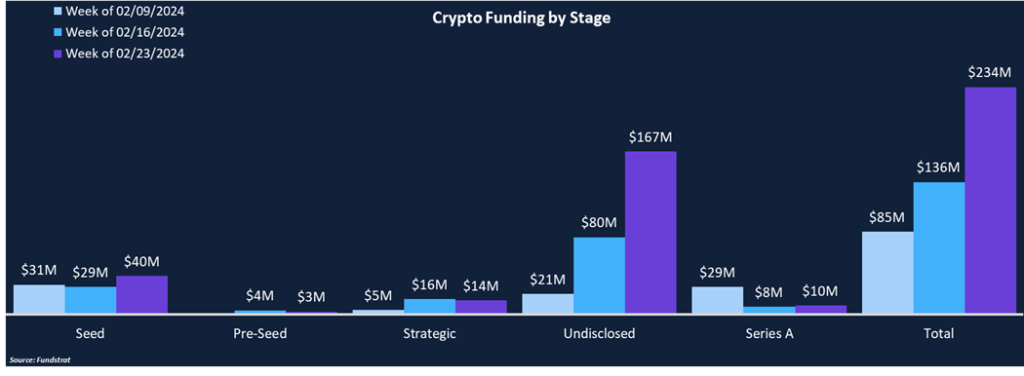

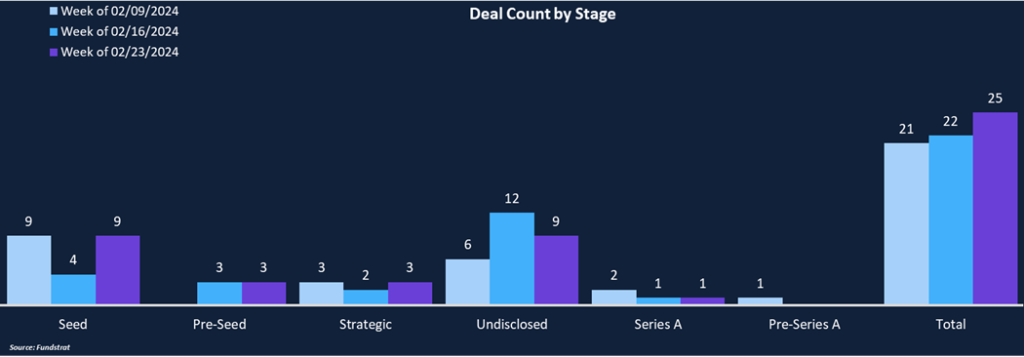

Crypto funding surged 72% to $234 million from $136 million, while deal count rose 14% to 25 deals. Infrastructure was the clear winner this week, largely due to Eigen Labs’ $100 million fundraising round led by Andreessen Horowitz (DotW). The $100 million round is tied for the largest deal in 2024. For three consecutive weeks, funding and deal counts have primarily been concentrated in Infrastructure and DeFi deals, which is interesting considering DeFi was one of the least funded categories throughout 2023. DeFi projects raised $17 million across seven deals, representing 7% of total funding and 28% of the deal count. Of the disclosed deal stages, seed rounds accounted for the largest portion of fundraising and deal count, at 17% and 36%, respectively.

Funding by Category

Funding by Deal Stage

Deal of the Week

Eigen Labs, the development company behind EigenLayer, raised $100 million from a16z in an undisclosed round. The deal is tied with Hashkey Group for the largest fundraise of 2024. EigenLayer is an Ethereum restaking protocol, allowing staked Ether to be reused to secure other protocols or networks.

Why is This Deal of the Week?

Restaking is a new crypto primitive that has the potential to supercharge the crypto ecosystem by allowing developers to leverage Ethereum’s highly crypto-economically secure and decentralized network to build reliable and scalable protocols. A wide array of services/protocols can be built on top of EigenLayer, including data availability layers, cross-chain messaging, transaction ordering, off-chain data access, AI inference, and many others, creating a higher quantity and quality of use-cases that will result in better end-user experiences. The excitement surrounding restaking is evident in how quickly EigenLayer is attracting user deposits. EigenLayer initially launched in June and has been slowly raising the amount of deposits it’ll accept. It has surpassed $8 billion in TVL as users are also depositing in an effort to earn “points” that will likely be redeemable for Eigen tokens in the future. EigenLayer has yet to launch its actively validated services (AVS), aka the third-party networks that will leverage EigenLayer for security. The first AVS to launch will be EigenDA, Eigen’s data availability layer.

Some have raised concerns about the potential security risks associated with restaking, but that has not stopped investors or protocols from being built on top of EigenLayer. Liquid restaking protocols like Ether.fi and Puffer Finance give users a way to leverage their Eigen deposits similarly to how LST’s have become a backbone of DeFi. They have been extremely popular as Ether.fi has accumulated over $1.4 billion in TVL in recent months, and Puffer Finance eclipsed the $1 billion TVL mark in less than a month since launching.

Selected Deals

Superfluid, an asset streaming protocol, raised $5.1 million in an undisclosed round led by Fabric Ventures. Other notable investors include Circle Ventures, Multicoin Capital, Safe, Wagmi Ventures, among others. Superfluid streamlines crypto-native business operations such as payroll, vesting, subscriptions, and rewards by automating token flows to necessary destinations. Superfluid previously raised $9 million in their 2021 seed round and raised necessary capital to bring the protocol to the next level and get the proper partners on board.

AltLayer, a restaked rollup-as-a-service protocol, raised 14.4 million in a strategic round led by Polychain Capital and Hack VC. Other investors include OKX Ventures, Hashkey Capital, Primitive Ventures, and others. AltLayer allows for easy deployment of native and restaked rollups with optimistic and ZK technology stacks. AltLayer leverages EigenLayer’s (our DotW) restaking mechanism to help developers accelerate Ethereum scaling. The fresh funding will be utilized to expand AltLayer’s team and improve its rollup infrastructure.

Monkey Tilt, a Web3 fantasy sports platform, raised $21 million in an undisclosed round led by Polychain Capital. Other investor participation included Hack VC, Poker Go, Accomplice, Paper Ventures, and Folius Ventures. Monkey Tilt hopes to give customers a decentralized and secure gaming experience, using blockchain functions to guarantee fairness and transparency. The funding will be used to develop the platform and grow within the GambleFi industry.

Citrea, a Bitcoin zero-knowledge rollup, raised $2.7 Million in a seed round led by Galaxy Ventures. Other investors included Delphi Ventures, Eric Wall, and Anurag Arjun. Citrea is aiming to be the first Bitcoin zk-rollup that enhances the capabilities of Bitcoin’s block space. Citrea will be based on the EVM, allowing existing developers to essentially bridge their applications with minimal effort. The funding will be used to help grow Bitcoin’s growing DeFi and NFT ecosystems.