CeFi Continues Its Streak

Weekly Recap

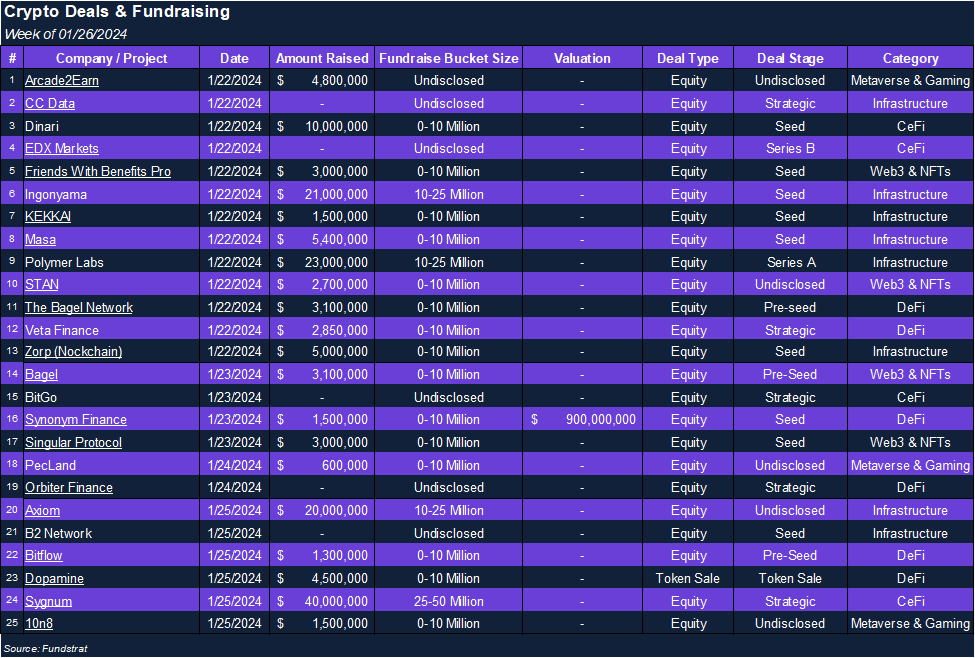

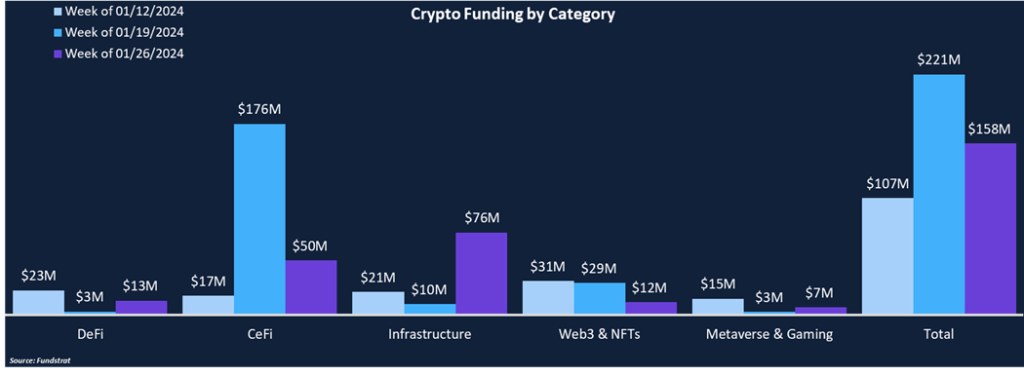

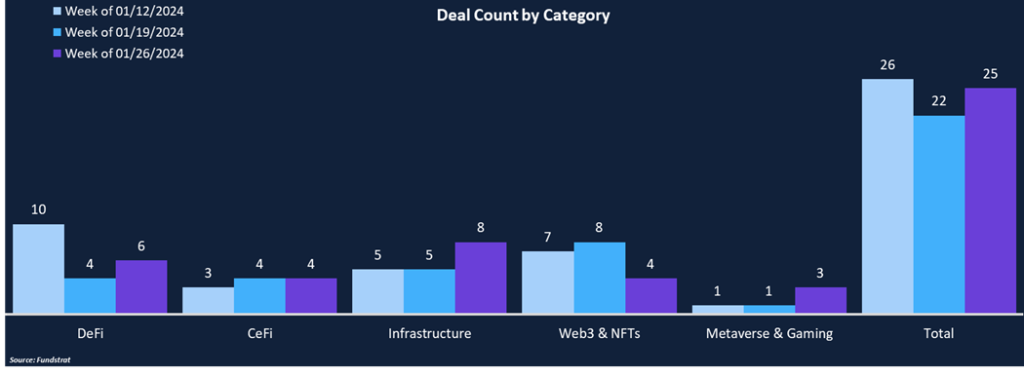

Total funding fell 29% week-over-week from $221 million to $158 million, while deal count rose about 14% from 22 to 25. This week marks the third consecutive week with triple-digit total funding and over 20 deals, potentially signaling increasing appetite in the private market. Infrastructure and CeFi were the leading categories, raising $76 million and $50 million, respectively. CeFi deals struggled in 2023 but have been a strong category through the first month of 2024 as investors bet on companies that will onboard users to crypto.

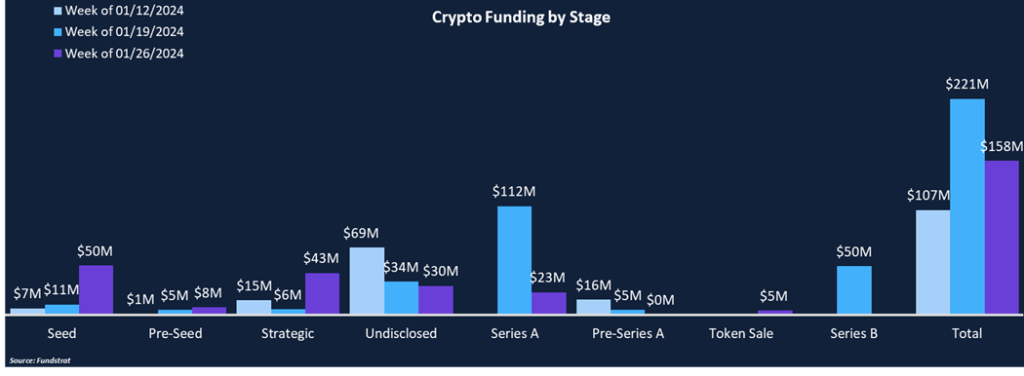

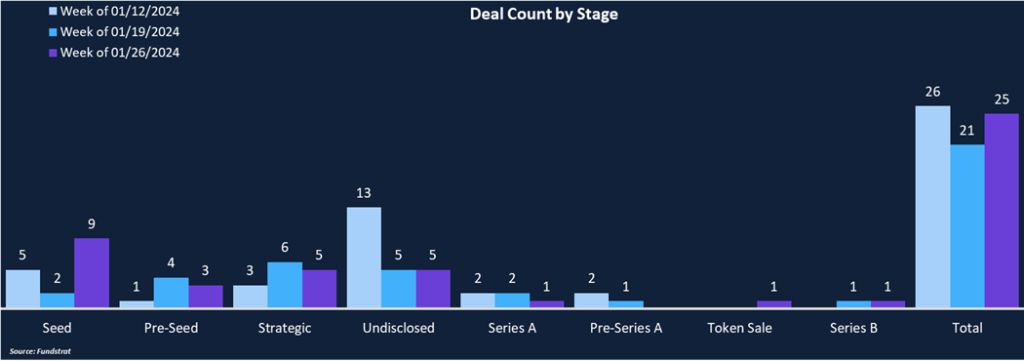

From a deal stage perspective, Seed rounds were the most popular, representing 36% of total deals and 32% of total funding. There was one Series B round completed by EDX Markets – a digital asset exchange backed by Citadel – for an undisclosed amount with investment from Pantera Capital and Sequoia Capital. Strategic rounds had the highest average deal size at $21.4 million, largely attributable to our Deal of the Week, Sygnum.

Funding by Category

Funding by Deal Stage

Deal of the Week

Global digital asset banking group, Sygnum, raised $40 million in a strategic round, valuing the company at $900 million, marking the second largest valuation of 2024 thus far. Azimut Holdings, an asset management firm, led the investment round. The “Strategic Growth Round” was oversubscribed and exceeded the initial target of raising $35 million. The funding will be used to expand Sygnum’s offerings in new European and Asian markets to take advantage of positive market trends within the digital assets industry.

Why is this Deal of the Week?

Sygnum offers a comprehensive suite of regulated digital asset services, including banking, asset management, tokenization, trading, staking, custody, and more. Sygnum is a prominent player in Europe and Asia with a Swiss banking license and CMS and MPI licenses in Singapore. They finished 2023 with over $100 million in annual revenue run rate and achieved positive cash flow in Q4. Its assets under administration have grown to over $4 billion, with over 1,700 clients across 60 countries. 2022 and 2023 saw many CeFi institutions blow up, such as FTX/Alameda, Silvergate, 3AC, and First Republic, among others, leaving a gap to be filled by other industry participants. CeFi fundraising was one of the least funded categories throughout 2023, and it is encouraging to see Sygnum taking advantage of the opportunity and restoring trust in the industry “via regulation and good governance.” As the market continues to pick up steam through 2024, Sygnum is well-positioned to “empower everyone everywhere to own digital assets with complete trust.”

Selected Deals

Dinari, a blockchain-based securities platform, raised $10 million in a seed round with investor participation from Balaji, Srinivasan, Version One Ventures, Sancus Ventures, and others. Dinari aims to provide access to real-world asset-backed tokens through its dShare Platform. Built on Arbitrum, dShare offers access to securities such as Apple or Tesla stock or other RWAs. The funding will be used to fuel Dinari’s continual growth of building a user-friendly platform for both traditional and crypto-centric assets.

EDX Markets, a digital asset exchange backed by prestigious traditional finance names like Fidelity and Citadel, raised an undisclosed amount in a Series B round led by Pantera Capital and Sequoia Capital. The funds will be used to expand operations and enter new markets. EDX is designed to meet the needs of both crypto-native firms and traditional financial institutions, leveraging traditional finance practices on a purpose-built crypto platform. In conjunction with the funding announcement, EDX also announced the launch of its digital asset clearinghouse, EDX Clearing.

KEKKAI, a security-focused crypto wallet provider, raised $1.5 million in a Seed funding round. Investor participation included Bixin Ventures, Sora Ventures, Decima Fund, and Dora Ventures. KEKKAI is focused on fraud protection with transaction simulation features that can detect malicious smart contracts or honeypots and give users risk warnings before engaging in transactions. The funds will be used to improve KEKKAI’s products and add new features to its mobile app and browser plugin.

Esports startup Stan raised $2.7 million in an undisclosed round with investor participation from Aptos Labs, CoinDCX Ventures, Pix Capital, and others. Stan had previously raised $2.5 million in 2022, and co-founder Parth Chadha stated that the new funding should give Stan a runway for about two years. Some funds are earmarked for marketing expenses, further product development, and onboarding more creators onto the platform. Stan is a fan engagement platform tailored for esports enthusiasts, offering a space for collecting, playing, and interacting with favorite esports and gaming collectibles.