Funding Activity Slows in Last Week of Summer

Weekly Recap

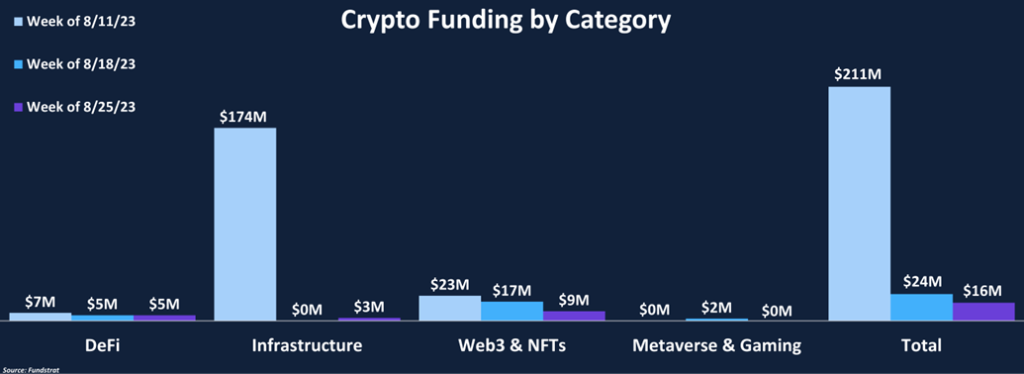

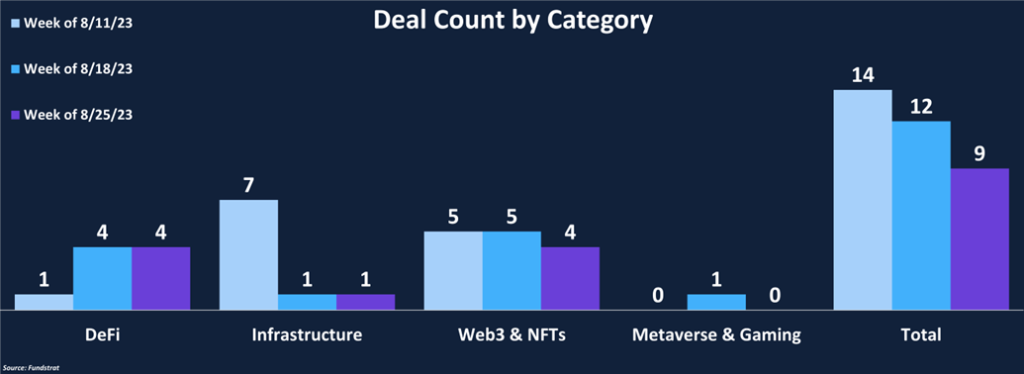

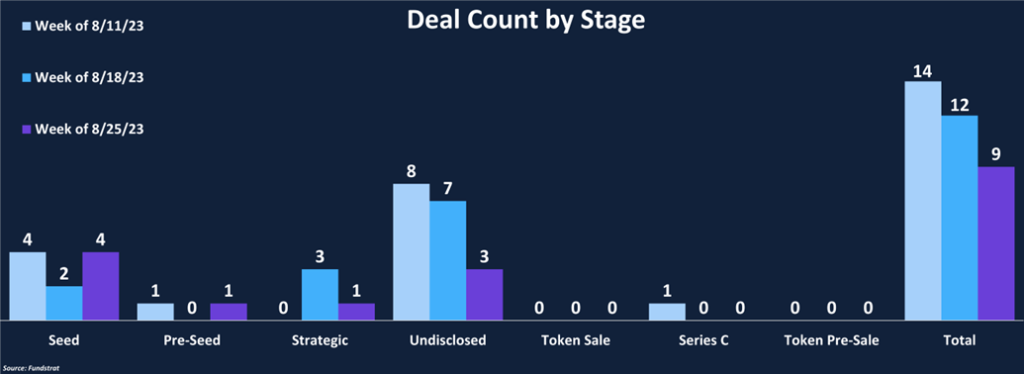

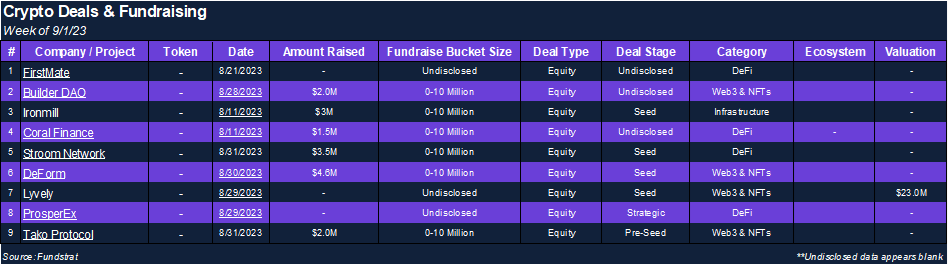

In the final week of summer, crypto funding activity diminished. Total weekly funding fell to $16 million from $24 million the previous week. Deal count fell 25% to just 9 deals. Of the nine deals, both DeFi and Web3 & NFTs notched four deals. The Web3 & NFTs deals were slightly larger, totaling $9 million in investment compared to DeFi’s $5 million. A noticeable trend in the last month has been the popularity of deals in the Web3 space as blockchain-oriented social media sites like Friend.tech have taken the spotlight.

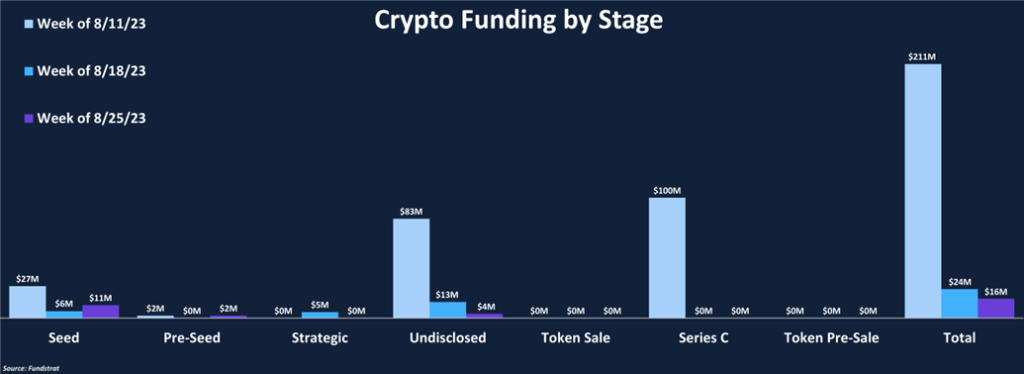

To no surprise, Seed rounds were the investment choice for venture capitalists. Nearly half the deals this week were Seed investments, totaling almost 70% of the total funding amount. There was one Pre-Seed round by Tako Protocol, raising $2 million. Tako Protocol is building an open social recommendation layer to recommend, advertise, and curate on Web3 Social. It will be interesting to see if funding activity picks up after Labor Day and finishes the year on a strong note.

Funding by Category

Funding by Deal Stage

Deal of the Week

Stroom Network, a bitcoin liquid staking protocol, raised $3.5 million in an oversubscribed Seed round led by Greenfield. Other investors included Mission Street, Lemniscap, No Limit Holdings, and Cogitent Ventures, among others. Stroom Network is striving to replicate the mechanics of Ethereum liquid staking to allow bitcoin holders to deposit tokens with Stroom and receive a liquid staking token (similar to wBTC) which is EVM compatible, allowing holders to leverage their capital and pursue other yield opportunities on Ethereum. Stroom plans to use the funds expand its team and accelerate the launch of its liquid staking token (LST).

Why Is This Deal of the Week?

One of the major pain points of the Lightning Network is a lack of liquidity, hindering the adoption of the payments network. Stroom is hoping to alleviate Lightning’s problem by sourcing dormant bitcoin liquidity and utilizing liquid staking mechanics. When users stake their bitcoin with Stroom, they will begin earning Lightning Network routing fees while having the optionality to pursue other yield opportunities across blockchains with Stroom’s LST (lnBTC). Stroom’s utility is two-fold: increased liquidity for the Lightning Network, and additional yield and composability for bitcoin holders. Reducing the technical expertise of running a Lightning node should make Stroom a popular choice for bitcoin holders looking to earn extra yield or leverage their holdings across DeFi. Payments remains a relatively untapped sector in crypto and Stroom hopes to be the key to unlock the Lightning Network’s potential.

Selected Deals

Web3 marketing firm DeForm, raised $4.6 million in a Seed round led by Kindred Ventures. Other investor participation included Elad Gil, Scalar Capital, and others. Marketers can gain useful insights about their customers from analyzing blockchain data. DeForm is serving those insights on a via their suite of Web3 data and survey creation tools. DeForm plans to use the funds to expand its team and improve upon its cross-chain analytics, as verifying customer behavior across various networks can sometimes be tedious or cumbersome.

FirstMate, a company hoping to provide NFT creators with personalized digital marketplaces, raised $3.75 million in an undisclosed round led by Dragonfly Capital. Other investors included Coinbase Ventures and NextView. FirstMate envisions a future in which NFT creators can easily create their own websites displaying their work and aggregating price data from various NFT exchanges. FirstMate will offer creators the tools to seamlessly create custom digital marketplaces with no coding required. FirstMate has already helped Bankless, Sound, FELT Zine, and others build personalized marketplaces.

ProsperEx, a decentralized exchange combining on-chain derivatives and real-world asset (RWA) trading, raised an undisclosed amount in a Strategic round with EMURGO Ventures. EMURGO is a prominent name in the Cardano ecosystem and serves as a marquee investment for ProsperEx and brings a sense of credibility to the project. ProsperEx hopes to capitalize on the growth of on-chain derivatives and serve as the gateway to safe and efficient trading.

Reports you may have missed

WEEKLY RECAP Weekly funding decreased 25% from $209 million to $157 million, and the total deal count declined 19% from 32 to 26 deals. DeFi was the most funded category this week, anchored by Polymarket’s $45 million Series B round, the largest fundraise of the week. Infrastructure was not far behind, totaling $61 million across eight deals. As we begin to approach the end of 1H 2024, Infrastructure and DeFi have been the two consistent...

WEEKLY RECAP Total funding rose 58% this week from $128 million to $203 million, while total deals ticked up to 29 compared to last week’s 26. Infrastructure was the dominant category, representing 64% of funding and 55% of deal count. There were five CeFi deals this week (including our DotW), one of the higher totals for the category in recent weeks. Seed rounds amassed a staggering $92 million in funding...

WEEKLY RECAP Weekly funding fell from $152 million to $125 million across 23 deals compared to last week’s 31. The largest deal of the week was a $47 million strategic round completed by Securitize, notably led by BlackRock and making CeFi the leading fundraising category this week. As one of the largest asset managers in the world, the investment carries significant weight in legitimizing the tokenization sector. BlackRock used Securitize...

WEEKLY RECAP Crypto funding was relatively unchanged week-over-week, with a 4% decrease to $138 million, while deal count saw a larger decrease, falling 29% to 25 deals. Infrastructure deals comprised 73% of total funding and Web3 and Gaming combined for 26%, with remaining categories making up the last 1%. As highlighted in our Q1 Funding Report, Series A funding has been a standout deal stage this year, and this week...