27% Increase in Funding to End Q2

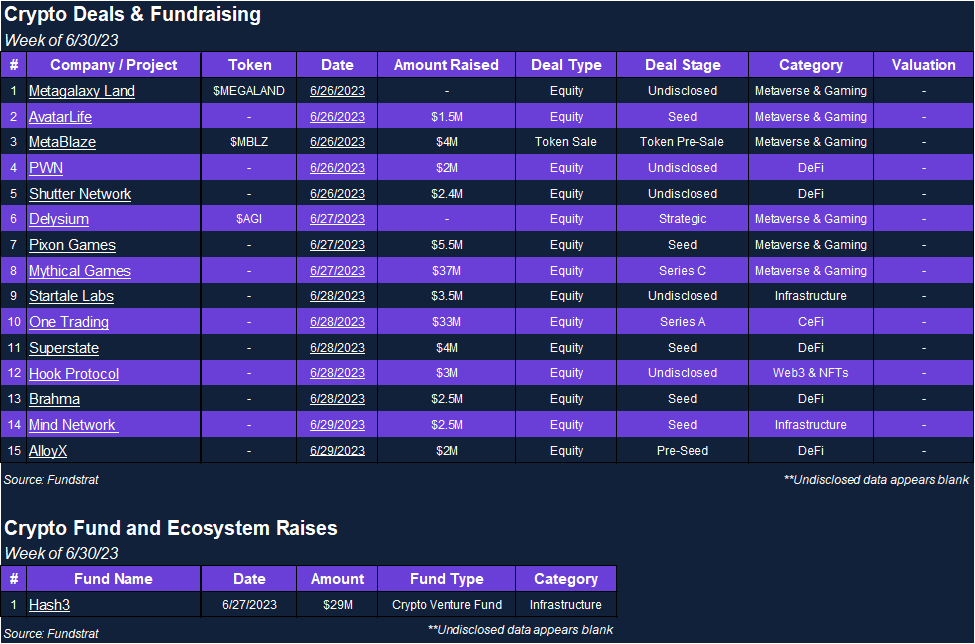

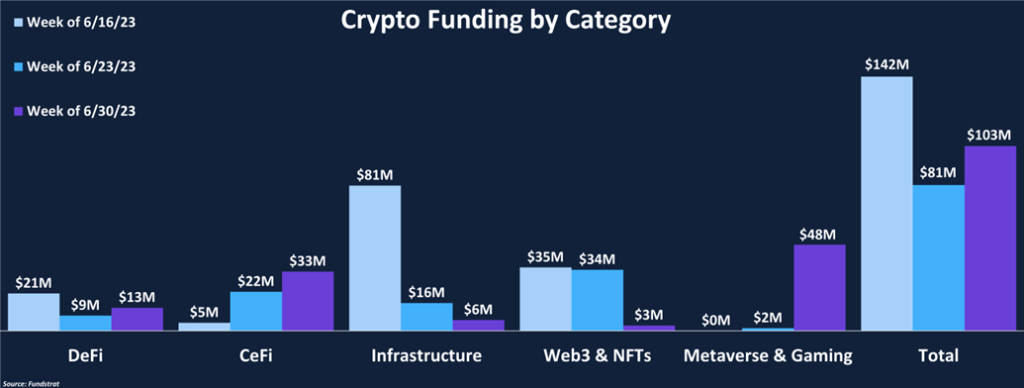

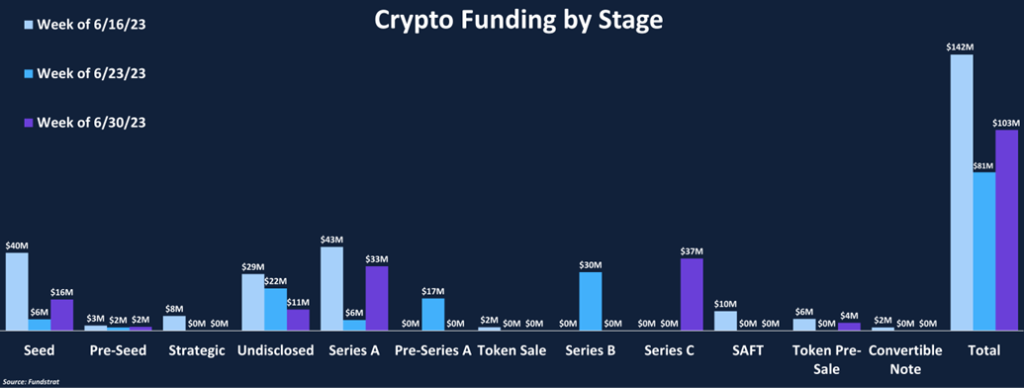

Crypto funding rose on a weekly basis to $103 million compared to $81 million last week. Metaverse & Gaming and CeFi were the two strongest categories this week, accounting for 47% and 32% of total funding, respectively. This week’s average deal size was $7.9 million, exceeding the previous two weeks and ending the month on a strong note.

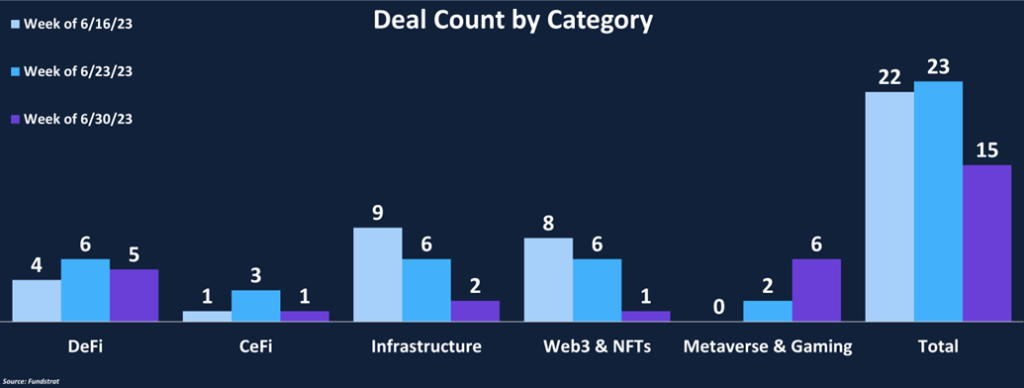

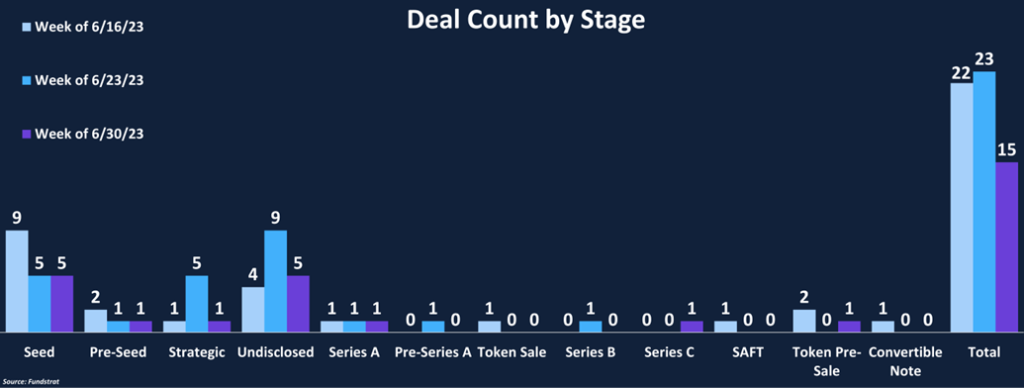

Metaverse & Gaming also led the week in deal count, with six deals. Although DeFi only accounted for 13% of funding, it had the second highest deal count (5), representing a third of all deals. There was one Series C deal this week (Mythical Games), only the second Series C deal this quarter, as venture capitalists have been placing their bets on early-stage projects. Mythical Games was also the largest deal of the week ($37 million), which is logical given the late-stage fundraise. Seed stage deals were the most popular category for the third consecutive week, representing 33% of all deals.

Hash3 conducted the sole investment fundraise this week, raising $29 million to invest in seed stage projects, and there were no M&A transactions.

Funding by Category

Funding by Deal Stage

Deal of the Week

This week’s Deal of the Week is Mythical Games, which raised $37M in a Series C1 round led by Scytale Digital with participation from ARK Invest, Animoca Brands, MoonPay, Proof VC, and Stanford Athletics. Mythical Games plans to use this capital to launch a new marketplace and pursue other revenue-generating initiatives. Mythical Games is a technology company at the intersection of video games and economics. Mythical Games vision is integrating digital ownership, Web3, and gaming to create a unique and enjoyable player experience. The Mythical Platform is a system for blockchain developers and publishers to build or integrate play-to-earn economies into their games, increasing engagement and unlocking new business and game models.

Why is this the Deal of the Week?

Gaming is one of the most promising subsectors in crypto. Despite this, most of the crypto games we’ve seen released have been relatively low-quality compared to AAA traditional gaming titles. Much of this is due to the time and effort of creating these top-tier video games. This is why it is exciting to see a gaming studio like Mythical Games, which is led by gaming industry veterans from franchises such as Call of Duty, World of Warcraft, and Guitar Hero, receive funding. With sales volume so far of $29 million in the last 30 days, Mythical stands as one of the leading blockchains for NFT transactions. The new funds serve as an extension of previous capital raises, which included securing $225 million in two rounds during 2021.

Selected Deals

One Trading is a digital asset exchange created as a spin-out of Bitpanda Pro. The company will launch an institutional-grade platform aiming to become the most efficient and scalable in the industry. While many exchanges use a pay-per-trade-based fee model, One Trading intends to utilize a membership-level model where fees vary based on trading volume size. The exchange has secured $33M in funding through its Series A round led by Valar Ventures. In addition, the funding round included investor participation from Wintermute Ventures, MiddleGame Ventures, Keyrock, and Speedinvest.

Shutter Network is a DeFi-based platform that provides the necessary infrastructure to prevent front-running and other types of malicious maximal extractable value (MEV) on Ethereum. The platform plans to accomplish this using a threshold cryptography-based distributed key generation (DKG) protocol. The platform has secured $2.36M in funding through an undisclosed round that included investor participation from OKX Ventures, Alphemy Capital, Owl Ventures, and others. Shutter Network intends to allocate the capital raised towards advancing community engagement and product development.

PWN is a DeFi-based peer-to-peer (P2P) protocol aiming to revolutionize mortgage financing through decentralization. The protocol plans to accomplish this by accepting tokens and NFTs as collateral for lending. In addition, PWN will also launch a community-driven DAO that will supervise the protocol’s operations. The company has secured $2M in funding through an undisclosed round. The deal included investor participation from Digital Finance Group, StarkWare, Safe Ecosystem Foundation, and others. PWN intends to allocate the capital toward developing new features and improving protocol accessibility.

Pixion Games is a Web3 gaming studio focusing on creating competitive multiplayer games. The studio plans to accomplish this by incorporating its proprietary tournament platform, user-generated content (UGC), and tradable game assets. The company has secured $5.5M in funding through an extended seed round. Investors included Shima Capital, Mechanism Capital, Blizzard Fund, and others. Pixion Games intends to allocate the capital raised towards growing its workforce and building the tech stack for Fableborne, an action-based role-playing game (RPG) built on Avalanche.

AlloyX is a DeFi-based protocol aiming to aggregate tokenized credit. The protocol plans to accomplish this by utilizing a liquid real-world asset vault. The company has secured $2M in funding through its pre-seed round led by Hack VC. Additionally, the funding round had participation from Digital Currency Group, MH Ventures, Circle Ventures, and others. AlloyX has allocated the capital raised towards the integration of nine credit protocols.