Swan Closes Largest CeFi Raise YTD

Weekly Recap

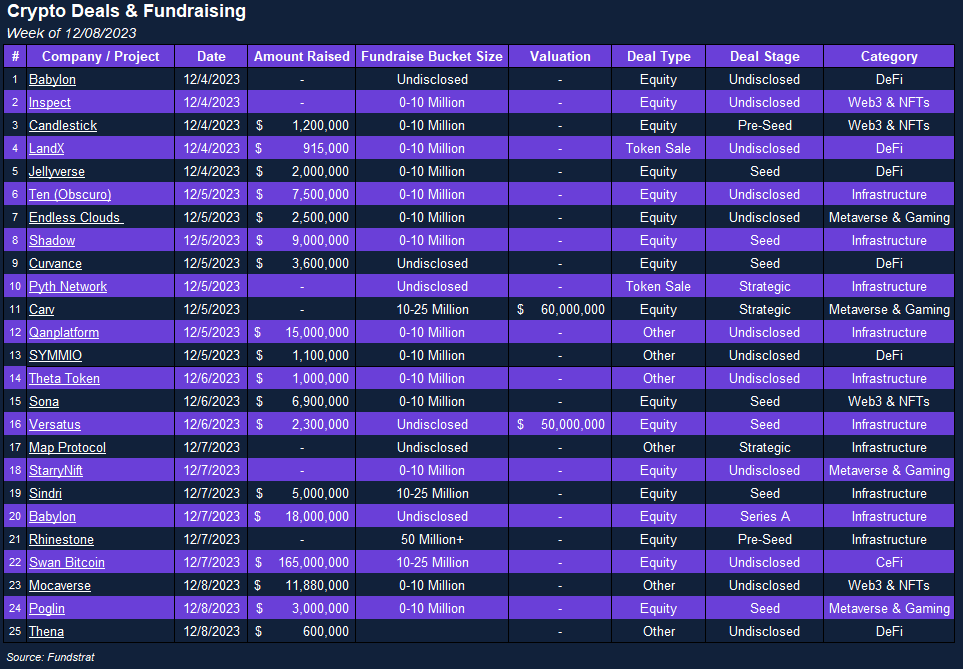

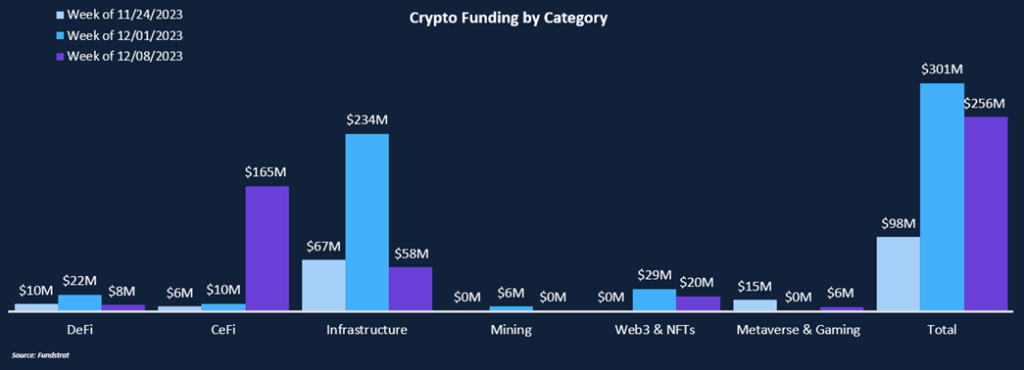

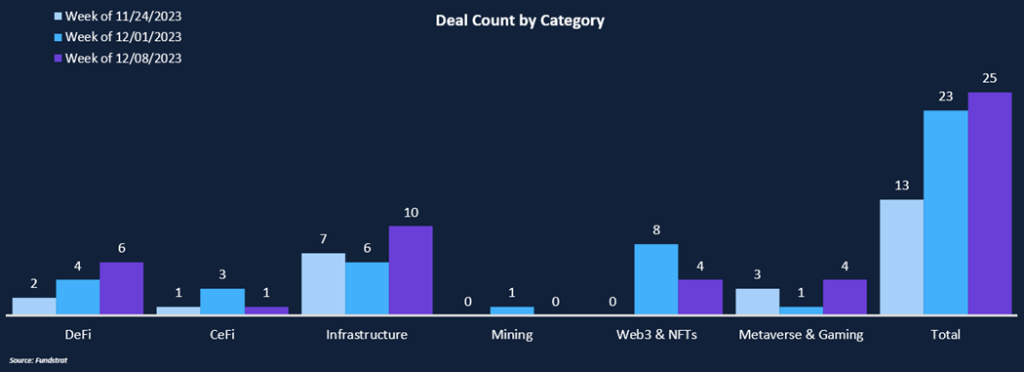

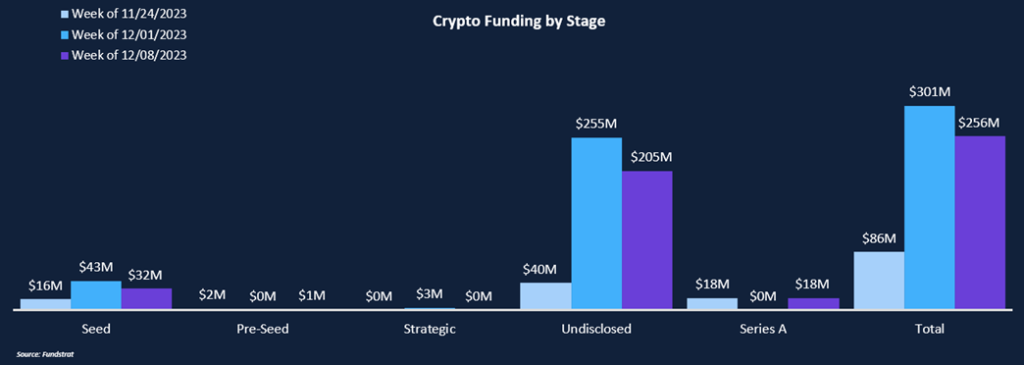

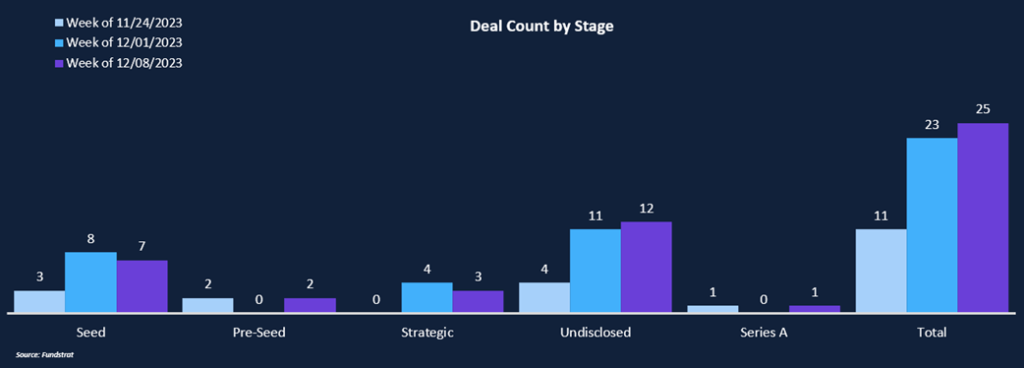

Crypto funding remains elevated, below last week’s total of $301 million but ending the week at a robust $256m. Deal activity increased by two deals this week as 25 deals were announced. Infrastructure was the most common category, with ten deals closed and $58m raised. CeFi led the week in funding, with Swan’s $165 million raise notching the largest deal closed in the category this year. Unlike most CeFi competitors, Swan offers no other digital assets on its platform. The company focuses on making buying and holding Bitcoin as easy as possible. DeFi, Web3 & NFTs, and Metaverse & Gaming saw early-stage deal activity, with deals closed in seed and pre-seed stages. Private market investors are beginning to venture further on the risk curve in unproven areas such as music NFTs and metaverse-based games. The high levels of funding and deal activity in areas largely ignored throughout the bear market could be early signs of a regime change in private crypto markets.

Funding By Category

Funding By Deal Stage

Deal of the Week

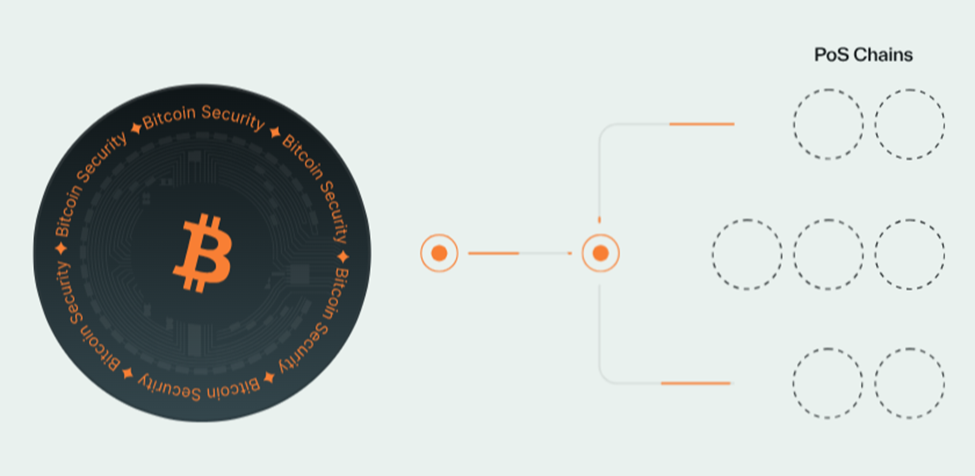

Bitcoin staking protocol Babylon has raised $18 million in a Series A funding round led by Polychain Capital and Hack VC. Other investors in the round include Framework Ventures, Polygon Ventures, OKX Ventures, and Symbolic Capital. Babylon operates a staking-as-a-service platform that allows Bitcoin holders to delegate their holdings to validate transactions on the Bitcoin network and earn yield. Unlike with bitcoin lending platforms, users retain custody and control of their bitcoin while still earning passive income through Babylon’s infrastructure. The company plans to use the new capital raised to expand its core engineering and product teams.

Why is this Deal of the Week?

Babylon’s software enables users to earn passive income on their Bitcoin holdings. The software allows users to delegate or assign the rights to validate transactions on the Bitcoin network to Babylon’s nodes without transferring their Bitcoin. As a validator on the Bitcoin network, Babylon’s nodes can earn Bitcoin transaction fees, which they then share with the users staking through Babylon. There has been growing interest and demand among cryptocurrency holders to generate returns on their assets without selling them. Babylon aims to benefit from this trend by giving Bitcoin holders a way to earn income from their holdings. Babylon co-founder Rich Rosenblum noted that the recent struggles of centralized crypto lending platforms demonstrate the need for non-custodial staking solutions. The founders believe staking will be essential for Bitcoin’s long-term security as mining block rewards decrease over time.

One of the emerging themes in the recent bullish market has been innovation on Bitcoin, which has typically been focused on use cases as a store of value and payments. Bitcoin is evolving its own ecosystem with native NFTs, tokens, and soon, potentially DeFi. Deals like Babylon show interest in private markets to fund this emerging opportunity.

Selected Deals

The Pyth Oracle Network, specializing in low-latency blockchain data, has recently concluded a strategic fundraising round. Key investors in this round include notable firms like Castle Island Ventures, Multicoin Capital, and Wintermute Ventures. This funding initiative is part of Pyth’s effort to decentralize governance following the distribution of PYTH governance tokens to over 90,000 crypto wallets. The raised funds, whose amount remains undisclosed, will enable these new stakeholders to influence Pyth’s future development through their token-based voting power in the governance system.

Sona, a new music streaming and marketplace platform, has raised $6.9 million in seed funding from Polychain Capital, Haun Ventures, and Rogue Capital. This funding will be used to develop new features and expand the engineering team. The platform combines ad-free streaming with a marketplace for unique digital song assets known as SONAs, allowing artists to auction these assets for immediate financial liquidity. Sona’s focus is to empower artists financially and connect them more closely with their fans.

Swan, a Bitcoin investment platform, has successfully raised $165 million in funding, allocating $125 million towards private equity and venture capital. Although founder Cory Klippsten did not disclose specific details of the raise, he emphasized that Swan’s investment efforts are predominantly concentrated on the Bitcoin ecosystem. Furthermore, Klippsten revealed plans for Swan to secure an additional $150 million in 2024 to facilitate its expansion.