Three Weeks of Triple-Digit Fundraising

Weekly Recap

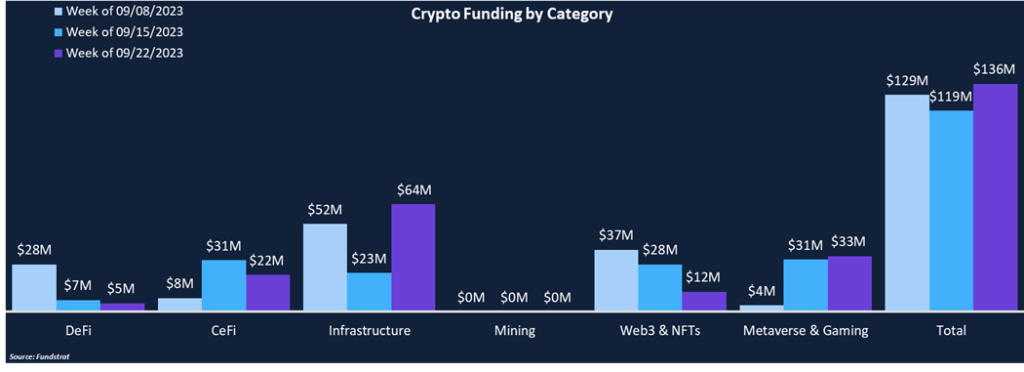

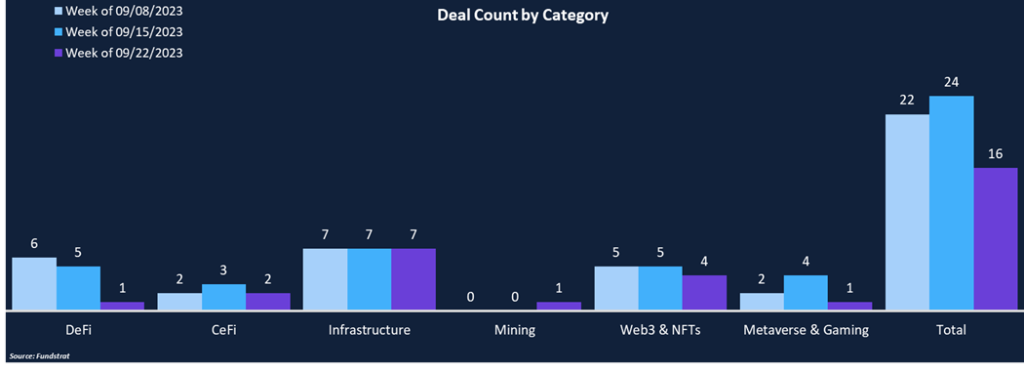

This week marked the third consecutive week of total funding over $100 million. This week’s total rose to $136 million compared to last week’s $119 million. A trend has developed of projects beginning to emerge from stealth development and announcing their product updates or new fundraises. Projects may be seeing light at the end of the tunnel of this bear market and think it is the right time to emerge.

Infrastructure was the most popular category this week, comprising 47% of the total funding amount and 44% of the deal count. CeFi has seen a notable uptick in recent weeks, totaling $22 million this week across two deals. Investors may be moving on from the woes of previous CeFi blowups and beginning to allocate to the sector again.

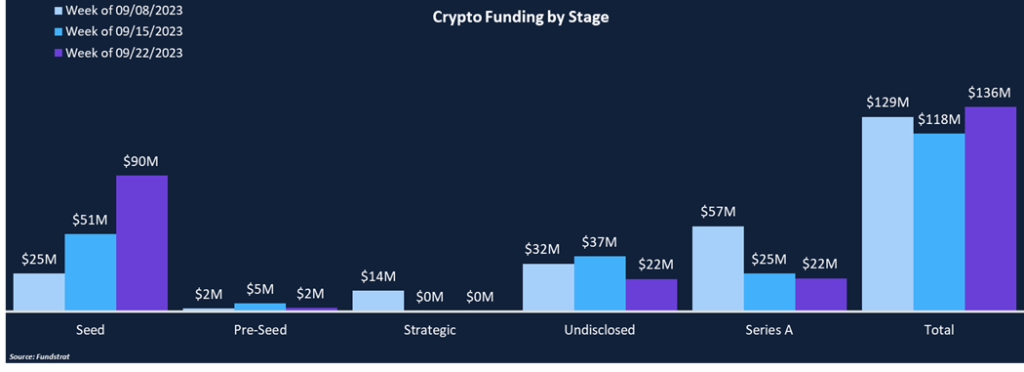

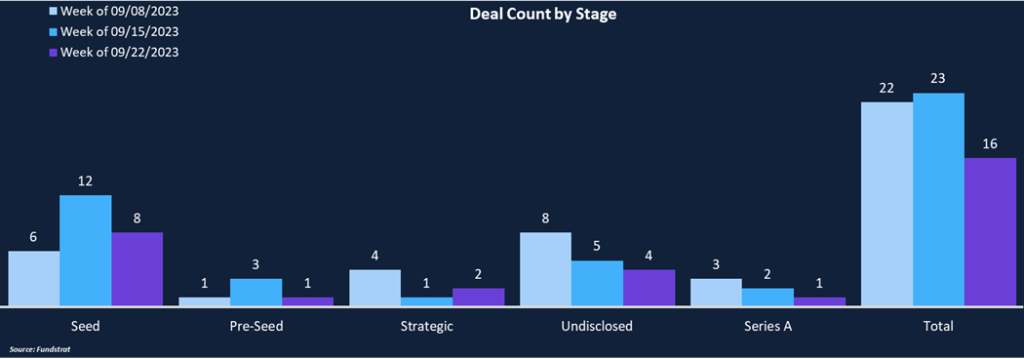

From a deal stage perspective, fundraising was highly concentrated in Seed deals, which made up two-thirds of the total funding. Proof of Play (deal of the week) raised $33 million in a Seed deal, the second-largest Seed investment this year. Overall, the last three weeks of funding data paint a rosier picture of the space heading into Q4.

Funding by Category

Funding by Deal Stage

Deal of the Week

Proof of Play, a blockchain gaming and infrastructure company, raised $33 million in a Seed round led by a16z and Greenoaks. Other investor participation included Anchorage Digital, Naval Ravikant, Zynga, and Twitch founders Justin Kan and Emmett Shear. Proof of Play is led by FarmVille co-creator and Zynga executive Amitt Mahajan. Proof of Play combines the responsibilities of a gaming studio and a blockchain infrastructure company to create real, fun, fully on-chain games. The funding will be used to boost the growth of its first game, Pirate Nation.

Why Is This Deal of the Week?

Proof of Play closed the second largest seed deal of the year, and its investor list is a who’s who of the gaming industry. Mahajan has a stellar track record in game development – FarmVille is Facebook’s top game of all time with over 300 million players. With an experienced leadership team and prominent investors behind them, Proof of Play hopes to create the best open-sourced gaming ecosystem in the industry. Proof of Play’s tech stack is built to fuel the next generation of on-chain gaming, with features such as mirroring tech, gasless and signless transactions, and game-optimized verifiable random function (VRF). Proof of Play released a beta version of its first game, Pirate Nation, in December. Pirate Nation is an on-chain RPG game which is currently invite-only. The team has been shipping weekly updates and plans to use the additional capital to make sure Pirate Nation is sustainable and built for longevity. Proof of Play plans to open-source its technology, allowing other developers to develop their own add-ons or features and enhance the gaming experience.

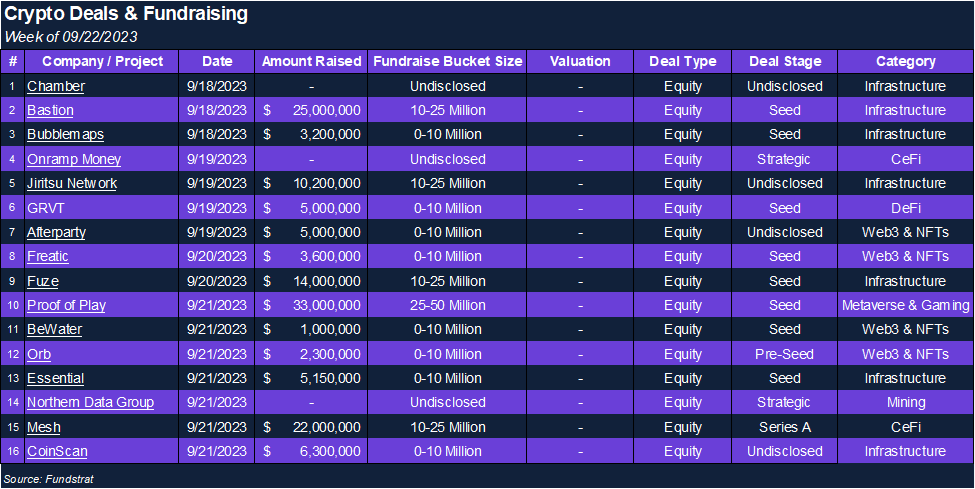

Selected Deals

Bastion, a blockchain infrastructure company focused on enhancing traditional enterprises by leveraging Web3 technology, raised $25 million in a Seed round led by a16z. The two founders of Bastion are former a16z employees and received funding from their ex-employer. Bastion announced the funding and its first product suite, which enables companies to integrate Web3 infrastructure with a white-label product. Bastion’s product uses a proprietary routing system to select which functions leverage blockchain technology and which use legacy systems. With Bastion’s platform, enterprises do not need to individually source crypto solutions like custody, wallet management, or onboarding, creating faster and easier ways for companies to integrate blockchain technology into their businesses.

CoinScan, a crypto analytics firm, emerged from stealth this week, announcing it has raised $6.3 million in funding in an undisclosed deal. CoinScan is backed by billionaire Shalom Meckenzie, founder of sports-betting analytics company SBTech and the largest individual shareholder of DraftKings. CoinScan aims to provide users with analytics to give traders an edge and reduce the chances of suffering from an exploit or scam. “Rugging” is a common problem in crypto and has become even worse as crypto interest has waned throughout the bear market. Over $1 billion has been lost to crypto exploits and scams this year alone. CoinScan hopes to prevent that number from increasing and plans to use the funding for product development and expansion.

Mesh, a digital asset management platform, raised $22 million in a Series A round led by Money Forward. Other investor participants included Galaxy Digital, Samsung Next, Streamlined Ventures, among others. Mesh’s latest fundraise brings its total to $32 million, and it plans to use the new capital to continue developing its deposits and payments tools. Mesh enables financial institutions to securely transfer digital assets to their customers’ accounts across different platforms and wallets. Mesh has already integrated transfers and payments with 300+ leading exchanges and wallets, serving as a pass-through instruction layer for all transfers. Mesh is streamlining the payments and transfers process and reducing friction for businesses and consumers.