Funding Activity Jumps with Market

Weekly Recap

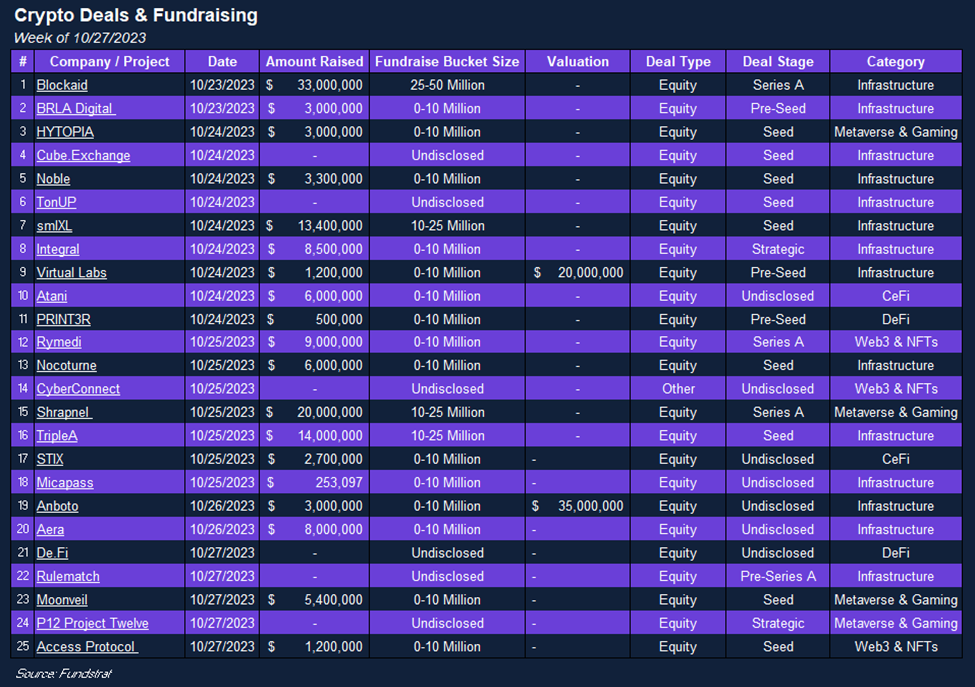

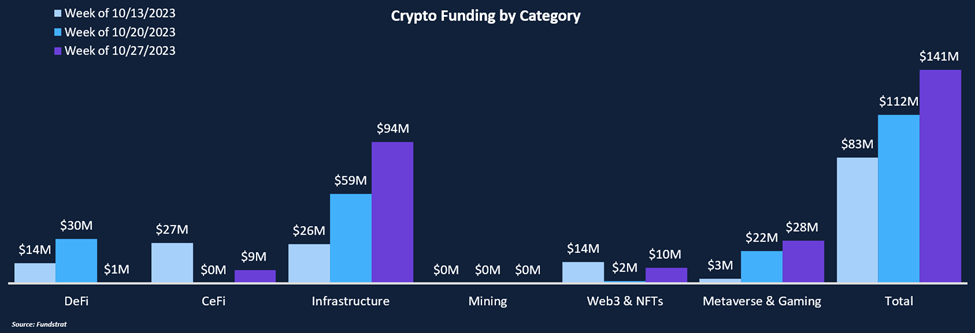

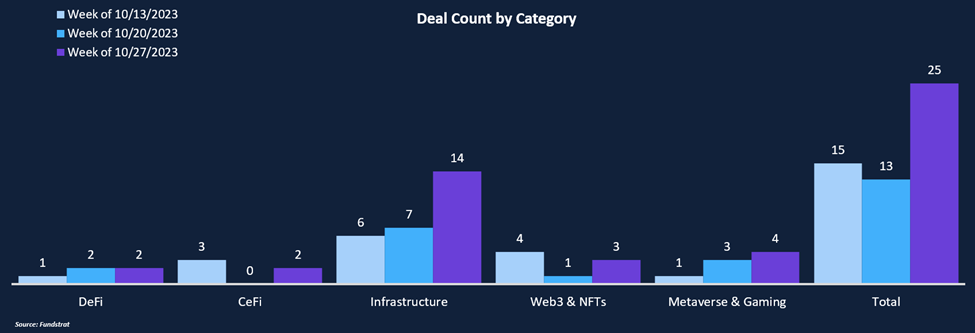

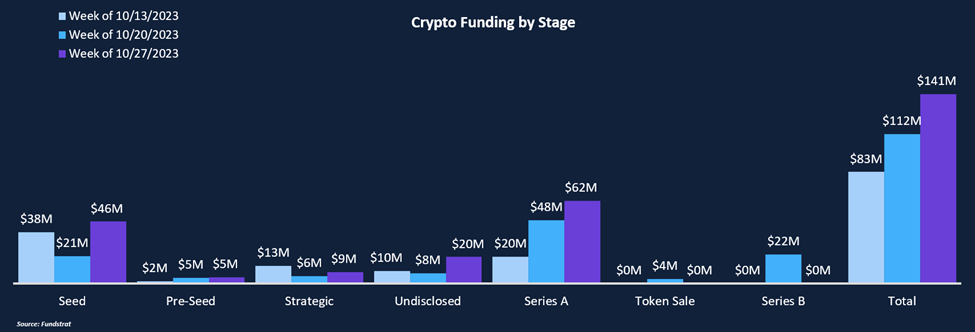

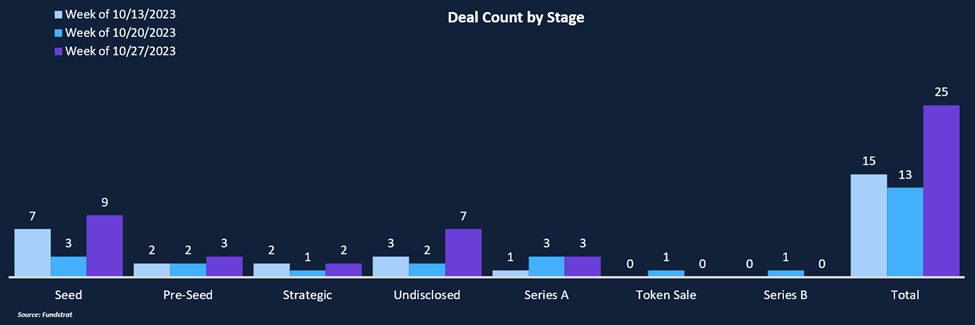

Funding is following the market higher, jumping $29 million from last week to $141 million. This week also saw a jump in activity, with 25 deals closed compared to 13 last week. Infrastructure was by far the most popular category, with 14 deals announced. Deals were funded in numerous infrastructure verticals, including trading software, payments, and compliance, among others. From a deal stage perspective, raises remain concentrated on Seed and Pre-Seed companies, with half of the deals this week falling in these categories. There was an uptick in Series A funding, with three companies raising $62m as investors gained confidence in more established business models. These included our deal of the week, web3 cybersecurity firm Blockaid, which raised $33m. There was also a large Series A raise in the gaming category, with blockchain-based first-person shooter Shrapnel raising $20 million. Given the sharp rally in liquid token markets this week, it will be interesting to see if the surge in activity and funding follows in the private market.

Funding by Category

Funding by Deal Stage

Deal of The Week

Blockaid, a web3 security company, has emerged from stealth mode with $33 million in funding to safeguard users against fraud, phishing, and hacks. Founded in September 2022, the company recently concluded its series A funding round, led by Ribbit Capital and Variant, with participation from Cyberstarts, Sequoia Capital, and Greylock Partners. Blockaid aims to use the funds to expand its product, customer base, and team.

Why is this Deal of The Week?

The company’s mission is to protect users from malicious transactions before they occur. It counts Metamask, Opensea, Rainbow, and Zerion among its initial customers. Blockaid offers a security layer compatible with all blockchains, scanning transactions originating from wallets, interacting with decentralized applications (dapps), or reaching smart contracts. It claims to be the only security solution capable of effectively simulating off-chain signatures (EIP-712s) like on-chain transactions.

In the last three months alone, Blockaid has scanned 450 million transactions, prevented 1.2 million malicious transactions, and safeguarded $500 million in user funds that could have otherwise been compromised. The company’s founders, Ido Ben-Natan (CEO) and Raz Niv (CTO) are former Israeli military cyber intelligence personnel, and its team includes over 20 experts from Israeli Unit 8200, a renowned cybersecurity unit. Blockaid operates out of offices in New York and Tel Aviv, addressing the growing need for security in the web3 space.

Selected Deals

Seattle-based game studio Neon Machine, known for its upcoming first-person shooter game Shrapnel, has raised $20 million in Series A funding, with Polychain Capital leading the round. Other investors include Griffin Gaming Partners, Brevan Howard Digital, Franklin Templeton, IOSG Ventures, and Tess Ventures. This funding will support the development of Shrapnel, a shooter game built around NFTs on the Avalanche network. The game is set to release an early-access version in December 2023, followed by a full launch in 2024. Shrapnel aims to offer in-game content as NFTs, including weapon parts, weapons, and cosmetics, on its Avalanche subnet. It also emphasizes user-generated content and the ability for players to create and mint their own game items as NFTs. Neon Machine has raised a total of $37.5 million from seed funding, Series A, and private token sale rounds.

Anboto Labs, a Hong Kong-based provider of cryptocurrency trading tools, has secured $3 million in funding from investors Kronos Ventures, Cherry Crypto, Mechanism Capital, XBTO, and Matrixport. With this investment, Anboto’s valuation now stands at $35 million, according to Guillaume Forcade, one of its co-founders. The company has launched a non-custodial trading platform designed for institutional traders, following an 18-month closed beta period that saw $4 billion in trading volume across 20 exchanges and blockchain networks. This platform offers various execution algorithms and security features like multi-factor authentication and IP whitelisting. Anboto plans to further expand its trading features to make institutional-grade execution tools accessible to all crypto traders in the coming months.

Access Protocol has secured $1.2 million in seed funding from investors, including DV Ventures, CMS Holdings, Sora Ventures, and DoublePeak, as well as angel investors. The funds will be used to develop their Sketch and Scribe products and launch Access v2 in late Q4 or early Q1 2024. They aim to onboard more creators, increasing from 50 to 200, and grow their subscriber base from 220,000 to over 1 million. Investors see Access Protocol as a key player in the web3 content space, bridging the gap between web2 and web3 media.