Metaverse & Gaming Sector Revives

Weekly Recap

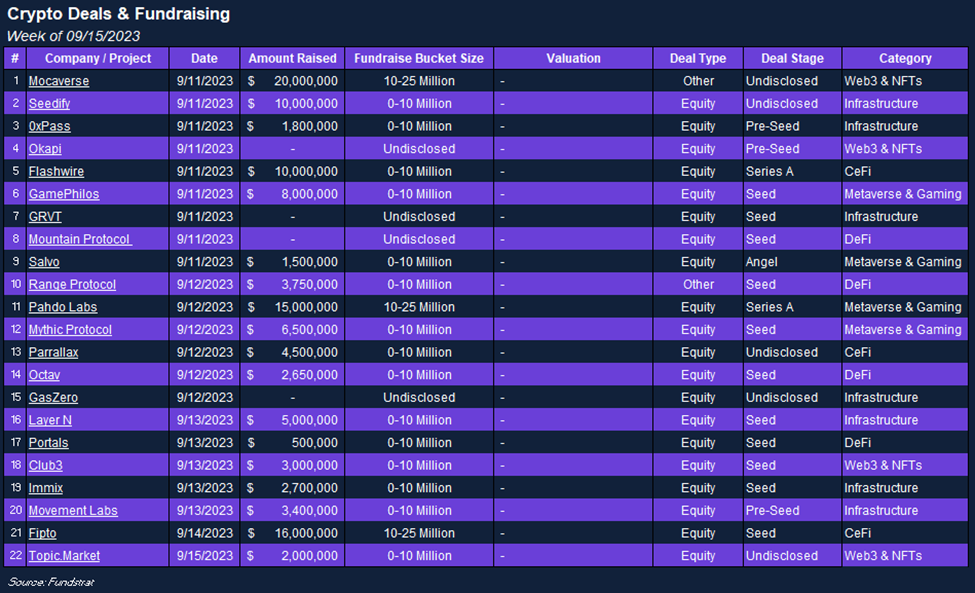

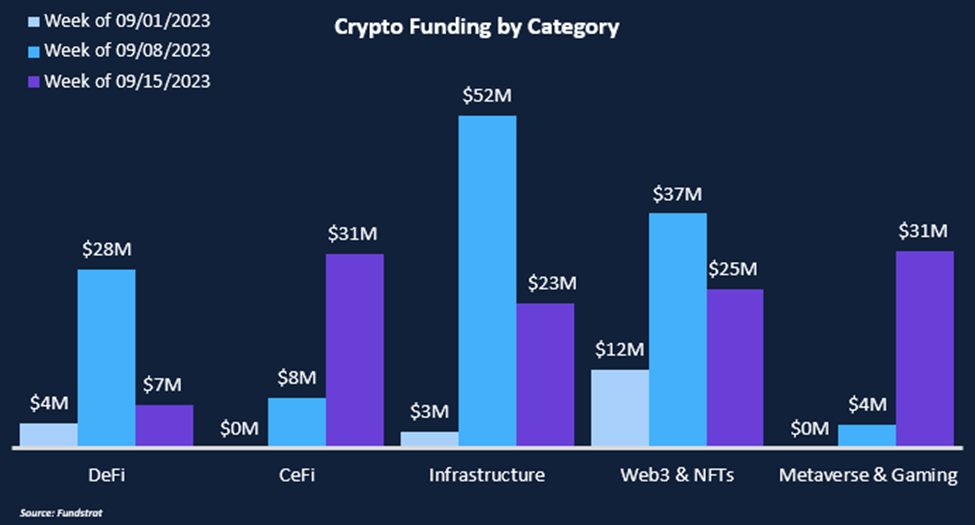

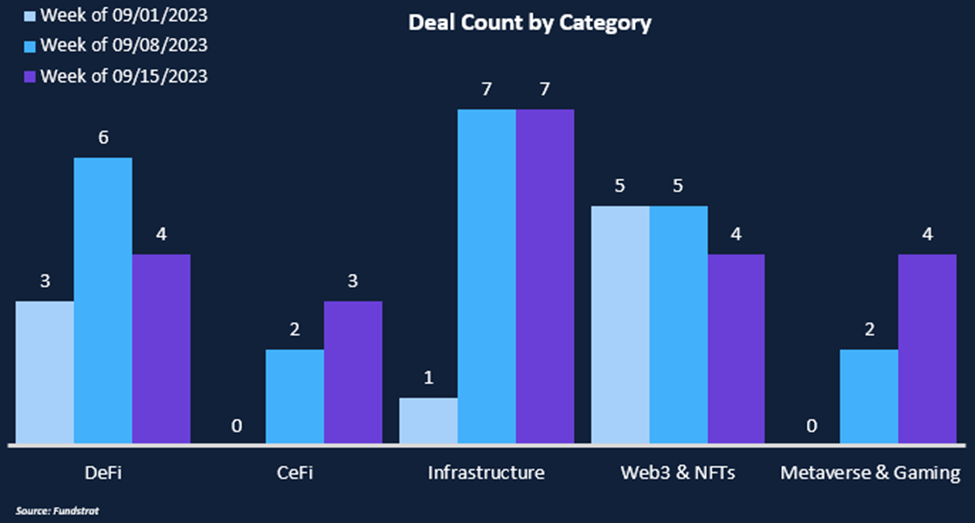

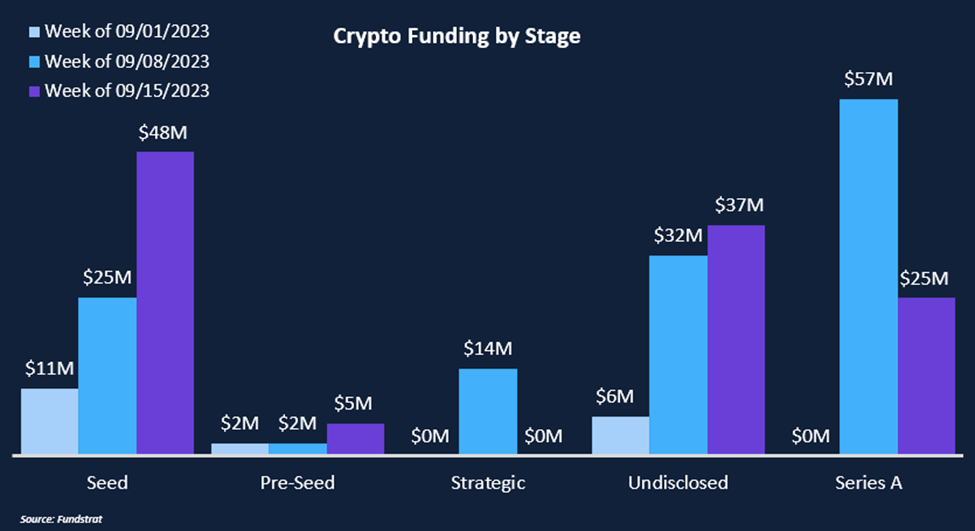

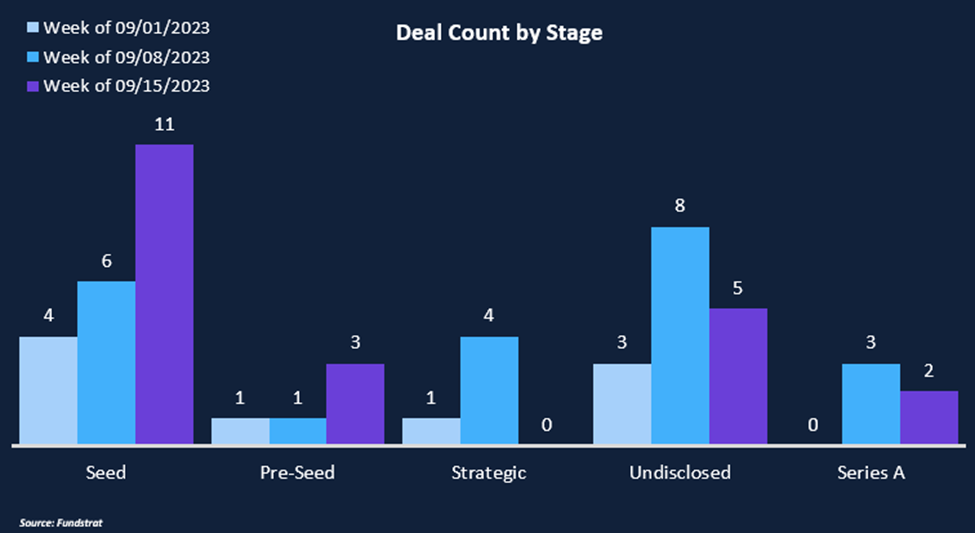

Momentum has continued after last week’s rebound in funding, with both deal count and total funding at similar levels. Total funding dropped $13m but still reached a robust $116m, while deal count stayed level with last week at 22 deals. Metaverse & Gaming is resurging after only three deals were announced for the category in August. These start-ups raised $31m in four deals, half of which came from anime gaming company Pahdo Labs, one of our selected deals. CeFi companies also raised $31m between three deals, including our deal of the week, Flashwire. These companies are focused on building Web3 financial services for both retail and institutions. Last year’s implosions of major CeFi players left investors hesitant to invest in space after news emerged that many of the most prominent players had fraudulent practices. This gap may be creating opportunities for companies willing to operate more ethically.

Funding by Category

Funding by Deal Stage

Deal of The Week

This week’s Deal of the Week is Flashwire Group, which raised $10 million in a Series A round from institutional investors in the crypto industry, including Legend Trading, Cobo, GATE.io, VeChain, CyberX, SuperChain Capital, and more. Flashwire looks to bridge the gap between traditional finance and Web3. Its core products include a crypto-friendly digital bank (Flashwire.com), a cryptocurrency debit card, Stella Pay (stellapay.io), and an institutional cryptocurrency lending platform Anxin Finance (Anxin. finance). Funding will be used to broaden its range of operations, expand its team, and continue research and development to create distinctive services in the industry..

Why is this the Deal of the Week?

Flashwire’s products aim to address industry challenges and provide users with tangible benefits. They have partnered with leading banks, credit card companies, traditional financial services, and crypto trading services like Legend Trading and custody services like Cobo. By combining global financial services, crypto liquidity, and advanced asset custody solutions, Flashwire is building a product lineup for institutions and individuals, evolving into a distinctive industry ecosystem. For instance, their digital banking and debit card services will soon transition to open platforms, enabling other FinTech firms to customize, white-label, and utilize these services freely.

The implosions of major CeFi players like FTX and Celsius have left a gap for companies looking to provide onramps and Web3-enabled financial services. The size that major CeFi players grew to before imploding is a testament to the market’s hunger for user-friendly products. Despite crypto’s decentralized ethos, centralized players will always play a key component in onramping users and providing financial services to retail and industry players. Investors are funding companies like Flashwire, hoping to capitalize on the opportunity still in the market. Companies that can improve or simply operate more ethically than their predecessors will likely emerge as significant winners for the next evolution of crypto financial services.

Selected Deals

Movement Labs raised over $3 million in a pre-seed round and introduced a Movement SDK for Web3. Notable investors included Varys Capital, dao5, Blizzard The Avalanche Fund, and others. The funding will support the development of Move, a secure smart contract programming language. The Movement SDK, featuring the M1 blockchain, provides high-performance environments for blockchain ecosystems and addresses cold-start issues. M1 emphasizes community involvement, transparency, and easy adoption of alternative virtual machines, balancing performance and accessibility.

New York-based game development studio Pahdo Labs has secured $15 million in Series A funding with Andreessen Horowitz (a16z) as the primary investor, supported by Pear VC, BoxGroup, Long Journey Ventures, Neo, and Global Founders Capital. Pahdo Labs’ core mission is to create a virtual world co-built by players. Their upcoming game will allow users to craft their anime-style universes utilizing AI-powered or procedurally generated tools, emphasizing creative and social aspects within the anime RPG genre. The studio invites anime and action role-playing game enthusiasts to participate in Pre-Alpha playtests for their upcoming project, Halcyon Zero, in September 2023.

Mountain Protocol has announced an undisclosed seed raise led by Castle Island Ventures, with participation from Coinbase Ventures, New Form Capital, Daedalus Angles, and others. Mountain Protocol has introduced a yield-bearing stablecoin named USDM, which received approval from the Bermuda Monetary Authority as a digital asset issuer on July 27. This stablecoin is positioned as the first nationally-regulated, yield-bearing stablecoin. USDM, an ERC-20 token, is intended to provide non-U.S. users access to U.S. Treasury yields and can be utilized in various DeFi protocols. USDM is fully backed by short-term U.S. Treasuries and offers daily rewards through rebasing at a 5% APY rate. The rebasing mechanism is akin to Lido Finance’s stETH and is familiar to the crypto community.