DeFi Gaining Momentum

Weekly Recap

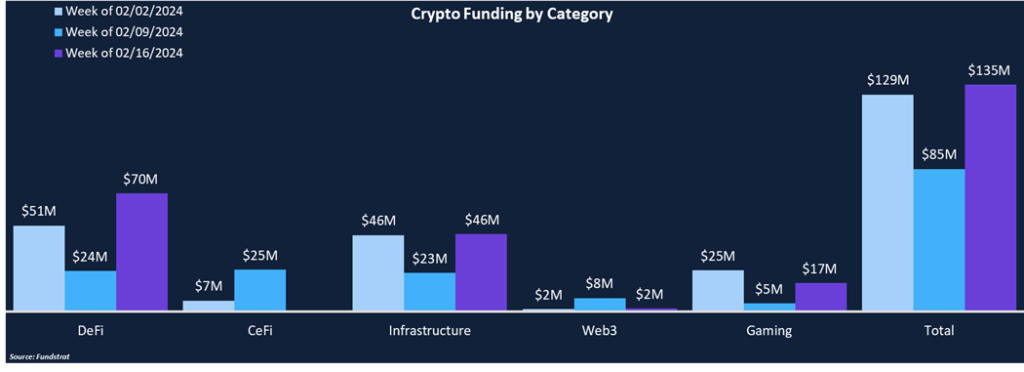

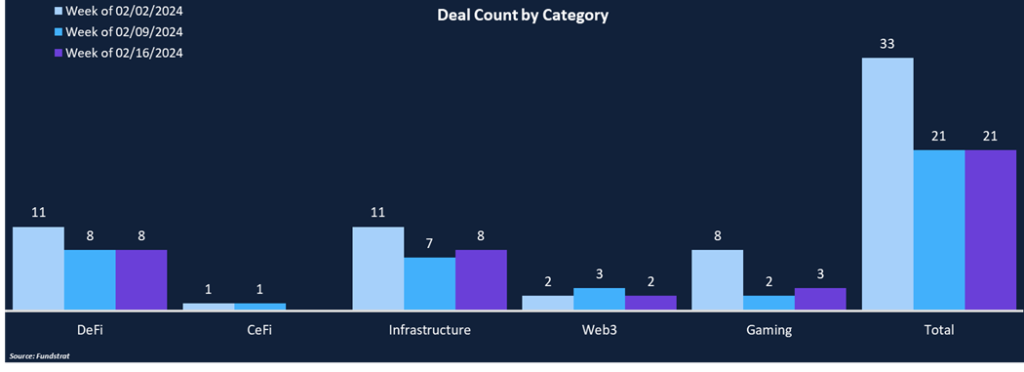

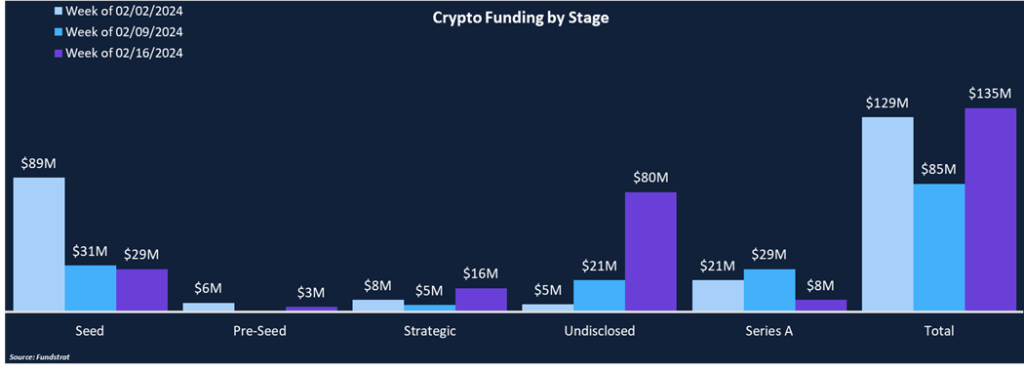

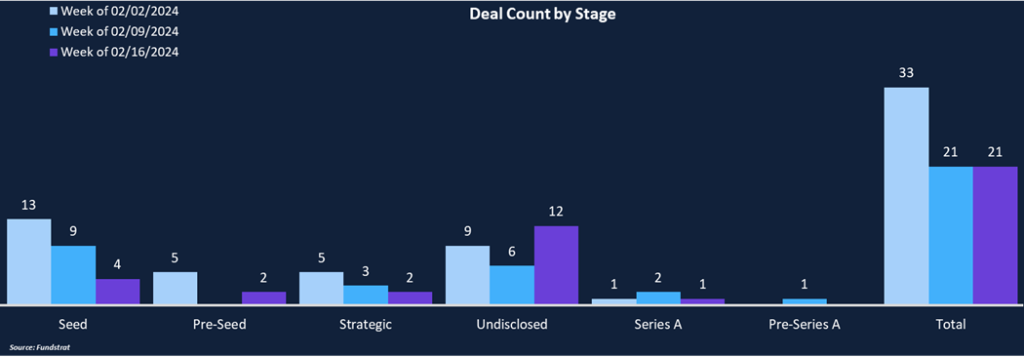

Crypto funding rose 59% week over week from $85 million to $135 million, while deal count held steady at 21 total deals. DeFi was the most funded category from both a fundraising and deal count perspective, raising $70 million across eight deals, including a $14 million strategic round completed by Ethena Labs and led by Dragonfly Capital. Ethena is striving to create a yield-bearing synthetic dollar by leveraging Ethereum staking and delta-neutral hedging. The funding round brought Ethena’s valuation to $300 million. Infrastructure was the second most funded category, totaling $46 million across eight deals, comprising approximately 34% of total funding and 38% of deal count. From a deal stage perspective, over 57% of deals failed to disclose the funding round type, leaving seed rounds as the most funded at $40 million across four deals.

Funding by Category

Funding by Deal Stage

Deal of the Week

Architect, a trading infrastructure founded by Brett Harrison, a former FTX executive, raised $12 million in an undisclosed round led by BlockTower and Tioga Capital. Other investors include Coinbase Ventures, CMT Digital, ParaFi Capital and others. The investment round brings Architect’s total funding to $17 million since launching in January 2023. The funding will be used to improve Architect’s derivatives brokerage for retail and institutional investors. Additionally, the funding will support Architect’s plans to expand into the EU and APAC regions.

Why is this Deal of the Week?

Architect provides traders with comprehensive trading and portfolio management software for digital assets. Architect offers a modular product suite with low latency OEMS technology, automated and manual trading tools, smart order routing, ready-made algorithms, and full support for risk monitoring, clearing, and settlement. They support a wide variety of assets including perpetuals, spot digital assets, future spreads, options combos, fixed income options, among others. Additionally, Architect provides white-label solutions that can easily integrate into exchange or broker systems. The team is highly experienced, with decades of experience building large-scale distributed systems and trading infrastructure at quantitative trading firms.

Derivatives trading volume continues to expand within crypto and many traditional financial institutions continue experimenting with tokenization of real-world assets. As digital asset trading expands, market demand for high-throughput, low-latency trading and distribution infrastructure operated by regulated intermediaries will continue to grow. There are only a handful of companies with infrastructure as sophisticated as Architect’s, positioning them to fill the market’s need and mature with the industry. The funding will help Architect rapidly scale its technology across asset classes and be a first-mover on novel RWA products.

Selected Deals

Witness, a digital ownership protocol, raised $3.5 million in a seed round led by Huan Ventures with participation from Coinbase Ventures. Witness is led by former Paradigm, Google, and Facebook engineer Sina Sabet and a former venture investor from Framework Ventures, Joe Coll. Witness is designed to issue digital ownership for any form of data by leveraging existing blockchain technology. Witness allows enables any data to be hashed, then Witness creates an on-chain checkpoint for that hash, essentially providing record of the data set at the checkpoint time, allowing any future users to access the data and confirm it hasn’t been tampered with since being issued.

Helika, a Web3 gaming analytics platform, raised $8 million in a Series A round led by Pantera Capital, bringing Helika’s total funding to $12.6 million. Other investors included Sparkle Ventures, Diagram Ventures, and Sfermion. Helika’s product suite allows Web3 companies on-chain and off-chain analytics to help them optimize user acquisition, retention, and engagement. Helika works with many of the big-names in Web3 gaming including Immutable, Treasure Dao, Gala Games, Animoca Brands, Yuga Labs, among others. Helika will use the funds to accelerate development of its AI-powered game management platform.

Analog, a layer-zero protocol focused on bringing interoperability to Web3, secured $16 million in an undisclosed funding round led by Tribe Capital, with support from NGC Ventures, Wintermute, GSR, and others. The funding round values Analog at $120 million on a fully diluted basis. Analog’s product suite includes Analog Watch, a developer facing data marketplace, GMP Protocol, its cross-chain messaging protocol, and Timechain, its decentralized PoS network built to power cross-chain apps. The funding will be used to advance Analog’s product suite and grow its client base.