Funding Takes a Breather

Weekly Recap

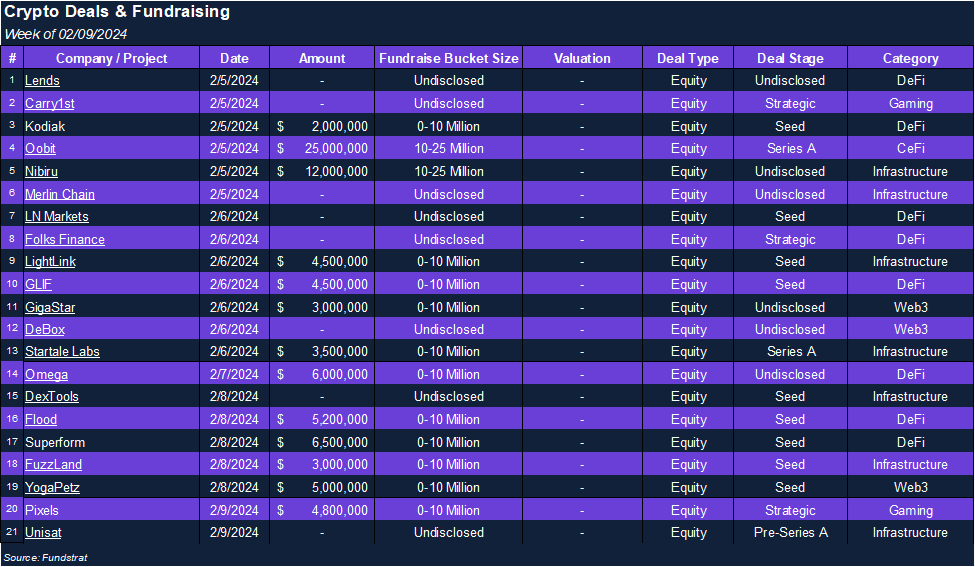

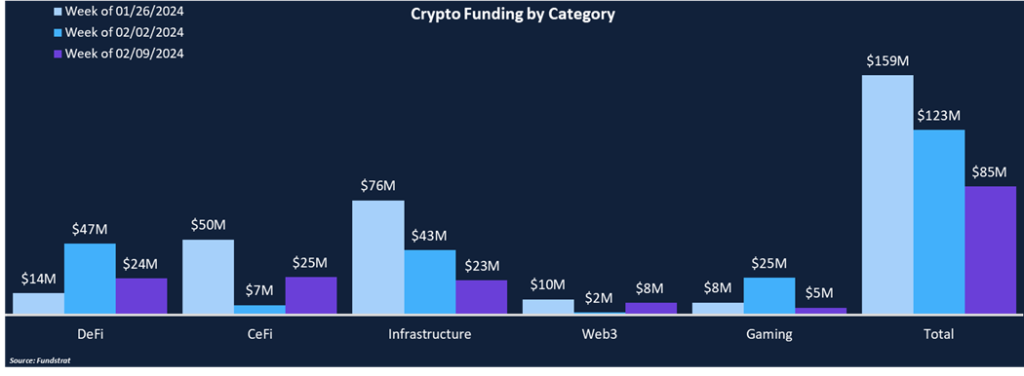

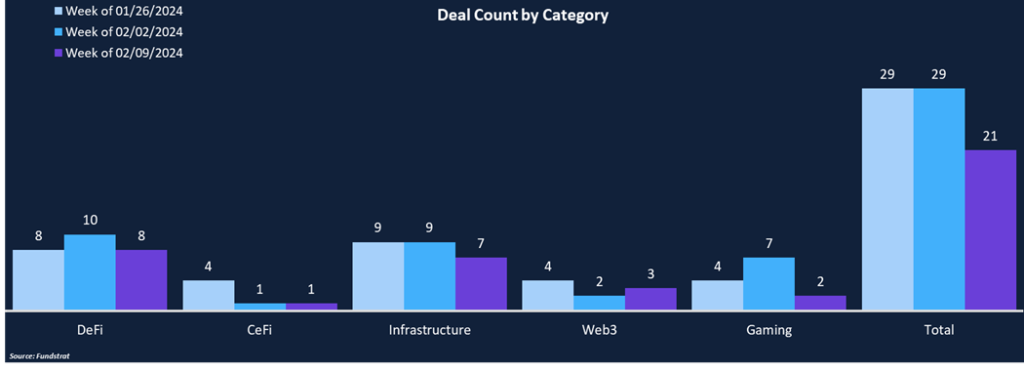

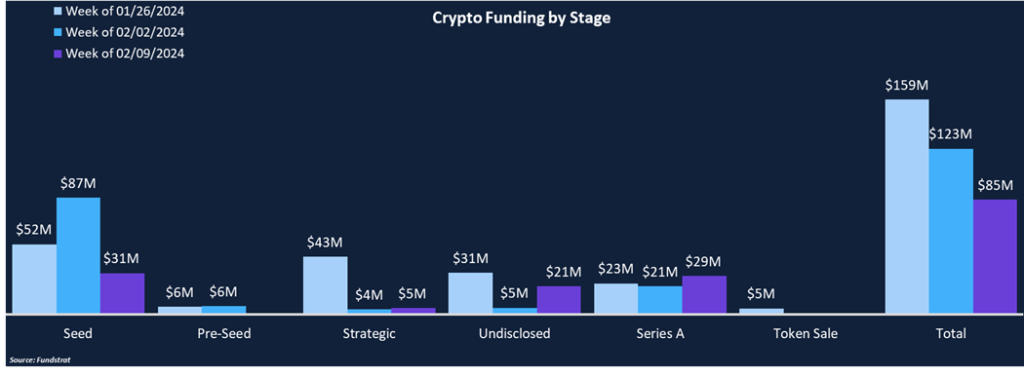

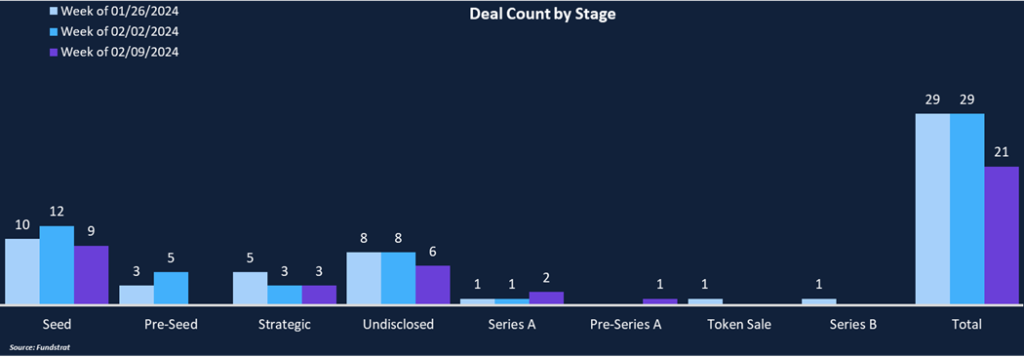

Crypto funding cooled to $85 million this week, the first sub-$100 million week since the start of 2024. Funding was relatively evenly distributed across the DeFi, CeFi, and Infrastructure categories, totaling approximately 85% of the fundraising, while Web3 and Gaming only comprised about 15%. Deal count fell 28% from 29 to 21. DeFi was the most popular category from a deal count perspective, tallying eight deals and representing 38% of all deals. Looking at deal stages, fundraising was concentrated in Seed and Series A rounds, which made up about 70% of total funding and 52% of the deal count. The largest fundraising round this week was Oobit’s $25 million Series A deal (DotW). Three strategic rounds were announced this week, including an investment from Sony’s Innovation Fund, which invested an undisclosed amount into Carry1st, the top game publisher in Africa.

Funding By Category

Funding By Deal Stage

Deal of The Week

Oobit, a mobile payments app, raised $25 million via its Series A round led by Tether, with other participation from Solana co-founder Anatoly Yakovenko. Oobit’s valuation was not disclosed in the announcement. The Oobit app allows customers to pay for everyday purchases using crypto assets, while merchants receive fiat currency on the backend. Users can fund their Oobit wallets with over 35 different assets and use the popular tap-to-pay feature at any merchants that accept Visa or Mastercard.

Why is this Deal of the Week?

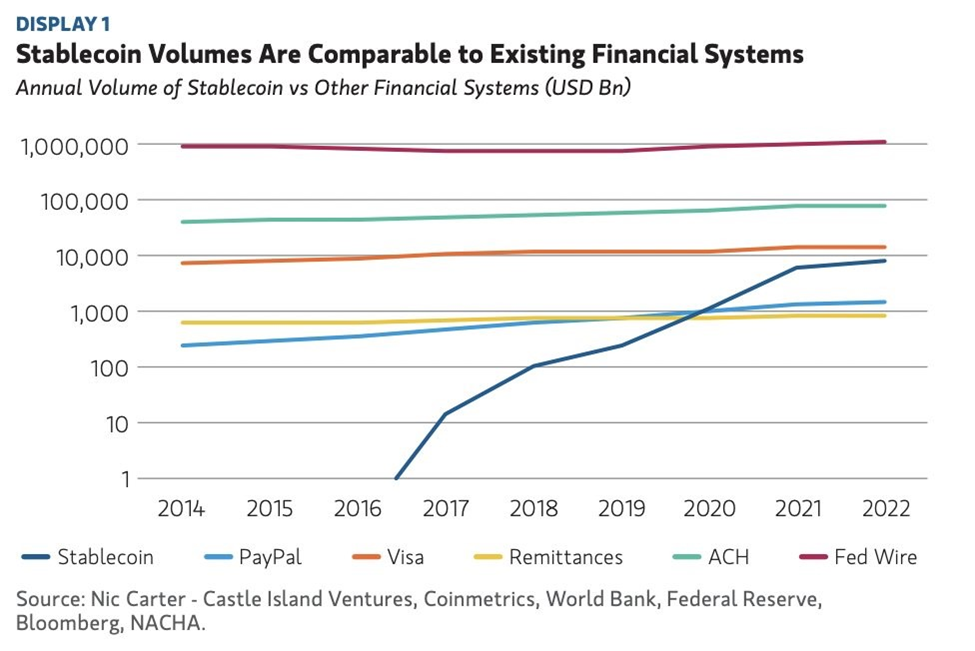

Payments is a sector within crypto that has yet to entirely find product-market fit. Stablecoins are clearly a massive success within crypto and are likely the first iteration of crypto payments adoption. The disruption is clearly evident when comparing stablecoin transfer volume to traditional financial systems.

The problem is that most stablecoin success is attributed to person-to-person (P2P) transfers rather than person-to-business. The next wave of adoption will potentially be through payment apps such as Oobit. Crypto users need more efficient ways of leveraging their digital assets to pay for everyday goods and services. Oobit hopes to disrupt the space by using its digital wallet and crypto debit card to reduce payment friction and drive business and user adoption. Currently, customer assets have to be held within Oobit’s digital wallet, but they plan to enhance the app to enable the use of 3rd party wallets, offering customers a non-custodial option if they prefer. The new funding should help Oobit grow and move to the forefront of the payments sector, especially with Tether as a partner, who represents the largest stablecoin by market capitalization and monthly transfer volumes.

Selected Deals

Dextools, a leading crypto data platform, raised an undisclosed amount in a seed round led by OKX ventures. The investment marks the start of a strategic partnership that will have OKX integrate Dextools directly into its OKX Web3 Platform. Dextools averages over 20 million monthly users and provides helpful data and analytics to crypto traders. Dextools plans to use the funding to add additional features to the platform and ensure they are equipped to advance blockchain innovation across all market conditions.

Merlin Chain, a Bitcoin layer-2 network, raised an undisclosed amount in a funding round from 24 investors, including OKX Ventures, ABCDE, Foresight Ventures, and Kucoin Ventures. Merlin Chain offers a native scaling solution integrating zk-rollups, a decentralized oracle network, and on-chain fraud-proof modules. Merlin Chain is built by Bitmap Tech, the team behind the BRC-420 marketplace and other ordinals projects. Merlin Chain went live on mainnet yesterday and accumulated over $50 million TVL in the first two hours after launching. Merlin Chain plans to use the funding to continue enriching the Bitcoin ecosystem, boost liquidity, and grow the ecosystem.

GLIF, a “liquid leasing” protocol for Filecoin, raised $4.5 million in a seed round led by Multicoin Capital with follow-on participation from Zee Prime Captial, Fintech Collective, Big Brain Holdings, and others. GLIF is the largest protocol by TVL within the Filecoin ecosystem and is the liquid staking equivalent for Filecoin. Users can deposit their Filecoin holdings into the protocol to earn rewards. GLIF also announced the launch of its points program that rewards users for past and future activity on the platform, which will entitle users to GLIF’s token airdrop down the line. With the new funding, GLIF plans to grow the platform’s TVL to 100 million FIL leases, or $495 million.