Funding Finds a Pulse

Weekly Recap

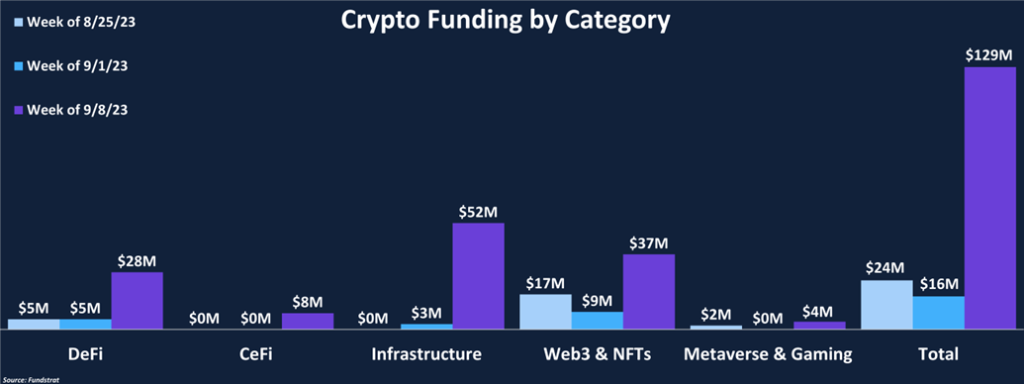

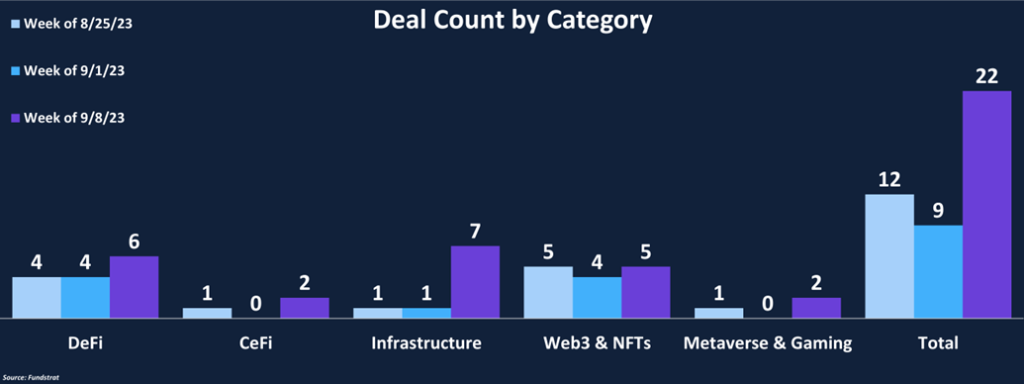

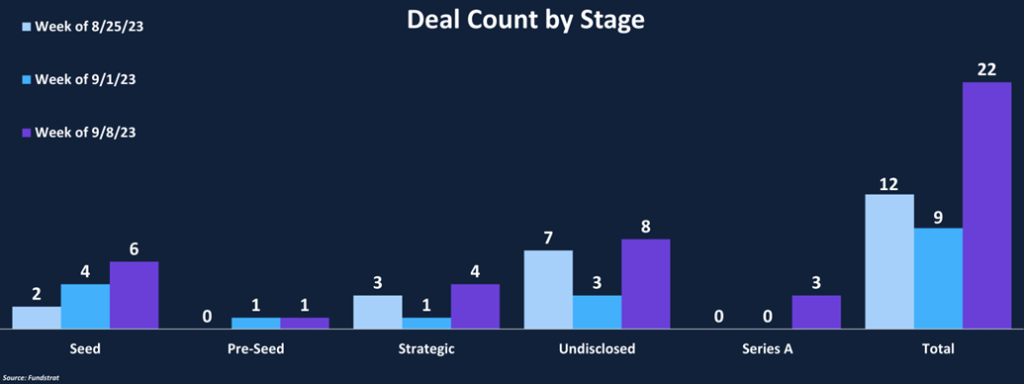

After two weeks of lackluster funding activity, there was a considerable rebound in both total fundraising and deal count. Total funding rose to $129 million, over 8x last week’s total, while deal count more than doubled. In addition to funding activity increasing, the average deal size increased to $8 million compared to $3 million last week. Four deals were in the $10-$25 million bucket, the highest count in recent months.

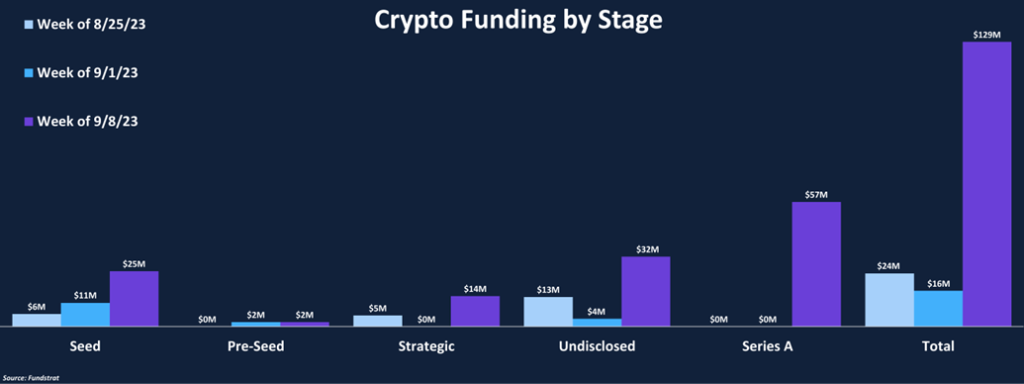

Infrastructure was the highest funded category ($62m), followed by Web3 & NFTs with $37 million. Over the last month, there has been a trend of deal counts being concentrated between DeFi and Web3 & NFTs. The trend remained intact with the addition of Infrastructure garnering seven deals. From a deal stage perspective, funding was concentrated in the Seed and Series A stages, representing 19% and 44% of total funding, respectively. Deal count distribution was similar, with Seed rounds comprising 27% of total deals and Series A rounds comprising 14%.

Funding by Category

Funding by Deal Stage

Deal of the Week

Story Protocol, an open-source network focused on intellectual property (IP) rights, raised $25 million via a Series A deal led by Andreessen Horowitz. Other investors included Endeavor, Samsung Next, and Insignia Ventures Partners, among others. The Series A round is the largest deal of the week and marks a significant investment given the volume and size of crypto funding through Q3. Story Protocol previously raised $29 million in May, bringing its funding total to $54 million. Story hopes to use the funds to democratize and revolutionize IP creation for artists, fans, and developers.

Why is this Deal of the Week?

Intellectual property is a massive issue among creators as proving ownership and tracking usage across digital platforms is extremely difficult. As the creator economy continues to grow, it’s important that artists can track how their IP is used and shared, ensuring they are paid in accordance with their IP usage. Story Protocol hopes to tackle this problem by simplifying the processes of maintaining intellectual property and providing transparent provenance tracking and fair attribution by leveraging blockchain technology. Story Protocol provides a streamlined framework to manage the entire lifecycle of IP development, including features like frictionless licensing and revenue sharing. As an open-source network with a modular architecture, Story hopes to attract an expansive network of third-party developers who provide unique services to create a new paradigm where artists have greater control over their intellectual property.

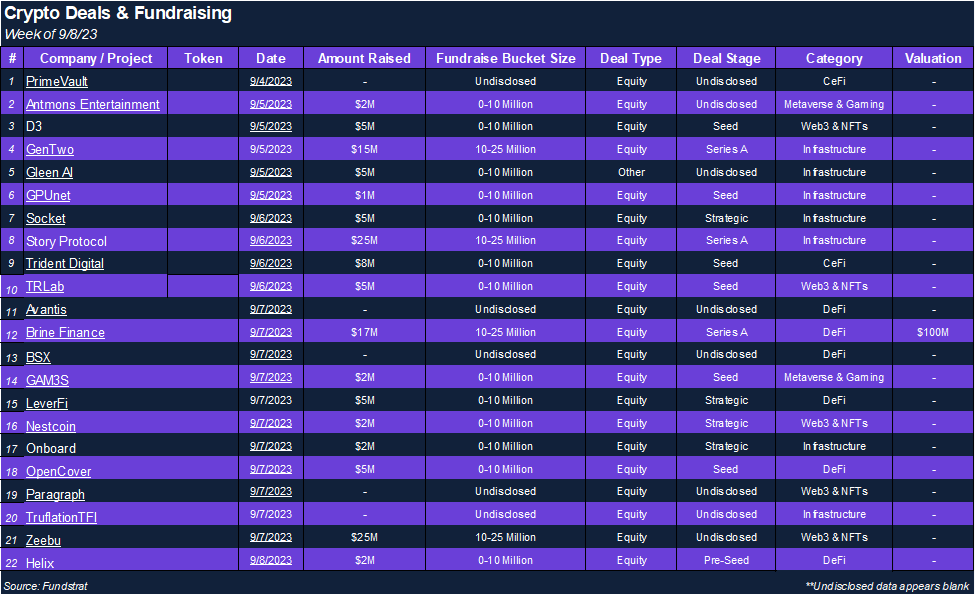

Selected Deals

Brine Finance, a decentralized order-book exchange powered by StarkWare, has completed a Series A deal of $16.5 million led by Pantera Capital. The fundraising round values the protocol at $100 million, one of the loftier valuations in recent deals. The round had other investor participation from Elevation Capital, Starkware Ltd, Spartan Group, and others. Brine Finance has already accumulated over $500 million in trading volume and hopes to compete with centralized exchanges as the platform of choice for large traders across crypto.

GenTwo, a Swiss fintech platform specializing in the securitization of assets, completed a Series A deal worth $15 million led by Point72 Ventures, the venture capital arm of hedge fund manager Steve Cohen. GenTwo’s platform will allow digital assets to be securitized and brought to market in a quick, seamless manner. In addition to the capital, Pete Casella, senior partner at Point72, will join GenTwo’s board of directors. GenTwo plans to use the funding to expand globally and continue driving innovation on its financial engineering platform.

Trident Digital Group, a newly started crypto lending business, raised $8 million via a Seed round led by White Star Capital and New Form. Trident Digital Group seeks to capitalize on the massive gap in the crypto lending market left by bankrupt players like Genesis and Voyager. Trident’s founders are former bankers who held senior roles at Coinbase and Matrixport. Companies entering the crypto lending market are starting to appear, as Coinbase recently announced the launch of their institutional lending product. Trident will use the capital to help launch its first yield product tied to U.S. Treasuries and win deposits from other financial institutions.

Zeebu, a blockchain-based settlement platform focused on revolutionizing the telecom industry, raised $25 million in a presale funding round, which saw participation from several strategic partners, including Bankai Ventures. Zeebu raised $10 million more than the initial hard-cap of $15 million, displaying investors’ excitement for Zeebu’s on-chain invoice settlement product, which should help disintermediate traditional banking channels and lower costs for the telecom industry.