AI and Blockchain Intersect

Weekly Recap

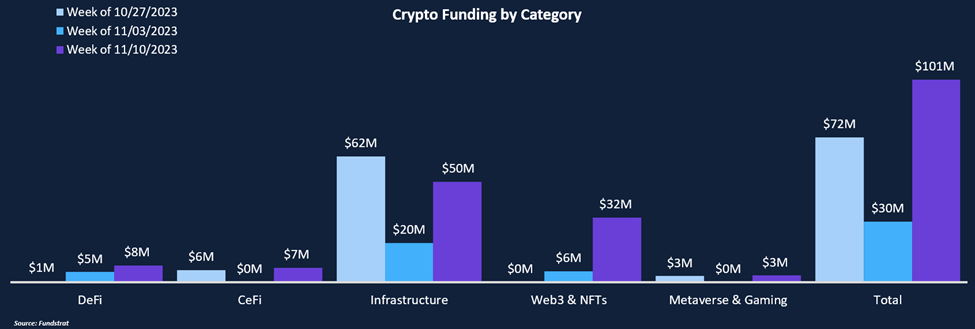

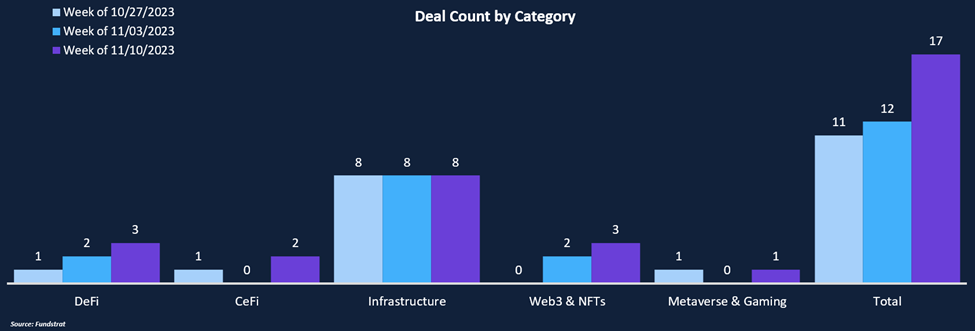

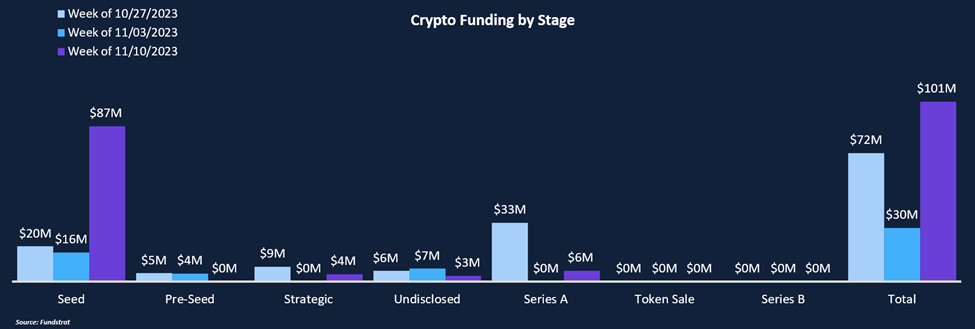

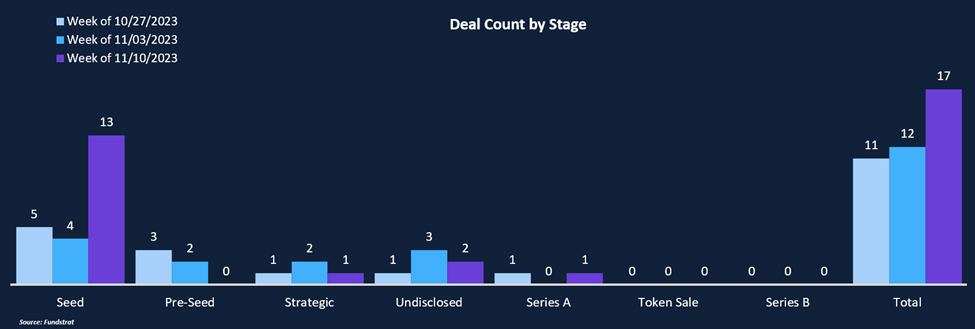

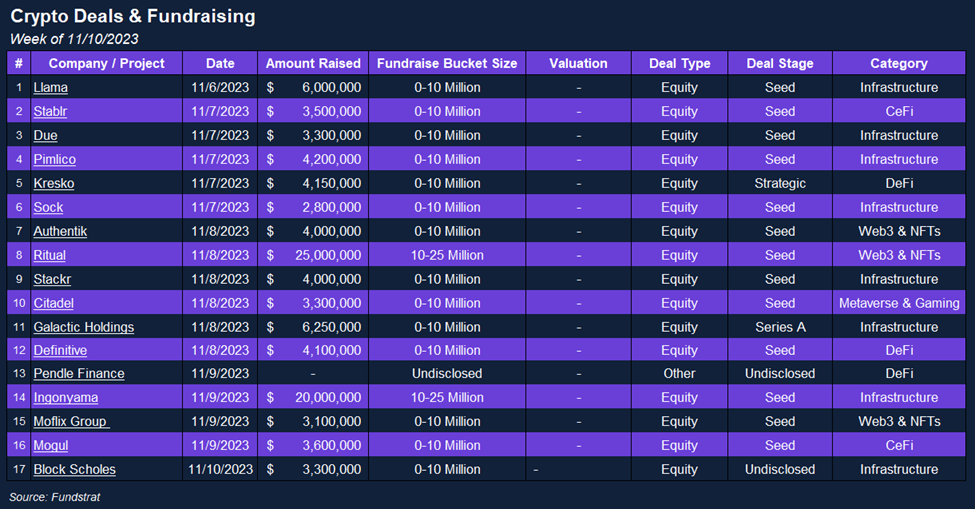

Funding jumped $71 million from last week’s lackluster $30 million to total $101 million for the week. The deal count increased to 17, with 13 deals focused on seed-stage companies. Infrastructure remains the most popular category, although investors seem to be honing in on blockchain applications outside digital assets. The second largest deal of the week, Ingonyama, raised $20 million to develop next-generation semiconductors that leverage cryptography. Ritual, our deal of the week, raised a leading $25 million to design a decentralized AI compute network, aiming to compete with the likes of Anthropic and Google. The applications of blockchains outside of digital assets have had relatively little traction aside from a few projects, with most start-ups looking to capitalize on opportunities focused on existing crypto users, who primarily use investing-based applications. We will closely monitor whether this becomes a new investing trend, as the convergence of AI and Blockchain could become a whole new category of infrastructure that targets blue ocean opportunities.

Funding by Category

Funding by Deal Stage

Deal of The Week

Ritual, a decentralized artificial intelligence compute platform, has raised $25 million in a funding round led by Polygon Ventures. Other investors included Ethereal Ventures, Collider Ventures, SignalFire, and strategic investor HashKey. This brings Ritual’s total funding to date to $31 million. Ritual aims to build a decentralized marketplace for buying and selling AI compute power. The funding will support Ritual’s goal of enabling the development of AI models and applications by providing scalable and affordable compute. Ritual co-founder Sid Mishra said the capital will help scale the network and onboard more GPU sellers and AI buyers.

Why Is This the Deal of the Week?

The platform will connect buyers who need AI processing with sellers who have spare GPU power to offer. Ritual’s distributed network architecture allows anyone to contribute computing power and earn rewards. Ritual competes with centralized providers like Anthropic, Amazon, and Google, which currently dominate the AI computing market. As a decentralized alternative, Ritual wants to make AI development more accessible and its marketplace more transparent. Polygon Ventures partner Arjun Sethi said Ritual’s technology addresses the growing need for compute in artificial intelligence research and development. He believes the project can help catalyze the next generation of AI innovation.

Ritual’s first product is Infernet – a network of nodes that allows smart contracts to access AI models for inference. This will enable new on-chain applications using AI. The founders have expertise in both blockchain and AI. They believe combining the two fields can lead to powerful new capabilities not possible with today’s centralized, closed AI systems.

Selected Deals

Ingonyama, a semiconductor firm specializing in cryptography, raised $20 million in a seed funding round led by Walden Catalyst, including major VC funds like Geometry and BlueYard Capital. CEO Omer Shlomovits, a former crypto company co-founder and Unit 8200 alumnus, is steering the company towards developing privacy-centric technology. Ingonyama, founded in 2022 and staffed by about 25 employees, is working on a parallel computing processor to accelerate advanced cryptography. Currently using GPUs for software development, the company aims to enhance applications reliant on sophisticated cryptography.

Sock, a fintech startup building an API for banking data, has raised $2.8 million in seed funding led by Deciens Capital. The startup provides a single API for developers to access real-time financial data from user bank accounts and cards. The founders, former Plaid engineers, aim to build an open banking API similar to Plaid but more developer-friendly. The funding will support expanding data pipelines and financial institution connections.

Spartan Group’s venture capital arm, Spartan Capital, has invested in Pendle Finance, a decentralized finance protocol for interest rate derivatives. The amount of the investment was undisclosed. Pendle offers fixed-rate lending and borrowing for variable-rate assets, enabling yield rate optimization for DeFi users. The protocol has grown rapidly, reaching $350 million in total value locked. The investment from Spartan Capital will support Pendle’s continued growth and product development in the fast-growing DeFi derivatives space.

Reports you may have missed

WEEKLY RECAP Crypto funding was relatively unchanged week-over-week, with a 4% decrease to $138 million, while deal count saw a larger decrease, falling 29% to 25 deals. Infrastructure deals comprised 73% of total funding and Web3 and Gaming combined for 26%, with remaining categories making up the last 1%. As highlighted in our Q1 Funding Report, Series A funding has been a standout deal stage this year, and this week...

WEEKLY RECAP Crypto funding rose 92% from $213 million to $410 million, one of the highest weekly totals in months. The majority of funding came from two deals: Monad’s $225 million round (DotW) and Auradine’s $80 million Series B round, the first mining deal of 2024. Auradine’s Teraflux family of Bitcoin ASIC miners has set new performance and energy efficiency benchmarks and has shown robust field performance, which has helped...

WEEKLY RECAP Funding fell 27% from $282 million last week to $206 million this week across 34 deals. Triple-digit funding seems to be the new normal, as there has been a notable uptick in the private market in recent weeks. Despite the overall increase in activity, there has been a lack of CeFi-related projects in recent weeks, with just one deal in each of the last two weeks. Agora was the singular...