CeFi Resurgence

Weekly Recap

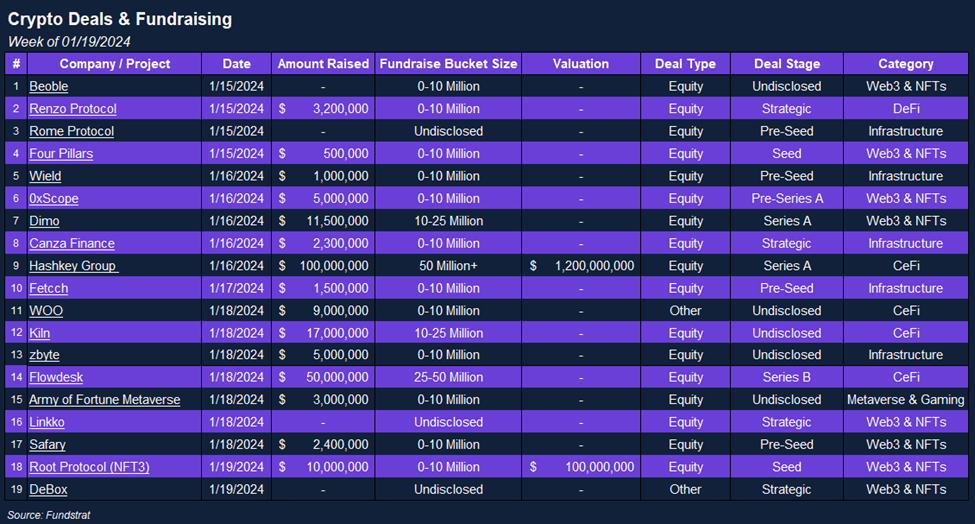

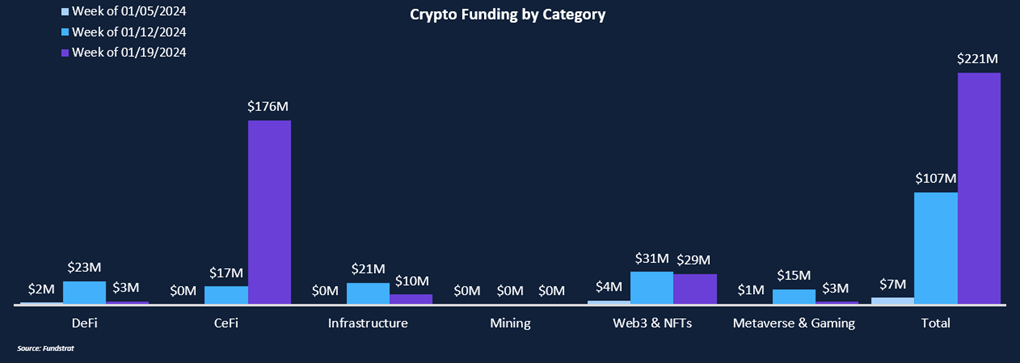

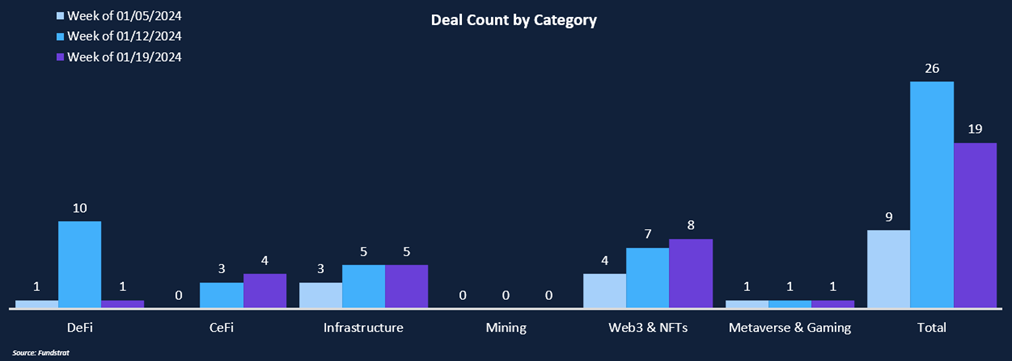

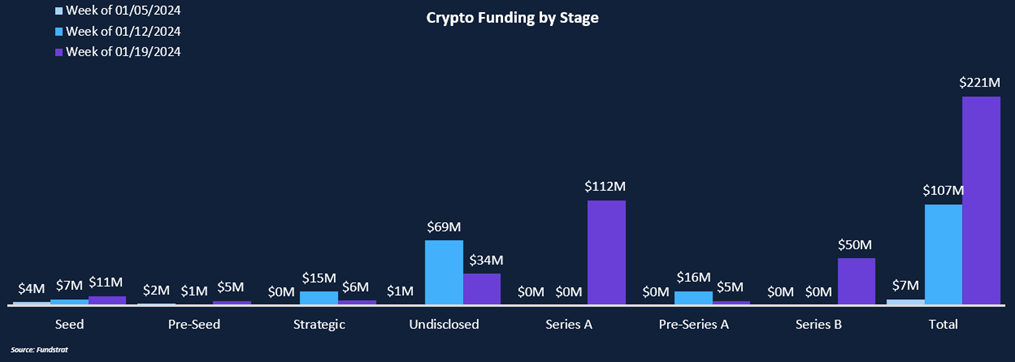

Crypto private markets have seen a flurry of activity the past two weeks, with 45 deals announced, raising $329m. Deal activity fell to 19 deals this week, down from last week’s 26. Funding doubled to $221m from $107m the prior week. Nearly half the funding this week came from Hashkey Group, which raised $100m at a hefty $1.2bn valuation. Haskey is a major digital assets financial services provider in Asia, with licenses from Hong Kong, where it launched the first licensed virtual asset exchange app. Interest in CeFi seems to be picking up again, comprising $176m of the total $221m raised this week. The category was largely neglected by investors last year, as the sting of blow-ups from FTX and Celsius, among others, led to investors seeking opportunities in other verticals. Yet, with the launch of the Bitcoin ETF and growing demand for institutional-grade service, CeFi funding could see a resurgence.

Web3 & NFTs have also seen elevated activity, with nearly one-third of the deals in the last two weeks. We define the category as general dApps or anything comprising digital ownership, digital economy, identity, IoT, and NFT collections. It is essentially an umbrella term for leveraging blockchain outside its most common use cases of financialization or computation networks. Our deal of the week, DIMO, which has created a network of car ownership data through incentivizing data sharing, is an excellent example of a unique use case enabled by Web3. As blockchain attempts to embed itself into more mainstream use cases, we expect investors to continue funding experimentation.

Funding By Category

Funding By Deal Stage

Deal of the Week

Digital Infrastructure Inc., the company behind the DIMO network, has secured $11.5 million in a Series A funding round led by CoinFund. This investment boosts the startup’s total funding to $22 million. CoinFund’s Chief Investment Officer, Alex Felix, will join the startup’s board of directors. The DIMO network is a decentralized protocol for car data, with an app that lets users access their car data and earn rewards in DIMO tokens. The funding round saw participation from various investors, including Slow Ventures, ConsenSys Mesh, Borderless Capital, Bill Ackman’s Table Management, and former General Motors CEO G. Rick Wagoner Jr. This capital injection is crucial for DIMO in establishing itself as a leading decentralized physical infrastructure network (DePIN).

Why Is This Deal of the Week?

DIMO represents a community-driven initiative reshaping the future of mobility services. It links drivers and their data with developers and manufacturers, creating an extensive and beneficial Internet of Things (IoT) network, initially focusing on user-owned cars. DIMO enhances the driving experience by enabling drivers to save money, gain insights on optimal car maintenance, and contribute to a future where driving apps prioritize vehicle owners’ interests over those of the companies that develop them. This is achieved simply through the sharing of user data.

With over 36,000 cars connected, representing over $1 billion in assets, DIMO is expanding its utility for developers and plans to introduce new tools for network building throughout the year. In 2023, the DIMO network experienced a 900% growth, increasing its connected cars from 3,000.

The DIMO protocol, which launched its mainnet in late 2022, also initiated a token airdrop as a reward for connecting cars to the network. One of the token’s functions is facilitating governance, contributing to the network’s decentralization. DIMO has a circulating market cap of $96.5m million, with a fully diluted market cap of $457.9 million.

Selected Deals

Bitfinity, a Bitcoin Layer 2 network compatible with Ethereum’s Virtual Machine (EVM) and built on the Internet Computer protocol, has raised $7 million in funding, reaching a valuation of $130 million. The project, co-founded by Max Chamberlin, secured this investment through token rounds, with notable backers including Polychain Capital, ParaFi Capital, Warburg Serres, Dokia Capital, and Draft Ventures. The funding comprises a $1 million seed round in 2021 and a subsequent growth round. The network is currently in testnet phase with plans to launch on mainnet soon. It stands out for allowing Ethereum developers to create Bitcoin-enabled decentralized applications. The network promises faster and more cost-effective deployment of EVM dApps compared to Ethereum. Bitfinity also supports Bitcoin Ordinals, BRC-20 tokens, and EVM assets, aiming to expand decentralized finance on the Bitcoin blockchain.

HashKey Group, a key digital asset financial services player in Asia, announced securing nearly $100 million in a Series A funding round, valuing it over $1.2 billion pre-money. The round drew existing shareholders, new institutional investors, leading Web3 institutions, and strategic partners. The funds will enhance HashKey’s Web3 ecosystem, diversify its licensed Hong Kong business, and support global compliant, innovative growth. In 2023, HashKey led regulatory developments in Hong Kong’s virtual asset sector, launching the first licensed virtual asset exchange app in Hong Kong. It quickly gained over 155,000 users and averaged a $630 million daily trading volume in the last 30 days. Additionally, HashKey Exchange formed partnerships with over ten brokerage firms and six public companies. HashKey Group’s core businesses include HashKey Capital, a global digital asset and blockchain technology asset manager; HashKey Cloud, a blockchain node validation service; HashKey Tokenisation, a tokenization services provider; and HashKey NFT, a Web3 PFP incubation and community service provider.