Phygital NFTs

Weekly Recap

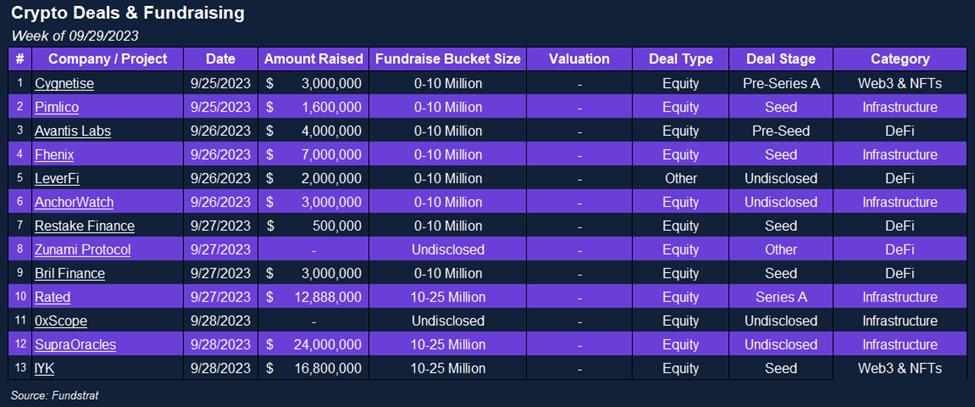

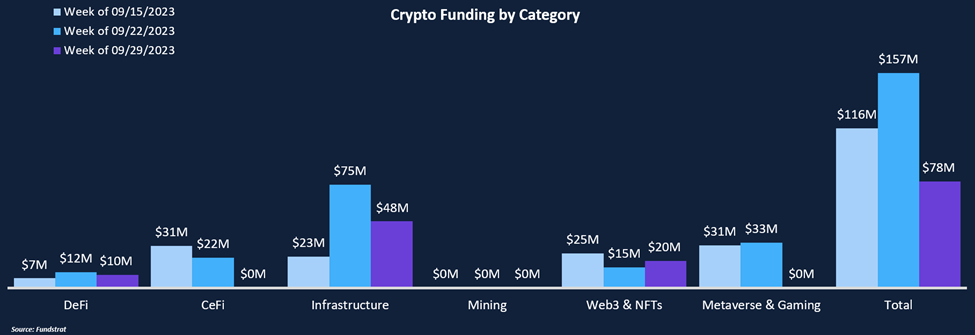

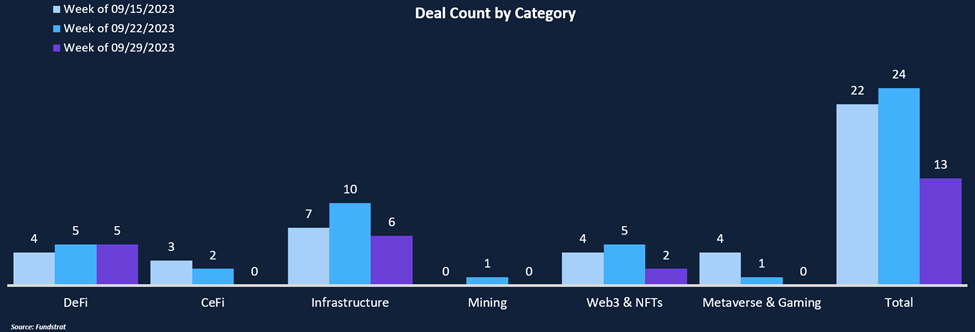

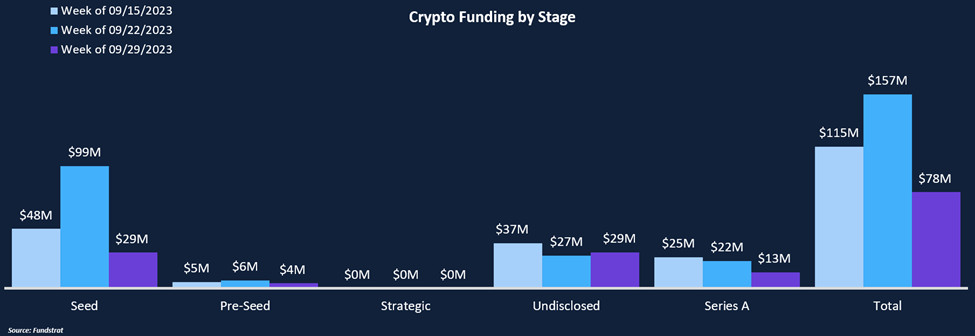

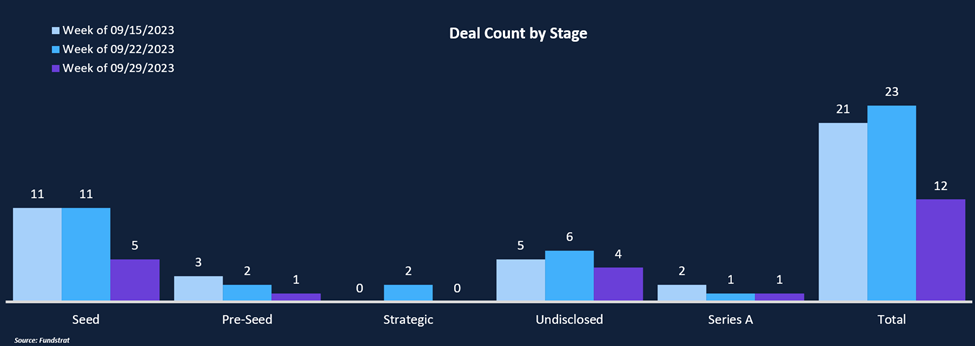

The crypto VC market finally broke its three-week streak of over $100 million weekly funding, falling to $78 million this week. Infrastructure emerged as the top-funded category for the second week, raising $48 million. Most came from Rated Labs and SupraOracles, two of our selected deals. This week, rather than the infrastructure blockchains we are accustomed to seeing, there was an emerging interest in data analytics and cross-chain functionality, both critical components of the evolving infrastructure landscape. Web3 & NFTs were the second most funded category, with $20 million total, mostly comprised of our Deal of The Week IYK. IYK is a phygital experience company that enables white-label experiential NFTs for major brands and creators. DeFi received relatively less funding at only $10 million but nearly matched Infrastructure in deal count at five deals closed. Investors seem eager to fund pre-seed and seed-stage deals for teams hoping to bring new primitives to market. A strong September completed what has been a roller-coaster market for funding. Next week, we will dive into how 3Q looked in our quarterly funding report.

Funding by Category

Funding by Deal Stage

Deal of The Week

IYK, a web3 startup that offers tools for bridging the gap between the physical and digital realms, has secured $16.8 million in seed funding. The leading investor in this round was A16z Crypto, with additional participation from investors including 1kx, Collab Currency, Lattice Capital, and gmoney. IYK, which was part of the a16z Crypto Startup School, an accelerator program by the venture capital firm, did not disclose specific details regarding the timing of the seed round or its structure and valuation.Funding will be used to hire its first business development executive and expand its team from the current ten members.

Why is this the Deal of the Week?

IYK is a web3 startup that empowers brands, musicians, and creators to construct digital-physical experiences, facilitating engagement with their customers and fans while maintaining a strong community connection. They offer a range of products, including a near-field communication chip for tokenizing physical items and events, including NFTs. IYK also provides developer APIs and modular tools for customizing these experiences.

Since its establishment in 2021, IYK has onboarded over 100 creators spanning various industries, such as fashion, music, and art. The company is launching a self-service platform to expand its reach to more brands and creators, enabling the creation of digital-physical experiences. According to co-founder Ryan Ouyang, IYK allows creators to build ready-to-use experiences with no-code tools or collaborate with developers to enhance these experiences using IYK’s APIs. Unlike competitors, Collect.ID or LNQ, IYK doesn’t restrict users to a specific chip type, authentication system, or its own domain. It provides greater freedom and versatility.

The name “IYK” stands for “If You Know,” derived from “IYKYK” (“If You Know You Know”). It reflects the idea that consumers can engage with physical products, knowing that there’s a digital universe they can access, which evolves over time and offers rewards for participation. To drive adoption beyond the limited crypto native participants currently in the market, consumers will need to be presented with unique experiences enhanced by blockchain technology in novel ways, which is exactly what IYK aims to accomplish.

Selected Deals

Supra has raised $24 million in private investment funding to continue building its state-of-the-art oracle technology. The project hopes to be pivotal in transitioning from Web2 to Web3 by enhancing oracles, cross-chain communication protocols, and their advanced consensus mechanism, building a more secure and interconnected future. The team, consisting of PhDs, has authored extensive whitepapers exceeding 150 pages, which have undergone peer-academic review. Their contributions span secure multi-party computation, decentralized consensus, and blockchain oracles. Dr. Aniket Kate, a leading figure known for his work on KZG Polynomial Commitments crucial to Ethereum’s L2 scaling, spearheads Supra’s innovations, rapidly becoming the new benchmark for cutting-edge oracle protocols.

Rated Labs, the company behind Rated, has secured $12.9 million in a Series A funding round. They aim to bolster transparency and context in Web3 infrastructure data. Archetype led the funding round, with participation from initial seed investors Placeholder, 1confirmation, Cherry, and Semantic, as well as new supporters like Robot Ventures, Chorus One, Factor, and Maelstrom. Since their inception in 2022 and the launch of their Rated Explorer platform, they’ve garnered almost 150,000 unique visitors, handled 60 million calls via the Rated API in 45+ integrations, and formed key partnerships in the Ethereum Staking ecosystem. Their mission is to establish an independent and transparent perspective on critical blockchain infrastructure, laying the groundwork for a new operating system for finance, commerce, media, and beyond.

Avantis Labs, a DeFi derivatives ecosystem, has secured $4 million in seed funding. The round was spearheaded by Pantera Capital, with participation from Founders Fund, Galaxy, Coinbase’s Base Ecosystem Fund, and investment from Modular Capital. The funding will be channeled towards expanding their primary offering, Avantis, a perpetual trading and market-making protocol. Avantis aims to empower institutional and retail investors to engage in crypto and RWAs trading with leverage of up to 100x through its decentralized exchange.