Flashbots Achieves Unicorn Status

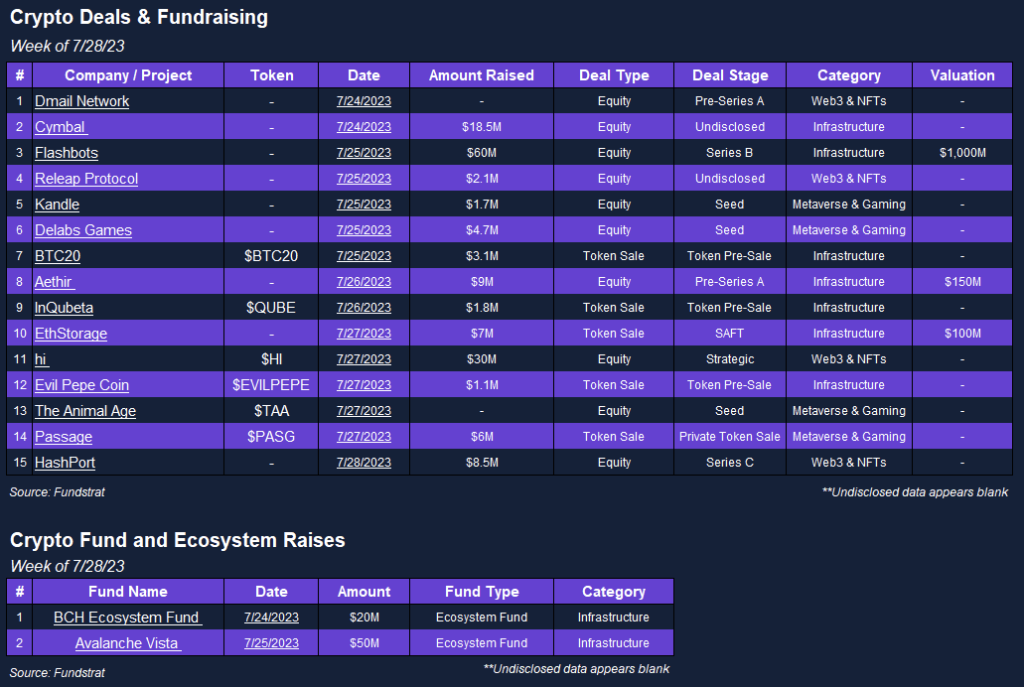

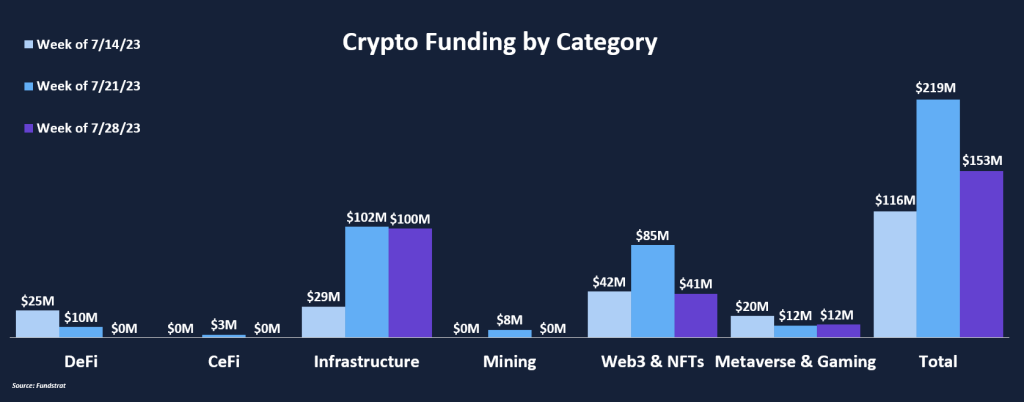

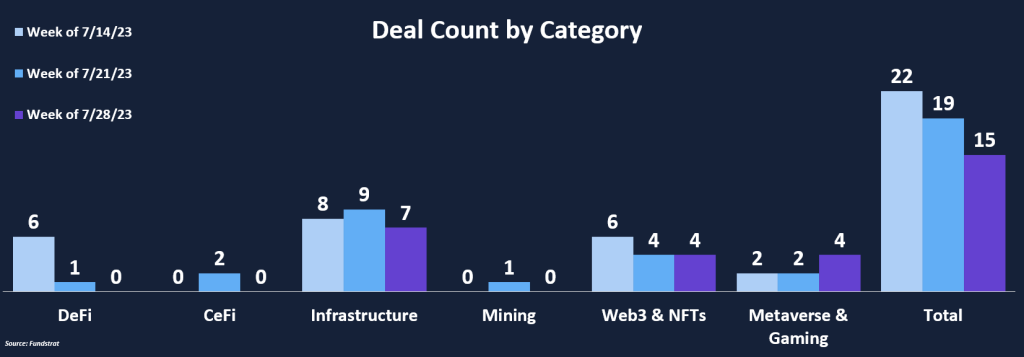

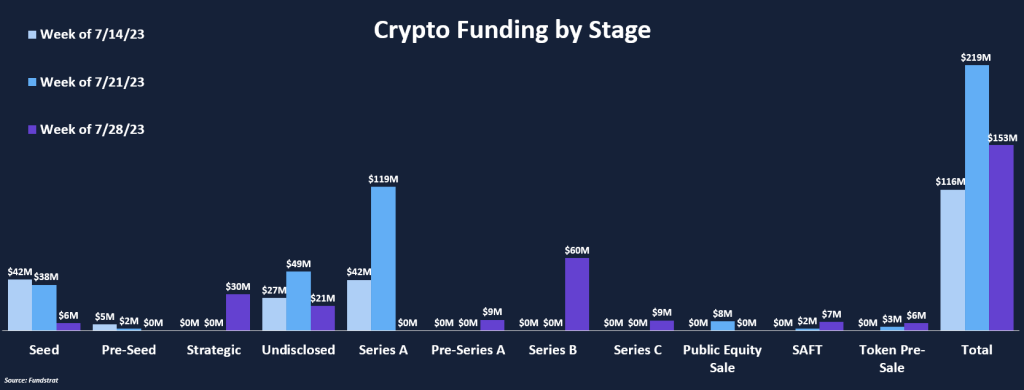

Crypto funding fell on a weekly basis to $153 million compared to $219 million last week. Notably, 10 of the 15 deals announced this week secured funding within the $0-$10 million range. This is significant because it continues a trend of crypto VCs increasingly allocating capital towards early-stage funding rounds and being more selective in later stages. Our team highlighted this trend in our Q2 2023 Crypto Fundraising Report.

Infrastructure-related projects received the most funding this week, with seven deals totaling $100 million. Flashbots received $60 million in funding at a $1 billion valuation in its Series B round, making the project one of four that have raised at unicorn valuations in 2023. Interestingly, Flashbots picked investors based on a reverse pitch format where VCs presented their case for decentralization to win allocation in the round. Flashbots focuses on Maximal Extratable Value (MEV), utilizing their services as block producers on Ethereum to extract value by reordering, including, or excluding transactions within a block. This has become an extremely lucrative business and a key component in the Ethereum ecosystem. Our team covered MEV in depth as part of our Crypto Concepts series.

Funding by Category

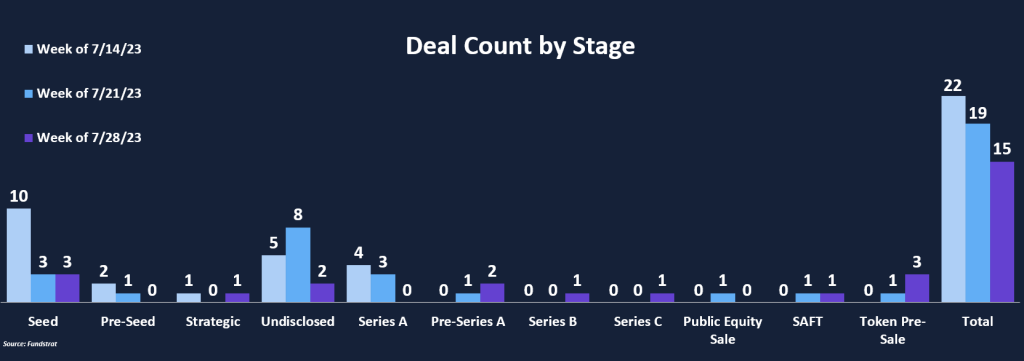

Funding by Deal Stage

Deal of The Week

This week’s Deal of the Week is Flashbots, which raised $60 million in a Series B round led by Paradigm. Flashbots is an Ethereum-based research and development startup that aims to remove the negative impacts of Maximal Extractable Value (MEV). Flashbot’s aim is to enable a permissionless, transparent, and fair ecosystem regarding MEV extraction. This falls under three goals: democratizing access to MEV revenue, bringing transparency to MEV activity, and redistributing MEV revenue. Flashbots currently has a product that builds core infrastructure and ecosystem tooling as well as a research arm that explores MEV market dynamics and blockchain design challenges.

Why is this Deal of the Week

MEV or Maximal Extractable Value (MEV) occurs when the block producers in a blockchain (miners or validators) extract value by reordering, including, or excluding transactions within a block, often at the expense of users. In other words, block producers can determine the order in which transactions are processed on the blockchain and exploit that power to their advantage. This can be compared to front-running in traditional markets. MEV has become highly profitable and widespread on Ethereum in the past few years, with the cumulative amount of MEV extracted on the network exceeding $714M, up from $78M at the start of 2021. Flashbots is on the cutting edge of democratizing MEV and mitigating the negative impacts of it. This round puts Flashbots at a unicorn valuation of $1 billion.

Selected Deals

Delabs Games, the crypto gaming arm of 4:33 Creative Lab, is aiming to build games that utilize blockchain technology. The studio has already released Rumble Racing Star, a racing game that incorporates the usage of NFTs. In addition, the studio also plans to release two new titles soon. The company has secured $4.7M in funding through its seed round led by Hashed Ventures. Also, the funding round included investor participation from Polygon Labs, Spartan Labs, Planetarium, and Merit Circle. Delab Games intends to allocate the capital raised toward developing additional gaming titles built on Polygon.

Cymbal is an infrastructure-based platform aiming to create a readable blockchain explorer that allows users to search for activities and events housed on-chain. The company has secured $18.5M in funding through an undisclosed round. In addition, the funding round included investor participation from Coinbase Ventures, Solana Ventures, First Round Capital, UTA Ventures, and others. Cymbal intends to allocate the capital raised toward product development and operational expansion.

hi is a Web3 & NFT-based project aiming to create an all-in-one platform for users offering services related to investing, payments, and savings. In addition, the platform is also developing hi Protocol, an L2 solution built on Ethereum, focusing on creating a unique authentication mechanism for developers. The company has secured $30M in funding through a strategic round. The only investor for the round was Animoca Brands. Along with driving a more positive impact for the entire Web3 ecosystem, the platform intends to allocate the capital raised towards developing its protocol and application further in collaboration with Animoca Brands.

Aethir is a decentralized cloud-based infrastructure (DCI) platform aiming to make complicated cloud resources easily accessible. The platform is primarily designed for artificial intelligence (AI) and gaming use cases. The company has secured $9M in funding at a $150M valuation through its Pre-Series A round. The funding round was co-led by Sanctor Capital, CitizenX, Hashkey, and Merit Circle. In addition, the round also included investor participation from Animoca Brands, Big Brain Holdings, Tess Ventures, and others. Aethir intends to allocate the capital raised towards geographical expansion and further development of the platform’s infrastructure.

EthStorage is an infrastructure-based platform aiming to scale Ethereum storage using a Layer-2 network. By periodically submitting storage proofs from the platforms Layer-2 network to Ethereum L1, allows for EthStorage to utilize mainnet security features while increasing storage capacity affordably. The company has secured $7M in funding at a $100M valuation through a simple agreement for future tokens (SAFT) structured seed round. In addition, the funding round was led by dao5 and included investor participation from SevenX Ventures, Avant Blockchain Capital, Foresight Ventures, and others.