2023 Crypto Fundraising Report

Jan 12, 2024

Author

Key Takeaways

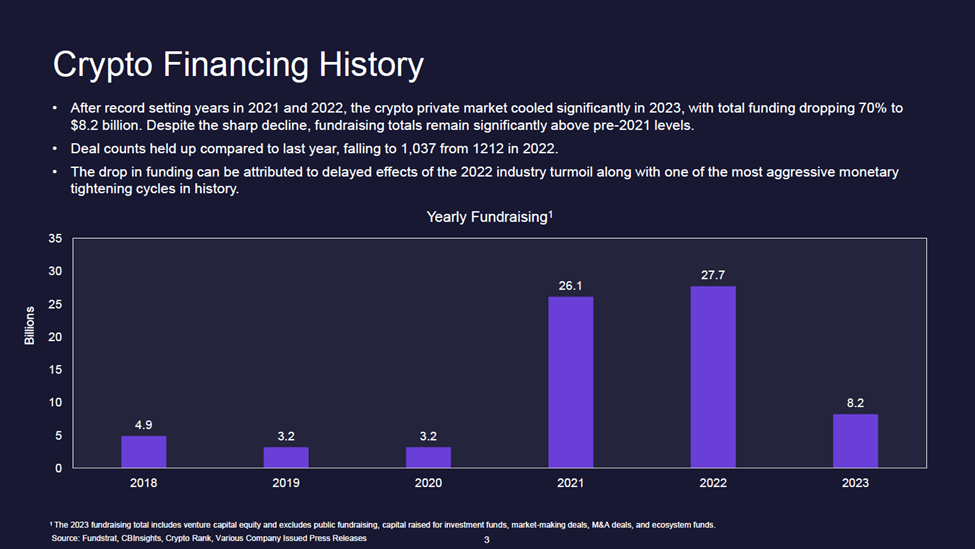

- After record setting years in 2021 and 2022, the crypto private market cooled significantly in 2023, with total funding dropping 70% to $8.2 billion. Despite the sharp decline, fundraising totals remain significantly above pre-2021 levels.

- Deal counts held up compared to last year, falling to 1,037 from 1212 in 2022. The drop in funding can be attributed to delayed effects of the 2022 industry turmoil along with one of the most aggressive monetary tightening cycles in history.

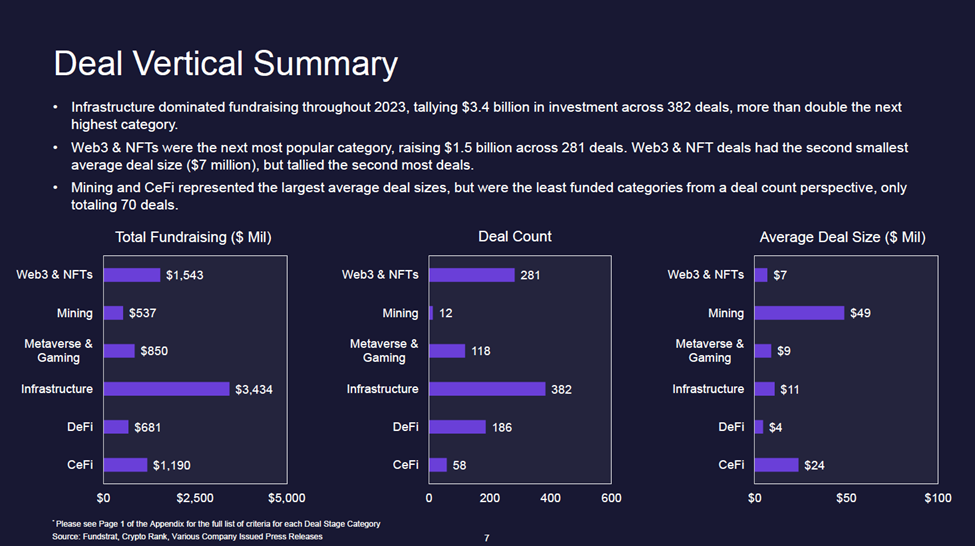

- Infrastructure dominated fundraising throughout 2023, tallying $3.4 billion in investment across 382 deals, more than double the next highest category.

- Seed rounds remained the preference from investors, representing 37% of all deals and 24% of the total fundraising amount.

- The two largest valuations of 2023 were cross-chain messaging protocols, LayerZero and Wormhole, which were valued at $3 billion and $2.5 billion, respectively. Crypto is likely heading towards a multi-chain future, and having the proper interoperability infrastructure remains paramount within the ecosystem.

Click HERE for the full report.

Key Slides from This Report

Slide 3: Crypto Financing History

Slide 7: Deal Vertical Summary

Slide 8: Deal Stage Summary