Average Deal Size Continues to Exceed Q1 Levels

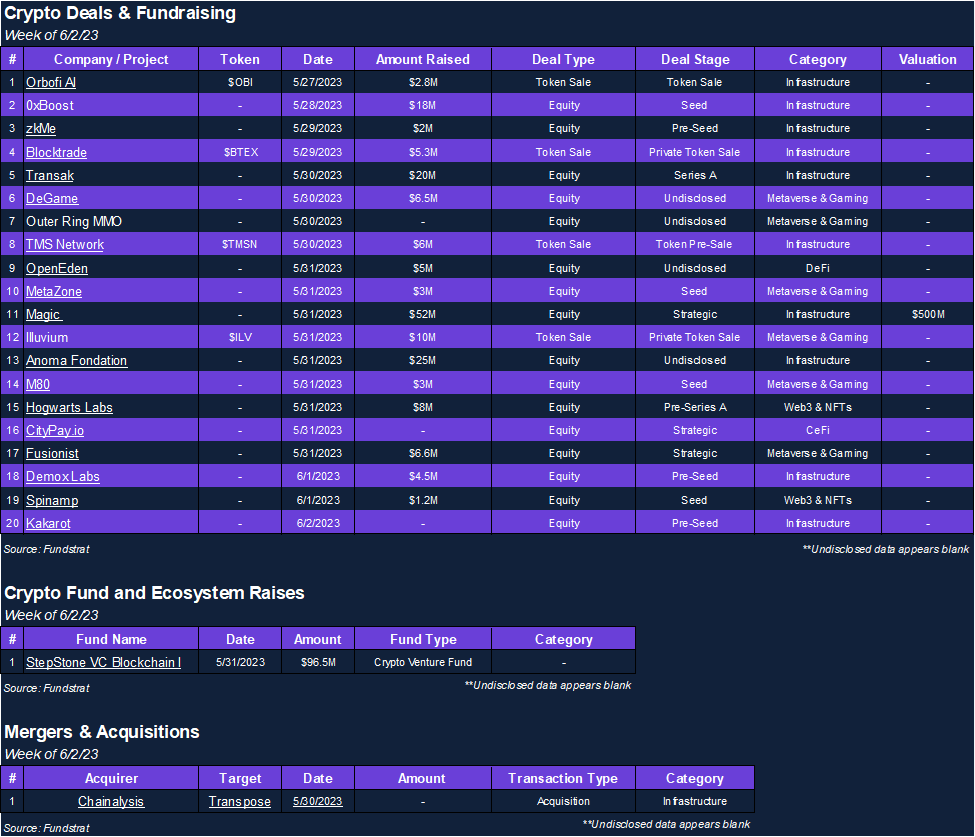

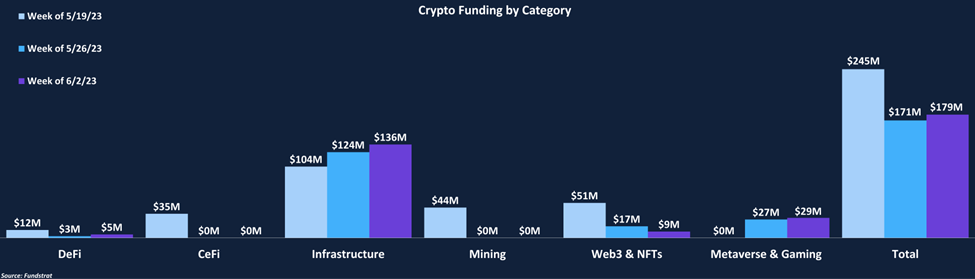

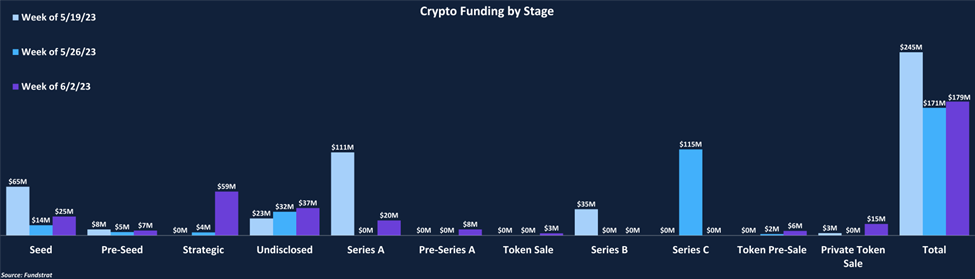

Crypto funding maintained last week’s levels, rising slightly to $179 million from $171 million. The general trend of Infrastructure and Seed deals being the most common continued. Additionally, Infrastructure deals made up 76% of the total fundraising amount. Interestingly, this was the second week in a row for CeFi and Mining not tallying any deals, as both categories have lost their luster throughout the ongoing bear market.

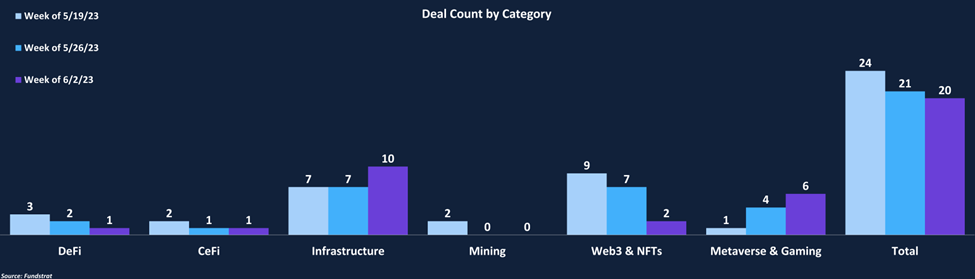

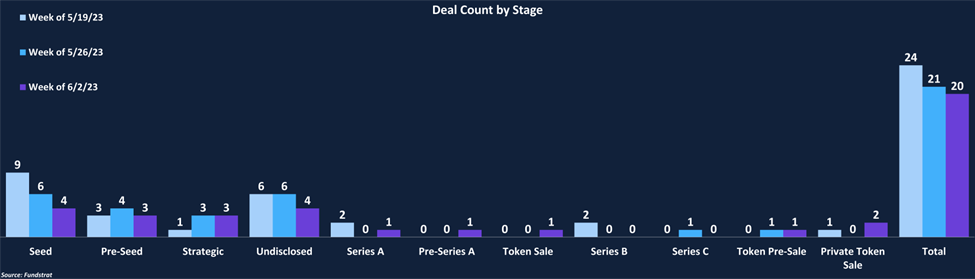

Deal counts were relatively evenly distributed across Pre-Seed, Seed, and Strategic deals, comprising half of the total deal count. Strategic rounds had the highest funding total ($59 million) between those three deal stages. The larger total can be attributed to our Deal of the Week, in which Magic raised $52 million. This week’s average deal size was $10.5 million, marking the third consecutive week of average deal size exceeding Q1’s $8.6 million average.

There was one M&A transaction this week in which data analytics firm Chainalysis acquired Transpose, a blockchain infrastructure company. The transaction amount was undisclosed, but Chainalysis believes Transpose’s technology will help them meet its clients’ data demands and bolster its position as the most trusted source of Web3 data.

Funding by Category

Funding by Deal Stage

Deal of the Week

This week’s Deal of the Week is Magic, a web3 wallet-as-service provider. Magic raised $52M in a strategic funding round led by PayPal Ventures with participation from Cherubic, Synchrony, KX, Northzone, and Volt Capital. Magic has wallet software that provides a safe and easy way for companies to onboard their customers to web3. Magic is currently used by brands in retail, music, fashion, and gaming. Magic looks to use the funding to expand functionality, enhance use cases and deepen integration within the European Union and Asia-Pacific region.

Why Is This the Deal of the Week?

Although crypto infrastructure continues to improve and be built out, using crypto remains difficult for the everyday user. For example, self-custodial wallets containing seed phrases and passwords leave lots of room for error that could cause a loss of funds. Some of these wallets also don’t have an easy way to on-ramp fiat currency and require the user to send crypto to fund the wallet. This is why if crypto is going to onboard millions of new users, it is essential to have safe and accessible solutions. Magic hopes to solve this by providing a seamless way for a company’s existing customers to onboard to web3. Once a vendor implements Magic’s SDK in their code base, wallets can be instantaneously user-created through existing email, social, SMS, or federated logins. Magic removes the need for seed phrases and browser extensions, which makes it indistinguishable from standard web2 experiences. To date, Magic has generated more than 20 million unique wallets, and over 130,000 developers use its SDK.

Selected Deals

Demox Labs is an infrastructure-based platform with a focus on utilizing zero-knowledge technology. The platform recently launched Leo Wallet, a digital asset wallet emphasizing safety and privacy. The company has secured $4.5M in funding through its pre-seed round led by HackVC. In addition, the funding round included investor participation from Coinbase Ventures, OpenSea, Amplify Partners, and others. Demox Labs intends to use the capital raised to increase the interoperability of Leo Wallet with additional blockchains and develop new privacy-related blockchain infrastructure.

Fusionist is a blockchain-based gaming company aiming to grow the adoption of Web3 gaming. The firm plans to create an ecosystem of strategic science fiction-related role-playing games (RPGs). The titles will also allow players to obtain collectible NFTs. Fusionist will release its three gaming titles first on the BNB Chain, with plans to expand to other Layer-1 networks in the future. The company has secured $6.6M in funding through a strategic round co-led by FunPlus and Binance Labs. Fusionist intends to use the capital raised to grow its workforce, userbase, and fast-track new game development.

Anoma is an infrastructure-based platform that provides developers access to a full-stack architecture that helps construct decentralized applications (dApps). Use cases for the platform’s architecture include decentralized rollup sequencers, exchanges (DEXs), and DeFi applications. The company has secured $25M in funding through an undisclosed round led by CMCC Global. Additionally, the funding round included investor participation from Delphi Digital, Electric Capital, Bixin Ventures, Perridon Ventures, and others. Anoma intends to use the capital raised to create new strategic partnerships, improve platform architecture, and for R&D.

Transak is an infrastructure-based platform focused on onboarding users from Web2 to Web3. The platform plans to accomplish this by allowing Web3 applications to easily integrate Transak’s payment infrastructure, which is designed to have a simplified and intuitive user interface. The company has secured $20M in funding through its Series A round led by CE Innovation Capital. The fundraising round also included investor participation from Animoca Brands, Third Kind Venture Capital, UOB Venture Management, Signum Capital, and others. Transak intends to use the capital raised to develop its onboarding solutions further and grow the platform’s global presence.

MetaZone is a metaverse & gaming-based platform that allows developers and creatives to mint NFTs for applications, which can be distributed within the metaverse. The company has secured $3M in funding through its seed round, co-led by CMT Digital and Sfermion. In addition, the funding round included investor participation from IOSG Ventures, Infinity Ventures Crypto, Polygon Studios, and others. MetaZone intends to use the capital raised towards growing its tokenized application platform.