DeFi Beginning to Shine

Weekly Recap

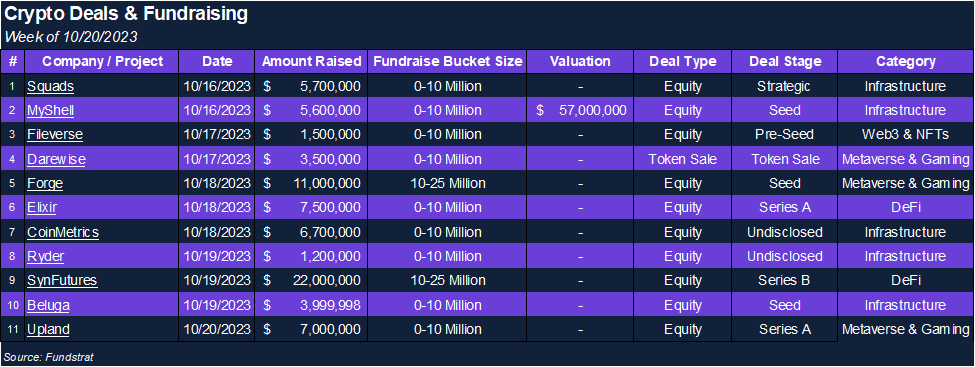

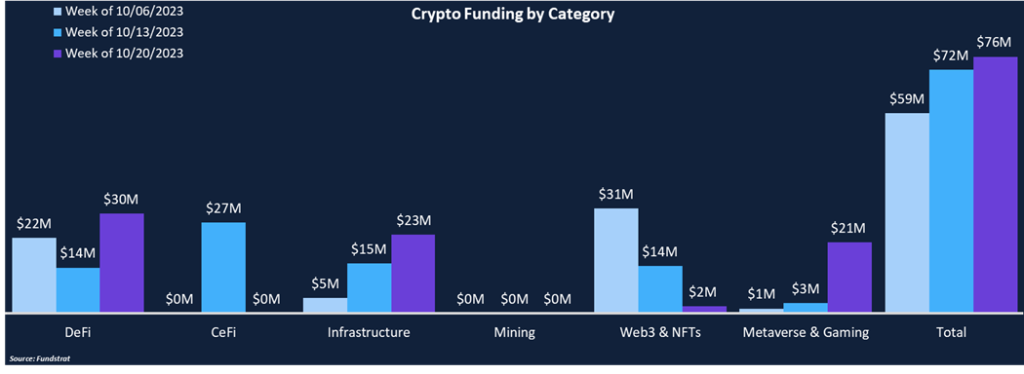

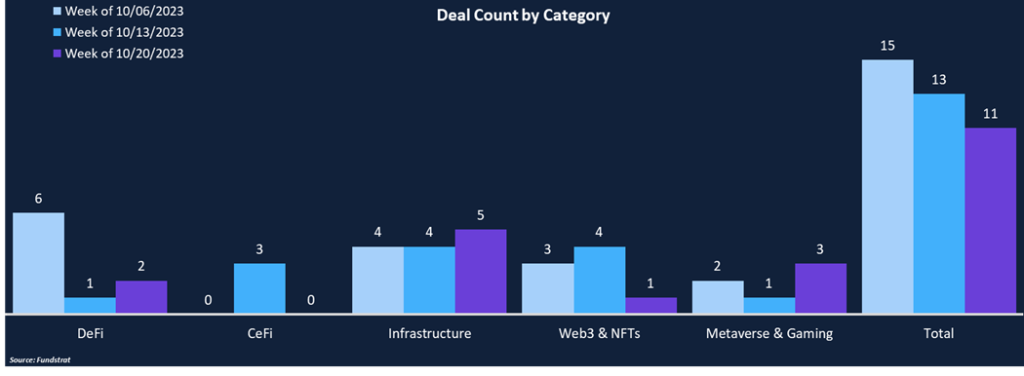

Weekly funding was on pace with last week’s levels, with total funding rising marginally to $76 million while deal count fell slightly to 11. DeFi was the most funded category this week, largely attributable to SynFutures’ $22 million Series B round (Deal of the Week). DeFi has been the hottest sector in Q4, making up 32% of total funding thus far. Infrastructure was the second most funded category this week, comprising 31% of funding amount and 45% of deal count. Infrastructure’s dominance as a category has waned in recent weeks, accounting for a fifth of the last three weeks’ total funding.

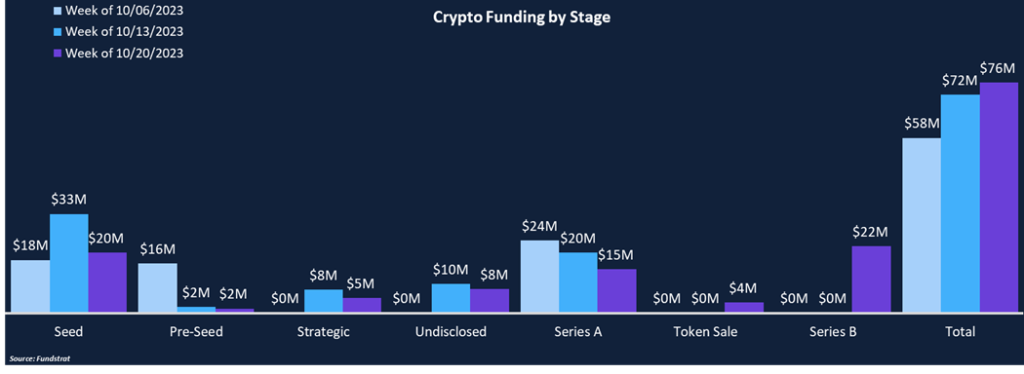

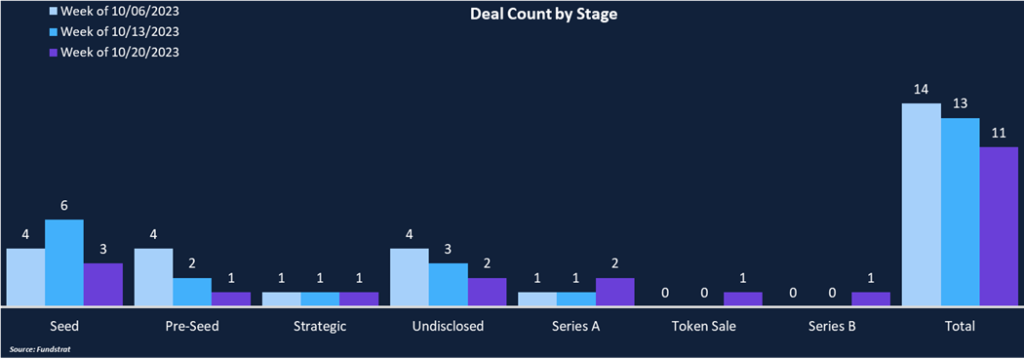

From a deal stage perspective, deals were relatively evenly distributed, with Seed rounds being the most popular, representing 27% of both deal count and total funding. This week marked the first Series B deal of Q4 and just the 10th of 2023. Darewise Entertainment, an Animoca subsidiary behind the MMO game Life Beyond, completed the only token sale of the week. Darewise raised $3.5 million to continue developing its Bitcoin metaverse ecosystem.

Funding By Category

Funding By Stage

Deal of the Week

SynFutures, a decentralized perpetual futures exchange, raised $22 million in a Series B round led by Pantera Capital. Other investor participation included HashKey Capital and Susquehanna International Group. The funding round brings SynFutures’ total funding to $37.4 million after raising $15.4 million across Seed and Series A rounds in 2021. Built on Polygon, SynFutures claims to be the most capital-efficient AMM in DeFi designed for any asset, with over 270 trading pairs.

Why is this Deal of the Week?

SynFutures has dovetailed the funding announcement with the release of its testnet v3 product, including its new AMM model, Oyster AMM. Oyster combines the best of order book exchanges and AMMs to maximize capital efficiency. Oyster enables 30-second asset listings, allowing for new trading pairs to be listed almost instantaneously as well as unified liquidity, improving capital efficiency for the whole ecosystem. SynFutures has facilitated over $21.4 billion in cumulative trading volume with over 100k traders. In addition to perpetual futures, SynFutures has an NFT Futures product that allows users to long or short NFT collections with up to 3x leverage. CEO Rachel Lin expects DeFi activity will resurge next year following the Bitcoin halving and improvement in macroeconomic conditions, but she believes DeFi’s current infrastructure is inadequate to handle a true explosive surge. On that front, she hopes SynFutures is the solution facilitating the next wave of crypto derivatives demand.

Selected Deals

Forge, an interoperable blockchain gaming company, raised $11 million in a seed round led by Makers Fund, BITKRAFT, and Animoca Brands. Other investors included Hashkey Capital, Polygon Ventures, Formless Capital, and Adaverse. Forge is a unique gaming platform that rewards players for their in-game achievements. Forge wants to unlock the value of their gaming profiles and be rewarded for their contributions to gaming communities. Often, gamers spend large amounts of time and energy accumulating in-game milestones and are stuck with nothing to show for it once they move on to the next game. With a Forge profile, gamers will have an on-chain identity that accounts for their gaming experiences and lets them earn rewards as they continue to play. Forge announced the fundraising round in sync with the launch of its first beta game. Beta users will be eligible to win in-game rewards and real-life rewards such as Amazon gift cards or gaming PC.

Solana-based multisig protocol Squads raised $5.7 million led by Placeholder, with participation from 6th Man Ventures, L1 Digital, Solana Ventures, Multicoin Capital, Jump Crypto, Delphi Ventures, and others. The strategic round brings Squad’s total funding amount to $12.5 million. Squads has become a staple across the Solana DeFi ecosystem, securing over $500 million in total value for over 100 different teams. Squads just released SquadsX, a new chrome-based extension allowing institutions to connect their multisigs to Solana Defi apps and perform various on-chain strategies. The new funding is earmarked for expanding support for institutional investors and crypto native startups, developing a mobile smart wallet, and advancing account abstraction on Solana.

Elixir, a decentralized market-making protocol, raised $7.5 million in a Series A fundraising round led by Hack VC with participation from NGC Ventures, AngelList Ventures, Bloccelerate, Ledger Prime, Hudson River Trading, and others. The fundraising round values Elixir at $100 million, and the funds will be used to improve liquidity across decentralized order book exchanges. Centralized exchanges typically gravitate towards the order book model, but decentralized exchanges have struggled with liquidity in the current market environment. Elixir allows users to supply liquidity directly to pairs on order book exchanges, offering similar return profiles as AMM liquidity providers while supporting deeper liquidity.