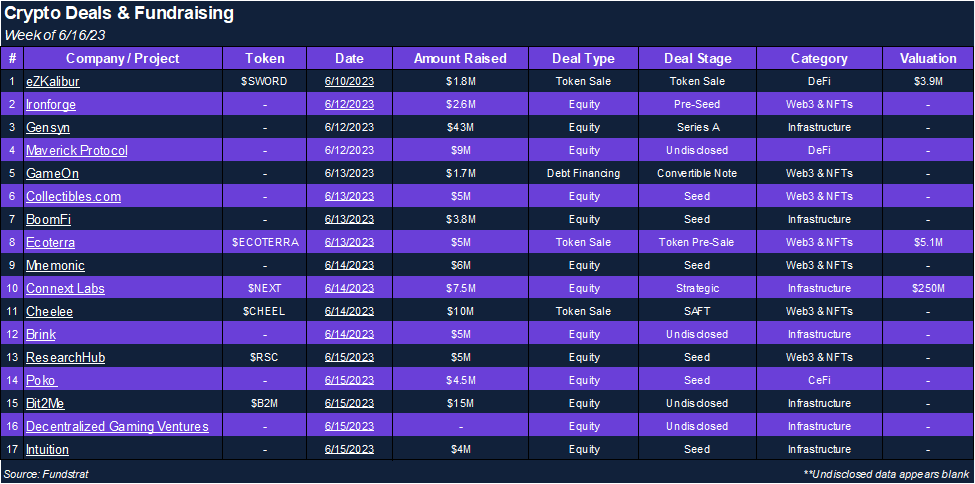

Funding Declines as Q3 Approaches

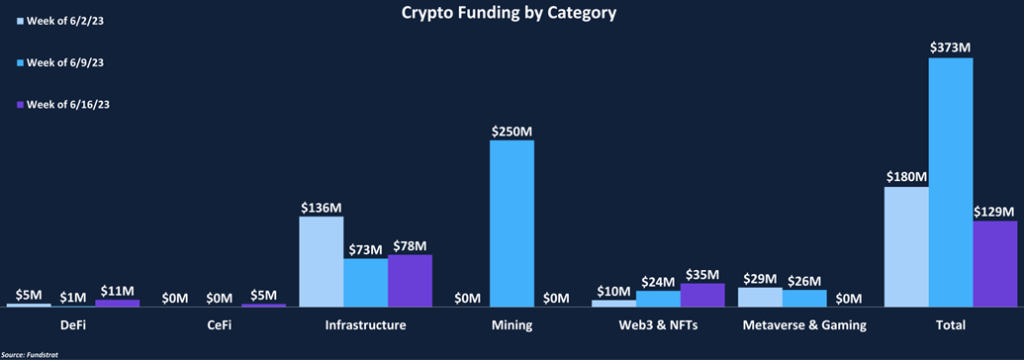

Crypto funding dropped sharply this week, falling to $129 million from $373 million. To no surprise, Infrastructure deals once again garnered the largest amount of funding, equating to $78 million. Web3 & NFTs were the second largest category by funding ($35 million) and tied Infrastructure with the highest deal count (7). The average deal size across all categories was $8.1 million – a considerable decline from last week’s $25 million average.

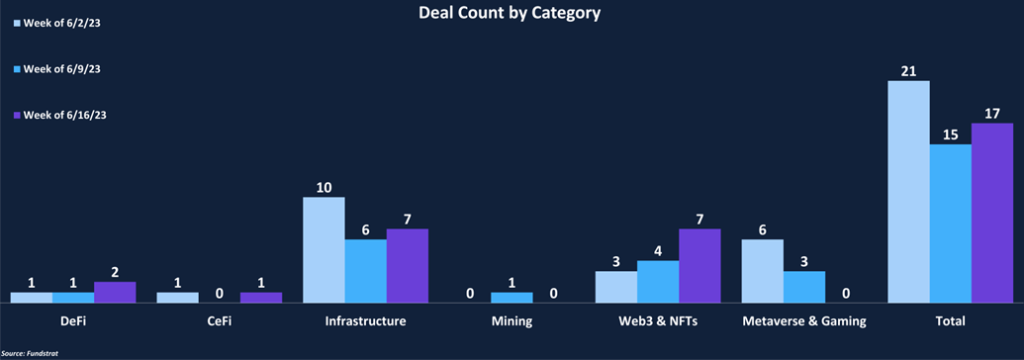

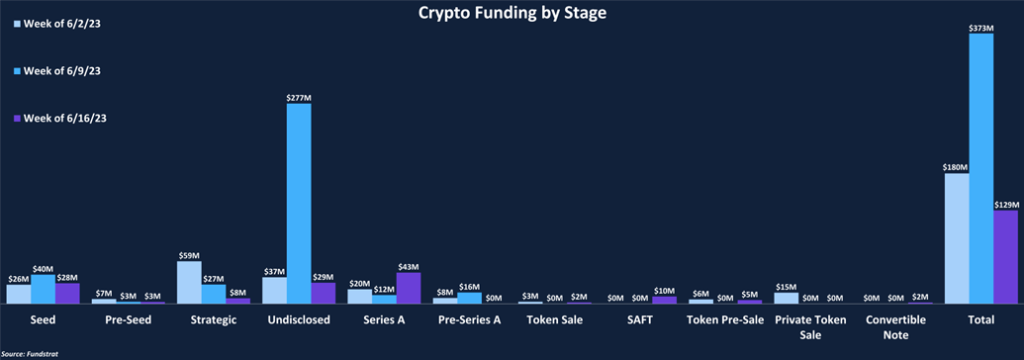

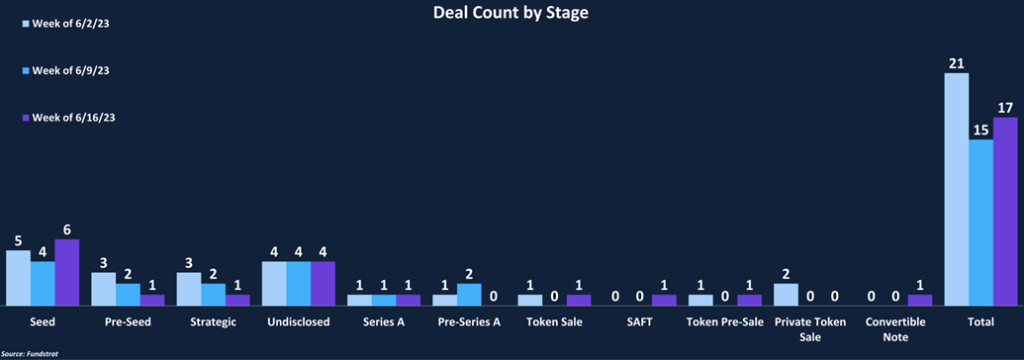

Despite the large decrease in funding and average deal size, the total number of deals rose to 17 compared to last week’s 15. Over 82% of the deal count came from Infrastructure and Web3 & NFTs, with the next most popular category being DeFi with two deals (12%). Seed deals represented 35% of all deals, while the rest were evenly distributed across various deal stages. Although there was only one Series A round, it represented 36% of total funding. There were no fund/ecosystem raises or M&A transactions to report this week.

Funding by Category

Funding by Deal Stage

Deal of the Week

This week’s Deal of the Week is Gensyn, which raised $43M in a Series A round led by A16z Crypto with participation from CoinFund, Canonical Crypto, and Protocol Labs, among others. Gensyn is a machine learning compute protocol that provides a blockchain-based marketplace that connects buyers and sellers of computing power. Gensyn believes that an open system of computational resources is the best way to ensure everyone is represented by the AI systems we create.

Why Is This the Deal of the Week?

Due to the AI boom this year, sparked by successes like ChatGPT, demand for Graphic Processing Units (GPUs) has skyrocketed. AI systems often use GPUs to accelerate their computations and enhance performance. GPUs are specialized hardware devices designed to handle parallel processing tasks, making them well-suited for AI workloads that involve heavy computations, such as deep learning and neural networks. These compute processors are what enable AI systems to absorb information. Gensyn is capitalizing on this by building a blockchain-based marketplace protocol that allows developers to build AI systems while paying on demand. The Gensyn Protocol aims to disintermediate oligopolies such as AWS and doesn’t charge a margin, significantly lowering the cost of computing. Ben Fielding, Gensyn’s co-founder, stated, “We believe the key to useful, aligned AI is allowing everyone in the world to contribute to its development. The best way to mitigate bias and misalignment is to allow more people to build models that reflect their views. In order to do that, we need open infrastructure that connects models to the core resources, crucially computational hardware, that make them function.”

Selected Deals

Mnemonic is a Web3 & NFT-based platform that provides creators within the NFT space with insightful data analytics by utilizing application programming interfaces (APIs). This allows developers to efficiently and reliably create products for their users. The company has secured $6M in funding through an extension of its seed round led by Salesforce Ventures. In addition, the funding round included investor participation from FIN Capital, Orange DAO, Polygon Ventures, and FIN Capital. Mnemonic intends to use the capital raised to expand its APIs.

Connext Labs is an infrastructure-based platform focused on creating a blockchain interoperability protocol. The platform aims to provide developers with the ability to construct interchain applications accessible from any network. The company has secured $7.5M in funding at a $250m valuation through a strategic round. Additionally, the funding round included investor participation from IOSG Ventures, Polychain Capital, Fenbushi Capital, Polygon Ventures, and others. Connext Labs intends to use the capital raised to set up the Connext Foundation.

Maverick Protocol is a DeFi-based platform that provides users with the necessary infrastructure to create more efficient decentralized finance markets. The protocol has secured $9M in funding through an undisclosed round led by Founders Fund. The funding round also included investor participation from Coinbase Ventures, Pantera Capital, Binance Labs, and Apollo Crypto. Maverick Protocol intends to use the capital raised towards developing effective solutions for cross-chain liquidity and liquid staking token infrastructure.

Bit2Me is an infrastructure-based platform offering users access to a crypto exchange. In February 2022, the exchange was issued a license by the Bank of Spain to become the first crypto service provider in the country. The company has secured $15M in funding through an undisclosed round led by Investcorp. Other investor participation included Telefónica Ventures, YGG Fund, Stratminds VC, and others. Bit2Me intends to use the capital raised to continue growing its presence within Latin America and Spain.

Collectibles.com is a Web3-based platform aiming to create a community and marketplace for the collectibles market. The platform will integrate smart contracts and blockchain technology to optimize commerce and offer advanced functionality. The company has secured $5M in funding through its seed round led by Blockchange Ventures. Additionally, the funding round included investor participation from Blockwall Capital, GFR Fund, Peter Thiel, and others. Collectibles.com intends to launch in the fall of 2023 and will use the capital raised to expand its vertical offerings to include coins, comic books, stamps, and more.