Venture Funding Slides Lower

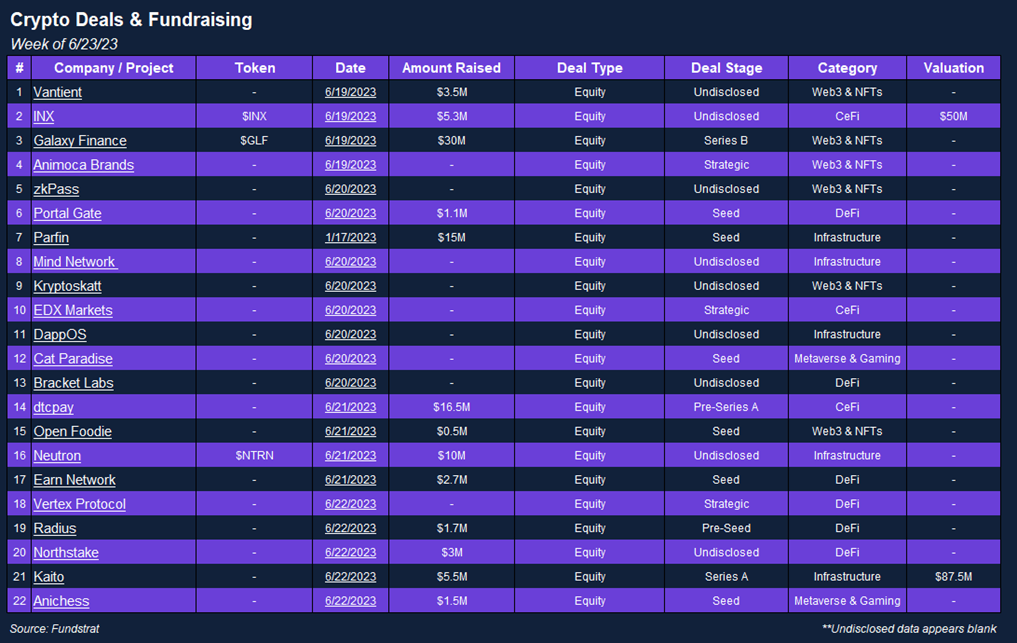

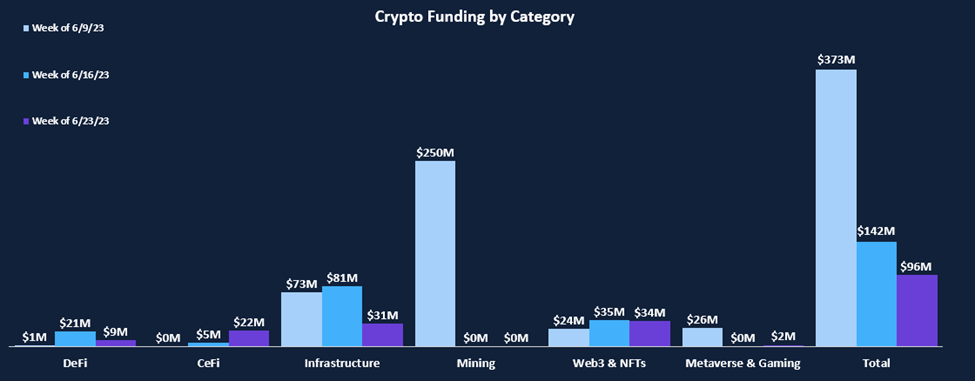

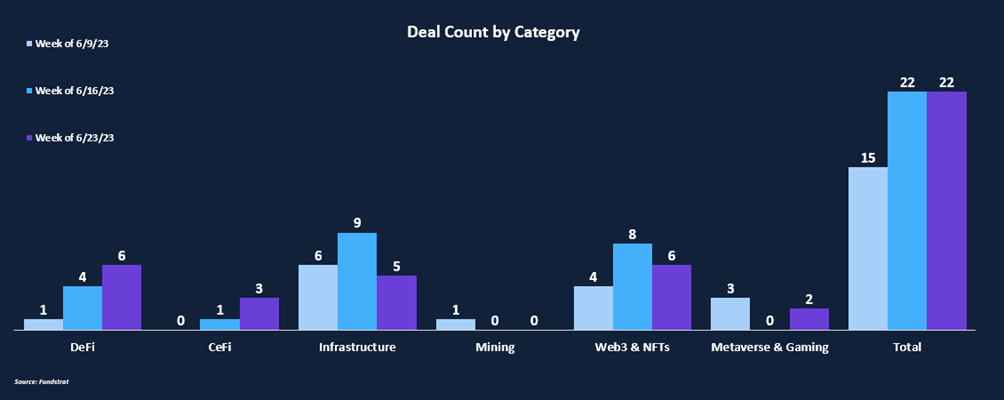

Funding decreased this week to the lowest levels all month, declining from $142M to $96M. While funding decreased, the total number of deals remained the same at 22. Web3 & NFTs had the most funding this week, with six deals totaling $34M, including digital asset wallet Galaxy Finance, the largest deal of the week at $30M. Infrastructure had the second most funding at $31M. Each other sector lagged behind, with Mining and Metaverse & Gaming being the least funded, each receiving no funding.

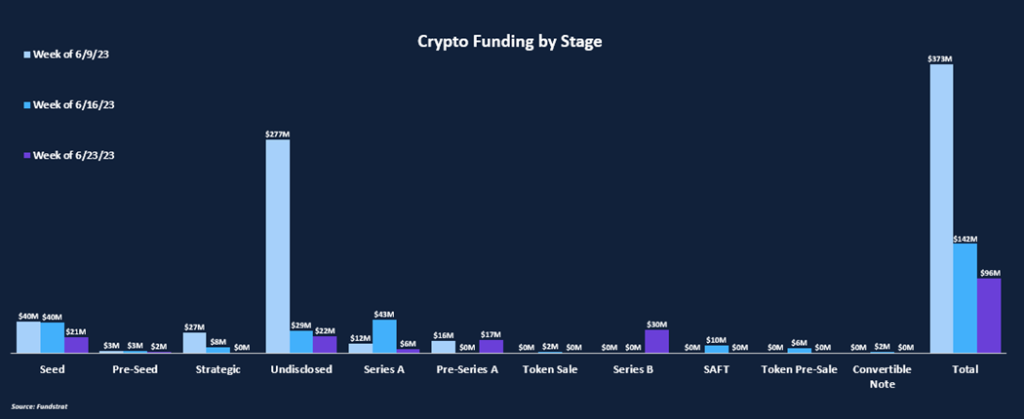

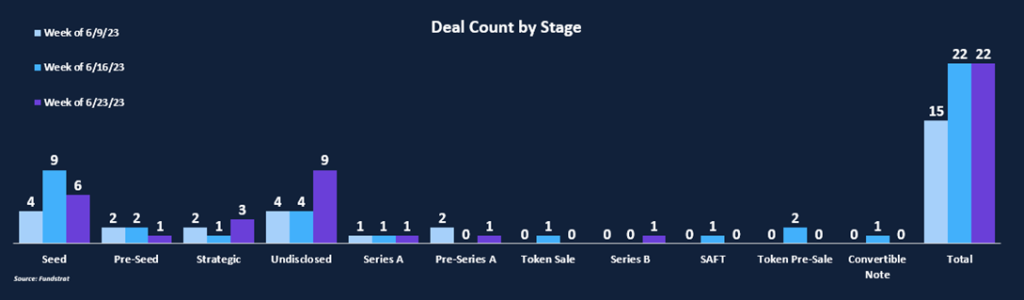

While many deals this week didn’t disclose what round they were, the majority of deals were early stage, with 6 of the 22 being seed round.

Funding by Category

Funding by Stage

Deal of The Week:

Maverick Protocol, a DeFi Infrastructure project, raised $9m in an undisclosed round led by Founders Fund, with participation from Pantera Capital, Binance Labs, Coinbase Ventures, and Apollo Crypto. This follows an $8m strategic raise from February of 2022, with participation from Panteral Capital, Circle, Spartan Group, and CMT Digital. According to founding member Alvin Xu, Maverick aims to “provide critical market infrastructure required to eliminate inefficiencies from DeFi and help the industry grow to new highs.” The team recently launched a decentralized exchange in March, with $37m in TVL. Maverick also focuses on building efficiencies in liquid staking infrastructure by addressing fragmented multi-chain liquidity. It will utilize the newly acquired funding to expand the protocol, integrate additional blockchain networks, and entice fresh developers and projects to join its ecosystem.

Why is this the Deal of The Week?

While most DeFi projects launch marginal improvements that derive from existing models almost every week, Maverick stands out as a team looking to move the whole ecosystem forward. Maverick aims to revolutionize the DeFi landscape by offering an inclusive approach to crypto asset listing. They address the limitations of decentralized markets, particularly in trading mid-cap tokens and limited trading pairs. By introducing a derivatives DEX with open listings, Maverick taps into the immense potential of derivatives, which account for over 50% of the daily crypto trading volume. They achieve this by utilizing a protocol allowing any trading pair and accepting any ERC20 token as collateral, expanding liquidity opportunities for global traders and providers.

Maverick differentiates itself through its industry-leading pricing facilitated by the Automated Liquidity Placement (ALP) AMM. This innovative mechanism optimizes liquidity placement around the market price, enhancing liquidity providers’ capital efficiency and reducing slippage for traders. Additionally, Maverick eliminates the complexity of collateral management for liquidity providers, empowering them to stake and participate in the platform’s ecosystem passively. This passive staking feature positions Maverick as an ideal foundation for building future DeFi applications, further driving the growth and accessibility of decentralized finance.

Selected Deals

Kaito is an infrastructure-based platform aiming to create a crypto-tailored AI-powered search engine. The platform plans to optimize the search engine by filtering content based on topic mining, recommendation, ranking, and more. The company has secured $5.5M in funding through its Series A round at an $87.5M valuation. The funding round was co-led by Superscrypt and The Spartan Group. This round follows up on Kaito’s $5.3M seed round led by Dragonfly Capital in Q1 2023.

Dtcpay is a CeFi-based platform aiming to provide businesses with efficient payment processing solutions. The platform plans to accomplish this by allowing its clients to offer their customers increased digital currency and fiat-based payment options. The company has secured $16.5M in funding through its pre-Series A round led by Kwee Liong Tek. In addition, the funding round also included investor participation from Tham Sai Choy, Jean-Marc Poullet, and David Tung. Dtcpay intends to use the capital raised for global expansion and product development.

Anichess is a gaming-based platform aiming to create a decentralized chess game. Created in partnership between Chess.com and Animoca Brands, the platform plans to incorporate strategic layers and esport elements within the original game. The company has secured $1.5M in funding through its seed round. In addition, the funding round included investor participation from Bing Ventures, GameFi Ventures, Asymmetry Capital, and others. Anichess intends to use the capital raised for product development and workforce expansion.

Neutron is an infrastructure-based cross-chain smart contract platform developed within the Cosmos ecosystem. The platform is currency interoperable with 51 blockchains and emphasizes interchain security. The company has secured $10M in funding through an undisclosed round co-led by CoinFund and Binance Labs. In addition, the funding round included investor participation from LongHash Ventures, Nomad, and Delphi Ventures. Neutron intends to use the capital raised for ecosystem growth and advancing the development of its blockchain software.

Galaxy Finance is a Web3 & NFT-based platform aiming to provide users access to a digital asset wallet that incorporates social features to promote user interaction. In addition, the platform also offers educational resources to onboard new crypto users. The platform has secured $30M in funding through its Series B round, co-led by Tally Capital, BlackPine, and QCP Capital. Galaxy Finance intends to use the capital raised to expand its product offerings and grow the platform’s presence in the Asian market.